Japan Industrial Bearings Market Size, Share, Trends and Forecast by Bearing Type, End Use Industry, and Region, 2026-2034

Japan Industrial Bearings Market Summary:

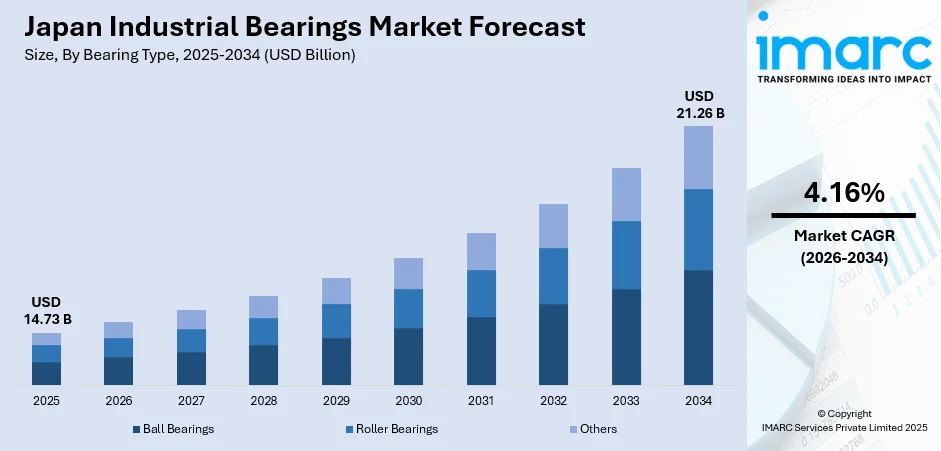

The Japan industrial bearings market size was valued at USD 14.73 Billion in 2025 and is projected to reach USD 21.26 Billion by 2034, growing at a compound annual growth rate of 4.16% from 2026-2034.

The market expansion stems from accelerating automotive electrification where hybrid electric vehicles captured substantial market penetration alongside rising automation investments driven by demographic workforce constraints. Industries are deploying advanced bearing solutions across electric vehicle powertrains and automated manufacturing systems while renewable energy infrastructure projects generate sustained demand for high-durability components in wind turbine applications, collectively exdpanding the Japan industrial bearings market share.

Key Takeaways and Insights:

- By Bearing Type: Ball bearings dominate the market with a share of 63% in 2025, driven by extensive applications in electric vehicle e-axles requiring lightweight designs and low-friction performance characteristics.

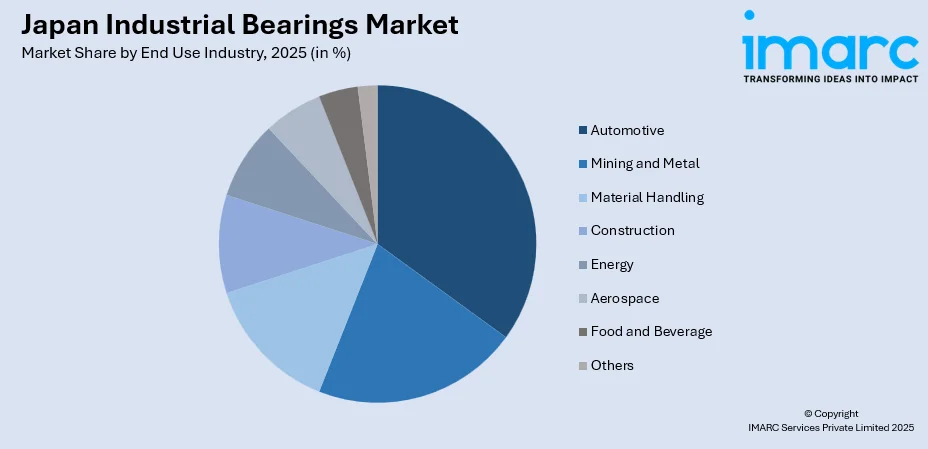

- By End Use Industry: Automotive leads the market with a share of 35% in 2025, propelled by Japan's leadership in automotive manufacturing where hybrid vehicles reached substantial market penetration.

