Japan Industrial Automation Components Market Size, Share, Trends and Forecast by Component, Application, End Use Industry, and Region, 2026-2034

Japan Industrial Automation Components Market Overview:

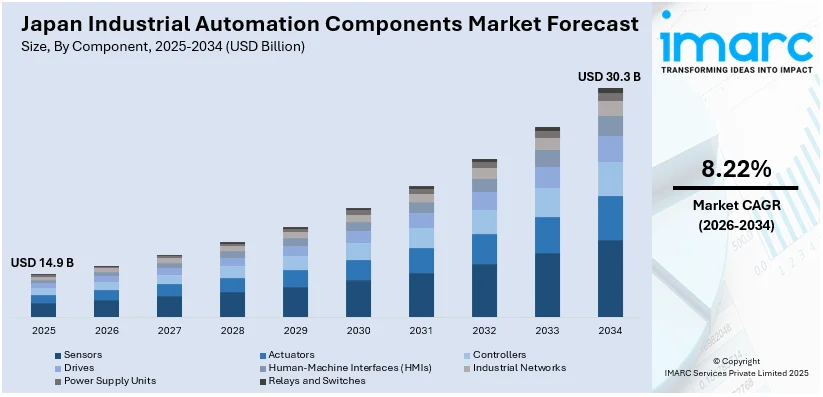

The Japan industrial automation components market size reached USD 14.9 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 30.3 Billion by 2034, exhibiting a growth rate (CAGR) of 8.22% during 2026-2034. At present, manufacturers are adopting smart manufacturing technologies to raise productivity, operational efficiency, and product quality. Moreover, the rising use of industrial robots is revolutionizing Japanese manufacturing processes, driving the demand for precision automation devices like servo motors, sensors, and actuators. Additionally, the heightened focus of the government on industrial automation is expanding the Japan industrial automation components market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 14.9 Billion |

| Market Forecast in 2034 | USD 30.3 Billion |

| Market Growth Rate 2026-2034 | 8.22% |

Japan Industrial Automation Components Market Trends:

Increased Adoption of Smart Manufacturing Technologies

The Japan market for industrial automation components is experiencing steady growth as manufacturers are adopting smart manufacturing technologies to improve productivity, operational efficiency, and product quality. Japanese factories are implementing superior automation solutions like programmable logic controllers (PLCs), industrial sensors, and human-machine interfaces (HMIs) to maximize production processes. This change is encouraged by the necessity to reduce human error, minimize operating downtime, and enhance accuracy in manufacturing processes. The use of smart manufacturing is also consistent with Japan's Society 5.0 national vision, which encourages the application of sophisticated technologies to develop a more sustainable and efficient industrial society. Firms are also spending money on Industrial Internet of Things (IIoT) platforms to facilitate real-time monitoring and predictive maintenance, which helps improve asset reliability. As the change gathers pace, the need for advanced automation pieces that facilitate real-time data processing and machine-to-machine communication is rising in the industry. The IMARC Group predicts that the Japan IIoT market size will reach USD 15.6 Billion by 2033.

To get more information on this market Request Sample

Increased Utilization of Robotics in Industrial Operations

The use of industrial robots is quickly revolutionizing Japanese manufacturing processes, driving the demand for precision automation devices like servo motors, sensors, and actuators. Industries are shifting towards robotic systems for operations that require high accuracy, high speed, and high repeatability. This trend can be seen, in particular, in industries like the automotive sector, electronics industry, and semiconductor industry, wherein production requirements are increasing while tolerance for defects decreases. Japanese companies are using robotics to help compensate for labor shortages due to the nation's aging population to deliver stable productivity levels without sacrificing quality. Besides this, advancements in cobots are promoting small and medium-sized (SME) businesses to automate, considering their simplicity of implementation and safety aspects. Cobots are utilized along with humans to deal with challenging assembly, inspection, and material handling processes. With the increasing adoption of robotics automation, the compatible and stable automation parts market is continuously growing to support the multifaceted requirements of advanced industrial systems. Flexiv, a creator of versatile robotics solutions, teamed up with Kurabo, a Japanese leader in fast image processing and 3D measurement technology, to create the revolutionary Kuravizon adaptive robot. By combining Flexiv's top-tier force control technology with Kurabo's sophisticated 3D vision sensing technology, Kurasense, the Kuravizon robot was released for sale on January 10th, 2025.

