Japan Intravenous Solution Market Size, Share, Trends and Forecast by Type, Nutrients, and Region, 2026-2034

Japan Intravenous Solution Market Summary:

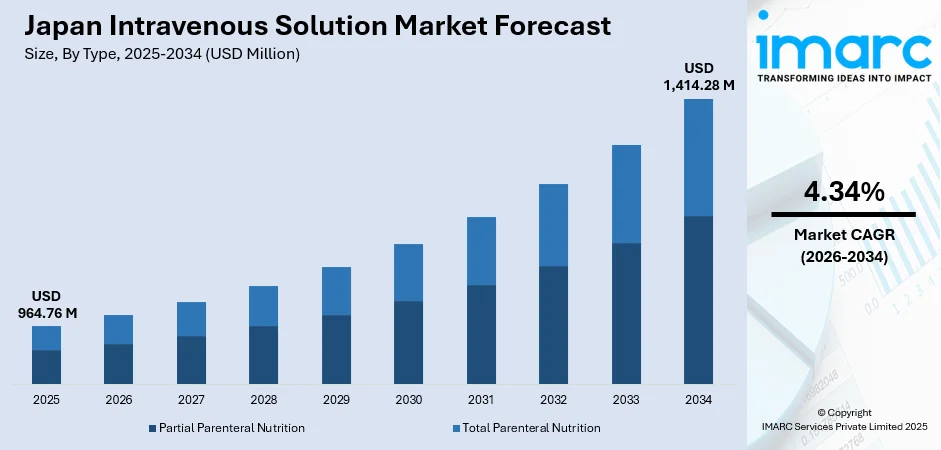

The Japan intravenous solution market size was valued at USD 964.76 Million in 2025 and is projected to reach USD 1,414.28 Million by 2034, growing at a compound annual growth rate of 4.34% from 2026-2034.

Japan's intravenous solution market is experiencing significant expansion driven by the nation's rapidly aging population and rising prevalence of chronic diseases requiring nutritional intervention. The advanced healthcare infrastructure, coupled with supportive government policies and technological innovations in parenteral formulations, continues to fuel market growth across diverse clinical applications.

Key Takeaways and Insights:

- By Type: Partial parenteral nutrition dominates the market with a share of 64% in 2025, driven by its widespread application in patients requiring supplemental nutritional support alongside oral or enteral feeding to maintain adequate nutrient intake.

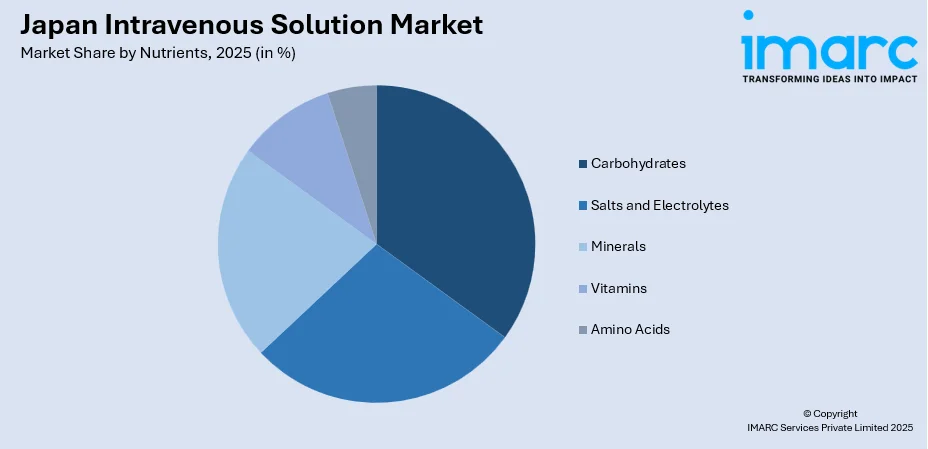

- By Nutrients: Carbohydrates lead the market with a share of 32% in 2025, owing to their essential role as primary energy sources in parenteral nutrition formulations and widespread utilization across diverse patient populations requiring intravenous nutritional support.

- By Region: Kanto Region represents the largest segment with a market share of 35% in 2025, attributed to its concentration of leading hospitals, healthcare facilities, and pharmaceutical companies driving demand for advanced intravenous solutions (IV).