- By Region: Kanto region represents the largest segment with a market share of 38% in 2025, anchored by Tokyo's high concentration of business establishments and the presence of major automotive manufacturers, electronics producers, and machinery fabricators across Tokyo, Yokohama, and surrounding industrial zones.

- Key Players: The Japan industrial bearings market exhibits strong competitive intensity with multinational bearing manufacturers leveraging advanced engineering capabilities alongside domestic producers specializing in high-precision components for automotive, industrial machinery, and renewable energy applications.

To get more information on this market Request Sample

Japan's industrial bearing market operates at the intersection of demographic transformation and technological advancement where an aging workforce averaging 36.25 million citizens aged 65 and above drives accelerated automation adoption across manufacturing sectors. The automotive industry installed 13,000 industrial robots during 2024 representing the highest five-year deployment level as manufacturers respond to labor constraints through automated assembly systems requiring specialized bearing solutions. Renewable energy infrastructure expansion presents additional growth channels with offshore wind capacity reaching operational levels during 2024 supported by government targets. For instance, the Japanese automotive industry achieved robot density of 1,531 units per 10,000 employees positioning fourth globally demonstrating sustained electrification momentum that continuously elevates bearing performance requirements.

Japan Industrial Bearings Market Trends:

Electric Vehicle Transition Accelerating Specialized Bearing Development

Automotive manufacturers are advancing electric vehicle (EV) production capabilities through specialized bearing technologies designed for high-speed electric motor applications and extended operational durability under elevated thermal conditions. Engineering developments focus on friction reduction mechanisms that directly enhance battery efficiency and vehicle range extension across hybrid and fully electric platforms. Japanese bearing manufacturer NSK Ltd. introduced seventh-generation low-friction tapered roller bearings achieving 20 percent friction reduction across all rotation speeds while supporting internal combustion, hybrid electric, and battery electric vehicle configurations. Moreover, manufacturers engineer bearing solutions specifically addressing electrolytic corrosion challenges inherent in electric powertrains where voltage differentials accelerate component wear patterns requiring innovative material treatments and design modifications for sustained performance reliability.

Smart Bearing Integration with Predictive Maintenance Capabilities

Industrial operations are incorporating intelligent bearing systems equipped with embedded sensors monitoring temperature fluctuations, vibration patterns, and rotational speed parameters in real-time configurations enabling predictive maintenance protocols. These sensor-integrated bearing assemblies transmit operational data to centralized monitoring platforms where machine learning algorithms identify emerging failure indicators before critical breakdowns occur. Manufacturing facilities deploy these smart bearing solutions across automated production lines and robotic systems where unplanned downtime generates substantial productivity losses and maintenance cost escalations. The integration of Internet of Things (IoT) connectivity with artificial intelligence analysis transforms bearing components from passive mechanical elements into active data sources supporting operational efficiency optimization through condition-based maintenance scheduling that minimizes equipment failures while extending bearing service life intervals. IMARC Group predicts that the Japan IoT market is projected to reach USD 1,86,064.6 Million by 2033.

Offshore Wind Energy Infrastructure Deployment

Renewable energy projects are expanding offshore wind turbine installations requiring specialized bearing designs withstanding harsh marine environments including saltwater exposure, temperature extremes, and continuous high-load rotational operations. Wind turbine main shaft bearings must deliver multi-decade service life under variable wind conditions while supporting blade assemblies generating megawatt-scale electrical output. Japan reached 253.4 megawatts offshore wind capacity during 2024 with government infrastructure targets establishing 10 gigawatts by 2030 creating sustained bearing demand across turbine manufacturing and maintenance operations. Bearing manufacturers develop solutions addressing extended operational lifespans required for renewable energy infrastructure where turbine accessibility limitations and maintenance cost considerations necessitate maximum reliability performance characteristics.

