Japan Industrial Paints & Coatings Market Size, Share, Trends and Forecast by Product Type, Type, Application, End User, and Region, 2026-2034

Japan Industrial Paints & Coatings Market Overview:

The Japan industrial paints & coatings market size reached USD 5,614.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 8,224.3 Million by 2034, exhibiting a growth rate (CAGR) of 4.33% during 2026-2034. The market is fueled by the development of coating technologies, including eco-friendly, low-VOC, and water-based coatings, to overcome environmental issues and regulatory needs. Growing need for corrosion-resistant coatings in maritime and infrastructure uses, along with Japan's focus on innovation and quality standards also sustains the growth of specialized coatings to address the varied needs of numerous industries, further increasing the Japan industrial paints & coatings market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 5,614.9 Million |

| Market Forecast in 2034 | USD 8,224.3 Million |

| Market Growth Rate 2026-2034 | 4.33% |

Japan Industrial Paints & Coatings Market Trends:

Increasing Demand from Automotive and Transport Industries

Japan's automotive industry plays a large role in defining its industrial coatings and paints market. As the home to some of the world's leading car manufacturers, Japan puts heavy importance on quality, innovation, and environmental practices in car production. This results in high demand for sophisticated coatings with corrosion resistance, lightweight strength, and decorative finishes. With the increasing shift toward electric vehicles (EVs) and autonomous technologies, there is a greater demand for coatings that enable thermal management and electromagnetic shielding. Also, marine and rail industries in Japan, which are part of its logistics and public transport networks, are also driving demand. These applications demand coatings with long-term salt, moisture, and UV resistance. Japan's focus on ensuring infrastructure and transport resilience, particularly in a typhoon- and coastal erosion-prone climate, further drives the Japan industrial paints & coatings market growth, as they are specifically designed for durability and longevity in extreme environmental conditions.

To get more information on this market Request Sample

Innovation-Driven Sustainability and VOC Regulation Compliance

Environmental awareness is an integral part of Japan's industrial policy and consumer expectations, shaping trends in the coatings market. Tighter national air quality controls have spurred the broad use of low-VOC and water-based coatings. Japanese producers are making significant investments in bio-based and solvent-free technologies to comply with both domestic regulations and global requirements. Companies and research institutions are working together on the creation of next-generation coatings that are biodegradable, energy-efficient during application, and reduce environmental impact across the life cycle of the product. Powder coatings are greatly preferred in industrial usage because they have high transfer efficiency and contain no harmful solvents. Additionally, energy-saving coatings like heat-reflective or insulating coatings are becoming increasingly popular as a result of the nation's energy-saving campaign, especially after the Fukushima disaster. These trends driven by sustainability mirror both regulatory adherence and general societal change toward responsible production, with Japan at the forefront of environmentally friendly coatings innovation.

Digitalization and Smart Coating Technologies

Japan's dominance in cutting-edge manufacturing and electronics is being dominated by the coatings industry through smart and functional coatings. Increased demand for coatings that respond or adapt to changes in the environment—like temperature-sensing paints or self-healing paints for car and industrial applications are also prevalent. Moreover, Japanese companies are working on the inclusion of nanotechnology in coatings to increase aspects like anti-fouling, anti-bacterial properties, and wear resistance. For industries like semiconductors and precision machinery, the demand for ultra-clean and antistatic coatings is increasing. In addition, digitalization during the application process is on the rise. Intelligent robotics and robotic spray systems are being employed for uniform application and minimizing waste. These are highly important in Japan's high-cost manufacturing base where precision, efficiency, and less downtime is vital. The focus on high-tech, value-added coatings is hence an immediate response to Japan's wider industrial strategy based on prioritizing innovation, quality control, and long-term performance.

Japan Industrial Paints & Coatings Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type, type, application, and end user.

Product Type Insights:

- Water-based

- Solvent-based

The report has provided a detailed breakup and analysis of the market based on the product type. This includes water-based and solvent-based.

Type Insights:

- Automotive and Refinish Coating

- Protective Coating

- Powder Coating

- General Industrial Coating

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes automotive and refinish coating, protective coating, powder coating, general industrial coating, and others.

