Japan Industrial Motors Market Size, Share, Trends and Forecast by Type of Motor, Voltage, End User, and Region, 2025-2033

Japan Industrial Motors Market Overview:

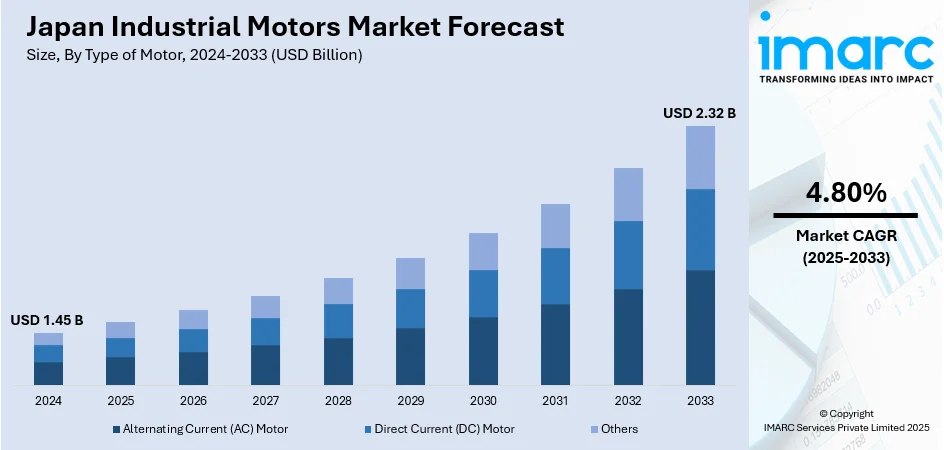

The Japan industrial motors market size reached USD 1.45 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.32 Billion by 2033, exhibiting a growth rate (CAGR) of 4.80% during 2025-2033. At present, rising adoption of the Internet of Things (IoT) is enabling smarter, more connected, and more efficient operations across various sectors. Besides this, industries, such as automotive, electronics, robotics, and precision machinery, depend heavily on motors for powering equipment, automation systems, and production lines, thereby contributing to the expansion of the Japan industrial motors market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.45 Billion |

| Market Forecast in 2033 | USD 2.32 Billion |

| Market Growth Rate 2025-2033 | 4.80% |

Japan Industrial Motors Market Trends:

Growing adoption of IoT

Rising adoption of IoT is positively influencing the market in Japan. With IoT integration, industrial motors are no longer just mechanical devices, they are becoming intelligent components within a broader system. Sensors and connected technologies allow real-time monitoring of motor performance, temperature, vibration, and energy usage. This data helps operators detect issues early, schedule maintenance before failures occur, and optimize motor utilization for better efficiency. IoT-enabled systems contribute to overall energy management, which aligns with Japan’s focus on sustainability and cost reduction. In addition, remote access and control allow operators to monitor motor operations from anywhere, improving safety and convenience. The incorporation of IoT with motors is also supporting the development of smart factories, a key focus in Japan’s shift towards Industry 4.0. As more companies are modernizing their facilities and adopting digital transformation, the demand for motors compatible with IoT systems is growing steadily. As per industry reports, the Japan IoT market was valued at USD 19.10 Billion in 2024 and is set to attain USD 47.34 Billion by 2030 with a CAGR of 16.16%

To get more information on this market, Request Sample

Presence of strong manufacturing base

Japan’s strong manufacturing base plays a key role in stimulating the Japan industrial motors market growth. According to industry reports, in April 2025, Japan's manufacturing production rose by 0.60% compared to April 2024. Industries, such as automotive, electronics, robotics, and precision machinery, depend heavily on industrial motors for powering equipment, automation systems, and production lines. These sectors require motors with high efficiency, durability, and accuracy to maintain consistent output and product quality. As Japan continues to focus on advanced manufacturing and export-based production, industrial motors remain essential for smooth and efficient operations. The country’s emphasis on technological innovations and quality control is further creating the need for specialized motors tailored to specific industrial applications. With continuous investments in upgrading machinery and automation, the demand for modern industrial motors continues to increase within Japan’s strong and diversified manufacturing landscape.

