Japan Industrial Material Handling Robotics Market Size, Share, Trends and Forecast by Type of Robot, Payload Capacity, Operational Environment, Application, End Use Industry, and Region, 2026-2034

Japan Industrial Material Handling Robotics Market Summary:

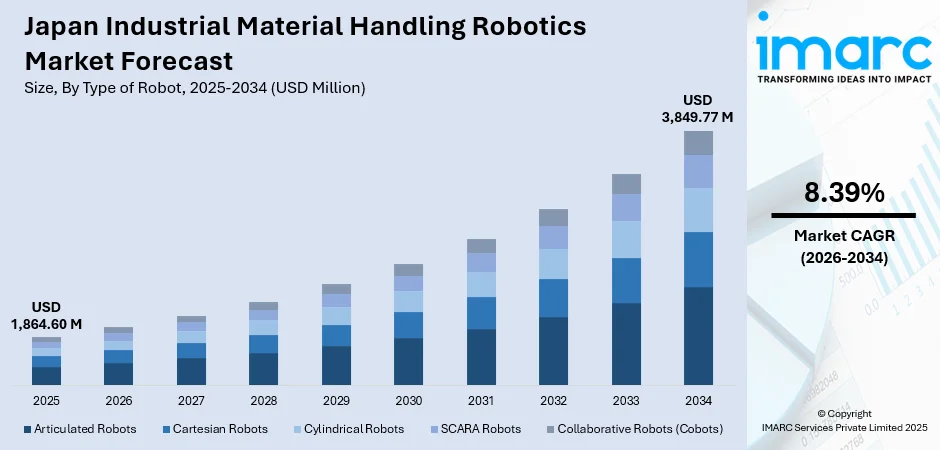

The Japan industrial material handling robotics market size was valued at USD 1,864.60 Million in 2025 and is projected to reach USD 3,849.77 Million by 2034, growing at a compound annual growth rate of 8.39% from 2026-2034.

The market is driven by increasing adoption of automation technologies across manufacturing and logistics sectors, Japan's declining workforce availability, and rising demand for precision handling systems. Advanced robotics integration in production facilities and warehouses supports operational efficiency and throughput optimization. Government initiatives promoting industrial digitization and smart manufacturing further accelerate deployment. These factors collectively contribute to the expanding Japan industrial material handling robotics market share.

Key Takeaways and Insights:

-

By Type of Robot: Articulated robots dominate the market with a share of 32% in 2025, driven by their flexibility, multi-axis motion, and capability to handle complex tasks across diverse industrial applications efficiently.

-

By Payload Capacity: Medium payload (51 kg to 300 kg) leads the market with a share of 45% in 2025, owing to versatility, balanced lifting and speed, and broad applicability in standard manufacturing processes.

-

By Operational Environment: Indoor represents the largest segment with a market share of 59% in 2025, driven by benefits from controlled conditions, precision operations, and established infrastructure in manufacturing facilities.

-

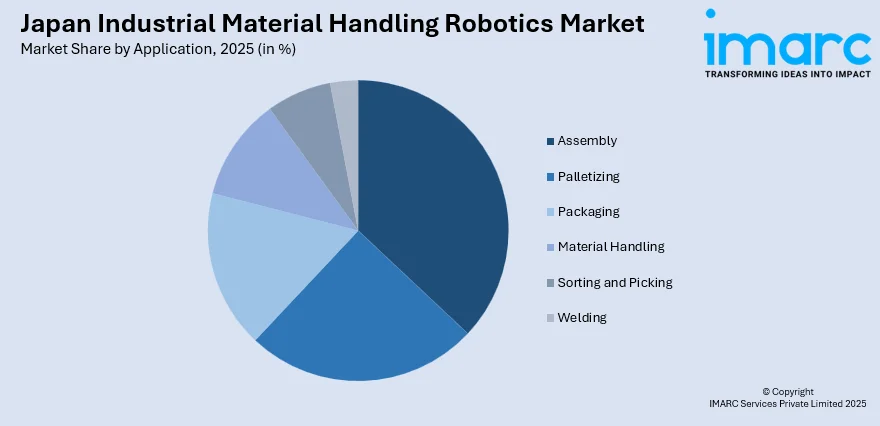

By Application: Assembly dominates the market with a share of 25% in 2025, driven by Japan’s precision manufacturing demands, quality standards, and need for repetitive, consistent task execution.

