Japan Industrial Gearboxes Market Size, Share, Trends and Forecast by Type, Design, Application, and Region, 2026-2034

Japan Industrial Gearboxes Market Summary:

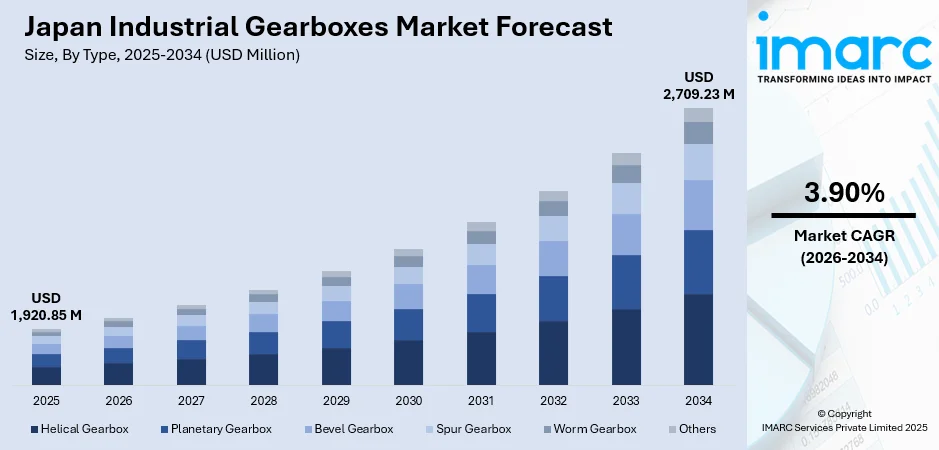

The Japan industrial gearboxes market size was valued at USD 1,920.85 Million in 2025 and is projected to reach USD 2,709.23 Million by 2034, growing at a compound annual growth rate of 3.90% from 2026-2034.

The expansion of automotive production facilities in the country and rising adoption of industrial automation driven by acute labor shortages from an aging workforce is supporting the market growth. Apart from this, the growing investments in renewable energy infrastructure particularly offshore wind power projects, and advancements in electric vehicle (EV) manufacturing are creating a positive outlook for the Japan industrial gearboxes market share.

Key Takeaways and Insights:

-

By Type: Helical gearbox dominates the market with a share of 38% in 2025, owing to its superior load-bearing capacity, smooth operation characteristics, and widespread adoption in automotive transmissions.

-

By Design: Parallel axis leads the market with a share of 62% in 2025, driven by its cost-effective manufacturing processes, simplified maintenance procedures, and optimal performance in high-torque industrial applications.

-

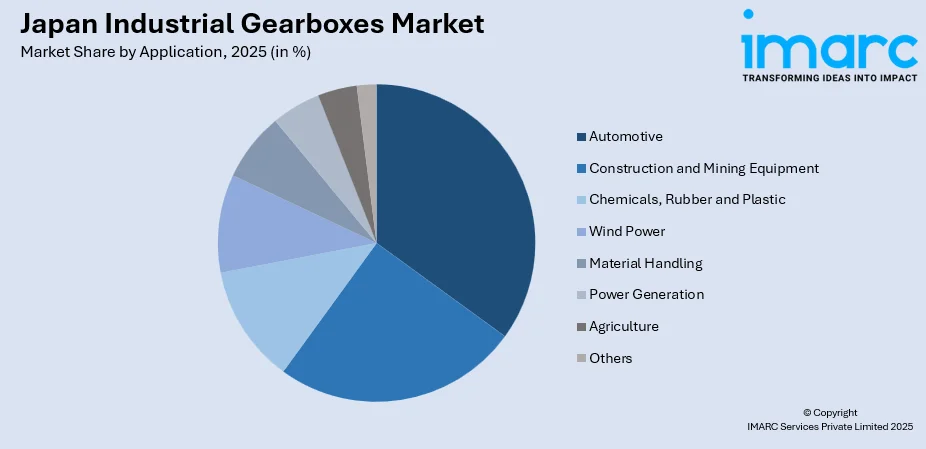

By Application: Automotive represents the largest segment with a market share of 16% in 2025, supported by Japan's position as a global automotive manufacturing hub with major producers.

-

By Region: Kanto region leads the market with a share of 32% in 2025, attributed to its concentration of automotive manufacturing facilities, advanced robotics companies, and precision machinery producers clustered around the Greater Tokyo metropolitan area.

