Japan Home Diagnostic Testing Market Size, Share, Trends and Forecast by Test Type, Form, Distribution Channel, and Region, 2026-2034

Japan Home Diagnostic Testing Market Summary:

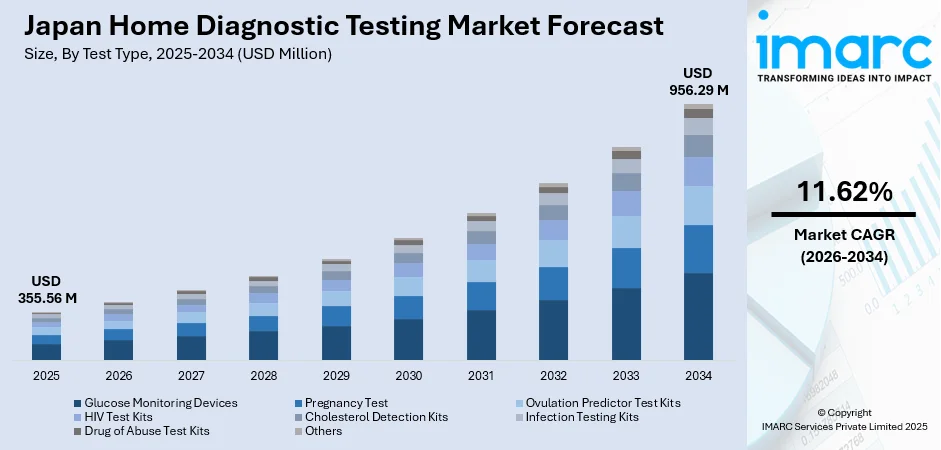

The Japan home diagnostic testing market size was valued at USD 355.56 Million in 2025 and is projected to reach USD 956.29 Million by 2034, growing at a compound annual growth rate of 11.62% from 2026-2034.

The Japan home diagnostic testing market is experiencing robust expansion driven by the nation's rapidly aging population, which has led to increased prevalence of chronic conditions requiring frequent monitoring. Rising health awareness among consumers, coupled with preferences for convenient at-home testing solutions, continues to strengthen demand. Government initiatives promoting preventive healthcare and digital health integration further support market momentum. Technological advancements in portable diagnostic devices, combined with expanding retail pharmacy networks and growing e-commerce penetration, are enhancing product accessibility across the country, thereby bolstering Japan home diagnostic testing market share.

Key Takeaways and Insights:

- By Test Type: Glucose monitoring devices dominate the market with a share of 34% in 2025, driven by Japan's rising diabetic population requiring regular blood sugar monitoring and the growing adoption of continuous glucose monitoring systems among elderly consumers seeking convenient disease management solutions.

- By Form: Strips lead the market with a share of 29% in 2025, owing to their cost-effectiveness, ease of use for self-testing applications, and widespread availability across retail pharmacies and drug stores throughout Japan.

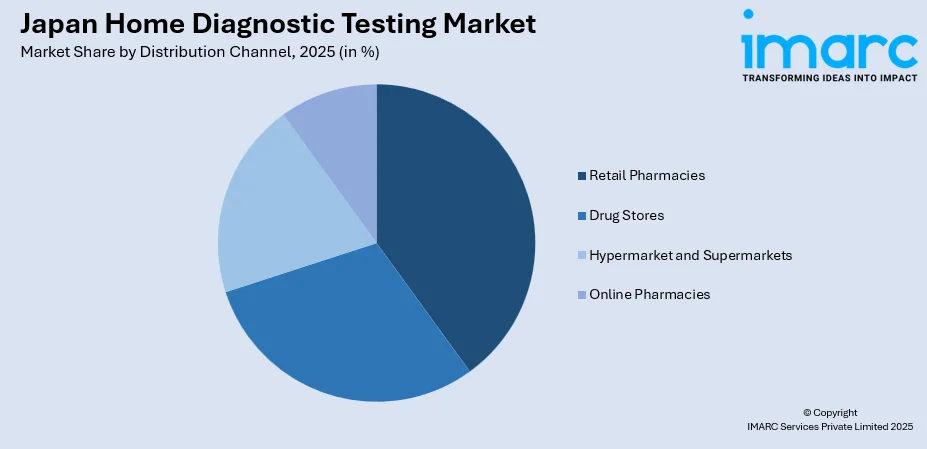

- By Distribution Channel: Retail pharmacies represent the largest segment with a market share of 40% in 2025, supported by consumer trust in pharmacist guidance, extensive store networks offering comprehensive product assortments, and the convenience of immediate product availability for healthcare needs.

- By Region: Kanto Region prevails the market with a share of 36% in 2025, attributable to its dense population concentration in metropolitan Tokyo, advanced healthcare infrastructure, high consumer spending power, and presence of major healthcare facilities and digital health startups.

