Japan Home Furnishings Market Size, Share, Trends and Forecast by Product, Price, Distribution Channel, and Region, 2026-2034

Japan Home Furnishings Market Summary:

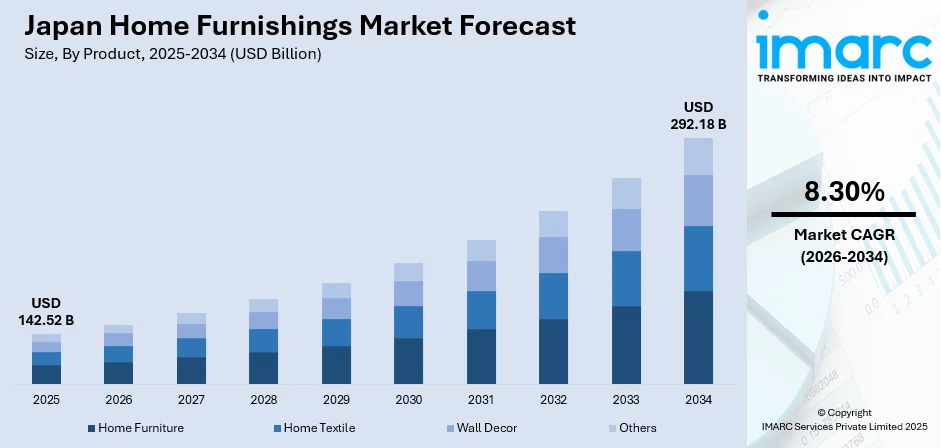

The Japan home furnishings market size was valued at USD 142.52 Billion in 2025 and is projected to reach USD 292.18 Billion by 2034, growing at a compound annual growth rate of 8.30% from 2026-2034.

The Japan home furnishings market is experiencing steady growth driven by evolving consumer lifestyles, increasing urbanization, and the rising demand for space-efficient and multifunctional furniture solutions. The market benefits from an aging population seeking ergonomic designs, growing preference for minimalist aesthetics suited to compact urban living, and the digital transformation of retail channels enhancing consumer accessibility.

Key Takeaways and Insights:

-

By Product: Home furniture dominates the market with a share of 48% in 2025, driven by sustained consumer investment in living room, bedroom, and dining furniture that enhances both functionality and aesthetic appeal of residential spaces.

-

By Price: Mass segment leads the market with a share of 72% in 2025, reflecting Japanese consumers' preference for value-oriented, affordable furnishing solutions that deliver quality and functionality without premium pricing.

-

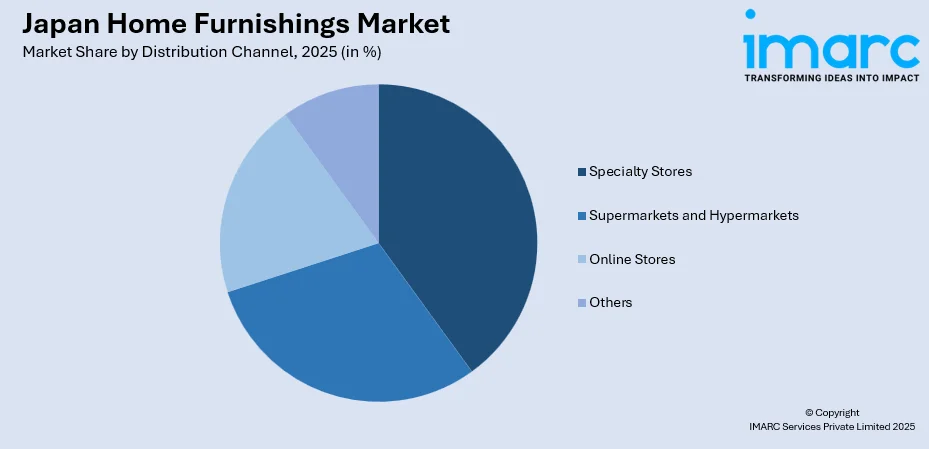

By Distribution Channel: Specialty stores represent the largest segment with a market share of 28% in 2025, owing to Japanese consumers' cultural emphasis on quality craftsmanship, personalized service, and the ability to physically inspect furniture before purchase.