-

Key Players: The Japan industrial gearboxes market exhibits moderate competitive intensity, with established domestic manufacturers competing alongside various international players through continuous product innovation and strategic collaborations.

To get more information on this market Request Sample

The industrial gearbox sector in Japan operates within a highly mature manufacturing ecosystem characterized by stringent quality standards and advanced technological capabilities. In 2024, Japan added 663 megawatts of new wind turbine capacity, bringing total wind energy infrastructure to 5,840 megawatts, which necessitates specialized high-capacity gearbox systems for power generation applications. The automotive industry's transition toward electrification presents both challenges and opportunities, as hybrid electric vehicles commanded a major portion of Japan's electric car market, with each vehicle requiring sophisticated transmission systems that integrate conventional mechanical gearboxes with electric motor drive units. Meanwhile, the robotics manufacturing sector continues expanding, driving consistent demand for precision reduction gearboxes used in robotic joints and actuators. In 2024, JERA commissioned the 112-megawatt Ishikari Bay New Port Offshore Wind Farm, Japan's largest operational offshore wind project, exemplifying the scale of infrastructure initiatives that create substantial demand for marine-grade industrial gearbox systems.

Japan Industrial Gearboxes Market Trends:

Integration of Internet of Things (IoT) and Predictive Maintenance Technologies

Industrial gearbox manufacturers increasingly incorporate IoT sensors and artificial intelligence (AI)-powered monitoring systems that enable real-time performance tracking and predictive maintenance capabilities. These smart gearbox solutions provide continuous vibration analysis, temperature monitoring, and lubrication condition assessment, allowing operators to detect potential failures before critical breakdowns occur. Manufacturing facilities deploying these intelligent systems report significant reductions in unplanned downtime and maintenance costs, particularly in automotive assembly plants and semiconductor fabrication facilities where production continuity directly impacts profitability. Kubota Corporation, a Japanese agricultural machinery maker, has been proactively tackling the larbor shortage crisis since the 2010s by creating various products and solutions for automating farming equipment, enhancing efficiency through data analytics, visualizing crop development, and additional initiatives. At the beginning of this R&D initiative, Kubota anticipated three separate phases leading to the complete automation of farming machinery. It has successfully advanced from Step 1, Automated steering with a farmer present, to Step 2, Automated, uncrewed operation with farmer oversight. By 2024, approximately 700 units from this series had been delivered and were operational on farms throughout Japan.

Expansion of Electric and Hybrid Vehicle Powertrain Solutions

Automotive manufacturers develop specialized gearbox configurations tailored for electric vehicle drivetrains that differ fundamentally from conventional internal combustion engine transmissions. These electrified powertrains require compact, lightweight reduction gearboxes capable of handling high-speed electric motor rotations while delivering optimal torque multiplication. As reported by Nikkan Jidosha Shimbun, a daily publication focused on the automotive sector in Japan, sales of new hybrid vehicles in the country rose by 9.2 percent in 2024 compared to the prior year, reaching a historic high of 2,040,181 units. The shift creates substantial opportunities for gearbox manufacturers who can engineer solutions meeting stringent noise, vibration, and harshness standards while accommodating the unique operating characteristics of electric propulsion systems.

Adoption of Lightweight Materials and Compact Designs

Manufacturers increasingly utilize advanced metallurgy and composite materials to reduce gearbox weight without compromising structural integrity or load-bearing capacity. These engineering innovations respond to automotive industry demands for vehicle weight reduction to improve fuel economy and extend electric vehicle driving ranges. Aerospace applications similarly prioritize weight minimization to enhance aircraft performance and reduce operational costs. Material science advancements enable the production of higher-strength alloys and surface treatments that extend gear tooth lifespan while permitting more compact housing designs. The miniaturization trend proves particularly valuable in collaborative robot applications, where space constraints and payload limitations necessitate extremely compact precision gearboxes. In 2024, Japan sustained its status as the second-largest market for industrial robots, with 44,500 units deployed.

Market Outlook 2026-2034:

The Japan industrial gearboxes market is positioned for steady expansion through the forecast period, supported by multi-decade infrastructure renewal initiatives and continued manufacturing sector modernization. Government commitments toward achieving carbon neutrality by 2050 will drive substantial investments in offshore wind power installations. The market generated a revenue of USD 1,920.85 Million in 2025 and is projected to reach a revenue of USD 2,709.23 Million by 2034, growing at a compound annual growth rate of 3.90% from 2026-2034. Automotive sector transformation toward electrification and autonomous driving technologies necessitates continuous gearbox innovation, with hybrid vehicles expected to maintain market leadership throughout the forecast period while battery electric vehicle adoption gradually accelerates.

