Japan Industrial Welding Machines Market Size, Share, Trends and Forecast by Welding Technology, Automation Level, Power Source Type, Sales Channel, End Use Industry, and Region, 2026-2034

Japan Industrial Welding Machines Market Overview:

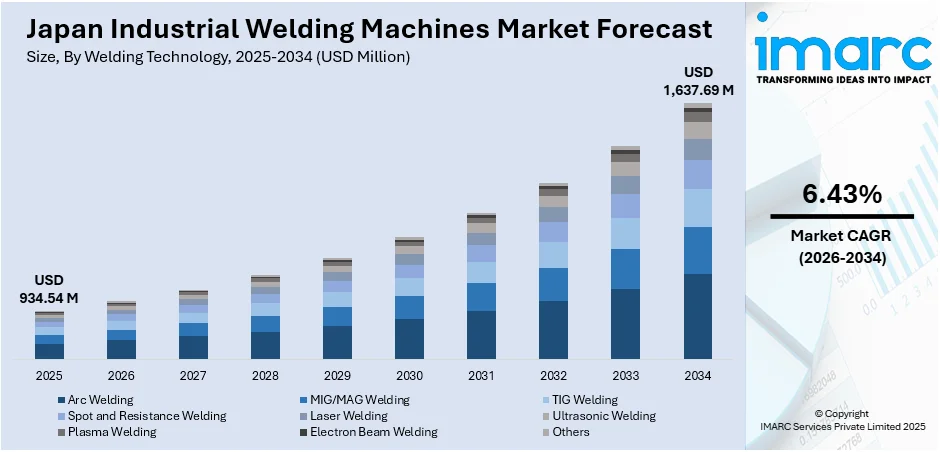

The Japan Industrial Welding Machines Market size reached USD 934.54 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,637.69 Million by 2034, exhibiting a growth rate (CAGR) of 6.43% during 2026-2034. The demand for robotics and automation to enhance operational efficiency, precision, and overcome labor shortages is driving the market. Moreover, the focus on energy-efficient and eco-friendly solutions also complies with strict environmental laws. The merging of intelligent technologies and Internet of Things (IoT) capabilities also improves system performance and enables predictive maintenance. All these developments, coupled with automation trends and sustainability aspirations, are ultimately growing the Japan industrial welding machines market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 934.54 Million |

| Market Forecast in 2034 | USD 1,637.69 Million |

| Market Growth Rate 2026-2034 | 6.43% |

Japan Industrial Welding Machines Market Trends:

Focus on Energy-Efficient and Eco-Friendly Solutions

As environmental issues escalate, Japan's welding sector is gradually moving towards power-efficient and environmentally friendly alternatives. Companies are emphasizing equipment with low power consumption and minimal emissions in accordance with the country's stringent environmental protection laws. Technologies such as inverter-based welding equipment are becoming increasingly popular as they help reduce energy consumption without compromising performance. This shift is in line with international initiatives to minimize carbon footprints in production and is aligned with Japan's sustainability objectives. Through these green technologies, businesses can reduce their operation costs while promoting environmental conservation. Consequently, environmental-friendly welding machines are on the rise, allowing manufacturers to comply with regulatory requirements and remain competitive in a market that is environmentally conscious.

To get more information on this market Request Sample

Adoption of Automation and Robotics

The Japanese industrial welding market is swiftly embracing automation and robotics to boost efficiency, precision, and cost-effectiveness. Robotic welding systems, including automated arms and CNC-controlled machines, are increasingly adopted in automotive and aerospace sectors to achieve faster production and consistent, high-quality welds. These systems also help reduce labor costs by handling repetitive tasks, addressing Japan’s ongoing skilled labor shortage. This allows experienced workers to concentrate on complex operations, enhancing overall productivity. Supporting this trend, Japan operated approximately 435,299 industrial robots in 2023, a 5% rise from the previous year, reflecting the country’s growing reliance on automation. This technological shift enables manufacturers to maintain high accuracy and reliability while remaining competitive globally, as advanced manufacturing processes offer significant advantages in quality, speed, and operational cost reduction.

Integration of Smart Technologies and IoT

The Japanese welding industry is leveraging smart technologies and IoT to enhance the performance of welding machines. Equipment now comes with integrated sensors and connectivity, allowing real-time data collection and monitoring. This enables predictive maintenance, reduces downtime, and increases operational efficiency. By gathering data on welding parameters and equipment condition, manufacturers can optimize production and improve the lifespan of machines. These innovations reflect Japan’s commitment to advancing Industry 4.0, and the integration of smart welding solutions is helping companies stay ahead thus supporting the Japan industrial welding machines market growth. The trend towards IoT-connected machines is a key driver of modernization in the industry.

Japan Industrial Welding Machines Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on welding technology, automation level, power source type, sales channel, and end use industry.

Welding Technology Insights:

- Arc Welding

- MIG/MAG Welding

- TIG Welding

- Spot and Resistance Welding

- Laser Welding

- Ultrasonic Welding

- Plasma Welding

- Electron Beam Welding

- Others

A detailed breakup and analysis of the market based on the welding technology have also been provided in the report. This includes arc welding, MIG/MAG welding, tig welding, spot and resistance welding, laser welding, ultrasonic welding, plasma welding, electron beam welding, and others.

