Japan Hosiery Market Size, Share, Trends and Forecast by Type, End Use, and Region, 2026-2034

Japan Hosiery Market Summary:

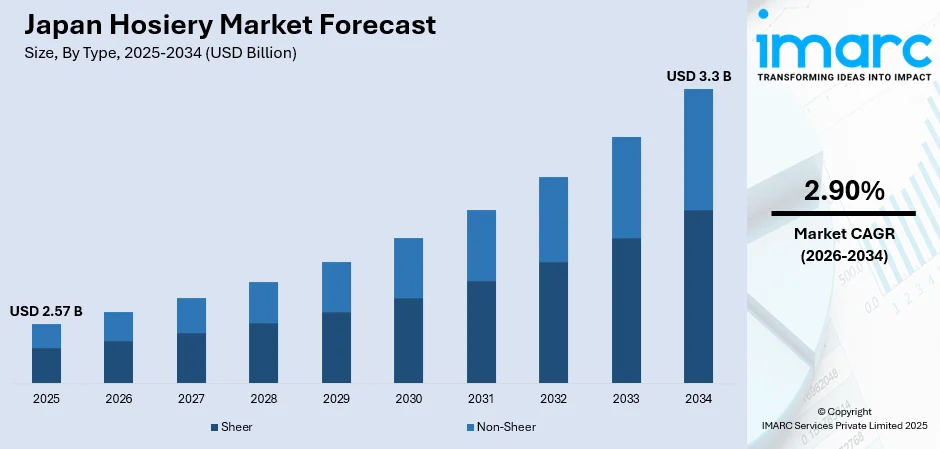

The Japan hosiery market size was valued at USD 2.57 Billion in 2025 and is projected to reach USD 3.3 Billion by 2034, growing at a compound annual growth rate of 2.90% from 2026-2034.

The Japan hosiery market is propelled by enduring cultural preferences for modest, polished dressing, complemented by seasonal wardrobe requirements and the country’s advanced domestic textile manufacturing capabilities. Growing demand for compression and comfort hosiery among the geriatric population further fuels category growth. Continuous innovations in fabric functionality, performance, and sustainability across product lines reinforce consumer appeal, driving market expansion and strengthening the overall Japan hosiery market share.

Key Takeaways and Insights:

-

By Type: Non‑sheer dominates the market with a share of 85.5% in 2025, driven by versatility for professional/formal attire, durable daily wear, and consumer preference for opaque coverage suitable throughout the year.

-

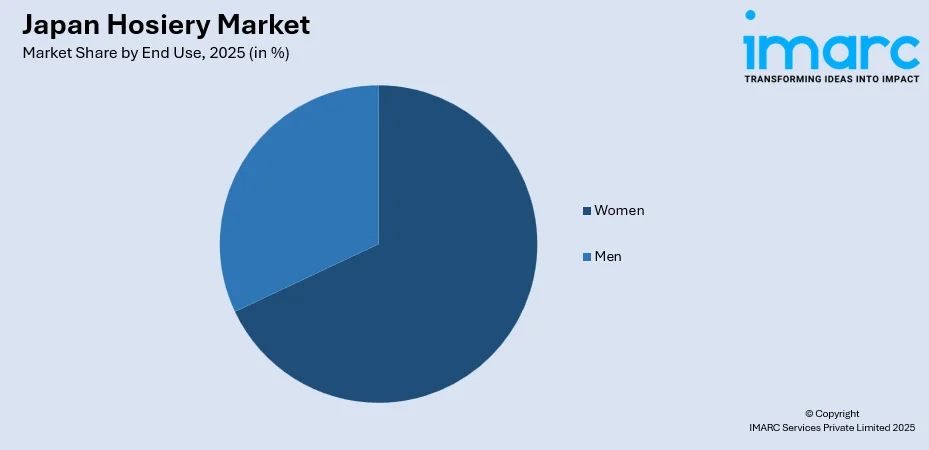

By End Use: Women lead the market with a share of 68% in 2025, supported by cultural emphasis on polished leg aesthetics, diverse casual-to-formal offerings, and strong seasonal purchasing habits in professional and fashion-conscious settings.

-

Key Players: The Japan hosiery market exhibits a mature competitive landscape, with established domestic manufacturers competing alongside international apparel brands across premium and mass-market segments through continuous innovation in comfort technology and sustainable materials.