- Key Players: The Japan intravenous solution market exhibits a competitive landscape with established domestic pharmaceutical manufacturers competing alongside global healthcare corporations. Market participants focus on formulation innovations, quality enhancements, and strategic collaborations to strengthen their market positioning.

To get more information on this market Request Sample

Japan's intravenous solution market is propelled by the nation's demographic transformation, characterized by one of the world's highest proportions of elderly citizens requiring specialized nutritional care. In May 2025, Otsuka Pharmaceutical Factory and ICU Medical completed the establishment of a joint venture aimed at bolstering IV solutions manufacturing and innovation, creating one of the largest global infusion therapy production networks. The healthcare system's emphasis on comprehensive patient management drives demand for advanced parenteral nutrition solutions addressing complex medical conditions. Technological advancements in formulation development have expanded treatment applications, introducing multi-chamber bags and customized nutrient combinations that enhance therapeutic efficacy and patient outcomes. Furthermore, Japan's robust pharmaceutical industry continues to innovate in areas including amino acid solutions, lipid emulsions, and vitamin-mineral preparations, creating diverse product portfolios catering to varied clinical requirements. The growing adoption of home parenteral nutrition programs is extending market reach beyond hospital settings, while supportive reimbursement policies facilitate patient access to essential intravenous therapies.

Japan Intravenous Solution Market Trends:

Advanced Multi-Chamber Bag Formulations

Japanese pharmaceutical manufacturers are developing sophisticated multi-chamber bag systems that combine multiple nutritional components while maintaining stability and sterility until administration. In September 2024, Otsuka Pharmaceutical Factory obtained marketing approval for “KIDPAREN Injection,” a three-chamber total parenteral nutrition solution that integrates amino acids, glucose, electrolytes, and vitamins in a single bag for patients with chronic kidney disease, illustrating local industry progress in advanced IV nutritional systems. These innovations integrate amino acids, glucose, electrolytes, lipids, and vitamins in convenient ready-to-use formats, reducing preparation time and contamination risks. The advancement toward comprehensive single-bag solutions streamlines clinical workflows and improves medication safety in healthcare settings.

Expansion of Home Parenteral Nutrition Services

The Japan intravenous solution market is witnessing growing adoption of home-based parenteral nutrition programs enabling patients with chronic conditions to receive nutritional therapy outside hospital environments. In 2025, Air‑Water expanded home infusion equipment production, including HPN pumps, by opening the East Japan Medical Center, addressing growing demand and enhancing quality of life for home care patients. Healthcare providers are developing patient education initiatives and support systems facilitating safe home administration. This trend addresses patient preferences for improved quality of life while reducing healthcare facility burdens and associated costs.

Personalized Nutritional Formulations

Increasing emphasis on individualized patient care is driving development of customized parenteral nutrition solutions tailored to specific metabolic requirements and disease states. Japan’s 2024 Critical Care Nutrition Guideline emphasizes tailoring parenteral nutrition timing and dosing to patients’ clinical conditions and metabolic needs, signaling a nationwide shift toward precise nutrient therapy in critical care. Healthcare institutions are implementing assessment protocols enabling precise nutrient dosing based on patient conditions, laboratory values, and therapeutic goals. This personalization trend enhances treatment effectiveness and minimizes complications associated with standardized approaches.

Market Outlook 2026-2034:

The Japan intravenous solution market demonstrates favorable growth prospects throughout the forecast period, supported by demographic factors, healthcare infrastructure investments, and therapeutic innovations. Continued expansion of geriatric care services, chronic disease management programs, and specialized nutritional support will sustain market demand. The market generated a revenue of USD 964.76 Million in 2025 and is projected to reach a revenue of USD 1,414.28 Million by 2034, growing at a compound annual growth rate of 4.34% from 2026-2034.

Japan Intravenous Solution Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Partial Parenteral Nutrition | 64% |

| Nutrients | Carbohydrates | 32% |

| Region | Kanto Region | 35% |

Type Insights:

- Partial Parenteral Nutrition

- Total Parenteral Nutrition

The partial parenteral nutrition dominates with a market share of 64% of the total Japan intravenous solution market in 2025.