-

By Region: Kanto Region dominates the market with a share of 36% in 2025, driven by Tokyo's massive urban population, high concentration of retail outlets, and significant consumer spending power in Japan's economic heartland.

-

Key Players: The Japan home furnishings market features a competitive landscape with dominant domestic retailers competing alongside international brands, characterized by vertically integrated business models, omnichannel retail strategies, and continuous product innovation focused on space efficiency and sustainability.

To get more information on this market Request Sample

The Japan home furnishings market continues to evolve in response to demographic shifts and changing lifestyle preferences. The increasing prevalence of single-person households and compact urban living spaces is driving demand for multifunctional, space-saving furniture solutions. Japanese consumers demonstrate strong preference for minimalist designs that maximize functionality while maintaining aesthetic simplicity. In 2024, IKEA Japan reconfigured its urbancity footprint; for instance, IKEA Shibuya was renovated and reopened in August 2024 as a more compact “City Shop” aimed at better serving urban dwellers, signaling how major retailers are adapting to changing livingspace and shoppingbehavior trends. The market is witnessing significant digital transformation as retailers enhance online platforms and implement omnichannel strategies to meet evolving shopping preferences. Additionally, the aging population is creating demand for ergonomic and accessible furniture designs that support independent living and comfort for elderly consumers.

Japan Home Furnishings Market Trends:

Rising Demand for Multifunctional and Space-Saving Designs

Japanese consumers increasingly seek furniture that maximizes utility in limited living spaces, driving innovation in convertible sofas, foldable tables, modular storage systems, and multipurpose pieces. That trend aligns in light of demographic shifts, for example, as of June 2023, about 34.0% of all households in Japan were “single-person households.” Manufacturers are responding with designs specifically engineered for compact apartments, featuring hidden storage, stackable components, and transformable configurations that address urban spatial constraints while maintaining comfort and style.

Growth of Home Office Furniture Segment

The sustained popularity of remote and hybrid work arrangements is fueling demand for dedicated home office furniture solutions. In fact, a recent report shows that in fiscal 2024, about 24.6% of employed persons in Japan worked remotely at least some of the time; this underscores that work‑from‑home is no longer a temporary trend but a stable part of many workers’ lives. Japanese consumers are investing in ergonomic desks, supportive office chairs, and organized workspace configurations that enhance productivity and comfort within residential environments. This trend reflects the permanent integration of work-from-home practices into Japanese professional culture.

Increasing Focus on Sustainable and Eco-Friendly Products

Environmental consciousness is influencing purchasing decisions as consumers prioritize sustainably sourced materials, recyclable components, and eco-friendly manufacturing processes. For instance, a 2025 consumer‑trends analysis found that over 70% of Japanese consumers now consider eco‑friendly attributes when buying products; this underscores the growing role of sustainability in purchase decisions. Furniture brands are responding by incorporating responsibly harvested wood, bamboo, recycled materials, and low-emission finishes into their product offerings, aligning with broader sustainability trends in Japanese consumer markets.

Market Outlook 2026-2034:

The Japan home furnishings market is positioned for sustained growth through the forecast period, supported by demographic trends, urbanization patterns, and evolving consumer preferences for functional and aesthetically pleasing living environments. The market is expected to benefit from continued digital retail expansion, innovative product development addressing space constraints, and growing demand from aging consumers seeking comfortable and accessible home solutions. The market generated a revenue of USD 142.52 Billion in 2025 and is projected to reach a revenue of USD 292.18 Billion by 2034, growing at a compound annual growth rate of 8.30% from 2026-2034.

Japan Home Furnishings Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Home Furniture | 48% |

| Price | Mass | 72% |

| Distribution Channel | Specialty Stores | 28% |

| Region | Kanto Region | 36% |

Product Insights:

- Home Furniture

- Home Textile

- Wall Decor

- Others

The home furniture dominates with a market share of 48% of the total Japan home furnishings market in 2025.