Increasing expenditure on renewable energy projects

Rising investments in renewable energy projects are fueling the market growth. In March 2025, Japanese renewable energy firm Trende revealed the successful conclusion of a JPY 1.07 Billion (around USD 7.2 Million) funding round, bringing on board four strategic partners as new shareholders, aimed at propelling Trende’s expansion efforts, including the enhancement of its primary solar and battery leasing service ‘Teraris’. Leveraging blockchain technology, the project encouraged local generation and use of renewable energy in farming communities. In wind energy, industrial motors play an important role in turbine operations, including blade pitch control and yaw mechanisms. In solar power systems, motors are employed in solar tracking devices that help panels follow the sun for maximum efficiency. Additionally, motors are essential in energy storage systems, where they support cooling, pumping, and control functions. As Japan is shifting toward cleaner energy to reduce carbon emissions and dependency on fossil fuels, renewable projects continue to expand. These projects require reliable and durable motors to ensure continuous operation.

Japan Industrial Motors Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type of motor, voltage, and end user.

Type of Motor Insights:

- Alternating Current (AC) Motor

- Direct Current (DC) Motor

- Others

The report has provided a detailed breakup and analysis of the market based on the type of motor. This includes alternating current (AC) motor, direct current (DC) motor, and others.

Voltage Insights:

- Low Voltage

- Medium Voltage

- High Voltage

A detailed breakup and analysis of the market based on the voltage have also been provided in the report. This includes low voltage, medium voltage, and high voltage.

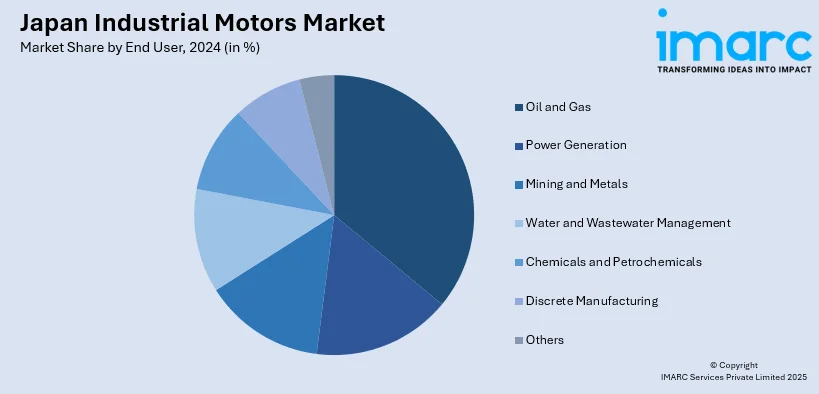

End User Insights:

- Oil and Gas

- Power Generation

- Mining and Metals

- Water and Wastewater Management

- Chemicals and Petrochemicals

- Discrete Manufacturing

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes oil and gas, power generation, mining and metals, water and wastewater management, chemicals and petrochemicals, discrete manufacturing, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Industrial Motors Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Type of Motors Covered | Alternating Current (AC) Motor, Direct Current (DC) Motor, Others |

| Voltages Covered | Low Voltage, Medium Voltage, High Voltage |

| End Users Covered | Oil and Gas, Power Generation, Mining and Metals, Water and Wastewater Management, Chemicals and Petrochemicals, Discrete Manufacturing, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan industrial motors market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan industrial motors market on the basis of type of motor?

- What is the breakup of the Japan industrial motors market on the basis of voltage?

- What is the breakup of the Japan industrial motors market on the basis of end user?

- What is the breakup of the Japan industrial motors market on the basis of region?

- What are the various stages in the value chain of the Japan industrial motors market?

- What are the key driving factors and challenges in the Japan industrial motors market?

- What is the structure of the Japan industrial motors market and who are the key players?

- What is the degree of competition in the Japan industrial motors market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan industrial motors market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan industrial motors market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan industrial motors industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)