Japan Industrial Air Compressors Market Size, Share, Trends and Forecast by Product, Lubrication, Operation, Capacity, End User, and Region, 2026-2034

Japan Industrial Air Compressors Market Overview:

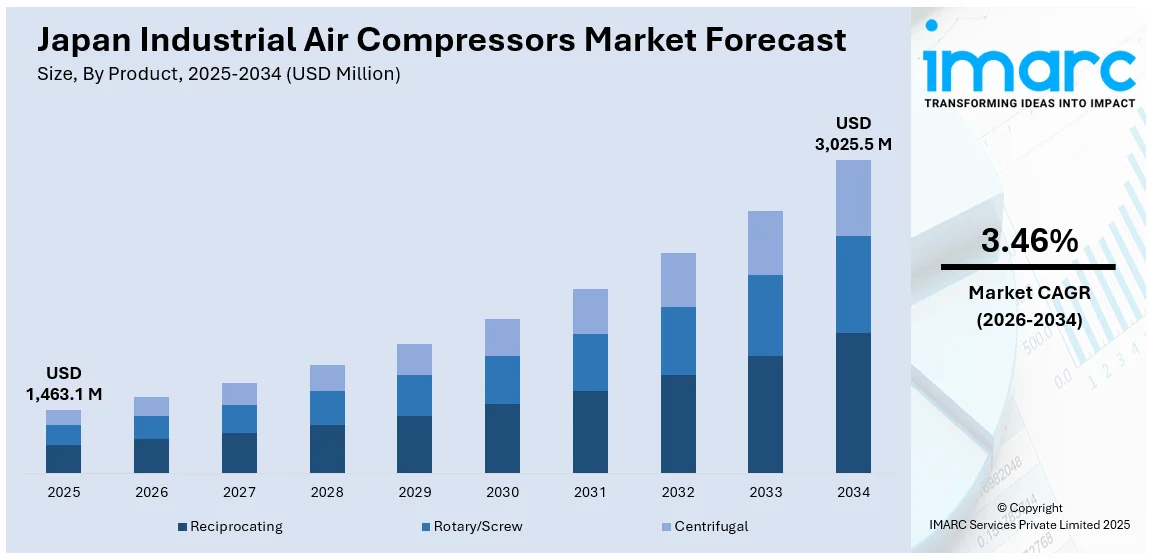

The Japan industrial air compressors market size reached USD 2,154.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 2,925.8 Million by 2034, exhibiting a growth rate (CAGR) of 3.46% during 2026-2034. Rising use in automotive manufacturing, electronics, and semiconductor sectors is driving Japan industrial air compressors market share. Demand for energy-efficient, oil-free systems, and smart predictive maintenance tools is growing. Industrial automation, robotics, CNC tools, and precision machinery investments further support expansion. Additionally, the market is bolstered by aging equipment replacements, food and beverage sector growth, clean energy focus, and integration with hydrogen infrastructure. Technological advancements in variable speed drive (VSD) compressors also enhance operational efficiency, reinforcing Japan’s industrial air compressors market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2,154.6 Million |

| Market Forecast in 2034 | USD 2,925.8 Million |

| Market Growth Rate 2026-2034 | 3.46% |

Japan Industrial Air Compressors Market Trends:

Growing Demand from Automotive Manufacturing Units

Japan's automotive industry remains a cornerstone of its economy, with motor vehicle production reaching approximately 9 million units in 2023, marking a significant recovery from pandemic-related disruptions. This resurgence is driven by both domestic demand and robust exports, with motor vehicle exports valued at USD 111.6 billion (17.3 trillion yen) in 2022. The production processes in automotive manufacturing heavily rely on industrial air compressors, which are essential for powering pneumatic tools, painting, and assembly line operations. The integration of advanced manufacturing technologies and automation in automotive plants has further amplified the need for reliable and efficient air compression systems capable of supporting continuous and precise operations. This growing reliance positions industrial air compressors as vital assets in maintaining competitiveness and innovation in Japan’s automotive sector.

To get more information on this market Request Sample

Expansion of electronics and semiconductor production

Japan’s electronics and semiconductor industries remain globally competitive, with companies like Sony, Panasonic, Renesas, and Toshiba investing in advanced facilities. These operations require stable, oil-free, and precision-controlled compressed air systems, especially in cleanrooms where contamination can damage sensitive components. With global chip demand rising, Japan is expanding and modernizing fabrication plants for advanced node production. Industrial air compressors are critical in processes like wafer handling, cooling, vacuum generation, and packaging. Government subsidies and partnerships further support domestic semiconductor growth. Compressed air is also used in testing labs and equipment cleaning. As automation increases, smart compressors with digital controls and energy monitoring are gaining traction to optimize air usage and reduce costs. High reliability is essential to ensure uptime in these capital-intensive environments. Additionally, rising demand for microchips in automotive electronics, smartphones, and industrial equipment is putting more pressure on factories, further driving the Japan industrial air compressors market growth.