Partial parenteral nutrition represents the largest type of segment in Japan's intravenous solution market, providing supplemental nutritional support to patients who can receive some nutrition through oral or enteral routes but require additional intravenous nutrients to meet their metabolic requirements. According to a 2024 report, Japanese hospitals have increasingly strengthened multidisciplinary Nutrition Support Teams (NSTs) to enhance parenteral nutrition practice, with clinical data showing NST‑led interventions significantly improved implementation of recommended nutrition therapies, reflecting stronger institutional focus on appropriate nutrition support. This approach is widely utilized across hospital settings for patients recovering from surgery, experiencing temporary gastrointestinal dysfunction, or requiring enhanced nutritional intake during illness recovery periods.

The segment's dominance reflects clinical preferences for maintaining gastrointestinal function whenever possible while ensuring adequate nutrient delivery. Japanese healthcare protocols emphasize early enteral feeding combined with parenteral supplementation, driving demand for partial parenteral nutrition solutions. Manufacturers continue developing specialized formulations addressing specific clinical scenarios including post-operative care, oncology support, and geriatric nutrition, expanding the segment's application scope across diverse patient populations.

Nutrients Insights:

Access the comprehensive market breakdown Request Sample

- Carbohydrates

- Salts and Electrolytes

- Minerals

- Vitamins

- Amino Acids

The carbohydrates leads with a share of 32% of the total Japan intravenous solution market in 2025.

Carbohydrates constitute the leading nutrient segment in Japan's intravenous solution market, serving as the primary energy source in parenteral nutrition formulations. Glucose-based solutions provide essential caloric support for patients unable to maintain adequate oral intake, supporting metabolic functions and tissue preservation during periods of nutritional compromise. The widespread requirement for energy provision across virtually all parenteral nutrition applications ensures consistent demand for carbohydrate solutions.

Japanese pharmaceutical manufacturers offer diverse carbohydrate formulations with varying concentrations and compositions tailored to specific clinical requirements. The segment benefits from established clinical protocols integrating glucose administration into standard parenteral nutrition regimens across medical specialties. Ongoing research focuses on optimizing carbohydrate delivery rates and combinations with other nutrients to enhance metabolic outcomes and minimize complications associated with intravenous glucose administration.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto Region exhibits a clear dominance with a 35% share of the total Japan intravenous solution market in 2025.

The Kanto Region dominates Japan's intravenous solution market with the largest share, anchored by Tokyo's concentration of leading university hospitals, specialized medical centers, and pharmaceutical headquarters. The region's advanced healthcare infrastructure and high population density generate substantial demand for parenteral nutrition solutions across acute care and chronic disease management applications.

Additionally, Kanto’s robust research ecosystem drives innovation in intravenous therapies, with numerous clinical trials and pilot programs evaluating novel formulations and multi-chamber bag systems. Collaboration between hospitals, biotech startups, and established pharmaceutical companies accelerates product development, ensuring rapid adoption of advanced IV solutions to meet the evolving nutritional needs of diverse patient populations.

Market Dynamics:

Growth Drivers:

Why is the Japan Intravenous Solution Market Growing?

Rapidly Aging Population Requiring Nutritional Support

Japan possesses one of the world's most aged populations, with elderly citizens representing an expanding proportion of the total population. As of September 2025, an estimated 36.19 million Japanese citizens, nearly 29.4 % of the population, were aged 65 or older, the highest proportion recorded and highlighting Japan’s status as the most aged society globally. This demographic transformation significantly influences healthcare demand, as older individuals frequently experience conditions affecting nutritional intake including swallowing difficulties, gastrointestinal disorders, and chronic diseases requiring medical intervention. The growing geriatric population creates sustained demand for parenteral nutrition solutions supporting patients unable to meet nutritional requirements through conventional feeding methods. Healthcare providers increasingly recognize the importance of adequate nutrition in elderly patient outcomes, driving adoption of intravenous solutions across hospitals, long-term care facilities, and home care settings.

Rising Prevalence of Chronic Diseases and Malnutrition

The increasing burden of chronic diseases including cancer, gastrointestinal disorders, and metabolic conditions drives demand for specialized nutritional interventions in Japan. According to reports, Japan reported 316,900 ulcerative colitis and 95,700 Crohn’s cases, a 40 % rise over eight years, driving increased demand for comprehensive nutritional support, including parenteral nutrition. Patients with conditions affecting nutrient absorption or requiring intensive medical treatments often develop malnutrition necessitating parenteral support. Cancer patients undergoing chemotherapy or radiation therapy frequently require intravenous nutrition to maintain strength and support immune function during treatment periods. Similarly, patients with inflammatory bowel disease, short bowel syndrome, and other gastrointestinal conditions depend on parenteral nutrition for survival and quality of life maintenance, creating consistent market demand across clinical specialties.