Government Plans and Industrial Policy Support

Industrial automation is encouraged by government policies and regulatory structures as a strategy to rejuvenate Japan's global manufacturing competitiveness. Strategic programs like the "Connected Industries" initiative and investment subsidies for smart factory equipment are inducing firms to step up their automation capacity. Public-private partnerships are being formed to speed the adoption of technologies like AI, big data analytics, and IIoT in industry. These initiatives are promoting knowledge transfer and innovation, particularly among small and mid-sized firms that historically did not have access to state-of-the-art technologies. Financial incentives and tax concessions for the purchase of automation equipment are also facilitating investment in high-precision components. Standardization and interoperability initiatives by the Japanese government to optimize technology integration across various industrial systems are also being facilitated. Through a positive environment for automation, such policy interventions are continually driving the demand for industrial automation components, making Japan a center of next-generation manufacturing solutions, thereby impelling the Japan industrial automation components market growth.

Japan Industrial Automation Components Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on component, application, and end use industry.

Component Insights:

- Sensors

- Actuators

- Controllers

- PLC

- DCS

- Drives

- Servo Drives

- VFDs

- Human-Machine Interfaces (HMIs)

- Industrial Networks

- Power Supply Units

- Relays and Switches

The report has provided a detailed breakup and analysis of the market based on the component. This includes sensors, actuators, controllers (PLC and DCS), drives (servo drives and VFDs), human-machine interfaces (HMIs), industrial networks, power supply units, and relays and switches.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Discrete Manufacturing

- Process Manufacturing

- Batch Manufacturing

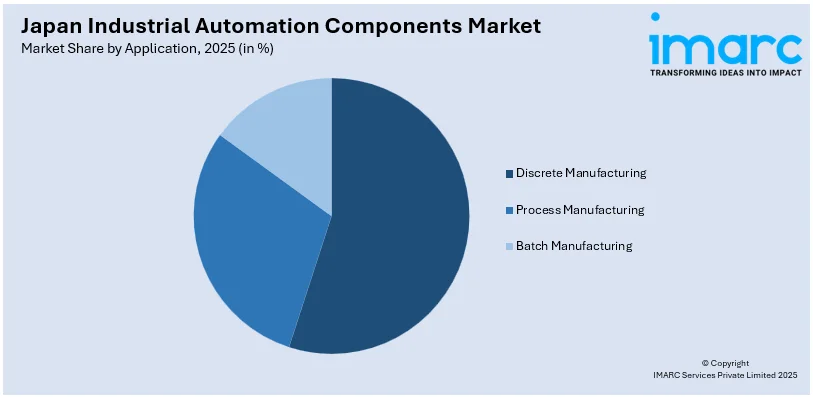

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes discrete manufacturing, process manufacturing, and batch manufacturing.

End Use Industry Insights:

- Automotive

- Food and Beverage

- Pharmaceuticals

- Oil and Gas

- Chemicals

- Electronics and Semiconductors

- Metals and Mining

- Water and Wastewater

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes automotive, food and beverage, pharmaceuticals, oil and gas, chemicals, electronics and semiconductors, metals and mining, water and wastewater, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Industrial Automation Components Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Applications Covered | Discrete Manufacturing, Process Manufacturing, Batch Manufacturing |

| End Use Industries Covered | Automotive, Food and Beverage, Pharmaceuticals, Oil and Gas, Chemicals, Electronics and Semiconductors, Metals and Mining, Water and Wastewater, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan industrial automation components market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan industrial automation components market on the basis of component?

- What is the breakup of the Japan industrial automation components market on the basis of application?

- What is the breakup of the Japan industrial automation components market on the basis of end use industry?

- What is the breakup of the Japan industrial automation components market on the basis of region?

- What are the various stages in the value chain of the Japan industrial automation components market?

- What are the key driving factors and challenges in the Japan industrial automation components market?

- What is the structure of the Japan industrial automation components market and who are the key players?

- What is the degree of competition in the Japan industrial automation components market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan industrial automation components market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan industrial automation components market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan industrial automation components industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)