Market Outlook 2026-2034:

The Japan industrial bearings market is positioned for sustained expansion through 2033 as demographic workforce transitions accelerate automation technology adoption across manufacturing sectors while automotive electrification programs drive specialized bearing requirements for EV powertrains. The market generated a revenue of USD 14.73 Billion in 2025 and is projected to reach a revenue of USD 21.26 Billion by 2034, growing at a compound annual growth rate of 4.16% from 2026-2034. Market revenue growth trajectories reflect continued investments in robotic manufacturing systems where bearing components enable precise automated operations alongside renewable energy infrastructure projects demanding high-durability solutions for offshore wind installations.

Japan Industrial Bearings Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Bearing Type | Ball Bearings | 63% |

| End Use Industry | Automotive | 35% |

| Region | Kanto Region | 38% |

Bearing Type Insights:

- Ball Bearings

- Roller Bearings

- Others

Ball bearings dominate with a market share of 63% of the total Japan industrial bearings market in 2025.

Ball bearings dominate the Japan industrial bearings market through widespread applications across automotive manufacturing where electric vehicle powertrains require lightweight precision components delivering reduced friction characteristics essential for battery efficiency optimization. Manufacturers engineer ball bearing assemblies specifically addressing electric motor requirements supporting rotational speeds exceeding conventional internal combustion applications while maintaining thermal stability under elevated operating temperatures. Japanese bearing producers developed compact lightweight ball bearing designs EV e-axles achieving friction reduction enabling weight savings per vehicle assembly. These engineering advances position ball bearings as critical enablers of automotive electrification programs where performance requirements continuously evolve toward higher precision tolerances and extended service life intervals. In 2024, NTN Corporation started providing all bearings for turbo pumps of the engine in the second H3 Launch Vehicle that was launched from Tanegashima Space Center at 9:22:55 (JST) on February 17.

Manufacturing automation systems extensively deploy ball bearing solutions across robotic assembly operations and precision machinery applications where smooth rotational movement supports accurate positioning requirements and minimal vibration transmission. The automotive industry installed 13,000 industrial robots during 2024 representing substantial automation investment requiring specialized bearing components throughout mechanical linkages and drive systems. Ball bearing manufacturing rose, showcasing consistent production capacity that caters to various industrial needs, including electronics assembly, food processing machinery, and aerospace part fabrication, where compact designs and high-speed functionalities meet precise operational criteria across several end-use sectors.

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Mining and Metal

- Material Handling

- Construction

- Energy

- Aerospace

- Automotive

- Food and Beverage

- Others

Automotive leads with a share of 35% of the total Japan industrial bearings market in 2025.

The automotive sector generates dominant bearing demand through Japan's extensive vehicle manufacturing infrastructure where hybrid EV production achieved high market penetration reflecting sustained electrification momentum across passenger car segments. EV powertrains require specialized bearing assemblies managing higher rotational speeds and thermal loads compared with conventional internal combustion configurations while supporting weight reduction objectives critical for battery range optimization. Japanese automotive manufacturers installed also installed industrial robots during 2024 marking the highest deployment level as automated assembly operations expand across vehicle production facilities requiring precision bearing components throughout robotic arm mechanisms and conveyor systems.

Bearing manufacturers developed large-diameter deep groove ball bearings specifically engineered for coaxial electric axle applications addressing unique load distribution patterns and compactness requirements inherent in electric vehicle drivetrain architectures. Automotive bearing solutions increasingly incorporate electrolytic corrosion resistance technologies protecting against voltage-induced degradation phenomena affecting electric motor bearings where discharge events generate abnormal noise and vibration patterns accelerating component wear. Japanese automakers maintain global leadership in hybrid vehicle technologies, supporting sustained bearing demand across both conventional and electrified powertrain configurations as manufacturers balance internal combustion, hybrid electric, and battery electric vehicle production responding to market preferences and regulatory requirements. Japan's new vehicle market grew by slightly more than 5% year-on-year to 393,160 units in June 2025, up from 373,599 units in the same month the previous year, as reported by the Japan Automobile Manufacturers Association.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

Kanto region exhibits a clear dominance with a 38% share of the total Japan industrial bearings market in 2025.

