Japan Induction Cooktop Market Size, Share, Trends and Forecast by Product, Application, Distribution Channel, and Region, 2026-2034

Japan Induction Cooktop Market Overview:

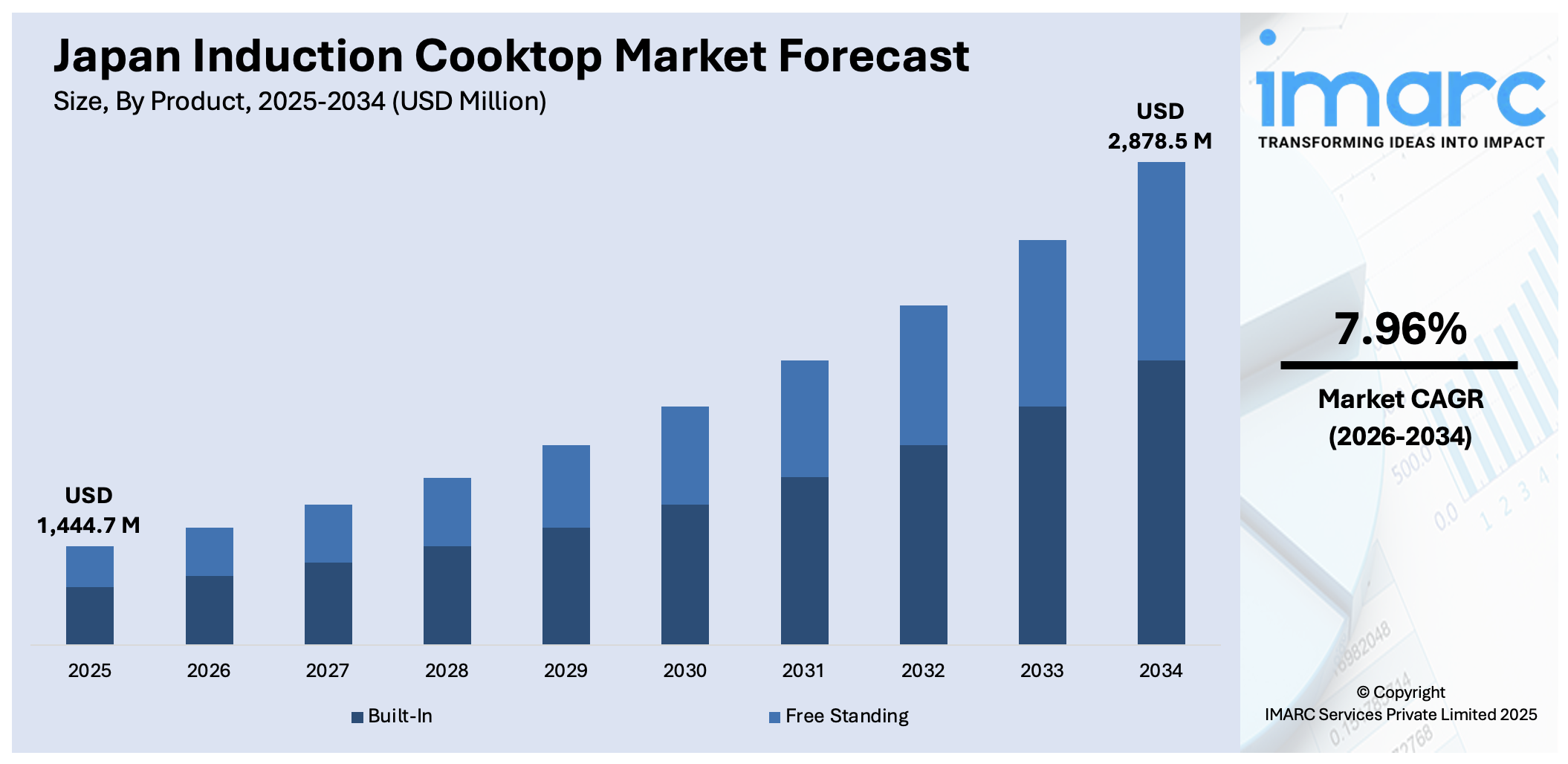

The Japan Induction cooktop market size reached USD 1,444.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 2,878.5 Million by 2034, exhibiting a growth rate (CAGR) of 7.96% during 2026-2034. Urbanization, integration with smart technology, and green consciousness are fueling this boom in demand for induction cooktops in Japan. Built-in products are preferred due to their compactness, and smart functions further increase user convenience and control. Customers are also looking for energy-efficient appliances that support sustainable living objectives. These trends demonstrate a cultural and technological change in domestic preferences throughout the nation. This changing environment is adding to the growth of the Japan induction cooktop market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,444.7 Million |

| Market Forecast in 2034 | USD 2,878.5 Million |

| Market Growth Rate 2026-2034 | 7.96% |

Japan Induction Cooktop Market Trends:

