Japan Keto Friendly Snacks Market Size, Share, Trends and Forecast by Flavor, Ingredient Type, Distribution Channel, and Region, 2026-2034

Japan Keto Friendly Snacks Market Summary:

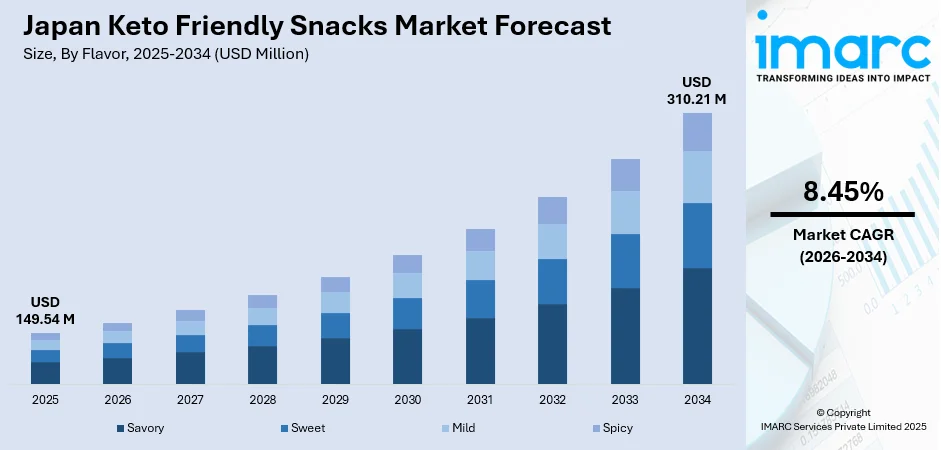

The Japan keto friendly snacks market size was valued at USD 149.54 Million in 2025 and is projected to reach USD 310.21 Million by 2034, growing at a compound annual growth rate of 8.45% from 2026-2034.

The market is driven by growing health consciousness among Japanese consumers seeking low-carbohydrate dietary alternatives that support metabolic wellness and weight management goals. Rising fitness culture, increasing demand for functional and clean-label food options, and the adoption of ketogenic dietary practices across diverse age demographics are propelling market expansion. Manufacturers are focusing on developing innovative snack formulations that align with traditional Japanese taste preferences, contributing to the expanding Japan keto friendly snacks market share.

Key Takeaways and Insights:

- By Flavor: Savory dominates the market with a share of 43.7% in 2025, driven by Japanese preference for umami-rich flavors and traditional snacking habits, the savory segment leads, incorporating familiar ingredients like seaweed, soy, and seasoned nuts.

- By Ingredient Type: Nuts and seeds lead the market with a share of 37.6% in 2025, attributed to their low-carbohydrate profile, high healthy fat content, and convenient on-the-go consumption, nuts and seeds dominate the market.

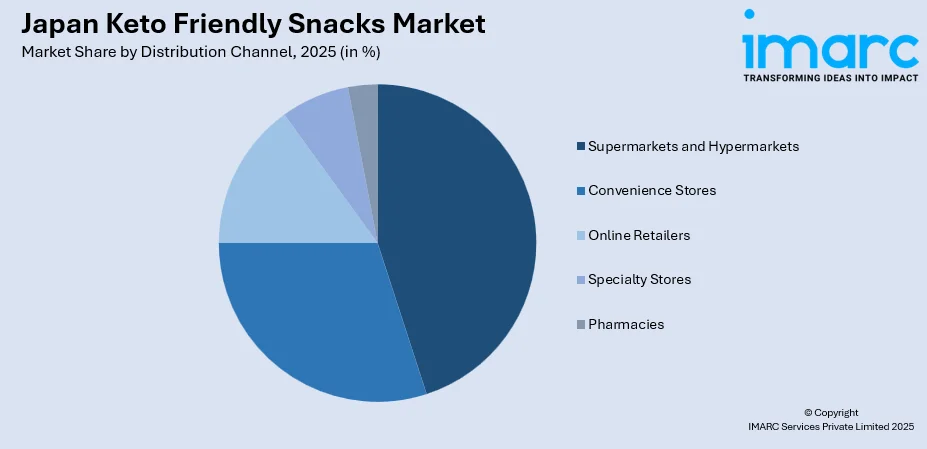

- By Distribution Channel: Supermarkets & hypermarkets represents the largest segment with a market share of 44.3% in 2025, fueled by extensive product variety, established consumer trust, and the ability to physically inspect items, supermarkets and hypermarkets hold the leading share.