-

By End Use Industry: Automotive leads the market with a share of 31% in 2025, owing to Japan’s advanced vehicle production ecosystem and widespread robotic integration in assembly lines.

- By Region: Kanto region dominates the market with a share of 25% in 2025, driven by major manufacturing concentration, advanced logistics, proximity to Tokyo innovation hubs, and strong industrial clusters.

-

Key Players: The Japan industrial material handling robotics market exhibits a consolidated competitive landscape, with established domestic technology corporations competing alongside international automation specialists. Market participants differentiate through technological innovation, service capabilities, and industry-specific solution development across manufacturing and logistics applications.

To get more information on this market Request Sample

The Japan industrial material handling robotics market is experiencing sustained expansion driven by fundamental structural factors reshaping the country's industrial landscape. Japan's aging demographic profile and declining labor force participation have created persistent workforce constraints, particularly in physically demanding manufacturing and logistics roles. This has accelerated corporate investment in automation technologies to maintain operational continuity and production output. As per sources, the International Federation of Robotics reported that Japan’s automotive industry installed around 13,000 industrial robots in 2024, up 11% year on year, the highest level since 2020. Simultaneously, Japanese industries maintain stringent quality standards and lean manufacturing principles that favor robotic precision over manual handling processes. The integration of advanced sensing technologies, artificial intelligence capabilities, and connectivity solutions has enhanced robotic system functionality, enabling broader deployment across diverse industrial applications. Government policies supporting industrial modernization and smart factory initiatives provide additional impetus for robotics adoption across small, medium, and large enterprises.

Japan Industrial Material Handling Robotics Market Trends:

Integration of Artificial Intelligence and Machine Learning Capabilities

The incorporation of artificial intelligence (AI) and machine learning (ML) technologies into material handling robotics represents a transformative trend reshaping operational capabilities across Japanese industries. These intelligent systems enable robots to adapt dynamically to changing production requirements, recognize objects with enhanced accuracy, and optimize movement paths in real-time. In December 2025, Yaskawa Electric and SoftBank signed an MOU to develop Physical AI robots, integrating AI and communication technologies to enhance robotic decision-making, flexibility, and real-world deployment capabilities. Moreover, ML algorithms allow robotic systems to improve performance through operational experience, reducing programming requirements and enhancing flexibility. The convergence of vision systems with AI processing enables sophisticated quality inspection, object classification, and adaptive gripping functionalities.

Expansion of Collaborative Robotics in Mixed Work Environments

Collaborative robotics deployment is gaining momentum across Japanese manufacturing and logistics facilities, enabling human-robot collaboration without traditional safety barriers. These systems incorporate advanced sensing and force-limiting technologies that allow safe operation alongside human workers, creating flexible production environments. As per sources, in June 2025, DOBOT launched CR 30H and Nova 2s collaborative robots in Nagoya, featuring higher payload capacity, advanced safety sensing, and flexible human-robot collaboration for manufacturing and logistics applications. Moreover, the trend reflects evolving workplace requirements where complete automation remains impractical due to task complexity or economic considerations. Collaborative robots excel in applications requiring human judgment combined with robotic precision and consistency, such as assembly assistance and material staging.