The home furniture segment maintains its leading position driven by sustained consumer investment in essential furnishing categories including living room seating, bedroom sets, dining furniture, and storage solutions. Japanese consumers prioritize functional designs that complement minimalist interior aesthetics while addressing the spatial limitations characteristic of urban apartments. The segment benefits from continuous product innovation focusing on modularity, convertibility, and space optimization. Moreover, under the 2025 national Home Energy Saving Campaign, the Japanese government offers subsidies for renovations that improve insulation and energyefficiency in homes; this incentive encourages homeowners to renovate or upgrade entire living spaces, creating demand for new furniture, fittings, and coordinated room designs.

The segment's dominance is reinforced by demographic trends including new household formation, apartment renovations, and the growing preference for coordinated room designs that create cohesive living environments. Retailers have responded by offering complete room solution packages that enable consumers to furnish entire spaces with matching styles and tones, enhancing the appeal of comprehensive furniture purchases over individual piece acquisitions.

Price Insights:

- Mass

- Premium

The mass leads with a share of 72% of the total Japan home furnishings market in 2025.

The mass segment's commanding market share reflects Japanese consumers' strong preference for value-oriented furniture that delivers quality and functionality at accessible price points. Leading retailers have perfected vertically integrated business models that control manufacturing, logistics, and retail operations to achieve cost efficiencies passed on to consumers. For instance, Nitori Holdings Co., Ltd., a major player in Japan’s mass‑market furniture segment, reported a 3.7% increase in net sales for the fiscal year ending March 2025, underscoring sustained demand for its affordable home‑furnishing offerings. This approach has established affordable home furnishings as attainable lifestyle products rather than significant financial investments.

The segment's strength is particularly evident among young professionals, first-time apartment renters, and budget-conscious families seeking practical solutions for furnishing their homes without compromising on style or durability. Retailers continue to expand product ranges within the mass segment, offering increasingly sophisticated designs and improved material quality while maintaining competitive pricing that resonates with cost-sensitive consumers across demographic groups.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

The specialty stores dominate with a market share of 28% of the total Japan home furnishings market in 2025.

Specialty stores maintain their leading position through deeply ingrained Japanese cultural values emphasizing quality, craftsmanship, and personalized shopping experiences. Consumers, particularly in premium and luxury segments, place significant importance on physically inspecting furniture, evaluating materials, and receiving expert advice from knowledgeable staff. Major specialty retailers operate extensive showroom networks where customers can experience complete room configurations and visualize how furniture will appear in their homes.

The specialty store segment benefits from retailers' investments in omnichannel integration, combining physical showroom experiences with digital platforms that enable product research, inventory checking, and convenient purchasing options. Leading specialty retailers have developed sophisticated membership programs and customer service offerings that foster loyalty and repeat purchases, strengthening their competitive position against emerging online-only competitors.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto region exhibits a clear dominance with a 36% share of the total Japan home furnishings market in 2025.

The Kanto region stands out as a central hub for home furnishings in Japan, driven by a concentration of urban centers, modern residential developments, and a diverse consumer base. The region’s retail landscape is highly developed, featuring a mix of large-format stores, specialty outlets, and design-focused boutiques. This variety allows consumers to access a broad range of home furnishing styles, from contemporary minimalism to traditional Japanese aesthetics, catering to different tastes and lifestyles.

Consumer preferences in the Kanto region are strongly influenced by trends in interior design, lifestyle choices, and space optimization. Homeowners and renters alike seek functional, stylish, and innovative furnishings that align with compact living spaces and evolving aesthetic sensibilities. Retailers respond with curated selections, personalized services, and design consultation offerings, ensuring that the region maintains its position as a leader in the Japanese home furnishings market, setting benchmarks for other areas.

Market Dynamics:

Growth Drivers:

Why is the Japan Home Furnishings Market Growing?

Rapid Urbanization and Evolving Living Spaces

Japan's continued urbanization is driving significant demand for furniture adapted to compact living environments. As more consumers reside in apartments and smaller homes, particularly in metropolitan areas, the need for space-efficient, multifunctional, and aesthetically pleasing furniture solutions continues to expand. In November 2025, Japan’s key ministries approved a budget supporting “eco‑homes,” subsidizing energy‑efficient renovations like insulation and windows under the Housing Energy‑Saving 2026 Campaign to promote sustainable living. This demographic shift is prompting manufacturers to innovate with modular designs, convertible pieces, and storage-integrated furniture that maximizes utility within limited square footage while maintaining visual appeal.