Japan Industrial Gearboxes Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Helical Gearbox |

38% |

|

Design |

Parallel Axis |

62% |

|

Application |

Automotive |

16% |

|

Region |

Kanto Region |

32% |

Type Insights:

- Helical Gearbox

- Planetary Gearbox

- Bevel Gearbox

- Spur Gearbox

- Worm Gearbox

- Others

Helical gearboxes dominate with a market share of 38% of the total Japan industrial gearboxes market in 2025.

Helical gearboxes achieve market leadership through their superior operational characteristics that address critical performance requirements in high-precision manufacturing environments. The angled tooth configuration enables smoother power transmission compared to straight-tooth alternatives, generating significantly lower noise levels and vibration during operation—attributes particularly valued in automotive assembly facilities and semiconductor manufacturing cleanrooms where acoustic and vibrational disturbances must be minimized. These gearboxes demonstrate exceptional load distribution capabilities across tooth surfaces, allowing them to handle substantial torque requirements while maintaining compact form factors suitable for space-constrained applications.

The aerospace and defense sectors represent growing application areas for helical gearbox technology, with manufacturers developing lightweight variants using titanium alloys and composite materials to meet stringent weight restrictions without compromising structural integrity. Renewable energy installations, particularly wind turbines, require large-capacity helical gearboxes engineered to withstand extreme environmental conditions while converting low-speed rotor rotation into high-speed generator input. The complexity of designing gearboxes for offshore wind applications presents significant engineering challenges, as systems must resist saltwater corrosion and maintain reliable operation despite constant vibration exposure and temperature fluctuations.

Design Insights:

- Parallel Axis

- Angled Axis

- Others

Parallel axis leads with a share of 62% of the total Japan industrial gearboxes market in 2025.

Parallel axis gearbox configurations deliver optimal performance characteristics for applications requiring substantial torque multiplication across relatively short center distances between input and output shafts. Manufacturing simplicity represents a significant competitive advantage, as parallel shaft arrangements permit straightforward assembly processes and simplified bearing selection compared to more complex angular configurations. Maintenance accessibility proves particularly valuable in industrial settings where equipment downtime directly impacts production schedules, enabling technicians to perform routine inspections and component replacements without extensive disassembly procedures.

Industrial automation systems increasingly adopt parallel axis servo gearboxes that combine precision positioning capabilities with high torque density, supporting the expansion of robotic manufacturing cells throughout Japan's automotive and electronics sectors. The configuration facilitates straightforward integration with electric motors and hydraulic power units, simplifying drivetrain design and reducing overall system complexity. The government is also allocating funds to facilitate industrial automation. On June 4, the Japanese administration endorsed the Integrated Innovation Strategy 2024, detailing key areas for the budget of the upcoming fiscal year. Three improvement initiatives were revealed including an overarching plan for critical technologies, bolstering cooperation from a worldwide viewpoint, and boosting competitiveness while maintaining safety and security in the AI domain.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Construction and Mining Equipment

- Automotive

- Chemicals, Rubber and Plastic

- Wind Power

- Material Handling

- Power Generation

- Agriculture

- Others

Automotive exhibits a clear dominance with a 16% share of the total Japan industrial gearboxes market in 2025.

Japan's automotive industry operates as a global manufacturing powerhouse, with major producers maintaining extensive domestic production facilities that collectively generate millions of vehicles annually. The transition toward hybrid electric vehicles accelerates demand for sophisticated transmission systems that seamlessly integrate conventional mechanical gearboxes with electric motor drive units, requiring precision-engineered components capable of managing complex power flow patterns between multiple energy sources. Automotive manufacturers continuously refine gearbox designs to achieve incremental efficiency improvements, as even marginal reductions in drivetrain friction losses translate into meaningful fuel economy enhancements across production volumes measured in millions of units.

Advanced driver assistance systems and autonomous driving technologies introduce additional complexity into automotive gearbox applications, as electric power steering systems and automated transmission controls require precision actuators and reduction mechanisms that respond instantaneously to electronic control signals. IMARC Group predicts that the Japan automotive software market is projected to attain USD 3.9 Billion by 2033. The shift toward battery electric vehicles presents both challenges and opportunities for gearbox manufacturers, as fully electric powertrains typically employ single-speed reduction gearboxes rather than multi-gear transmissions, potentially reducing content per vehicle while expanding opportunities in electric axle assemblies and wheel hub motor applications.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto region leads with a share of 32% of the total Japan industrial gearboxes market in 2025.

