Japan Home Healthcare Equipment Market Size, Share, Trends and Forecast by Product and Region, 2026-2034

Japan Home Healthcare Equipment Market Overview:

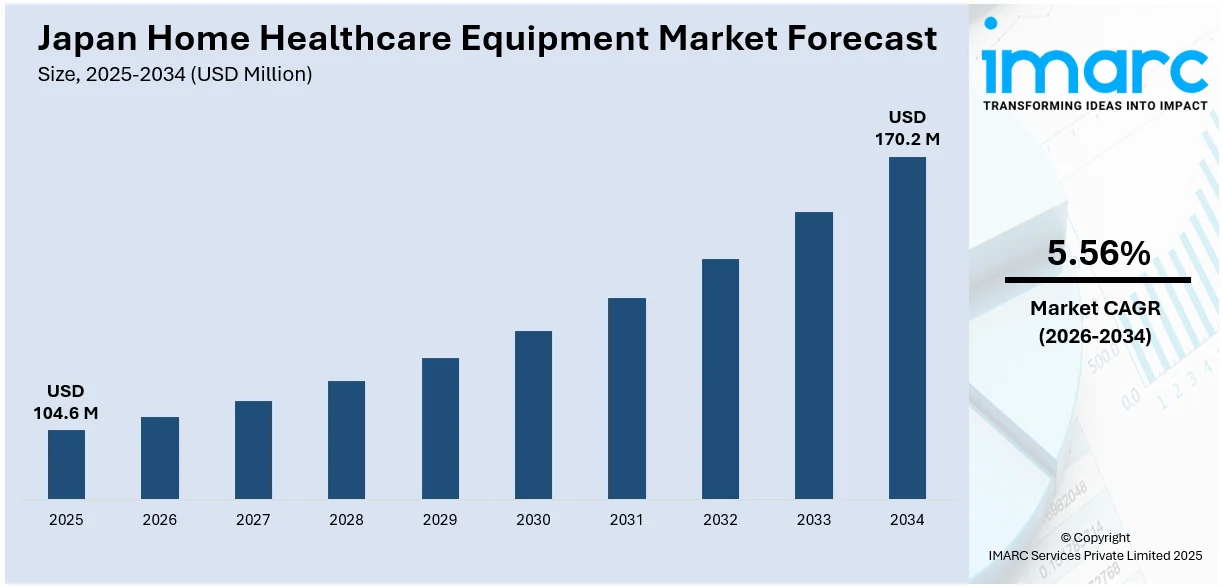

The Japan home healthcare equipment market size reached USD 104.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 170.2 Million by 2034, exhibiting a growth rate (CAGR) of 5.56% during 2026-2034. The market is driven primarily by Japan's rapidly aging populace which has spurred a boom in demand for medical devices that support independent living and effectively manage chronic illness. The Japanese government’s policies have also rendered home healthcare services easily accessible, irrespective of incomes. Improvement in telemedicine and mobile health applications has further enhanced the reach and efficiency of home healthcare by permitting real-time consultations and monitoring, significantly influencing the development of the Japan home healthcare equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 104.6 Million |

| Market Forecast in 2034 | USD 170.2 Million |

| Market Growth Rate 2026-2034 | 5.56% |

Japan Home Healthcare Equipment Market Trends:

Synthesis of Remote Monitoring and Artificial Intelligence

Japan's domestic healthcare device market is changing dramatically with the introduction of artificial intelligence (AI) and remote monitoring technologies. AI-enabled devices such as wearable ECG monitors and smart blood glucose meters enable ongoing monitoring of health status and early detection of potential health issues. These technologies enable timely intervention and reduce hospital visits to a minimum, while promoting maximum patient independence. Furthermore, the application of remote monitoring solutions allows healthcare providers to track patients' condition in real-time, resulting in subsequent personalized and streamlined care. The technology aligns with Japan's preventive approach to healthcare and desire to effectively manage chronic diseases at home. As a result, demand for AI-based home healthcare devices is on the rise, further fueling the Japan home healthcare equipment market growth.

To get more information on this market Request Sample

Focus on Geriatric Care and Mobility Support

With Japan's aging population increasing at a very fast rate, home medical equipment for the elderly is increasingly needed. According to the Ministry of Internal Affairs and Communications, Japan's old population grew by 20,000 between September 2023 and 2024, reaching 36.25 million, or a record 29.3 percent of the country's total population. As of September 15, the ministry reported that the aging rate, or the proportion of the population over 65, had increased by 0.2 percentage points. Hence, devices such as mobility aids, including wheelchairs and walkers, and hospital beds for the home and fall alert systems become essential for elderly individuals who want to live independently. These devices grant mobility along with security and convenience, allowing elderly patients to receive care at home rather than in the hospital or institutional setting. Efforts of the government of Japan, such as the Long-Term Care Insurance (LTCI) system, have also promoted the adoption of these devices by providing financial incentives for home care. As the population grows older, the demand for home healthcare equipment with specialist requirements is also expected to increase, driving innovation and development in this segment.

