Japan HVAC Market Size, Share, Trends and Forecast by Product Type, End User, and Region, 2026-2034

Japan HVAC Market Overview:

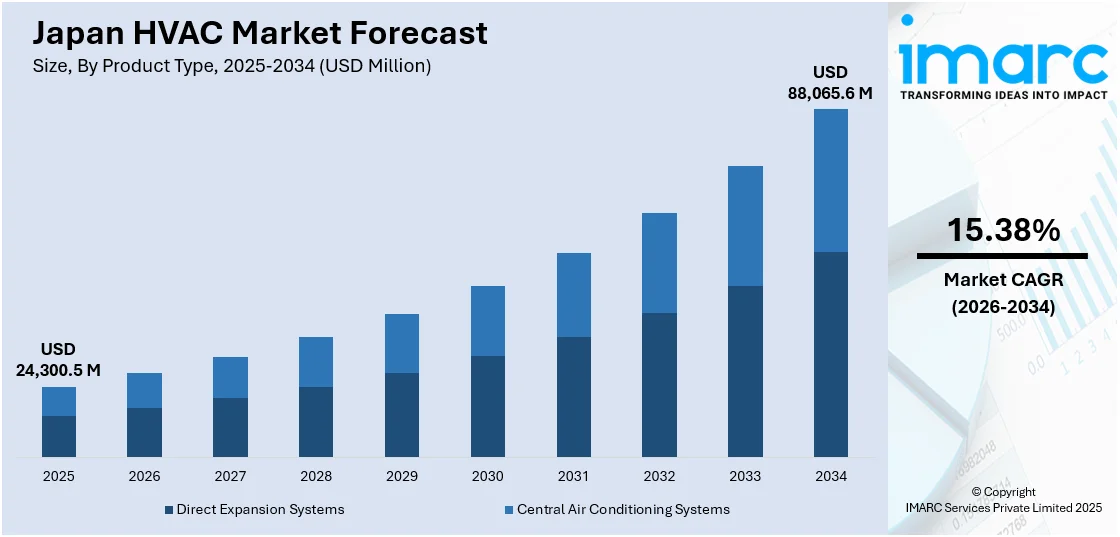

The Japan HVAC market size reached USD 24,300.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 88,065.6 Million by 2034, exhibiting a growth rate (CAGR) of 15.38% during 2026-2034. The market is driven by smart building integration and redevelopment across urban centers. Also, aging demographics and increased focus on indoor air quality in healthcare and residential spaces are shaping technology preferences. Additionally, industrial cleanroom requirements and energy efficiency norms are steering HVAC design innovation. Health-conscious design mandates, building automation, and decarbonization-driven incentives are further augmenting the Japan HVAC market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 24,300.5 Million |

| Market Forecast in 2034 | USD 88,065.6 Million |

| Market Growth Rate 2026-2034 | 15.38% |

Japan HVAC Market Trends:

Urban Redevelopment and Smart Building Integration

Japan’s ongoing urban redevelopment initiatives, particularly in metropolitan centers such as Tokyo and Osaka, are placing sophisticated HVAC systems at the core of next-generation building designs. With a substantial focus on energy optimization and automation, smart HVAC technologies, equipped with IoT sensors and real-time performance analytics, are becoming embedded into residential towers, commercial complexes, and transport infrastructure. Redevelopment efforts targeting earthquake-resistant construction and green certification standards have further expanded the demand for efficient HVAC installations. The country’s limited land availability necessitates vertical growth and high-density structures, each requiring centralized and scalable HVAC systems capable of ensuring consistent thermal regulation and indoor air quality.

To get more information on this market Request Sample

On January 7, 2025, Panasonic Corporation launched its OASYS Residential Central Air Conditioning System in the U.S. market, marking a significant advancement in Japanese HVAC innovation. The OASYS system, developed in Osaka, reduces energy consumption by over 50% compared to conventional systems through a combination of Mini Split AC units, Energy Recovery Ventilators (ERVs), and DC motor-driven fans. Developers are prioritizing modular designs and low-emission systems that comply with the Ministry of the Environment's efficiency directives. Heat recovery systems and zonal climate control units are being adopted to meet occupant comfort requirements while adhering to strict energy codes. Digital HVAC control platforms are also being introduced to assist facilities management teams in predictive maintenance and usage tracking. These developments, primarily concentrated in Japan’s largest business districts, underscore a broader transition toward integrated HVAC planning. This trend contributes significantly to Japan HVAC market growth by embedding environmental intelligence and automation into the foundation of modern urban infrastructure.