Rising need for energy-efficient and oil-free compressors

Energy efficiency has become a top priority for industrial operations in Japan due to high electricity costs and a national push toward carbon reduction. Industrial air compressors can consume a large share of a factory’s power, making efficiency improvements crucial for lowering operating costs. Traditional compressors that run constantly waste energy when full output is not needed. In contrast, energy-efficient models, especially those with variable speed drives (VSD), adjust output based on demand, cutting down unnecessary usage. Many Japanese companies are replacing older fixed-speed compressors with newer energy-saving units that come with built-in monitoring systems. These allow managers to track air consumption, energy use, and machine performance in real time. The shift is not just about energy savings—oil-free compressors are gaining traction because they eliminate the risk of contaminating products or tools. This is especially important in sectors like pharmaceuticals, food processing, and semiconductors, where even a trace of oil can cause product failures or safety issues.

Japan Industrial Air Compressors Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product, lubrication, operation, capacity, and end user.

Product Insights:

- Reciprocating

- Rotary/Screw

- Centrifugal

The report has provided a detailed breakup and analysis of the market based on the product. This includes reciprocating, rotary/screw, and centrifugal.

Lubrication Insights:

- Oil-free

- Oil-Filled

A detailed breakup and analysis of the market based on the lubrication have also been provided in the report. This includes oil-free and oil-filled.

Operation Insights:

- ICE

- Electric

The report has provided a detailed breakup and analysis of the market based on the operation. This includes ICE and electric.

Capacity Insights:

- Up to 100 kW

- 101–200 kW

- 201–300 kW

- 301–500 kW

- 501 kW and Above

A detailed breakup and analysis of the market based on the capacity have also been provided in the report. This includes up to 100 kW, 101–200 kW, 201–300 kW, 301–500 kW, and 501 kW and above.

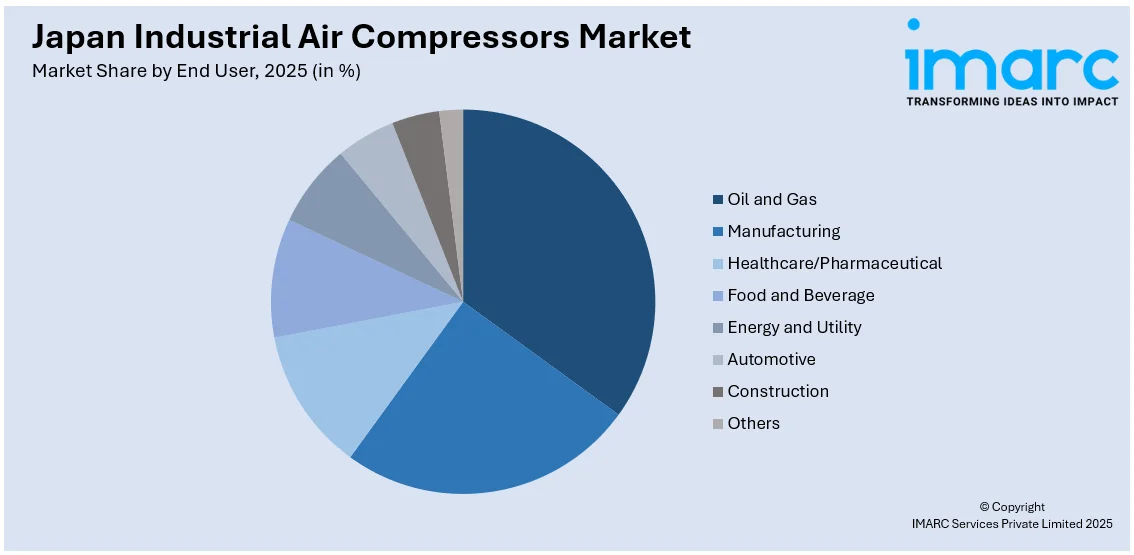

End User Insights:

Access the comprehensive market breakdown Request Sample

- Oil and Gas

- Manufacturing

- Healthcare/Pharmaceutical

- Food and Beverage

- Energy and Utility

- Automotive

- Construction

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes oil and gas, manufacturing, healthcare/pharmaceutical, food and beverage, energy and utility, automotive, construction, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Industrial Air Compressors Market News:

- In 2025, Mitsubishi Heavy Industries began field trials of a compressed air energy storage system in Vietnam with Petrovietnam Power Corporation (PV Power). The project aims to enhance grid stability and support renewable energy integration, marking a key step toward commercializing sustainable industrial energy solutions globally.

Japan Industrial Air Compressors Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Reciprocating, Rotary/Screw, Centrifugal |

| Lubrications Covered | Oil-free, Oil-Filled |

| Operations Covered | ICE, Electric |

| Capacities Covered | Up to 100 kW, 101–200 kW, 201–300 kW, 301–500 kW, 501 kW and Above |

| End Users Covered | Oil and Gas, Manufacturing, Healthcare/Pharmaceutical, Food and Beverage, Energy and Utility, Automotive, Construction, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan industrial air compressors market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan industrial air compressors market on the basis of product?

- What is the breakup of the Japan industrial air compressors market on the basis of lubrication?

- What is the breakup of the Japan industrial air compressors market on the basis of operation?

- What is the breakup of the Japan industrial air compressors market on the basis of capacity?

- What is the breakup of the Japan industrial air compressors market on the basis of end user?

- What is the breakup of the Japan industrial air compressors market on the basis of region?

- What are the various stages in the value chain of the Japan industrial air compressors market?

- What are the key driving factors and challenges in the Japan industrial air compressors market?

- What is the structure of the Japan industrial air compressors market and who are the key players?

- What is the degree of competition in the Japan industrial air compressors market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan industrial air compressors market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan industrial air compressors market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan industrial air compressors industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)