- Key Players: The Japan home diagnostic testing market exhibits a moderately competitive landscape, characterized by the presence of established multinational diagnostic corporations alongside domestic manufacturers offering diverse product portfolios across various testing categories and price segments.

To get more information on this market Request Sample

The Japan home diagnostic testing market continues to benefit from the nation's commitment to healthcare innovations and the seamless integration of technology into daily health management routines. The MHLW's 8th National Medical Strategic Plan covering 2024-2029 emphasizes Information and Communications Technology (ICT) and digitalization in healthcare, creating favorable conditions for at-home diagnostic solutions. Consumer preference for privacy in health screening, particularly for sensitive conditions, further accelerates the demand for home-based testing alternatives that provide accurate results without clinical visits. Expanding retail availability, greater insurance support for preventive testing, and proactive government promotion of early detection also strengthen market prospects. As manufacturers introduce more user-friendly, reliable, and disease-specific test kits, the market is expected to diversify and accelerate, appealing to both older adults seeking independence and younger users looking for faster, more accessible health insights.

Japan Home Diagnostic Testing Market Trends:

Integration of Artificial Intelligence (AI) and Digital Health Technologies

The Japan home diagnostic testing market is witnessing significant transformation through AI integration into diagnostic devices and health platforms. Smart diagnostic equipment, featuring machine learning (ML) algorithms, enables continuous health monitoring and early detection of potential conditions. These technologies allow timely interventions while reducing dependence on frequent clinical visits. In January 2025, Monitor Corporation launched its AI lung cancer diagnosis tool, MONCAD CTLN, in Japan through a partnership with Doctor-NET, demonstrating the nation's commitment to advancing AI-powered diagnostic capabilities.

Rise of Telemedicine and Remote Patient Monitoring

The expansion of telemedicine services is creating synergies with home diagnostic testing solutions across Japan. Digital health platforms increasingly integrate with at-home testing kits, enabling seamless data sharing between patients and healthcare providers. This trend reflects growing consumer demand for convenient healthcare access and reduces burden on overcrowded healthcare facilities. In July 2024, Amazon introduced its Pharmacy service in Japan, partnering with various local drugstores to deliver prescription medicines directly to homes while enabling pharmacist consultations through digital applications.

Growing Adoption of Point-of-Care (POC) Testing Solutions

POC testing solutions are gaining substantial traction as consumers and healthcare providers seek immediate diagnostic results outside traditional laboratory settings. As per IMARC Group, the Japan POC diagnostics market size reached USD 1.7 Billion in 2024. Portable multiplex testing devices capable of detecting multiple pathogens in single cartridges are becoming increasingly sophisticated. These advancements support same-visit treatment decisions and enhance chronic disease management efficiency.

Market Outlook 2026-2034:

Market expansion will be driven by continued technological innovation in portable diagnostic devices, expanding telemedicine adoption, and government support for digital health initiatives. The aging demographic will sustain demand for glucose monitoring and chronic disease management solutions, while growing health consciousness among younger population will diversify the consumer base. The market generated a revenue of USD 355.56 Million in 2025 and is projected to reach a revenue of USD 956.29 Million by 2034, growing at a compound annual growth rate of 11.62% from 2026-2034. Retail pharmacy modernization and e-commerce channel expansion will enhance product accessibility across urban and rural regions alike.

Japan Home Diagnostic Testing Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Test Type | Glucose Monitoring Devices | 34% |

| Form | Strips | 29% |

| Distribution Channel | Retail Pharmacies | 40% |

| Region | Kanto Region | 36% |

Test Type Insights:

- Glucose Monitoring Devices

- Pregnancy Test

- Ovulation Predictor Test Kits

- HIV Test Kits

- Cholesterol Detection Kits

- Infection Testing Kits

- Drug of Abuse Test Kits

- Others

Glucose monitoring devices dominate with a market share of 34% of the total Japan home diagnostic testing market in 2025.

Glucose monitoring devices hold prominence, as Japan's diabetes burden continues to escalate. In 2024, Japan had the 10th largest population of individuals with diabetes worldwide, totaling 10.8 Million. The elderly demographic demonstrates heightened susceptibility to type 2 diabetes and related metabolic conditions. Government reimbursement policies supporting diabetes management device accessibility further strengthen market penetration.

Self-monitoring blood glucose devices have become essential tools for daily disease management, enabling patients to track glucose fluctuations and adjust treatment regimens accordingly. This proactive approach helps prevent serious complications, including cardiovascular diseases and kidney disorders. The segment benefits from continuous technological innovations, enhancing device accuracy and user convenience. The integration of digital health applications with glucose monitors enables seamless data sharing with healthcare providers, facilitating personalized treatment adjustments and improving overall patient outcomes in chronic disease management.