Advancement of Autonomous Mobile Robotics for Intralogistics

Autonomous mobile robots are increasingly deployed within Japanese warehousing and manufacturing facilities for internal material transportation and logistics optimization. In March 2025, GROUND deployed its autonomous collaborative robot PEER 100 at Nippon Express warehouses, enhancing internal transportation, supporting mixed-work environments, and enabling diverse workforce participation in logistics operations. Furthermore, these systems navigate independently using advanced mapping, localization, and obstacle avoidance technologies, eliminating fixed infrastructure requirements associated with traditional conveyor systems. The flexibility enables rapid deployment and reconfiguration to accommodate changing facility layouts and operational requirements. Integration with warehouse management systems and manufacturing execution platforms allows coordinated material flow optimization across facility operations.

Market Outlook 2026-2034:

The Japan industrial material handling robotics market demonstrates strong growth potential through the forecast period, supported by sustained industrial modernization and automation adoption. Market revenue is projected to expand significantly as manufacturers across automotive, electronics, food processing, and logistics sectors intensify robotics integration to address operational challenges. Technological advancements enhancing system capabilities, declining implementation costs, and supportive government policies are expected to broaden adoption beyond traditional large-scale manufacturers to include medium-sized enterprises. The market outlook remains positive as structural factors driving automation investment persist across Japanese industry. The market generated a revenue of USD 1,864.60 Million in 2025 and is projected to reach a revenue of USD 3,849.77 Million by 2034, growing at a compound annual growth rate of 8.39% from 2026-2034.

Japan Industrial Material Handling Robotics Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type of Robot |

Articulated Robots |

32% |

|

Payload Capacity |

Medium Payload (51 kg to 300 kg) |

45% |

|

Operational Environment |

Indoor |

59% |

|

Application |

Assembly |

25% |

|

End Use Industry |

Automotive |

31% |

|

Region |

Kanto Region |

25% |

Type of Robot Insights:

- Articulated Robots

- Cartesian Robots

- Cylindrical Robots

- SCARA Robots

- Collaborative Robots (Cobots)

Articulated robots dominate with a market share of 32% of the total Japan industrial material handling robotics market in 2025.

Articulated robots maintain market leadership owing to their exceptional versatility and extensive range of motion capabilities across industrial applications. These multi-jointed robotic systems replicate human arm movements with superior precision, enabling complex manipulation tasks including assembly, welding, material transfer, and palletizing operations. The configuration provides access to confined spaces and awkward angles that alternative robot types cannot efficiently address. Japanese manufacturers particularly favor articulated robots for their adaptability across diverse production requirements.

The extensive supplier ecosystem surrounding articulated robots ensures robust support infrastructure, comprehensive spare parts availability, and established integration expertise throughout Japan. In November 2025, Nidec Drive Technology exhibited high-precision gearboxes for six-axis articulated robots at iREX 2025 in Tokyo, demonstrating versatile applications, integrated sensors, and solutions supporting advanced industrial automation systems. Moreover, these systems accommodate varying payload requirements within single installations, providing operational flexibility across production line configurations. Continued technological enhancements improving speed, accuracy, and payload capacity reinforce articulated robot dominance across material handling applications. The mature technology base and proven reliability across decades of industrial deployment establish articulated robots as the foundational platform for Japanese manufacturing automation strategies.

Payload Capacity Insights:

- Low Payload (Up to 50 kg)

- Medium Payload (51 kg to 300 kg)

- High Payload (Above 300 kg)

Medium payload (51 kg to 300 kg) leads with a share of 45% of the total Japan industrial material handling robotics market in 2025.

Medium payload (51 kg to 300 kg) dominates market share due to alignment with mainstream industrial handling requirements across Japanese manufacturing sectors. This payload range accommodates the majority of component weights encountered in automotive parts assembly, electronics manufacturing, packaging operations, and general material transfer applications. As per sources, Yamaha Motor expanded its Robonity single-axis robot lineup with a long-stroke model handling 200 kg, enabling high-speed, precise automation for automotive, electronics, and diverse material handling applications. Furthermore, the capacity provides optimal balance between handling capability and system agility, enabling efficient cycle times without compromising lifting performance. Manufacturers benefit from favorable cost-performance ratios compared to heavier-duty alternatives while avoiding limitations associated with lower payload platforms.