Emphasis on Aesthetic and Simple Designs

There is a tendency toward the development of home care devices in Japan that are functional while also being good-looking. Industries are attempting to create devices that are functional and blend harmoniously into domestic environments. Medical-grade devices and furniture, for instance, are being created with fashionable, up-to-date designs to reduce the clinical environment of home care settings. This approach aims to enhance the experience of the patient, instilling a feeling of increased comfort and less stigmatization using medical devices. In addition, the user interface and controls take precedence to facilitate accessibility for individuals with or without technological competencies. The emphasis on design and ease of use is contributing to the expansion of the recognition and popularity of home healthcare devices among consumers in Japan.

Japan Home Healthcare Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product.

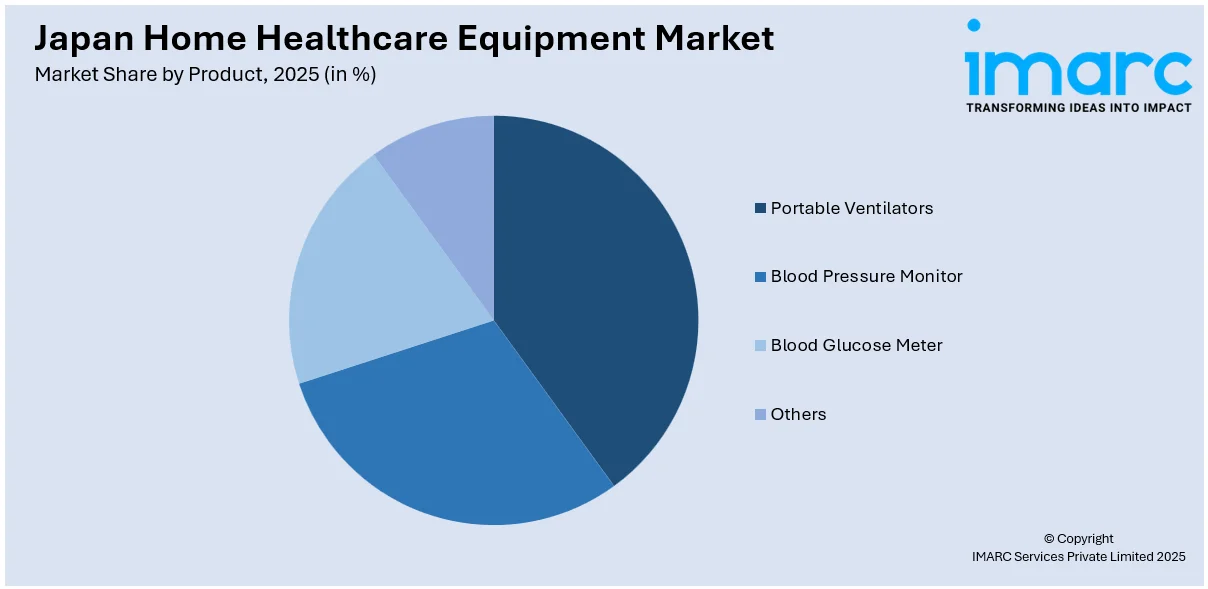

Product Insights:

Access the comprehensive market breakdown Request Sample

- Portable Ventilators

- Blood Pressure Monitor

- Blood Glucose Meter

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes portable ventilators, blood pressure monitor, blood glucose meter, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central /Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central /Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Home Healthcare Equipment Market News:

- In March 2025, Medical Japan 2025 Osaka, which brought together leaders in the medical and healthcare sectors to showcase innovations and promote advancements, returned to INTEX Osaka. The countdown to Medical Japan 2025 Osaka, Western Japan's premier medical and healthcare trade show begun and took place at INTEX Osaka from March 5–7, 2025, bringing together innovators, thought leaders, and industry professionals to showcase cutting-edge technologies, promote collaboration, and advance medical, pharmacy, elderly care, and healthcare.

- In March 2025, Sky Labs intensified its efforts in Japan by finalizing a distribution agreement with OMRON Healthcare shortly after obtaining a possible global distribution arrangement with Otsuka Pharmaceutical. The recent agreement will introduce the medical wearable company's smart ring blood pressure (BP) monitor to Japan's consumer health market by year-end. Cart BP pro is the first smart ring globally to receive clinical validation in comparison to standard BP measurement techniques, such as 24-hour ambulatory BP monitoring, invasive arterial BP measurement, and auscultatory methods. The device has received approval as a medical instrument in Korea and is included in health insurance for ongoing BP monitoring.

Japan Home Healthcare Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Portable Ventilators, Blood Pressure Monitor, Blood Glucose Meter, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central /Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan home healthcare equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan home healthcare equipment market on the basis of product?

- What is the breakup of the Japan home healthcare equipment market on the basis of region?

- What are the various stages in the value chain of the Japan home healthcare equipment market?

- What are the key driving factors and challenges in the Japan home healthcare equipment market?

- What is the structure of the Japan home healthcare equipment market and who are the key players?

- What is the degree of competition in the Japan home healthcare equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan home healthcare equipment market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan home healthcare equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan home healthcare equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current position of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)