Japan Industrial Boiler Market Size, Share, Trends and Forecast by Fuel, Application, and Region, 2026-2034

Japan Industrial Boiler Market Overview:

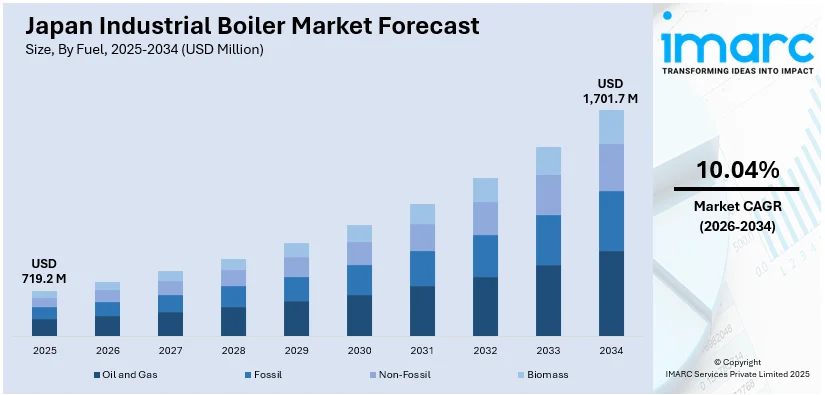

The Japan industrial boiler market size reached USD 719.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,701.7 Million by 2034, exhibiting a growth rate (CAGR) of 10.04% during 2026-2034. The market is driven by Japan’s decarbonization efforts and demand for energy-efficient, low-emission boiler systems in process-heavy industries. Sustained activity in chemical, food, and metal sectors ensures continuous demand for reliable, high-capacity thermal equipment, thereby fueling the market. Integration with waste heat recovery and renewable-based fuel systems aligns with national efficiency goals, further augmenting the Japan industrial boiler market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 719.2 Million |

| Market Forecast in 2034 | USD 1,701.7 Million |

| Market Growth Rate 2026-2034 | 10.04% |

Japan Industrial Boiler Market Trends:

Transition Toward Energy-Efficient and Low-Emission Boiler Technologies

Japan’s stringent environmental regulations and commitment to carbon neutrality are prompting industries to adopt cleaner, energy-efficient boiler systems. The country’s industrial sector, particularly in manufacturing, chemicals, and food processing, requires constant thermal energy, making fuel efficiency a central concern. In response, demand is growing for condensing boilers, supercritical steam generators, and systems integrated with heat recovery features. Energy audits and government-mandated efficiency assessments are encouraging companies to upgrade older systems with modern alternatives that minimize fuel wastage and reduce nitrogen oxide and carbon emissions. On April 22, 2025, IHI Corporation announced that its ammonia co-firing demonstration at Hekinan Thermal Power Station Unit 4 received the 2024 Technology Award from The Combustion Society of Japan and the JSME Award (Technology) from The Japan Society of Mechanical Engineers. The project, conducted in collaboration with JERA Co., Inc., successfully demonstrated a 20% ammonia co-firing ratio in a large-scale coal-fired boiler, achieving favorable results in combustibility, plant operability, and safety. The Ministry of Economy, Trade and Industry (METI) is promoting sustainable industrial equipment upgrades through subsidies and technical guidelines, which further accelerates compliance. Additionally, high electricity costs and fossil fuel import dependency incentivize investment in boilers with high thermal output per fuel unit consumed. These systems are often designed to support dual-fuel capabilities, offering flexibility in resource use during global fuel price fluctuations. As a result, modernizing industrial thermal infrastructure to align with national environmental goals is becoming both an economic and regulatory priority. These factors are central to driving the Japan industrial boiler market growth through the adoption of efficient and eco-conscious steam and heat generation technologies.