To get more information on this market Request Sample

The Japan hosiery market is propelled by a confluence of cultural, demographic, and technological factors that sustain consistent consumer demand. Japanese society places significant emphasis on polished, modest dressing across professional and social environments, creating a foundational requirement for hosiery products. The nation's advanced textile manufacturing capabilities enable continuous innovation in fabric quality, compression technology, and sustainable production methods. In August 2025, Atsugi launched its 180d double-layer stockings for fall/winter, tested in Harbin at −5℃ to −10℃, providing warmth, comfort, and durability for urban women and office workers. Moreover, growing health consciousness among consumers, particularly regarding leg circulation and comfort during extended wear, drives demand for functional hosiery variants. Seasonal climate variations necessitate wardrobe adaptations that include transitioning between sheer and opaque hosiery options. The established retail infrastructure, encompassing department stores, specialty shops, and robust e-commerce channels, ensures widespread product accessibility.

Japan Hosiery Market Trends:

Rising Preference for Sustainable and Eco-Friendly Hosiery Products

Environmental consciousness is increasingly influencing consumer purchasing decisions within Japan's hosiery sector, driving manufacturers toward sustainable production practices. Brands are adopting recycled nylon fibers, biodegradable packaging materials, and closed-loop dyeing processes to minimize ecological footprints. In October 2025, Nara-based Souki launched sustainable socks using Yoshino cedar and cypress “wooden thread” combined with upcycled cotton, supporting local recycling and funding Yoshino cherry tree planting initiatives. Moreover, consumers demonstrate growing willingness to pay premium prices for hosiery products manufactured through environmentally responsible methods. The integration of organic materials and plant-based fibers into product lines addresses demands for skin-friendly, chemical-free options. Manufacturers are implementing transparent supply chain practices and eco-certifications to build consumer trust and differentiate offerings.

Expansion of Athleisure-Influenced Hosiery Designs

The blurring boundaries between activewear and everyday fashion are reshaping hosiery design aesthetics and functionality requirements. Consumers increasingly seek hosiery products that transition seamlessly from professional environments to casual settings without compromising comfort or appearance. Manufacturers are incorporating performance features such as moisture management, stretch recovery, and breathable panels into traditional hosiery styles. In July 2025, Goldwin 0 launched its Performance Capsule in Toyama, featuring body-mapped compression tights and half-tights with ventilation panels, blending trail-running functionality with everyday athleisure wear for active consumers. The influence of wellness-oriented lifestyles encourages demand for products supporting active routines while maintaining elegant aesthetics. Design innovations include hybrid constructions combining the supportive elements of athletic compression wear with the refined appearance of conventional hosiery.

Growing Demand for Size-Inclusive and Body-Positive Hosiery Options

The hosiery market is experiencing transformation driven by consumer expectations for expanded size ranges and inclusive product offerings. As per sources, NAIGAI Co., Ltd. participated in the Japan Socks Association’s pop-up stores and social media campaign for “Sock Day,” promoting fashionable, inclusive socks across Osaka, Yokohama, and online. Furthermore, manufacturers are extending sizing options to accommodate diverse body types, moving beyond traditional limited size categories. Product development increasingly emphasizes comfortable waistbands, graduated compression, and adaptive fits that enhance wearability across different physiques. Marketing approaches are shifting toward body-positive messaging that celebrates diverse consumers and promotes self-confidence. Retailers are expanding shelf allocations for extended-size hosiery products, recognizing the commercial potential of addressing previously underserved consumer segments.

Market Outlook 2026-2034:

The Japan hosiery market is projected to demonstrate steady revenue growth throughout the forecast period, driven by sustained cultural preferences for refined legwear and continuous product innovation. Domestic manufacturers are expected to maintain competitive advantages through advanced textile technologies and quality-focused production methods. The geriatric demographic will continue stimulating revenue from compression and therapeutic hosiery categories. E-commerce channel expansion will facilitate market accessibility while enabling personalized shopping experiences. Sustainable product development and premium functional variants are anticipated to command growing revenue contributions across distribution channels. The market generated a revenue of USD 2.57 Billion in 2025 and is projected to reach a revenue of USD 3.3 Billion by 2034, growing at a compound annual growth rate of 2.90% from 2026-2034.

Japan Hosiery Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Non‑Sheer |

85.5% |

|

End Use |

Women |

68% |

Type Insights:

- Sheer

- Non-Sheer

The non‑sheer dominates with a market share of 85.5% of the total Japan hosiery market in 2025.

The non-sheer maintains dominant market positioning through its versatile applicability across Japan's professional and social environments. The segment benefits from consumer preferences for opaque coverage that delivers both aesthetic appeal and practical functionality during cooler seasons. Japanese workplace culture emphasizes formal dressing standards that favor non-sheer variants, particularly in corporate and service industry settings where polished appearance is essential. Product durability characteristics appeal to cost-conscious consumers seeking longer-lasting hosiery investments. In March 2025, Atsugi Co., Ltd. launched "Sugosuto," a next-generation legwear combining tights’ strength with stockings’ transparency, aiming to improve durability and prevent runs and tears.