The Kanto Region encompasses the Greater Tokyo metropolitan area and surrounding prefectures, hosting Japan's densest concentration of precision machinery manufacturers, automotive component suppliers, and advanced technology companies. Major industrial hubs within this region include Yokohama's port facilities, Kawasaki's heavy industry districts, and Saitama's automotive manufacturing complexes, collectively generating substantial demand for industrial gearbox systems across diverse application sectors. The region benefits from exceptional transportation infrastructure connecting manufacturing facilities with domestic and international markets, while proximity to research universities and technical institutes ensures access to skilled engineering talent essential for supporting advanced manufacturing operations.

The Kansai Kinki Region, centered around Osaka and Kobe, maintains strong industrial traditions in heavy machinery manufacturing and shipbuilding that generate consistent demand for large-capacity industrial gearboxes. Central Chubu Region hosts Toyota's extensive production network around Nagoya, positioning it as a critical automotive manufacturing hub where specialized transmission components support millions of vehicles produced annually. Kyushu Okinawa Region attracts semiconductor fabrication investments and advanced technology manufacturing facilities that require precision gearbox systems for cleanroom equipment and automated material handling.

Market Dynamics:

Growth Drivers:

Why is the Japan Industrial Gearboxes Market Growing?

Acute Labor Shortages Accelerating Industrial Automation Adoption

Japan confronts severe demographic challenges as its population ages rapidly, creating unprecedented labor supply constraints across manufacturing sectors. According to government data, Japan's senior population has reached an unprecedented 36.25 million individuals, with those 65 years or older representing nearly one-third of the Japanese population. The working-age population continues declining, with projections indicating potential workforce deficits exceeding 11 million workers by 2040, forcing companies to pursue automation strategies as essential business continuity measures rather than optional efficiency enhancements. Manufacturing facilities increasingly deploy collaborative robots and autonomous material handling equipment that require precision gearboxes for joint articulation and motion control, with each robotic installation incorporating multiple gearbox units across various arm segments and actuation points. Companies across sectors from automotive to food processing recognize automation not merely as cost optimization but as fundamental survival strategy, driving capital equipment investments that incorporate advanced gearbox technologies throughout automated production systems.

Expansion of Renewable Energy Infrastructure

Japan's commitment to achieving carbon neutrality by 2050 necessitates massive renewable energy capacity additions, with government targets specifying 10 gigawatts of offshore wind installations by 2030 and potentially reaching 30 to 45 gigawatts by 2040, creating substantial demand for specialized wind turbine gearboxes. Each wind turbine typically incorporates a main drivetrain gearbox converting low-speed rotor rotation into high-speed generator input, alongside numerous smaller gearboxes within blade pitch control systems and yaw mechanisms, multiplying gearbox content per installation. The Japanese government's March 2024 approval of regulatory amendments permitting offshore wind turbine installations within exclusive economic zones expands available development areas substantially, enabling projects in deeper waters previously inaccessible for fixed-foundation turbines.

Automotive Sector Electrification and Hybrid Technology Leadership

Japan's automotive manufacturers maintain global leadership in hybrid electric vehicle technology, with these vehicles commanding approximately 85 percent market share within the nation's electric car segment throughout 2024, requiring sophisticated transmission systems that coordinate power flow between internal combustion engines and electric motors. Major manufacturers continuously refine hybrid powertrain architectures to achieve incremental efficiency improvements. In 2024, Honda Motor Co., Ltd. conducted a press conference to outline the strategy for its hybrid-electric vehicle (HEV) operations and the recent progress made to its proprietary 2-motor hybrid system, Honda e:HEV. Honda also showcased upcoming technologies planned for integration in its future hybrid-electric vehicles

Market Restraints:

What Challenges the Japan Industrial Gearboxes Market is Facing?

High Capital Investment Requirements for Advanced Manufacturing Equipment

Industrial gearbox production necessitates substantial capital investments in precision machining centers, gear grinding equipment, and quality control instrumentation that present significant financial barriers particularly for small and medium-sized manufacturers. Specialized gear cutting machinery capable of achieving the tight tolerances required for high-performance applications costs millions of dollars, while maintaining calibration and tooling represents ongoing operational expenses. Japanese manufacturing standards demand exceptional quality consistency that requires advanced metrology systems and climate-controlled production environments, further elevating facility investment requirements. These capital intensity characteristics favor established manufacturers with existing infrastructure and financial resources, limiting market entry opportunities for potential competitors while constraining capacity expansion rates during demand growth periods.