Industrial Automation and Clean Manufacturing Requirements

Japan’s precision-driven manufacturing sector, encompassing electronics, robotics, semiconductors, and pharmaceuticals, places rigorous demands on climate stability and airborne particulate control. Cleanrooms, data centers, and specialized production facilities require HVAC solutions with stringent humidity and temperature control, coupled with minimal contamination risk. As industrial automation advances, facility climate systems must operate with exceptional consistency, integrating with digital control frameworks and maintenance protocols. Leading manufacturers are installing zone-specific HVAC systems that support high uptime and low power consumption, responding both to operational efficiency targets and environmental guidelines. These systems often incorporate multiple air filtration stages, static pressure regulation, and energy recovery ventilation (ERV).

On April 23, 2025, Carrier Japan introduced the Abound™ HVAC Performance platform, enhancing lifecycle solutions for commercial HVAC systems in Japan. This platform, integrated with a 24/365 Command Center in Tokyo, offers real-time digital monitoring, predictive maintenance, and compliance with Japan's GL-17 refrigerant leak detection guidelines, aiming to reduce downtime and optimize energy consumption. Japan’s commitment to decarbonization and sustainable development further incentivizes industries to upgrade existing systems with energy-efficient alternatives. Government programs offering financial assistance for green equipment installations, particularly under METI’s (Ministry of Economy, Trade and Industry) decarbonization roadmap, are accelerating this shift. Moreover, global clients increasingly require suppliers to comply with international environmental and quality standards, pushing domestic industries to align their HVAC capabilities accordingly. This confluence of industrial precision, regulatory alignment, and export competitiveness has established HVAC technologies as mission-critical infrastructure within Japan’s manufacturing value chain.

Japan HVAC Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type and end user.

Product Type Insights:

- Direct Expansion Systems

- Central Air Conditioning Systems

The report has provided a detailed breakup and analysis of the market based on the product type. This includes direct expansion systems and central air conditioning systems.

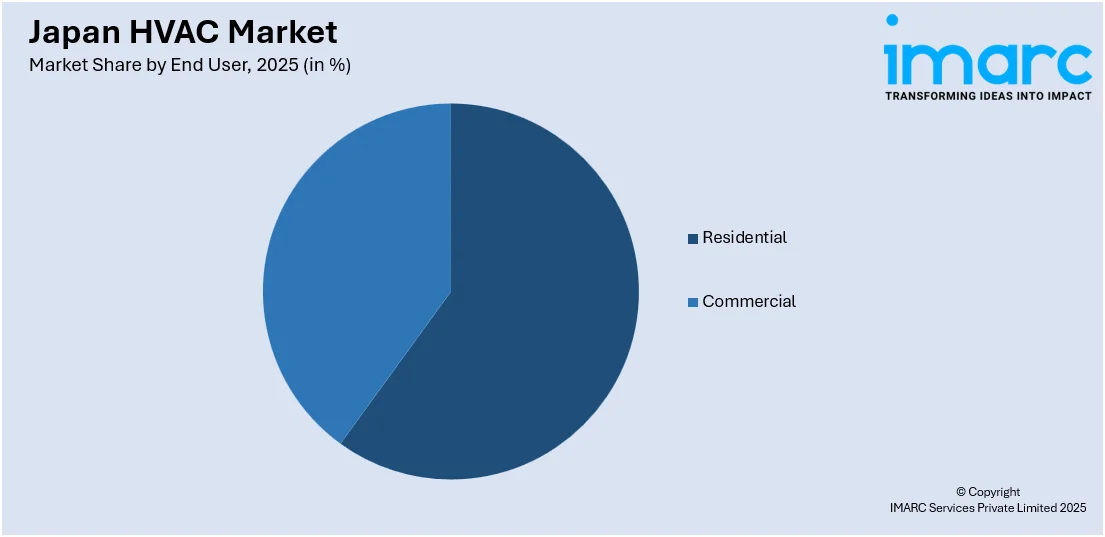

End User Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

The report has provided a detailed breakup and analysis of the market based on the end user. This includes residential and commercial.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all major regional markets. This includes Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan HVAC Market News:

- On November 26, 2024, Copeland and Daikin announced a joint venture to introduce inverter swing rotary compressor technology to the U.S. residential HVAC sector, with operations expected by H1 2025. The collaboration will leverage Daikin’s core technology and Copeland’s U.S. network to accelerate the adoption of energy-efficient, inverter-based heat pump systems. The initiative supports Daikin’s FUSION25 strategy, highlighting Japan’s expanding role in global HVAC decarbonization.

Japan HVAC Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Direct Expansion Systems, Central Air Conditioning Systems |

| End Users Covered | Residential, Commercial |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan HVAC market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan HVAC market on the basis of product type?

- What is the breakup of the Japan HVAC market on the basis of end user?

- What is the breakup of the Japan HVAC market on the basis of region?

- What are the various stages in the value chain of the Japan HVAC market?

- What are the key driving factors and challenges in the Japan HVAC market?

- What is the structure of the Japan HVAC market and who are the key players?

- What is the degree of competition in the Japan HVAC market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan HVAC market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan HVAC market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan HVAC industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)