The Kanto region commands substantial market presence anchored by Tokyo metropolitan area hosting over 680,000 business establishments encompassing automotive manufacturing centers, electronics production facilities, and machinery fabrication operations generating concentrated bearing demand across diverse industrial applications. Tokyo and Yokohama form an integrated industrial complex along Tokyo Bay featuring heavy industry concentrations spanning steel production, chemical manufacturing, and automotive assembly operations requiring extensive bearing applications throughout production machinery and finished product components. The region's proximity to major port facilities including Yokohama Port and Tokyo Port facilitates efficient bearing component distribution supporting just-in-time manufacturing protocols prevalent across Japanese industrial operations.

Manufacturing automation intensifies across Kanto region industrial zones where labor availability constraints drive robotic system deployments requiring precision bearing components throughout automated assembly lines and material handling equipment. The region hosts headquarters for major automotive manufacturers and electronics producers including operations in Kanagawa, Saitama, and Chiba prefectures supporting integrated supply chain networks. Advanced manufacturing sectors including aerospace component fabrication and semiconductor equipment production concentrate in Kanto region industrial parks where high-precision bearing requirements fulfill stringent tolerance specifications and cleanroom compatibility standards.

Market Dynamics:

Growth Drivers:

Why is the Japan Industrial Bearings Market Growing?

Automotive Electrification Momentum Driving Specialized Bearing Requirements

Japan's automotive transformation toward electrified powertrains generates sustained bearing demand demonstrating user adoption momentum alongside manufacturer investment commitments. Electric vehicle architectures require specialized bearing assemblies managing elevated rotational speeds exceeding 30,000 revolutions per minute within electric motor applications while withstanding thermal loads surpassing conventional internal combustion operating parameters. Electric vehicle production expansion continues with domestic automakers targeting battery manufacturing capacity increases supported by government subsidies. Moreover, the entry of new market players is bringing changes. For example, BYD provided 2,223 electric vehicles in Japan in 2024, indicating a 54% rise compared to the prior year. Conversely, Toyota's electric vehicle sales in its home market dropped by 30%, totaling only 2,038 units sold, as reported by the Japan Automobile Dealer Association. This accomplishment is particularly significant given that BYD just entered the Japanese market in early 2023.

Automation Adoption Accelerating Amid Demographic Workforce Constraints

Labor availability challenges intensify across Japanese manufacturing sectors as the working-age population declines one percent annually with senior citizens aged 65 and above reaching 36.25 million representing nearly one-third of total population during 2024. Industries respond through extensive automation technology deployments where industrial robot installations support production maintenance despite workforce limitations. Manufacturing facilities are deploying robotic systems across assembly operations, material handling processes, and quality inspection protocols requiring precision bearing components enabling smooth mechanical movement and accurate positioning capabilities essential for automated equipment reliability. Bearing solutions supporting automation applications demand minimal maintenance intervals and extended service life characteristics addressing labor shortage implications where technician availability constrains equipment servicing schedules.

Renewable Energy Infrastructure Development Supporting Long-Duration Bearing Demand

Offshore wind energy expansion generates sustained bearing demand as government infrastructure targets establishing new wind turbines supporting carbon neutrality commitments. In 2024, Japan has added 703.3 MW of new wind turbines, raising the total operational wind energy capacity to 5,840.4 MW, as reported by the Japan Wind Power Association (JWPA). Wind turbine installations require specialized bearing designs withstanding harsh marine environments including saltwater exposure, temperature extremes, and continuous rotational loads while delivering multi-decade service life supporting renewable energy economic viability.

Market Restraints:

What Challenges the Japan Industrial Bearings Market is Facing?

Raw Material Price Volatility and Supply Chain Vulnerabilities

Bearing manufacturers face ongoing challenges managing raw material cost fluctuations affecting steel alloys and specialized metals essential for high-performance bearing production. Price volatility for industrial metals and materials used in bearing fabrication fluctuated significantly over recent years directly impacting manufacturer cost structures and profit margins. Japan's reliance on imported raw materials exposes bearing producers to potential supply chain disruptions where natural disasters or global logistics constraints generate material shortages affecting production continuity.