Raw Material Cost Volatility and Supply Chain Vulnerabilities

Gearbox manufacturing relies heavily on specialty steel alloys and precision bearings subject to significant price fluctuations driven by global commodity markets and geopolitical events affecting supply availability. Steel prices experienced substantial volatility in recent years due to production capacity adjustments and trade policy changes, directly impacting manufacturer margins and complicating long-term pricing negotiations with customers. Semiconductor shortages that disrupted automotive production throughout recent years demonstrate supply chain vulnerabilities affecting components integral to modern smart gearbox systems incorporating electronic sensors and monitoring capabilities.

Transition Uncertainties in Automotive Electrification Trajectories

The automotive industry's gradual shift toward battery electric vehicles creates market uncertainty for traditional transmission component suppliers, as fully electric powertrains typically require simpler single-speed reduction gearboxes rather than complex multi-gear transmissions, potentially reducing content value per vehicle in long-term timeframes. While hybrid vehicles currently dominate Japan's electric car market, eventual transition toward pure battery electric architectures remains inevitable as battery technology advances and charging infrastructure expands, requiring gearbox manufacturers to balance investments between mature technologies serving current volumes and emerging applications representing future growth.

Competitive Landscape:

The Japan industrial gearboxes market exhibits moderate concentration with established domestic manufacturers maintaining substantial market positions through decades of technological development and customer relationships across key industrial sectors. Major Japanese companies leverage extensive product portfolios spanning multiple gearbox types and application segments, supported by nationwide service networks providing maintenance support and technical consultation. These domestic players benefit from geographic proximity to major customers in automotive and heavy machinery sectors, facilitating collaborative product development and rapid response to evolving technical requirements. International manufacturers maintain presence through local subsidiaries and distribution partnerships, offering competitive alternatives particularly in standardized product categories where price sensitivity influences purchasing decisions. Competition centers on technological innovation including smart gearbox capabilities incorporating predictive maintenance features, manufacturing quality consistency meeting stringent Japanese reliability expectations, and after-sales service responsiveness crucial for minimizing customer equipment downtime. Market participants pursue strategic collaborations with end-users to develop customized solutions for specialized applications, establishing long-term supply relationships that provide revenue stability while creating switching costs that discourage customer defections to alternative suppliers.

Recent Developments:

-

In September 2025, Japan's Terra Motors revealed its entry into the Pakistani market by introducing its premier electric three-wheeler, Kyoro, and encouraged local partners to distribute the vehicle as part of its regional growth plan. It features an 11.7 kilowatt-hour battery, a two-speed gearbox for ascending hills and swift acceleration, and requires four hours to charge.

Japan Industrial Gearboxes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Helical Gearbox, Planetary Gearbox, Bevel Gearbox, Spur Gearbox, Worm Gearbox, Others |

| Designs Covered | Parallel Axis, Angled Axis, Others |

| Applications Covered | Construction and Mining Equipment, Automotive, Chemicals, Rubber and Plastic, Wind Power, Material Handling, Power Generation, Agriculture, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan industrial gearboxes market size was valued at USD 1,920.85 Million in 2025.

The Japan industrial gearboxes market is expected to grow at a compound annual growth rate of 3.90% from 2026-2034 to reach USD 2,709.23 Million by 2034.

Helical gearbox segment dominated the market with approximately 38% revenue share in 2025, owing to superior load-bearing capacity, smooth operation characteristics, and widespread adoption in automotive transmissions and precision manufacturing applications where noise reduction and high efficiency are critical requirements.

Key factors driving the Japan industrial gearboxes market include acute labor shortages from an aging workforce accelerating industrial automation adoption, expansion of renewable energy infrastructure particularly offshore wind power installations, and automotive sector leadership in hybrid electric vehicle technology requiring sophisticated transmission systems. Additionally, government investments in infrastructure modernization and Industry 4.0 initiatives promote advanced manufacturing technologies incorporating precision gearbox systems.

Major challenges include high capital investment requirements for advanced precision manufacturing equipment that create barriers for smaller manufacturers, raw material cost volatility and supply chain vulnerabilities affecting specialty steel alloys and bearing components, and transition uncertainties associated with automotive electrification trajectories as battery electric vehicles gradually displace conventional powertrains requiring different gearbox configurations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)