The medium payload segment serves core industrial needs without over-engineering for specialized heavy-lifting requirements that represent smaller application volumes across Japanese industry. These systems demonstrate sufficient capability for standard manufacturing components including engine parts, electronic assemblies, packaged goods, and intermediate materials requiring repositioning throughout production sequences. Widespread applicability across industries and applications establishes medium payload robotics as the foundational segment within Japan's material handling automation landscape, supporting diverse operational requirements across facility types and manufacturing methodologies.

Operational Environment Insights:

- Indoor

- Outdoor

- Controlled Environment (Clean Rooms)

Indoor exhibits a clear dominance with a 59% share of the total Japan industrial material handling robotics market in 2025.

Indoor constitutes the dominant deployment setting for material handling robotics, reflecting concentration within enclosed manufacturing facilities and warehousing operations. Controlled indoor conditions enable precise robotic operation without environmental interference from weather, temperature fluctuations, or dust contamination that complicate outdoor deployments. This setting supports consistent performance and extended equipment service life while maintaining calibration accuracy essential for precision handling tasks. Japanese industrial facilities maintain sophisticated environmental controls supporting sensitive manufacturing processes and robotic system integration.

Established power infrastructure, connectivity provisions, and safety systems within indoor environments facilitate comprehensive automation deployments across production and logistics operations. Indoor settings encompass production lines, distribution centers, clean rooms, and processing facilities where material handling robotics deliver maximum operational value. The controlled atmosphere protects sensitive robotic components including sensors, actuators, and electronic systems from degradation factors present in outdoor environments. Climate-controlled facilities enable year-round consistent operations supporting just-in-time manufacturing philosophies prevalent throughout Japan's industrial ecosystem.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Assembly

- Palletizing

- Packaging

- Material Handling

- Sorting and Picking

- Welding

Assembly dominates with a market share of 25% of the total Japan industrial material handling robotics market in 2025.

Assembly applications dominate the market owing to Japan's advanced manufacturing sector requirements for precision component integration and consistent production quality. Material handling robotics supporting assembly operations position components accurately, maintain orientation consistency, and synchronize with automated fastening and joining processes. These systems address stringent tolerance requirements characteristic of automotive, electronics, and precision equipment manufacturing prevalent across Japanese industry. Assembly-focused robotics enable high-volume production while maintaining quality standards that manual handling cannot consistently achieve across extended operational periods.

The assembly segment benefits from established automation frameworks within Japanese manufacturing facilities designed around robotic integration from initial planning stages. Component presentation, subassembly staging, and finished product handling require coordinated robotic systems operating within defined cycle time parameters. Japanese manufacturers leverage assembly robotics to address workforce constraints while maintaining production throughput essential for competitive positioning. The application demands precise repeatability, gentle handling capabilities, and sophisticated sensing systems that modern material handling robotics provide across diverse assembly line configurations.

End Use Industry Insights:

- Automotive

- Food and Beverage

- Electronics

- Aerospace

- Pharmaceuticals

- Logistics and Warehousing

Automotive leads with a share of 31% of the total Japan industrial material handling robotics market in 2025.

The automotive dominates market share driven by Japan's globally recognized automobile manufacturing ecosystem and continuous production line modernization initiatives. Vehicle assembly operations require extensive material handling automation spanning body panel positioning, powertrain component transfer, interior assembly support, and finished vehicle logistics. Japanese automakers maintain sophisticated production systems integrating robotics throughout manufacturing sequences, establishing automotive facilities as concentrated robotics deployment environments. The industry's scale, production volumes, and quality requirements create substantial demand for advanced material handling solutions.