To get more information on this market Request Sample

Integration with Renewable and Waste Heat Recovery Systems

Industrial boilers in Japan are increasingly being integrated with renewable energy systems and waste heat recovery units, in response to national decarbonization goals and industrial efficiency mandates. Waste-to-energy projects and combined heat and power (CHP) systems are promoting the use of biomass, municipal solid waste, and industrial by-products as boiler fuel. This trend supports circular economy objectives and reduces dependence on imported fuels such as LNG and coal. Simultaneously, large facilities, particularly in heavy industries and industrial parks, are investing in heat exchangers and economizers that capture and reuse exhaust heat to preheat boiler feedwater, improving thermal efficiency. These integrated systems lower operational costs and align with ISO 50001 energy management standards increasingly adopted by Japanese manufacturers. Boiler vendors are developing modular systems that can be tailored for hybrid fuel usage, automated combustion control, and smart diagnostics to ensure regulatory compliance and performance optimization. On May 17, 2024, Miura Co., Ltd., a Japan-based global boiler manufacturer, announced its acquisition of U.S.-based Cleaver-Brooks, a leading provider of boiler room systems and equipment. Miura operates in 24 countries with around 6,000 employees and specializes in energy-saving and environmentally focused technologies, aligning with Cleaver-Brooks’ focus on integrated, high-efficiency boiler solutions. Government incentives under Japan’s Green Innovation Fund and decarbonization roadmaps are reinforcing investments in such integrated systems. The combined focus on sustainability, cost containment, and technological sophistication is strengthening demand for next-generation industrial boiler systems equipped to work within broader energy-efficient ecosystems.

Japan Industrial Boiler Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on fuel and application.

Fuel Insights:

- Oil and Gas

- Fossil

- Non-Fossil

- Biomass

The report has provided a detailed breakup and analysis of the market based on the fuel. This includes oil and gas, fossil, non-fossil, and biomass.

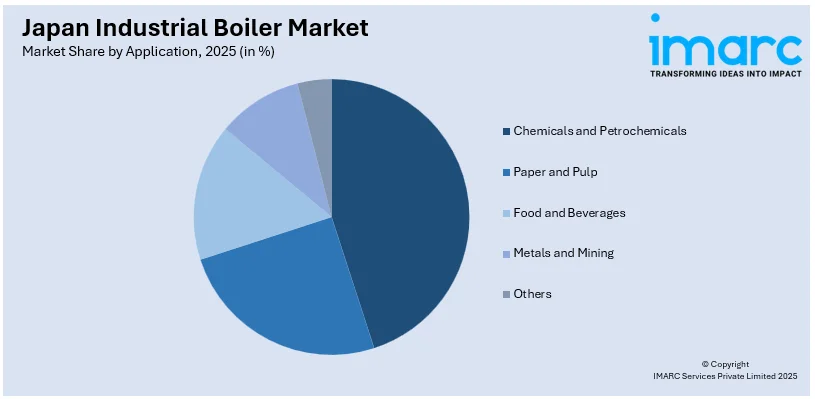

Application Insights:

Access the comprehensive market breakdown Request Sample

- Chemicals and Petrochemicals

- Paper and Pulp

- Food and Beverages

- Metals and Mining

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes chemicals and petrochemicals, paper and pulp, food and beverages, metals and mining, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all major regional markets. This includes Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Industrial Boiler Market News:

- On May 30, 2024, Daikin Industries and Miura Co., Ltd. announced a capital and business partnership to deliver integrated energy solutions for factories, combining air conditioning, steam boiler, and water treatment systems. Under the agreement, Daikin acquired a 4.67% stake in Miura, while Miura acquired 49% of Daikin Applied Systems Co., Ltd., a Daikin subsidiary specializing in industrial HVAC.

Japan Industrial Boiler Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fuels Covered | Oil and Gas, Fossil, Non-Fossil, Biomass |

| Applications Covered | Chemicals and Petrochemicals, Paper and Pulp, Food and Beverages, Metals and Mining, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan industrial boiler market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan industrial boiler market on the basis of fuel?

- What is the breakup of the Japan industrial boiler market on the basis of application?

- What is the breakup of the Japan industrial boiler market on the basis of region?

- What are the various stages in the value chain of the Japan industrial boiler market?

- What are the key driving factors and challenges in the Japan industrial boiler market?

- What is the structure of the Japan industrial boiler market and who are the key players?

- What is the degree of competition in the Japan industrial boiler market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan industrial boiler market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan industrial boiler market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan industrial boiler industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)