Increasing Demand for Built-In Induction Cooktops in Metropolitan Homes

Japan's changing urban lifestyle is compelling a discernible trend towards built-in induction cooktops, particularly within metropolitan households. The appliances provide a sleek, space-saving option that perfectly complies with the compact kitchen space common in Japanese apartments. Apart from their visual attractiveness, built-in versions offer increased functionality, enabling easy integration with cabinetry and countertops. This has also made them a popular option for homeowners looking for contemporary, minimalist kitchens. Additionally, many such appliances come equipped with touch-sensitive controls, advanced safety mechanisms, and temperature control systems that ensure precision, making them easy to use as well as efficient. For example, in January 2023, GE Appliances introduced 14 app-connected smart induction cooktops with Guided Cooking and Precision Temperature Control, positioning Japan's expanding demand for high-tech, energy-saving induction solutions for small urban kitchens. Furthermore, the trend also reflects the growing appeal of home remodeling and renovation work in Japan, where buyers want to substitute older gas stoves with cleaner and safer electric stoves. The Japan induction cooktop market growth is mirroring the rising popularity of this setup in urban residential settings.

To get more information on this market Request Sample

Smart Technology Integration Improving User Experience

Smart technology integration in induction cooktops is also emerging as a hallmark trend in Japan's contemporary kitchen scene. For example, in September 2024, Midea launched the Celestial Flex Series, the world's first Ki wireless-powered kitchen appliances, and the multi-functional Midea One Oven, innovations pacing Japan's expanding induction cooktop market and consumer interest in compact, energy-saving cooking solutions. Moreover, modern cooktops now include connectivity features like Bluetooth or Wi-Fi, which allow users to control and check their appliances via mobile apps. These integrated systems enable distant temperature control, timer configurations, and even guided cooking support, thus enhancing user convenience and accuracy. Moreover, smart sensors onboard the cooktops can recognize the diameter of cookware, balance power distribution, and heat level adjustments automatically, saving energy and improving safety. This step is consistent with Japan's overall transition toward smart homes and the use of Internet of Things (IoT) technologies. They want those features most in tech-savvy households for their capacity to make cooking easier and more uniform in culinary outcomes. With more homeowners emphasizing smart solutions, the use of smart technology in induction cooktops will likely grow in home environments.

Focus on Energy Efficiency and Environmental Sustainability

As a policy to environmental sustainability and conserving energy, induction cooktops are becoming increasingly popular for their higher energy efficiency than conventional gas or electric coil burners. Induction stoves use electromagnetic waves to heat cookware directly, which means less energy is lost as heat and much less energy is being consumed. With increasing nationwide concern about reducing the carbon footprint, homes are actively opting for appliances that fit into green living. Induction cooktops also enable lower indoor heat emission, resulting in cooler kitchen conditions and less dependence on supplementary cooling solutions during hot weather. Not only does this improve user comfort, but it also adds up to overall household energy conservation. In addition, the increasing popularity of induction technology also coincides with higher government support to encourage energy-efficient home appliances. The trend is part of a wider cultural move toward responsible consumption and optimal use of resources, which makes induction cooktops a sensible and sustainable option for Japan's green-conscious consumers.

Japan Induction Cooktop Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product, application, and distribution channel.

Product Insights:

- Built-In

- Free Standing

The report has provided a detailed breakup and analysis of the market based on the product. This includes built-in, and free standing.