Automotive complexity necessitates diverse robotic configurations addressing varying payload requirements, handling precision needs, and operational environments across facility zones. Tier-one and tier-two automotive suppliers similarly deploy material handling robotics to meet stringent delivery schedules and quality specifications demanded by vehicle manufacturers. The automotive sector's established automation culture, engineering expertise, and capital investment capacity position it as the leading robotics adopter within Japanese industry. Electric vehicle (EV) production expansion introduces additional automation requirements supporting battery handling and new assembly processes. As per sources, Toyota unveiled advanced battery EV and hydrogen technologies at its Technical Workshop, highlighting automation, intelligent systems, and diversified production strategies to transform automotive manufacturing and future mobility solutions.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

Kanto region dominates with a market share of 25% of the total Japan industrial material handling robotics market in 2025.

Kanto region dominates market share attributed to the concentration of major manufacturing facilities, superior logistics infrastructure, and proximity to Tokyo's technology innovation ecosystem. This region encompasses Japan's largest industrial clusters housing automotive assembly plants, electronics manufacturing facilities, and extensive warehousing operations serving the greater metropolitan area. Moreover, established transportation networks facilitate component supply chains and finished goods distribution, supporting intensive manufacturing activities requiring sophisticated material handling automation throughout production and logistics sequences.

Corporate headquarters concentration within Kanto provides access to decision-making authorities and engineering resources essential for major automation investments. The region benefits from dense supplier networks, technical service capabilities, and skilled workforce availability supporting robotics implementation and maintenance requirements. Research institutions and technology development centers located within Kanto contribute to ongoing innovation in material handling robotics applications. The combination of industrial density, infrastructure quality, and innovation ecosystem establishes Kanto as the primary market for material handling robotics deployment across Japanese industry.

Market Dynamics:

Growth Drivers:

Why is the Japan Industrial Material Handling Robotics Market Growing?

Demographic Pressures and Workforce Availability Constraints

Japan faces persistent demographic challenges characterized by an aging population structure and declining birth rates that fundamentally constrain industrial workforce availability. Manufacturing, logistics, and warehousing sectors experience pronounced difficulty recruiting workers for physically demanding material handling positions as the working-age population contracts. In May 2025, Japan's METI projected a 3.26 Million worker shortage in AI and robotics by 2040, intensifying demand for automation to address workforce constraints in manufacturing and logistics sectors. These structural labor market conditions create sustained demand for automation solutions capable of maintaining production output despite workforce limitations. Companies recognize that material handling robotics provide reliable operational capacity independent of labor market fluctuations, making automation investment strategically imperative rather than merely advantageous. The demographic trajectory suggests continued intensification of workforce constraints, positioning robotics as essential infrastructure for Japanese industrial competitiveness.

Manufacturing Excellence and Quality Assurance Requirements

Japanese industry maintains globally recognized standards for manufacturing precision, product quality, and operational consistency that favor robotic handling systems over manual alternatives. Material handling robotics eliminate human variability in repetitive tasks, ensuring consistent positioning accuracy, handling force, and process timing across production operations. This precision supports just-in-time manufacturing philosophies and zero-defect quality objectives embedded within Japanese industrial culture. Robotic systems integrate seamlessly with quality monitoring infrastructure, enabling real-time traceability and process verification throughout material flow sequences. The alignment between robotic capabilities and deeply established manufacturing excellence principles drives sustained adoption across industries where quality performance directly impacts competitiveness and customer relationships.

Technological Advancement and System Capability Enhancement

Continuous technological progress expands material handling robotics capabilities while improving accessibility for broader industrial adoption. Advances in sensing technologies, processing power, and AI enable robots to perform increasingly complex tasks with greater autonomy and adaptability. In December 2025, Techman Robot unveiled its High-Speed AI Inspection Solution and Auto AI Training at iREX 2025, enabling zero-downtime production and reducing AI deployment setup time by 90%. Vision systems, force feedback mechanisms, and advanced grippers enhance handling precision across diverse material types and configurations. Simultaneously, improved user interfaces and programming tools reduce implementation complexity, enabling deployment in operations lacking specialized robotics expertise. These technological developments expand addressable applications, improve return on investment calculations, and lower adoption barriers that previously limited robotics deployment to large-scale manufacturers with specialized engineering resources.