- By Region: Kanto region dominates the market with a share of 33.8% in 2025, supported by region’s dense urban population, elevated disposable incomes, health-conscious consumers, and strong retail infrastructure, the region leads in market adoption.

- Key Players: The competitive landscape is characterized by both established food manufacturers and emerging niche brands. Key players focus on flavor innovation, regional taste adaptations, and functional ingredients, leveraging distribution networks and marketing strategies to capture consumer loyalty and maintain market share.

To get more information on this market Request Sample

The Japan keto friendly snacks market is experiencing robust growth fueled by a fundamental shift in consumer dietary preferences toward health-oriented food choices. Japanese consumers are increasingly embracing low-carbohydrate lifestyles as awareness about metabolic health, blood sugar management, and sustainable weight control continues to expand across demographics. In October 2025, a survey found that over 76% of Japanese consumers aged 20–50 pay attention to sugar and calorie content when choosing snacks, and more than half are willing to pay a premium for healthier options. Moreover, the rising prevalence of fitness culture, particularly among urban millennials and health-conscious professionals, has created substantial demand for convenient snacking options that align with ketogenic dietary principles. Additionally, the growing emphasis on clean-label products featuring natural, recognizable ingredients resonates strongly with Japanese consumer expectations for quality and transparency. Manufacturers are responding by developing innovative formulations that honor traditional taste profiles while meeting strict carbohydrate restrictions, thereby bridging the gap between dietary functionality and culinary satisfaction.

Japan Keto Friendly Snacks Market Trends:

Integration of Traditional Japanese Ingredients in Keto Formulations

Japanese manufacturers are increasingly incorporating familiar local ingredients into keto-friendly snack development, creating products that resonate with domestic taste preferences while adhering to low-carbohydrate requirements. Ingredients such as konjac, seaweed, matcha, and fermented soy products are being reformulated into innovative snack formats that maintain ketogenic compliance. For example, in December 2024, NINZIA launched its sugar-free granola snack made with konjac fiber and Shiso City rice-koji, gaining strong consumer attention after its successful Makuake crowdfunding debut. Moreover, this approach addresses consumer hesitation toward unfamiliar diet-specific products by delivering comfort and familiarity. The fusion of traditional culinary elements with modern dietary science represents a significant evolution in product development strategies, enabling broader market acceptance across age groups who value both health benefits and authentic Japanese flavors.

Expansion of Functional Snacking with Added Health Benefits

The keto snacks segment is witnessing significant innovation through the incorporation of additional functional benefits beyond basic macronutrient profiles. Manufacturers are developing products enhanced with probiotics, collagen, adaptogens, and other wellness-focused ingredients that appeal to health-conscious consumers seeking multi-benefit snacking solutions. In November 2025, Oyatsu Company showcased its BODY STAR Protein Snack series at Wellness Food Japan 2025, highlighting its popular 20g-protein, non-sweet functional snack format. Further, this trend reflects the broader Japanese consumer expectation that food products should deliver holistic health advantages rather than serving purely as dietary compliance tools. The convergence of ketogenic principles with functional food innovation is creating differentiated product offerings that command premium positioning and attract consumers prioritizing comprehensive wellness through their dietary choices.

Premiumization and Artisanal Quality Positioning

The Japanese keto snacks market is experiencing a notable shift toward premium and artisanal product positioning, reflecting consumer willingness to pay higher prices for superior quality and craftsmanship. Manufacturers are emphasizing small-batch production methods, organic ingredient sourcing, and sophisticated flavor development to distinguish their offerings in an increasingly competitive landscape. In November 2024, Meiji expanded its WELLCACAO snack range with a new product made using proprietary cacao granules designed to reduce bitterness while retaining nutrients like polyphenols. Elegant packaging designs and detailed nutritional transparency further enhance perceived value among discerning consumers. This premiumization trend aligns with broader Japanese consumer culture that prioritizes quality over quantity, enabling brands to establish strong market positions through excellence in product development and presentation.

Market Outlook 2026-2034:

The Japan keto friendly snacks market is positioned for sustained revenue expansion throughout the forecast period, driven by deepening consumer commitment to low-carbohydrate dietary lifestyles and continuous product innovation. Market revenue is expected to demonstrate consistent growth as manufacturers invest in research and development to create increasingly sophisticated formulations that satisfy both nutritional requirements and taste expectations. The expansion of distribution networks, particularly through online retail channels and convenience store partnerships, will enhance product accessibility across urban and regional markets. The market generated a revenue of USD 149.54 Million in 2025 and is projected to reach a revenue of USD 310.21 Million by 2034, growing at a compound annual growth rate of 8.45% from 2026-2034.