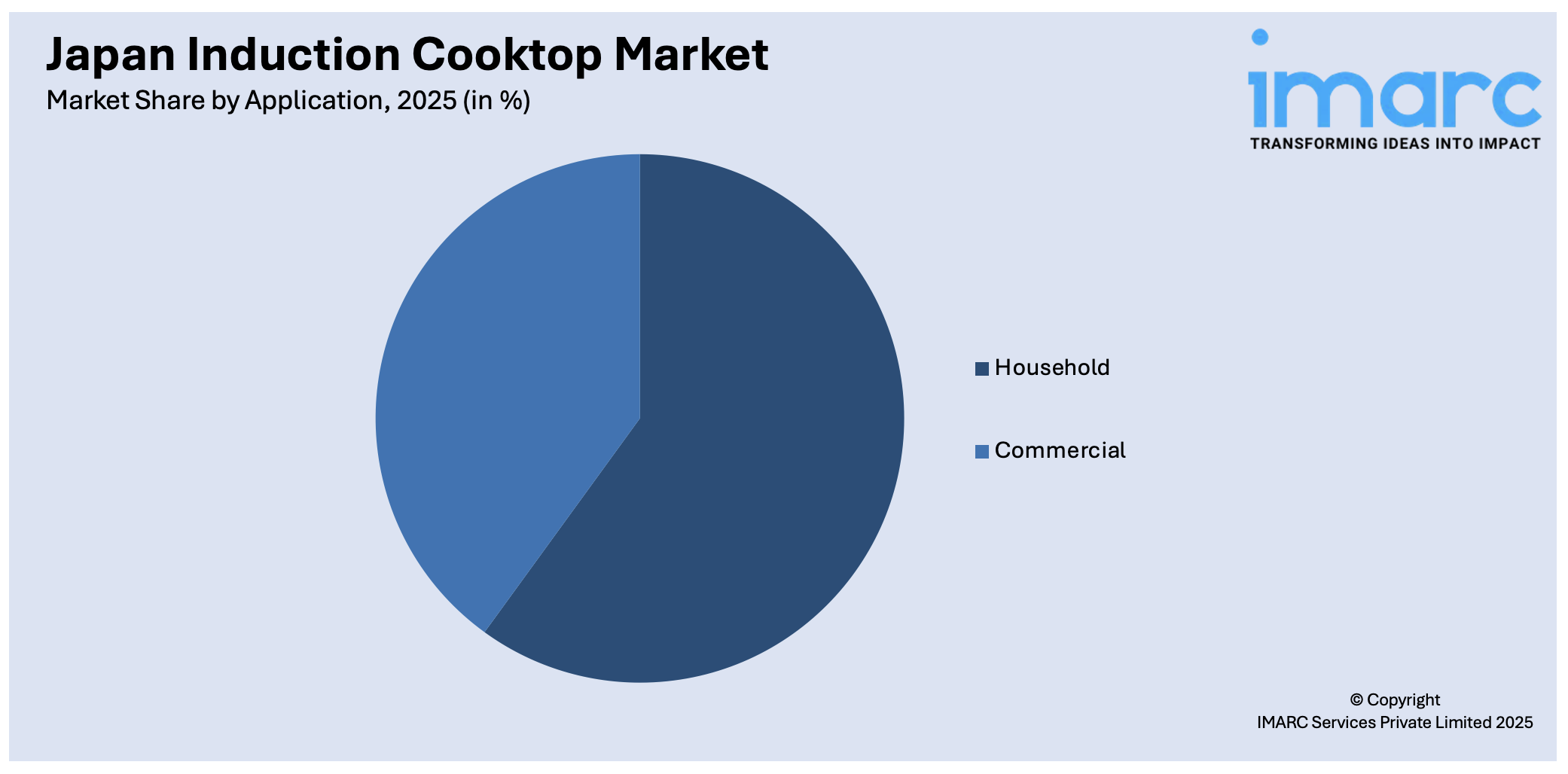

Application Insights:

Access the comprehensive market breakdown Request Sample

- Household

- Commercial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes household and commercial.

Distribution Channel Insights:

- Hypermarkets and Supermarkets

- Specialty Stores

- Online

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes hypermarkets and supermarkets, specialty stores, and online.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Induction Cooktop Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Built-In, Free Standing |

| Applications Covered | Household, Commercial |

| Distribution Channels Covered | Hypermarkets and Supermarkets, Specialty Stores, Online |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan Induction cooktop market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan induction cooktop market on the basis of product?

- What is the breakup of the Japan induction cooktop market on the basis of application?

- What is the breakup of the Japan induction cooktop market on the basis of distribution channel?

- What is the breakup of the Japan Induction cooktop market on the basis of region?

- What are the various stages in the value chain of the Japan Induction cooktop market?

- What are the key driving factors and challenges in the Japan Induction cooktop?

- What is the structure of the Japan Induction cooktop market and who are the key players?

- What is the degree of competition in the Japan Induction cooktop market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan Induction cooktop market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan Induction cooktop market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan Induction cooktop industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)