Japan Hydropower Equipment Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

Japan Hydropower Equipment Market Overview:

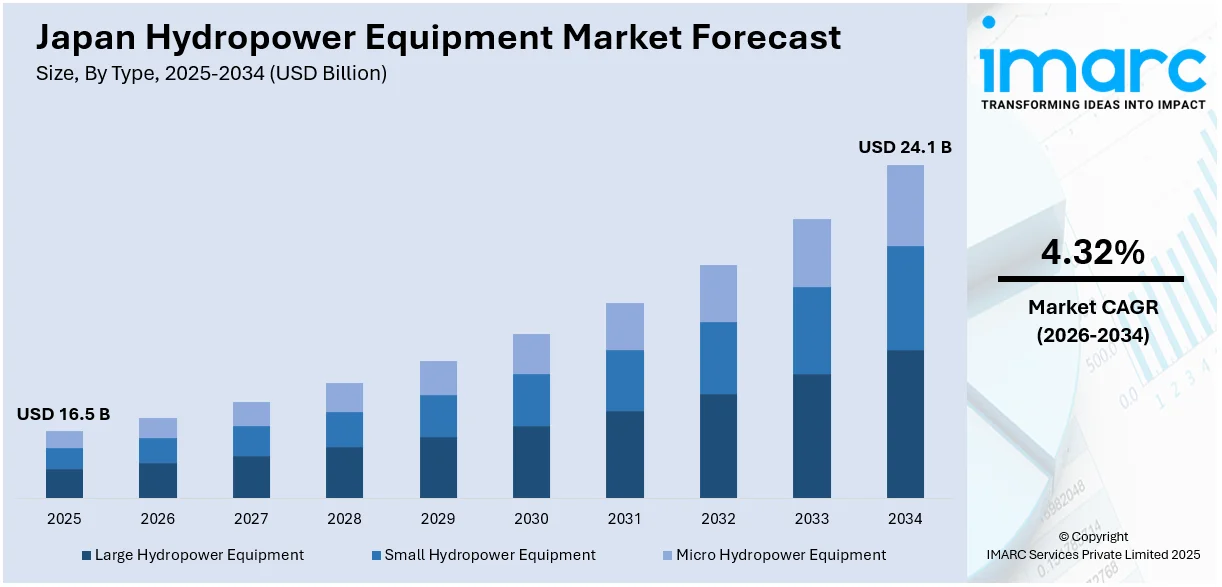

The Japan hydropower equipment market size reached USD 16.5 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 24.1 Billion by 2034, exhibiting a growth rate (CAGR) of 4.32% during 2026-2034. Increasing renewable energy demand, government support for clean energy, technological advancements, and the need for energy security are some of the factors contributing to Japan hydropower equipment market share. Additionally, Japan's focus on reducing carbon emissions and investing in sustainable infrastructure further boosts market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 16.5 Billion |

| Market Forecast in 2034 | USD 24.1 Billion |

| Market Growth Rate 2026-2034 | 4.32% |

Japan Hydropower Equipment Market Trends:

Hydropower Advancements in Renewable Energy Push

The Japan hydropower sector is witnessing significant developments with the launch of new plants designed to replace aging infrastructure and optimize energy production. Key partnerships are focusing on maximizing the potential of existing hydroelectric resources while improving sustainability and efficiency. These ventures aim to enhance renewable energy capabilities in key regions, contributing to Japan's broader commitment to carbon neutrality. By upgrading outdated facilities and leveraging modern technologies, the sector is playing a pivotal role in meeting national energy and environmental goals. This shift supports the country’s growing reliance on renewable sources, including hydropower, to reduce carbon emissions and enhance energy security. These factors are intensifying the Japan hydropower equipment market growth. For example, in February 2024, Hokkaido Electric Power and Mitsubishi Corporation launched commercial operations at the Ainumanai Power Plant in Hokkaido, marking the start of their hydroelectric alliance in the Donan region. The joint venture, Donan Hydroelectric LLC, would replace five existing Hokuden plants, utilizing current infrastructure and replacing aging facilities. This initiative aims to optimize hydropower resources and support Japan’s carbon neutrality goals through renewable energy.