The segment continues expanding through innovations in fabric weight, texture variations, and color offerings that address diverse consumer preferences. Manufacturers are developing advanced non-sheer constructions incorporating compression benefits, thermal regulation, and enhanced stretch recovery features. The adaptability of non-sheer hosiery for layering purposes during winter months sustains year-round demand patterns. Premium non-sheer variants featuring superior finishing and comfort technologies command strong consumer loyalty among quality-oriented purchasers.

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Men

- Women

Women lead with a share of 68% of the total Japan hosiery market in 2025.

Women constitute the dominant consumer segment, reflecting deeply established cultural norms regarding feminine legwear in Japanese society. Professional dress codes across corporate, hospitality, and retail sectors create consistent demand for hosiery products among working women. The extensive product variety available for female consumers, spanning multiple opacity levels, compression options, and design aesthetics, supports diverse purchasing occasions. Seasonal fashion cycles and coordinating hosiery with outerwear drive regular repurchase behavior.

Female consumers demonstrate advanced purchasing patterns, balancing considerations of quality, comfort, aesthetic appeal, and price across different usage occasions. The segment benefits from robust marketing investments by manufacturers targeting female demographics through fashion publications, social media, and retail partnerships. Growing emphasis on leg health and circulation support among middle-aged and older women expands functional hosiery adoption. Department store beauty and fashion counters maintain dedicated hosiery sections catering to female consumers seeking personalized product recommendations.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

Kanto region encompassing Tokyo and surrounding prefectures, represents the largest hosiery consumption market driven by concentrated corporate headquarters, extensive service industry employment, and fashion-forward consumer populations. Dense retail infrastructure and sophisticated distribution networks ensure comprehensive product availability across premium and mass-market segments.

Kansai/Kinki region centered on Osaka, Kyoto, and Kobe, constitutes a significant hosiery market supported by robust commercial activity and traditional cultural influences emphasizing refined presentation. The region's diverse economic base spanning manufacturing, tourism, and retail sectors maintains consistent demand across consumer demographics.

Central/Chubu region anchored by Nagoya's industrial economy, demonstrates steady hosiery consumption patterns aligned with professional workforce requirements across manufacturing and service industries. Regional retail development and growing e-commerce penetration enhance market accessibility for consumers across urban and suburban communities.

Kyushu-Okinawa region presents moderate hosiery demand influenced by subtropical climate conditions affecting seasonal consumption patterns. Tourism-driven economies and growing urban centers in Fukuoka support market development, with lighter denier products demonstrating stronger regional preference.

Tohoku region exhibits hosiery consumption patterns shaped by cooler climate conditions favoring heavier denier and non-sheer products. Regional economic activities in manufacturing and agriculture support working populations requiring professional attire, while geriatric demographics drive functional hosiery demand.

Chugoku region demonstrates moderate hosiery market activity supported by industrial employment centers and commercial development in Hiroshima and surrounding cities. Regional retail presence from national chains ensures product accessibility, while local consumer preferences align with broader national trends.

Hokkaido region reflects northern climate influences driving strong demand for thermal and heavier denier products during extended winter seasons. Tourism industry employment requirements and urban commercial activity in Sapporo sustain consistent market participation across product categories.

Shikoku region represents a smaller but stable hosiery market characterized by traditional retail channels and moderate e-commerce adoption. Regional demographic geriatric influences growing interest in comfort-focused and compression hosiery variants among health-conscious consumer segments.

Market Dynamics:

Growth Drivers:

Why is the Japan Hosiery Market Growing?

Cultural Emphasis on Polished Professional Appearance

Japanese workplace culture maintains rigorous standards for professional presentation, with hosiery serving as an essential element of formal and semi-formal attire. Corporate dress codes across industries explicitly or implicitly require polished legwear, creating non-discretionary demand among employed women. The service industry, encompassing hospitality, retail, and healthcare sectors, establishes specific appearance guidelines that include appropriate hosiery requirements. This cultural foundation ensures baseline market demand remains insulated from fashion fluctuations affecting discretionary apparel purchases. Social occasions including ceremonies, formal gatherings, and business entertainment similarly necessitate appropriate hosiery selection, extending demand beyond workplace requirements.