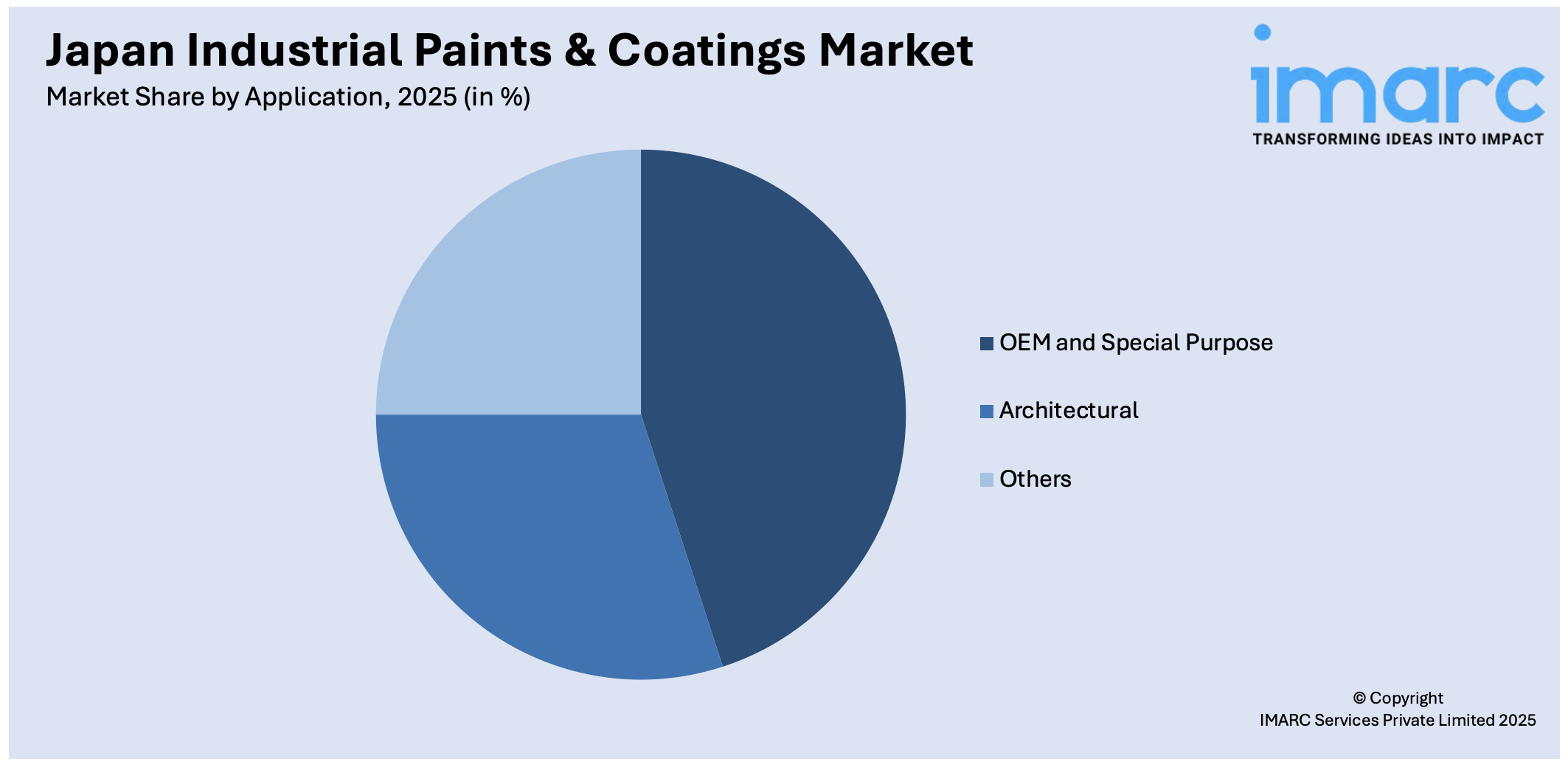

Application Insights:

Access the comprehensive market breakdown Request Sample

- OEM and Special Purpose

- Architectural

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes OEM and special purpose, architectural, and others.

End User Insights:

- Automotive

- Marine

- General Industries

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes automotive, marine, general industries, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central /Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central /Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Industrial Paints & Coatings Market News:

- In February 2024, Kansai Paint Co., Ltd. revealed that through its European subsidiary Kansai Helios Coatings GmbH, it will acquire the Industrial Coatings division of WEILBURGER Coatings GmbH and WEILBURGER Asia Ltd. The purchase will occur through a complete 100% share transfer of WEILBURGER owned by GREBE Holding GmbH, encompassing all the Industrial Coating operations, including sales and manufacturing locations of WEILBURGER across Europe, America, Asia, and beyond.

Japan Industrial Paints & Coatings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Water-based, Solvent-based |

| Types Covered | Automotive and Refinish Coating, Protective Coating, Powder Coating, General Industrial Coating, Others |

| Applications Covered | OEM and Special Purpose, Architectural, Others |

| End Users Covered | Automotive, Marine, General Industries, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central /Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan industrial paints & coatings market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan industrial paints & coatings market on the basis of product type?

- What is the breakup of the Japan industrial paints & coatings market on the basis of type?

- What is the breakup of the Japan industrial paints & coatings market on the basis of application?

- What is the breakup of the Japan industrial paints & coatings market on the basis of end user?

- What is the breakup of the Japan industrial paints & coatings market on the basis of region?

- What are the various stages in the value chain of the Japan industrial paints & coatings market?

- What are the key driving factors and challenges in the Japan industrial paints & coatings?

- What is the structure of the Japan industrial paints & coatings market and who are the key players?

- What is the degree of competition in the Japan industrial paints & coatings market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan industrial paints & coatings market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan industrial paints & coatings market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan industrial paints & coatings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)