Severe Workforce Shortages Constraining Manufacturing Operations

Labor availability constraints intensify across Japanese manufacturing sectors with 342 labor-shortage related bankruptcies recorded during 2024 representing substantial increases from previous periods. The working-age population declining one percent annually generates recruitment difficulties across skilled technical positions essential for bearing manufacturing operations. Companies struggle attracting and retaining qualified personnel across engineering, production, and maintenance roles where specialized knowledge requirements limit available talent pools affecting operational capacity expansion capabilities.

Domestic Wind Turbine Manufacturing Capacity Limitations

Japan lacks domestic large-scale wind turbine manufacturers creating dependencies on international suppliers for renewable energy infrastructure components. The absence of local turbine production capabilities limits bearing manufacturers' ability to develop integrated supply chain relationships supporting offshore wind project development. Import reliance for major wind turbine systems introduces lead time uncertainties and logistics costs affecting project economics while constraining opportunities for bearing producers to establish preferred supplier relationships with domestic turbine manufacturers.

Competitive Landscape:

The Japan industrial bearings market demonstrates concentrated competitive intensity with established multinational manufacturers leveraging extensive research development capabilities alongside domestic producers specializing in high-precision component fabrication. Leading bearing manufacturers invest substantially in friction-reduction technologies, sensor-integration capabilities, and advanced material engineering supporting product differentiation across automotive electrification applications and industrial automation systems. Companies pursue sustainability initiatives incorporating renewable energy utilization in manufacturing operations while advancing carbon neutrality objectives through process optimization and clean energy adoption. Market participants compete through technological innovation emphasizing smart bearing solutions with integrated monitoring capabilities enabling predictive maintenance protocols alongside traditional performance characteristics including load capacity, rotational precision, and extended service life under demanding operating conditions across diverse industrial applications.

Recent Developments:

- In November 2025, Mitsubishi Heavy Industries Thermal Systems Corporation. (MHI Thermal Systems), a division of Mitsubishi Heavy Industries (MHI) Group, revealed the introduction of its newly designed magnetic bearing centrifugal chiller, the "ETI-N" series, for the Japanese market. The "ETI-N" series magnetic bearing centrifugal chiller includes a magnetic bearing compressor that uses magnetic levitation forces to levitate and support the rotating shaft within the compressor.

- In November 2025, Fujitsu announced that it has developed a platform for NSK Ltd. to facilitate a business model that allows for value co-creation with user companies during the entire product lifecycle of bearing products. This system, utilizing the Fujitsu Sustainability Value Accelerator from Fujitsu’s Uvance business model aimed at tackling societal challenges, will gather and apply bearing data across departments, processes, and companies during the entire product lifecycle, offering services for condition monitoring and maintenance. The initiative aims to encourage the refurbishment and repurposing of bearing products, aligning with NSK's corporate philosophy of aiding a sustainable society via global environmental protection, while also boosting corporate value.

Japan Industrial Bearings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Bearing Type Covered | Ball Bearings, Roller Bearings, Others |

| End Use Industries Covered | Mining and Metal, Material Handling, Construction, Energy, Aerospace, Automotive, Food and Beverage, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan industrial bearings market size was valued at USD 14.73 Billion in 2025.

The Japan industrial bearings market is expected to grow at a compound annual growth rate of 4.16% from 2026-2034 to reach USD 21.26 Billion by 2034.

Ball bearings segment dominated the market with 63% share in 2025, driven by extensive applications in electric vehicle e-axles requiring lightweight designs and low-friction performance characteristics that enable extended battery range and improved energy efficiency.

Key factors driving the Japan industrial bearings market include automotive electrification momentum where hybrid electric vehicles achieved substantial market penetration, automation adoption accelerating amid demographic workforce constraints with senior population increasing, and renewable energy infrastructure development supporting long-duration bearing demand through offshore wind capacity expansion targeting 10 gigawatts by 2030.

Major challenges include raw material price volatility and supply chain vulnerabilities affecting steel alloy procurement, severe workforce shortages constraining manufacturing operations with 342 labor-shortage related bankruptcies during 2024, and domestic wind turbine manufacturing capacity limitations creating dependencies on international suppliers for renewable energy infrastructure components.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)