Demographic Geriatric and Health-Conscious Consumer Behavior

Japan's geriatric population profile creates sustained demand for hosiery products offering therapeutic and comfort benefits beyond aesthetic considerations. Compression hosiery designed to support circulation and reduce leg fatigue addresses health concerns prevalent among older consumers. Healthcare professional recommendations increasingly include compression stockings as preventive measures against venous disorders and post-operative recovery support. The wellness orientation extending across consumer age groups encourages adoption of mild compression variants among younger demographics seeking daily comfort enhancement. Product innovations addressing ease of wear, skin sensitivity, and breathability improve compliance and satisfaction among older users. In October 2025, Kao’s Curél brand introduced Boosting Hand Care Gloves and Heel Care Socks using Fine Fiber Technology, supported by surveys showing 73% of users concerned about hand dryness and 65% about heel dryness.

Advanced Domestic Textile Manufacturing Capabilities

Japan's sophisticated textile industry provides competitive advantages through continuous innovation in hosiery materials, construction techniques, and finishing processes. Domestic manufacturers leverage precision knitting technologies enabling seamless designs, reinforced stress points, and consistent sizing accuracy. Research investments yield proprietary fiber developments offering enhanced durability, run resistance, and functional properties including UV protection and temperature regulation. As per sources, in June 2025, Teijin Frontier unveiled a next-generation stretch fabric with ultra-fine multi-crimp structure offering lightweight comfort, quick-drying performance, and enhanced elasticity for advanced textile applications. Moreover, quality-focused production methods align with Japanese consumer expectations for premium performance and longevity, supporting brand loyalty and premium pricing strategies. Manufacturing proximity enables responsive inventory management and seasonal product adaptation.

Market Restraints:

What Challenges the Japan Hosiery Market is Facing?

Shifting Fashion Preferences Toward Casual Dressing

Evolving workplace norms increasingly accept casual attire, potentially reducing occasions requiring formal hosiery products. Younger generations demonstrate preferences for bare-leg aesthetics or alternatives such as ankle socks and leggings, challenging traditional hosiery demand patterns. Remote and hybrid working arrangements diminish daily requirements for professional presentation, impacting regular purchase frequency among employed consumers.

Price Sensitivity and Disposable Product Perception

Consumer perception of hosiery as frequently replaced disposable items creates resistance toward premium pricing, limiting manufacturer margins. Competition from lower-priced imported products pressures domestic manufacturers to balance quality investments against price competitiveness. Economic uncertainty encourages consumers to extend hosiery replacement cycles or trade down to economy-tier alternatives.

Climate and Seasonal Demand Variability

Japan's regional climate variations create uneven demand patterns, with warmer regions demonstrating lower consumption compared to temperate zones. Mild winter seasons reduce requirements for heavier denier products, impacting category revenue performance. Summer months present natural demand troughs as consumers prefer alternatives to traditional hosiery in humid conditions.

Competitive Landscape:

The Japan hosiery market operates within a mature competitive framework characterized by established domestic manufacturers maintaining significant presence alongside international apparel conglomerates. Competition centers on product innovation, quality differentiation, and brand positioning across distinct market tiers spanning premium, mid-range, and economy segments. Manufacturers invest substantially in research and development activities focused on advancing fabric technologies, comfort features, and sustainable production methods. Distribution strategy optimization remains critical, with competitors balancing traditional retail partnerships against growing e-commerce channel requirements. Private label offerings from major retailers intensify price competition within mass-market segments. Differentiation strategies emphasize functional benefits, fashion collaborations, and brand heritage to justify premium positioning and maintain consumer loyalty.

Recent Developments:

-

In March 2024, Sukeno launched a new “Liite” compression sock series, developed with midwives’ input. The range includes pile, toeless, and thin high socks, offering targeted support, enhanced comfort, and breathability, designed for ease of wear and practical use throughout different daily and seasonal conditions.

Japan Hosiery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Sheer, Non-Sheer |

| End Uses Covered | Men, Women |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan hosiery market size was valued at USD 2.57 Billion in 2025.

The Japan hosiery market is expected to grow at a compound annual growth rate of 2.90% from 2026-2034 to reach USD 3.3 Billion by 2034.

The non-sheer captured the largest market share, fueled by its versatility for professional attire, superior durability, and prevailing cultural preference for opaque coverage, making it highly suitable for formal and year-round dressing requirements.

Key factors driving the Japan hosiery market include cultural emphasis on polished professional appearance, geriatric demographics increasing demand for compression hosiery, advanced domestic textile manufacturing capabilities, and continuous innovation in comfort and sustainable materials.

Major challenges include shifting fashion preferences toward casual dressing, price sensitivity among consumers perceiving hosiery as disposable, competition from lower-priced imports, seasonal demand variability, and changing workplace norms reducing formal attire requirements.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)