Japan IoT Insurance Market Report by Type (Property and Casualty (P&C) Insurance, Health Insurance, Life Insurance, and Others), Application (Automotive and Transportation, Home and Commercial Buildings, Life and Health, Business and Enterprise, Consumer Electronics and Industrial Machines, Agriculture, and Others), and Region 2026-2034

Market Overview:

Japan IoT insurance market size reached USD 2.9 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 16.8 Billion by 2034, exhibiting a growth rate (CAGR) of 21.36% during 2026-2034. The market is primarily experiencing growth due to the growing adoption of telematics devices within the automotive and transportation sectors. These devices play a pivotal role in gathering data from vehicles and expediting the processing of insurance claims in the event of accidents or other incidents.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2.9 Billion |

| Market Forecast in 2034 | USD 16.8 Billion |

| Market Growth Rate (2026-2034) | 21.36% |

Access the full market insights report Request Sample

IoT insurance empowers global insurance firms to efficiently transmit, gather, and exchange vital client data. This technology facilitates collaboration between insurance brokers and policyholders, ultimately reducing claims payouts for insurers. Furthermore, IoT insurance caters to customer requirements by offering highly tailored and precise service packages. It leverages advanced technologies such as artificial intelligence (AI), machine learning, robotic process automation, augmented reality (AR), telematics, and drones to enhance the overall quality of services. Among the extensive services provided by IoT insurance are streamlined claim management, real-time risk assessment, and the reduction of operational costs for organizations involved in claims settlement management.

Japan IoT insurance Market Trends:

The Japan IoT insurance market is experiencing significant growth, driven by key factors that mirror the nation's dynamic insurance landscape. A pivotal driver is the remarkable expansion within the insurance sector, coupled with the increasing proliferation of connected devices across various industries. Additionally, the widespread adoption of telematics devices in the automotive and transportation sectors, aimed at real-time data collection from vehicles to expedite insurance claims processing in the event of accidents or incidents, stands as a prominent growth catalyst. Moreover, IoT devices like fitness trackers and smartwatches are extensively used for monitoring vital health metrics, enabling health insurers to track customer behavior and offer personalized discounts. Insurance companies are also capitalizing on IoT technologies to optimize operational efficiency and reduce premiums and risk-related expenses, which is acting as another significant growth-inducing factor. Besides this, the market growth is further propelled by advancements in data collection sensors and devices, as well as innovative insurance models. Furthermore, substantial investments in cloud and digital technologies, the commercialization of 5G networks, increased usage of connected vehicles, advancements in telematics, product innovations, and ongoing research and development (R&D) initiatives will collectively contribute to a favorable outlook for the market over the forecasted period.

Japan IoT Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type and application.

Type Insights:

To get detailed segment analysis of this market Request Sample

- Property and Casualty (P&C) Insurance

- Health Insurance

- Life Insurance

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes property and casualty (P&C) insurance, health insurance, life insurance, and others.

Application Insights:

- Automotive and Transportation

- Home and Commercial Buildings

- Life and Health

- Business and Enterprise

- Consumer Electronics and Industrial Machines

- Agriculture

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes automotive and transportation, home and commercial buildings, life and health, business and enterprise, consumer electronics and industrial machines, agriculture, and others.

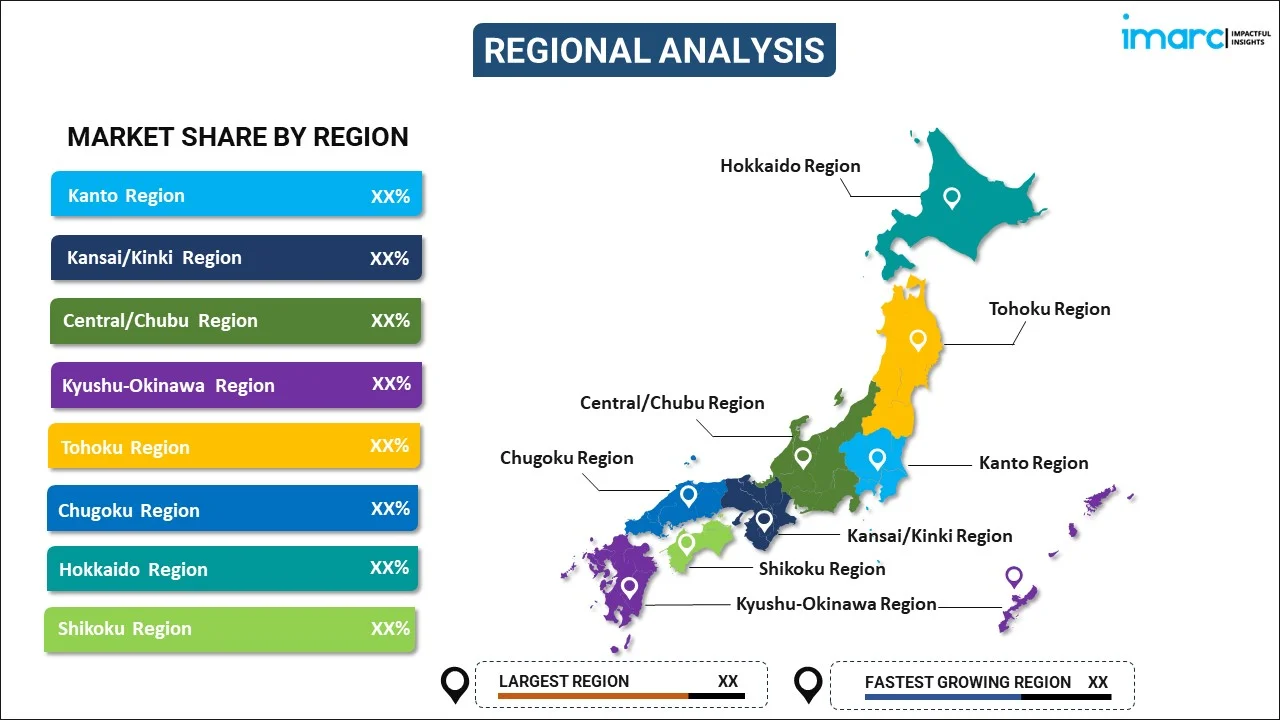

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan IoT Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Property and Casualty (P&C) Insurance, Health Insurance, Life Insurance, Others |

| Applications Covered | Automotive and Transportation, Home and Commercial Buildings, Life and Health, Business and Enterprise, Consumer Electronics and Industrial Machines, Agriculture, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan IoT insurance market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Japan IoT insurance market?

- What is the breakup of the Japan IoT insurance market on the basis of type?

- What is the breakup of the Japan IoT insurance market on the basis of application?

- What are the various stages in the value chain of the Japan IoT insurance market?

- What are the key driving factors and challenges in the Japan IoT insurance?

- What is the structure of the Japan IoT insurance market and who are the key players?

- What is the degree of competition in the Japan IoT insurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan IoT insurance market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan IoT insurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan IoT insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)