Form Insights:

- Cassettes

- Midstream

- Instruments

- Strips

- Test

- Digital Monitoring

- Dip Cards

Strips lead with a share of 29% of the total Japan home diagnostic testing market in 2025.

Strips represent the most accessible and cost-effective format for home diagnostic testing applications. Their simple operation requires minimal technical knowledge, making them suitable for elderly consumers and first-time users seeking reliable self-testing solutions. Blood sample collection using strips provides accurate results comparable to laboratory testing while offering the convenience of immediate readings at home. The format's versatility extends across multiple testing categories, including glucose monitoring, cholesterol detection, and infection screening applications.

Manufacturing advancements have significantly improved strip sensitivity and accuracy, building consumer confidence in home testing reliability. The format's affordability compared to electronic instruments supports regular testing frequency among chronic disease patients requiring daily monitoring. Retail pharmacies and drug stores maintain comprehensive strip inventories across major brands, ensuring consistent product availability. The established distribution infrastructure combined with competitive pricing strategies positions strips as the preferred format for budget-conscious consumers prioritizing testing accessibility over advanced digital features.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Retail Pharmacies

- Drug Stores

- Hypermarket and Supermarkets

- Online Pharmacies

Retail pharmacies exhibit a clear dominance with a 40% share of the total Japan home diagnostic testing market in 2025.

Retail pharmacies serve as primary healthcare access points throughout Japan, offering consumers professional pharmacist consultation alongside diagnostic product purchases. As per IMARC Group, the Japan pharmacy retail market size reached USD 114.26 Billion in 2024. These establishments provide personalized guidance on product selection, proper testing procedures, and result interpretation, creating value-added shopping experiences that build consumer loyalty. Chain pharmacy dominance ensures standardized service quality and comprehensive product assortments across locations.

The channel benefits from established consumer trust in pharmacist expertise and healthcare-related purchasing environments. Immediate product availability eliminates waiting periods associated with online ordering, appealing to consumers requiring urgent diagnostic solutions. Strategic pharmacy locations in residential neighborhoods and commercial districts maximize accessibility for diverse demographic segments. Retail pharmacies increasingly integrate digital services, including prescription management and telemedicine consultations, positioning themselves as comprehensive health management hubs that complement home diagnostic testing product offerings.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

Kanto Region represents the leading region with a 36% share of the total Japan home diagnostic testing market in 2025.

The Kanto Region leads the Japan home diagnostic testing market due to its large, urbanized population, advanced healthcare infrastructure, and strong digital adoption. Tokyo is a large urban city with approximately 37.1 Million inhabitants in 2024. Consumers in Tokyo and surrounding prefectures actively embrace convenient at-home testing solutions to save time and manage health proactively. High awareness about preventive care and broad access to pharmacies, clinics, and online platforms enable rapid market penetration and frequent product upgrades.

The region also benefits from the strong presence of technology companies and diagnostic manufacturers that introduce innovative, app-connected self-testing kits tailored to urban lifestyles. Widespread use of smartphones, telehealth platforms, and digital health records supports seamless integration of home diagnostic tools. Additionally, higher disposable incomes and busy work schedules create sustained demand for reliable, fast, and easy-to-use testing options, reinforcing Kanto’s position as the most influential and early-adopting market in Japan.

Market Dynamics:

Growth Drivers:

Why is the Japan Home Diagnostic Testing Market Growing?

Rapidly Aging Population and Escalating Chronic Disease Burden

Japan's demographic transformation represents a fundamental driver propelling the home diagnostic testing market forward. The nation possesses one of the world's oldest populations, with individuals aged 65 and over comprising 29.3% of total residents as of September 2024. This substantial elderly cohort demonstrates elevated susceptibility to chronic conditions, including diabetes, cardiovascular diseases, and metabolic disorders requiring continuous monitoring. Home diagnostic devices enable convenient disease management without frequent clinical visits, particularly valuable for mobility-limited seniors. Home diagnostic tools provide a convenient, accessible, and non-invasive alternative that enables seniors to track vital health parameters from the comfort of their homes. This shift not only empowers individuals to take greater control of their health but also reduces pressure on overburdened hospitals and clinics, allowing medical professionals to focus on more severe cases.

Government Initiatives Supporting Digital Health and Home Healthcare

Japanese government policies actively promote home-based healthcare and digital health integration, creating favorable regulatory conditions for market participants. These initiatives encourage telemedicine adoption and remote patient monitoring capabilities that complement home diagnostic testing solutions. As per IMARC Group, the Japan telemedicine market size reached USD 5.2 Billion in 2024. Regulatory pathways have also become more supportive, simplifying approvals for innovative home testing devices and ensuring they meet safety standards. Initiatives encouraging collaborations between medical device manufacturers, tech companies, and healthcare providers further stimulate product innovation tailored to Japan’s demographic needs. By reducing regulatory friction, improving digital accessibility, and promoting self-care, the government is effectively shifting health management from clinics to homes, making home diagnostic testing a central part of Japan’s modern healthcare strategy.