Technological Advancements in Parenteral Formulations

Continuous innovation in parenteral nutrition technology expands market opportunities through improved product safety, efficacy, and convenience. Japanese pharmaceutical manufacturers develop advanced multi-chamber bag systems combining multiple nutritional components with extended stability profiles, enhancing clinical utility and reducing preparation requirements. Novel lipid emulsions incorporating beneficial fatty acid profiles improve patient tolerance and metabolic outcomes. Additionally, specialized formulations addressing specific disease states and patient populations broaden therapeutic applications. These technological advancements increase healthcare provider confidence in parenteral nutrition therapies, driving adoption across diverse clinical settings and patient populations.

Market Restraints:

What Challenges the Japan Intravenous Solution Market is Facing?

Complications Associated with Parenteral Nutrition Administration

Intravenous nutrition administration carries inherent risks including catheter-related infections, metabolic complications, and liver dysfunction that require careful patient monitoring and management. These potential complications necessitate specialized healthcare professional expertise and sophisticated monitoring protocols, limiting administration settings and increasing overall treatment costs. Concerns regarding long-term parenteral nutrition complications influence clinical decision-making toward alternative feeding methods when feasible.

High Treatment Costs and Reimbursement Pressures

Parenteral nutrition therapies involve substantial costs encompassing specialized formulations, administration equipment, professional monitoring, and potential complication management. Healthcare budget constraints and reimbursement system pressures create challenges for widespread therapy adoption, particularly for long-term treatments. Cost considerations influence clinical decisions regarding parenteral versus enteral nutrition approaches and treatment duration, potentially limiting market expansion in certain patient segments.

Shortage of Specialized Healthcare Professionals

Effective parenteral nutrition management requires healthcare professionals with specialized training in nutritional assessment, formulation prescription, and complication monitoring. Japan's healthcare workforce faces demographic challenges reflecting broader population trends, creating potential shortages of qualified personnel for specialized nutrition support services. Limited availability of trained nutrition support teams may constrain service expansion, particularly in regions with fewer major medical centers.

Competitive Landscape:

The Japan intravenous solution market exhibits a moderately consolidated competitive structure characterized by established domestic pharmaceutical manufacturers alongside global healthcare corporations. Market participants compete through product innovation, quality assurance, manufacturing capabilities, and distribution network strength. Domestic companies leverage understanding of local regulatory requirements and healthcare system dynamics, while international players contribute global research expertise and comprehensive product portfolios. Strategic activities including product launches, formulation improvements, and manufacturing investments characterize competitive dynamics. Manufacturers increasingly emphasize comprehensive nutritional solution portfolios addressing diverse patient needs, specialty formulations for specific clinical applications, and customer support services differentiating their market positioning.

Recent Developments:

- In November 2024, Otsuka Pharmaceutical Factory established Otsuka ICU Medical LLC, acquiring ICU Medical’s IV solution business and securing a 60% stake. The new entity aims to strengthen global supply and advance technologies in IV solutions and clinical nutrition, following the companies’ 2024 joint venture.

Japan Intravenous Solution Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Partial Parenteral Nutrition, Total Parenteral Nutrition |

| Nutrients Covered | Carbohydrates, Salts and Electrolytes, Minerals, Vitamins, Amino Acids |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan intravenous solution market size was valued at USD 964.76 Million in 2025.

The Japan intravenous solution market is expected to grow at a compound annual growth rate of 4.34% from 2026-2034 to reach USD 1,414.28 Million by 2034.

Partial parenteral nutrition dominated the market with a 64% share, driven by its widespread application in patients requiring supplemental nutritional support alongside oral or enteral feeding.

Key factors driving the Japan intravenous solution market include the rapidly aging population, rising prevalence of chronic diseases and malnutrition, technological advancements in parenteral formulations, and expanding home parenteral nutrition.

Major challenges include complications associated with parenteral nutrition administration, high treatment costs and reimbursement pressures, shortage of specialized healthcare professionals, and the need for sophisticated patient monitoring protocols.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)