Market Restraints:

What Challenges the Japan Industrial Material Handling Robotics Market is Facing?

Substantial Capital Investment Requirements

Material handling robotics implementation demands significant upfront capital expenditure encompassing equipment acquisition, system integration, facility modifications, and workforce training costs. Small and medium enterprises face particular challenges justifying substantial initial investments despite potential long-term operational benefits. Extended payback periods and competing capital allocation priorities delay adoption decisions across budget-constrained organizations.

Technical Complexity and Integration Challenges

Successful robotics deployment requires sophisticated technical expertise for system design, programming, integration with existing infrastructure, and ongoing maintenance. Many potential adopters lack internal capabilities to manage implementation complexity effectively. Integration challenges multiply when connecting robotic systems with legacy equipment and enterprise software platforms across established manufacturing environments.

Operational Flexibility Limitations

Despite technological advances, material handling robots remain optimized for specific task parameters and may struggle adapting to significant production variations. Facilities producing diverse products in variable configurations face difficulties achieving comprehensive automation coverage. Frequent changeover requirements and custom handling needs may exceed current robotic flexibility capabilities in certain applications.

Competitive Landscape:

The Japan industrial material handling robotics market features a well-established competitive structure characterized by the presence of domestic technology leaders alongside international automation specialists. Market participants compete across multiple dimensions including technological innovation, application expertise, system reliability, and comprehensive service capabilities. Established players leverage decades of robotics development experience and extensive customer relationships, while newer entrants introduce specialized solutions addressing emerging application requirements. Competition intensifies around artificial intelligence integration, collaborative robotics platforms, and autonomous mobile systems representing growth segments. Differentiation strategies emphasize industry-specific expertise, integration services, and long-term partnership approaches that address customer operational challenges comprehensively rather than purely transactional equipment supply relationships.

Recent Developments:

-

In March 2024, Yokogawa Electric Corporation launched OpreX Robot Management Core, a comprehensive software solution integrating the management of multiple industrial robots. Designed to enhance safety, efficiency, and automation in plant operations, the platform supports inspection, data collection, and procedural instruction issuance, marking a significant step toward autonomous manufacturing operations.

Japan Industrial Material Handling Robotics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Type of Robots Covered | Articulated Robots, Cartesian Robots, Cylindrical Robots, SCARA Robots, Collaborative Robots (Cobots) |

| Payload Capacities Covered | Low Payload (Up to 50 kg), Medium Payload (51 kg to 300 kg), High Payload (Above 300 kg) |

| Operational Environments Covered | Indoor, Outdoor, Controlled Environment (Clean Rooms) |

| Applications Covered | Assembly, Palletizing, Packaging, Material Handling, Sorting and Picking, Welding |

| End Use Industries Covered | Automotive, Food and Beverage, Electronics, Aerospace, Pharmaceuticals, Logistics and Warehousing |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan industrial material handling robotics market size was valued at USD 1,864.60 Million in 2025.

The Japan industrial material handling robotics market is expected to grow at a compound annual growth rate of 8.39% from 2026-2034 to reach USD 3,849.77 Million by 2034.

Articulated robots held the largest market share owing to their exceptional versatility, multi-axis movement capabilities, and widespread applicability across diverse manufacturing and logistics applications requiring complex manipulation and precise material handling operations.

Key factors driving the Japan industrial material handling robotics market include demographic challenges constraining workforce availability, stringent manufacturing quality standards favoring robotic precision, technological advancements enhancing system capabilities, and government initiatives supporting industrial automation adoption.

Major challenges include substantial capital investment requirements limiting small enterprise adoption, technical complexity demanding specialized integration expertise, operational flexibility constraints in high-mix production environments, and extended implementation timelines impacting deployment decisions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)