Growing need for nursing care

The rising need for nursing care in Japan is strongly driving the home diagnostic testing market, as more individuals, particularly seniors, require continuous monitoring of chronic conditions without relying solely on in-person medical support. In fiscal 2023, in Japan, the overall number of nursing care recipients grew to 5,666,500, marking a 1.3% rise, while the total for preventive care recipients increased by 59,900 (5.1%) to reach 1,244,600. With the country facing a growing shortage of professional caregivers and nurses, families increasingly turn to home-based diagnostic tools to simplify daily health management. These devices allow routine checks for blood glucose, blood pressure, heart rhythm, and other vital indicators, reducing the burden on nursing staff while empowering patients to manage their conditions independently. Home diagnostic solutions also help caregivers track health status more efficiently, enabling early detection of complications and timely medical intervention. For elderly individuals living alone or in assisted environments, self-testing devices enhance safety and autonomy while minimizing frequent clinic visits.

Market Restraints:

What Challenges the Japan Home Diagnostic Testing Market is Facing?

Regulatory Complexity and Lengthy Approval Processes

Japan's stringent medical device regulations create substantial barriers for market entry and product innovations. Complex certification requirements extend approval timelines, delaying introduction of advanced diagnostic technologies. Manufacturers face significant compliance costs navigating regulatory pathways, particularly for novel AI-integrated devices requiring extensive clinical validation.

High Device Costs Limiting Consumer Accessibility

Premium pricing of advanced home diagnostic devices restricts market penetration among price-sensitive consumer segments. Sophisticated continuous glucose monitoring systems and connected health devices remain financially inaccessible for many households despite clinical benefits. Limited insurance coverage for certain diagnostic categories creates out-of-pocket burden that suppresses demand growth.

Data Privacy and Security Concerns

Data privacy and security concerns are slowing the growth of the market in Japan by reducing consumer confidence in sharing sensitive health information through digital platforms. Fears of data leaks, misuse of personal medical records, and inadequate protection measures make users hesitant to adopt app-connected or cloud-based test kits. These concerns also pressure companies to invest heavily in compliance, cybersecurity, and transparent data-handling practices, increasing operational complexity.

Competitive Landscape:

The Japan home diagnostic testing market exhibits moderate competitive intensity, characterized by the presence of established multinational medical device corporations alongside domestic manufacturers. Global players leverage advanced research capabilities, extensive distribution networks, and brand recognition to maintain market positions across premium product categories. Domestic companies compete through localized product development, competitive pricing strategies, and established relationships with healthcare providers and retail channels. Strategic partnerships between technology firms and diagnostic manufacturers are accelerating innovations in connected health solutions. Market participants are increasingly investing in AI integration, digital platform development, and user experience enhancement to differentiate offerings. Distribution channel expansion, particularly through e-commerce and pharmacy partnerships, represents a key competitive focus area.

Recent Developments:

- In August 2025, Onera Health enhanced clinical sleep diagnostics with a wireless, home-based PSG system crafted to comply with medical standards. Onera Health tackled the worldwide sleep disorder epidemic, particularly severe in Japan, by providing hospital-quality sleep testing in home settings. The firm facilitated precise diagnosis through a wireless, user-friendly system that allowed care without hospital stays, reducing strain on healthcare systems and enhancing access to treatment.

Japan Home Diagnostic Testing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Test Types Covered | Glucose Monitoring Devices, Pregnancy Test, Ovulation Predictor Test Kits, HIV Test Kits, Cholesterol Detection Kits, Infection Testing Kits, Drug of Abuse Test Kits, Others |

| Forms Covered | Cassettes, Midstream, Instruments, Strips, Test, Digital Monitoring, Dip Cards |

| Distribution Channels Covered | Retail Pharmacies, Drug Stores, Hypermarket and Supermarkets, Online Pharmacies |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central /Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan home diagnostic testing market size was valued at USD 355.56 Million in 2025.

The Japan home diagnostic testing market is expected to grow at a compound annual growth rate of 11.62% from 2026-2034 to reach USD 956.29 Million by 2034.

Glucose monitoring devices dominated the market with 34% share, driven by the substantial diabetic population requiring regular blood sugar monitoring and growing adoption of continuous glucose monitoring systems among elderly consumers.

Key factors driving the Japan home diagnostic testing market include the rapidly aging population with elevated chronic disease prevalence, government initiatives supporting digital health and home healthcare, technological advancements in AI-integrated diagnostic devices, and expanding retail pharmacy distribution networks.

Major challenges include regulatory complexity, high device costs limiting accessibility among price-sensitive consumers, data privacy and cybersecurity concerns affecting connected diagnostic platforms, and varying levels of digital literacy among elderly user segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)