Aging Population and Demand for Ergonomic Solutions

Japan's rapidly aging population is fundamentally reshaping home furnishings demand, creating substantial growth opportunities in ergonomic and accessibility-focused products. With individuals aged sixty-five and older representing a significant and growing demographic segment, there is increasing need for furniture that enhances comfort, supports mobility, and enables independent living. This trend is driving innovation in adjustable beds, supportive seating, and assistive furniture designs that combine functionality with aesthetic considerations.

Digital Transformation of Retail Channels

The accelerating digital transformation of furniture retail is expanding market accessibility and consumer engagement. Retailers are implementing sophisticated omnichannel strategies that integrate physical showroom experiences with comprehensive online platforms featuring product visualization tools, inventory management, and convenient delivery options. Reflecting the scale of the market, Japan’s retail sector reached USD 1,779.7 Billion in 2024, with projections by IMARC Group indicating growth to USD 2,006.9 Billion by 2033, highlighting the continued importance of digital strategies in capturing consumer demand. This digital evolution is enhancing consumer convenience, enabling broader product discovery, and facilitating purchases among digitally savvy demographics who prefer researching and ordering furniture through online channels.

Market Restraints:

What Challenges the Japan Home Furnishings Market is Facing?

Declining Population and Household Formation Rates

Japan's declining population presents a fundamental long-term challenge for the home furnishings market, potentially constraining the natural consumer base for furniture purchases. Reduced household formation rates may limit demand growth as fewer new homes require furnishing, placing greater emphasis on replacement purchases and renovation-driven consumption rather than first-time furnishing needs.

Space Constraints Limiting Large Furniture Demand

The prevalence of small living spaces in Japanese urban areas restricts demand for large, bulky furniture pieces, challenging manufacturers who must continuously innovate to meet functional needs within spatial limitations. This constraint requires significant investment in design and engineering to develop compact solutions without compromising comfort or utility.

Intense Price Competition in Mass Market Segment

The dominance of value-oriented mass market products creates intense price competition that may pressure profit margins across the industry. Retailers must balance cost efficiency with quality maintenance while competing against both established domestic players and international entrants seeking market share through aggressive pricing strategies.

Competitive Landscape:

The Japan home furnishings market features a competitive landscape characterized by dominant domestic retailers operating vertically integrated business models alongside international brands. Leading players differentiate through extensive store networks, comprehensive product ranges, omnichannel retail capabilities, and strong brand recognition built on consistent value delivery. Competition centers on price competitiveness, product innovation addressing space constraints, customer service quality, and digital platform sophistication that enhances the shopping experience across physical and online channels.

Recent Developments:

-

In June 2025, ITOKI unveiled its new office furniture brand “NII”, featuring designs by four internationally active designers. Focused on quality, comfort, and modularity, NII aims to redefine hybrid and flexible workspaces.

Japan Home Furnishings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Home Furniture, Home Textile, Wall Decor, Others |

| Prices Covered | Mass, Premium |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan home furnishings market size was valued at USD 142.52 Billion in 2025.

The Japan home furnishings market is expected to grow at a compound annual growth rate of 8.30% from 2026-2034 to reach USD 292.18 Billion by 2034.

Home furniture dominated the Japan home furnishings market with a share of 48%, driven by sustained consumer investment in living room, bedroom, and dining furniture that enhances residential functionality and aesthetic appeal.

Key factors driving the Japan home furnishings market include rapid urbanization creating demand for space-efficient furniture, an aging population requiring ergonomic solutions, digital transformation of retail channels, evolving lifestyle preferences toward minimalist designs, and growing demand for sustainable and eco-friendly products.

Major challenges include declining population potentially constraining the consumer base, space limitations in urban areas restricting large furniture demand, intense price competition in the mass market segment, and the need for continuous innovation to address evolving spatial and lifestyle requirements.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)