Automation Level Insights:

- Manual Welding Machines

- Semi-Automatic Welding Machines

- Fully Automatic Welding Machines

The report has provided a detailed breakup and analysis of the market based on the automation level. This includes manual welding machines, semi-automatic welding machines, and fully automatic welding machines.

Power Source Type Insights:

- Electric Welding Machines

- Gas Welding Machines

- Hybrid Welding Machines

A detailed breakup and analysis of the market based on the power source type have also been provided in the report. This includes electric welding machines, gas welding machines, and hybrid welding machines.

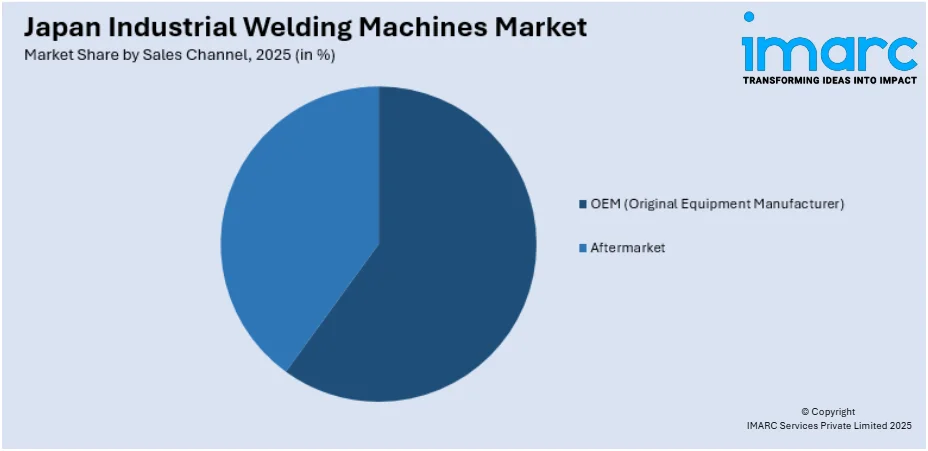

Sales Channel Insights:

Access the comprehensive market breakdown Request Sample

- OEM (Original Equipment Manufacturer)

- Aftermarket

The report has provided a detailed breakup and analysis of the market based on the sales channel. This includes OEM (original equipment manufacturer) and aftermarket.

End Use Industry Insights:

- Automotive

- Transportation

- Construction and Infrastructure

- Shipbuilding

- Aerospace and Defense

- Oil and Gas

- Energy and Power

- Heavy Machinery and Equipment

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes automotive, transportation, construction and infrastructure, shipbuilding, aerospace and defense, oil and gas, energy and power, heavy machinery and equipment, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto, Kansai/Kinki, Central/ Chubu, Kyushu-Okinawa, Tohoku, Chugoku, Hokkaido, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Industrial Welding Machines Market News:

- In April 2025, Techman Robot has partnered with Panasonic Connect’s Welding Systems Division to advance welding automation in Japan. This collaboration combines Techman Robot’s expertise in collaborative robotics with Panasonic’s welding technology. The initiative introduces the "Welding Node" module, simplifying robot-assisted welding deployment and addressing labor shortages. The partnership aims to accelerate automation, utilizing AI-powered systems and integrated vision platforms to enhance efficiency and scalability in the Japanese manufacturing sector.

- In April 2025, Yaskawa Electric, in collaboration with Toyota Motor Corporation, introduced a new welding method called Sequence Freezing Arc-Welding (SFA) on March 13, 2025. The innovative technique, applied to racing car roll cages, significantly reduces production time from two to three weeks to just two to three days. This advancement in robot-assisted welding promises to boost efficiency and revolutionize manufacturing processes, particularly in high-precision sectors like automotive.

Japan Industrial Welding Machines Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Welding Technologies Covered | Arc Welding, MIG/MAG Welding, TIG Welding, Spot and Resistance Welding, Laser Welding, Ultrasonic Welding, Plasma Welding, Electron Beam Welding, Others |

| Automation Levels Covered | Manual Welding Machines, Semi-Automatic Welding Machines, Fully Automatic Welding Machines |

| Power Source Types Covered | Electric Welding Machines, Gas Welding Machines, Hybrid Welding Machines |

| Sales Channels Covered | OEM (Original Equipment Manufacturer), Aftermarket |

| End Use Industries Covered | Automotive, Transportation, Construction and Infrastructure, Shipbuilding, Aerospace and Defense, Oil and Gas, Energy and Power, Heavy Machinery and Equipment, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan industrial welding machines market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan industrial welding machines market on the basis of welding technology?

- What is the breakup of the Japan industrial welding machines market on the basis of automation level?

- What is the breakup of the Japan industrial welding machines market on the basis of power source type?

- What is the breakup of the Japan industrial welding machines market on the basis of sales channel?

- What is the breakup of the Japan industrial welding machines market on the basis of end use industry?

- What is the breakup of the Japan industrial welding machines market on the basis of region?

- What are the various stages in the value chain of the Japan industrial welding machines market?

- What are the key driving factors and challenges in the Japan industrial welding machines market?

- What is the structure of the Japan industrial welding machines market and who are the key players?

- What is the degree of competition in the Japan industrial welding machines market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan industrial welding machines market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan industrial welding machines market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan industrial welding machines industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)