To get more information on this market Request Sample

Sustainable Energy Solutions for Rural Networks

The Japan hydropower equipment market is witnessing a shift toward sustainable energy solutions for rural mobile networks. Companies are increasingly adopting self-powered systems that combine hydroelectric technologies and jet turbines. These systems aim to offer low-cost, eco-friendly power sources, crucial for remote locations with limited access to traditional energy infrastructure. Alongside delivering continuous connectivity, these systems also monitor key parameters like water flow and CO2 reduction, aligning with broader environmental goals. This innovation supports the industry's push toward achieving carbon-neutral operations, with a particular focus on meeting net-zero emissions targets by 2030. For instance, in May 2024, NTT DOCOMO launched a demonstration of a self-powered hydropower cellular base station in Japan. The experiment, using a hydroelectric system and jet turbine, aimed to provide sustainable, low-cost energy for rural mobile networks. The system monitors power, water flow, and CO2 reduction. DOCOMO planned to implement it as part of its commitment to net-zero emissions by 2030 and carbon-neutral operations.

Japan Hydropower Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type and application.

Type Insights:

- Large Hydropower Equipment

- Small Hydropower Equipment

- Micro Hydropower Equipment

The report has provided a detailed breakup and analysis of the market based on the type. This includes large hydropower equipment, small hydropower equipment, and micro hydropower equipment.

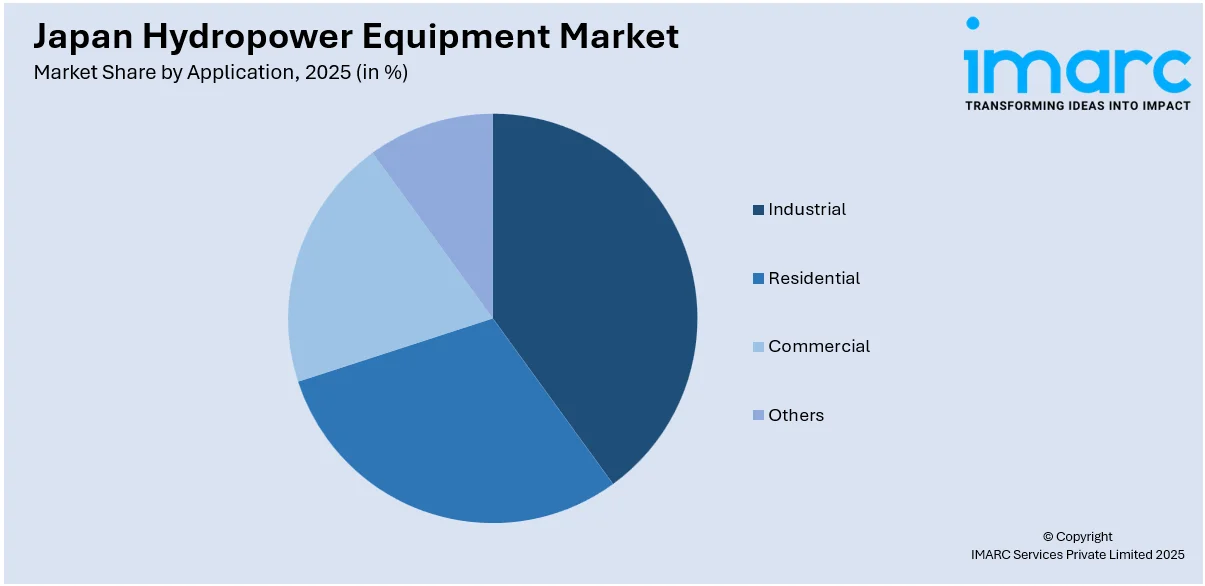

Application Insights:

Access the comprehensive market breakdown Request Sample

- Industrial

- Residential

- Commercial

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes industrial, residential, commercial, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Hydropower Equipment Market News:

- In February 2025, the Japan International Cooperation Agency (JICA) signed a loan agreement to support the construction of hydropower plants in Bhutan. This project, aimed at meeting rising power demand and promoting regional power exports, includes the development of Jomori and Druk Bindu plants. JICA would assist with the procurement of electromechanical equipment, transmission lines, and consulting services. The loan, amounting to JPY 13,688 Million, features a 25-year repayment period and aligns with SDGs focused on clean energy and economic growth.

Japan Hydropower Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Large Hydropower Equipment, Small Hydropower Equipment, Micro Hydropower Equipment |

| Applications Covered | Industrial, Residential, Commercial, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan hydropower equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan hydropower equipment market on the basis of type?

- What is the breakup of the Japan hydropower equipment market on the basis of application?

- What is the breakup of the Japan hydropower equipment market on the basis of region?

- What are the various stages in the value chain of the Japan hydropower equipment market?

- What are the key driving factors and challenges in the Japan hydropower equipment market?

- What is the structure of the Japan hydropower equipment market and who are the key players?

- What is the degree of competition in the Japan hydropower equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan hydropower equipment market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan hydropower equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan hydropower equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)