Japan Keto Friendly Snacks Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Flavor | Savory | 43.7% |

| Ingredient Type | Nuts and Seeds | 37.6% |

| Distribution Channel | Supermarkets & Hypermarkets | 44.3% |

| Region | Kanto Region | 33.8% |

Flavor Insights:

- Savory

- Sweet

- Mild

- Spicy

The savory dominates with a market share of 43.7% of the total Japan keto friendly snacks market in 2025.

The savory segment dominates Japan’s keto snack market, holding the largest share due to strong alignment with local taste preferences and traditional umami-rich flavors. Products incorporating soy sauce, miso, seaweed, and various seasonings resonate deeply with Japanese consumers, reflecting familiar culinary experiences. In November 2025, Calbee introduced its limited-edition Noriyan seaweed-alternative snack at Tokyo Station, offering Dashi Soy Sauce and Wasabi Salt flavors made from upcycled potato starch. Additionally, this segment’s versatility allows manufacturers to develop a wide range of offerings, from roasted nuts to vegetable crisps, ensuring relevance across snacking occasions. Continuous flavor innovation sustains its leadership and attracts repeat consumption.

The segment’s dominance is reinforced by its seamless integration into everyday snacking habits. Japanese consumers naturally favor savory options for between-meal consumption, requiring minimal behavioral adjustment. Seasonal and regional flavor variations further enhance appeal, while product formats catering to convenience and portion control encourage frequent adoption. As consumer interest in health-conscious, low-carb alternatives grows, the savory segment remains strategically positioned for sustained expansion, maintaining its stronghold in Japan’s competitive keto snack landscape.

Ingredient Type Insights:

- Nuts and Seeds

- Low-Carb Vegetables

- Meat and Poultry

- Dairy

- Plant-Based

The nuts and seeds lead with a share of 37.6% of the total Japan keto friendly snacks market in 2025.

The nuts and seeds segment leads Japan’s keto snack market due to its combination of convenience, nutritional benefits, and compatibility with low-carb diets. For example, in February 2024, NinjaFoods exhibited its starch syrup-free, wheat-free nut bars at the 24th Kitchen Equipment Exhibition in Tokyo, promoting plant-based, low-carb snack innovation and next-generation healthy eating solutions. Almonds, walnuts, sunflower seeds, and pumpkin seeds provide protein, healthy fats, and fiber, appealing to health-conscious consumers. Snack formulations range from roasted and lightly salted varieties to coated or spiced options, offering diverse taste experiences. The segment’s portability and functional value make it a preferred choice for on-the-go consumption, reinforcing its market leadership.

Consumer preference for nutrient-dense snacks further strengthens the nuts and seeds segment. Japanese buyers value products that support energy, satiety, and overall wellness, aligning with increasing interest in functional foods. Manufacturers capitalize on this trend by introducing innovative flavor combinations and regionally inspired seasonings that enhance appeal. Packaging designed for single-serve portions and resealable convenience supports daily snacking habits, ensuring sustained adoption. Overall, the segment’s health orientation and versatile offerings secure its dominant position in the keto snack market.

Distribution Channel Insights:

Access the Comprehensive Market Breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retailers

- Specialty Stores

- Pharmacies

The supermarkets & hypermarkets exhibits a clear dominance with a 44.3% share of the total Japan keto friendly snacks market in 2025.

Supermarkets and hypermarkets hold the largest share in Japan’s keto snack market, driven by wide product selection and convenient nationwide accessibility. They offer diverse savory, sweet, and nut-based options, catering to health-conscious consumers. Eye-catching displays, promotional campaigns, and organized shelving enhance visibility and encourage trial purchases, making these retail formats the preferred choice for low-carb snack shoppers seeking variety, convenience, and reliable access to trusted brands across urban and suburban locations. In October 2025, Japan’s leading convenience-store chains launched dedicated “low-calorie and high-protein snack” sections, featuring sugar-free chocolates, high-protein cookies, and energy bars to meet growing health-conscious demand.

The dominance of supermarkets and hypermarkets is reinforced by competitive pricing, bulk purchase options, and loyalty programs that encourage repeat buying. In-store sampling and promotional activities educate consumers about keto-friendly products, while collaborations with local and international brands expand offerings. These retail formats effectively combine convenience, variety, and affordability, supporting sustained consumer engagement. Their ability to meet evolving dietary preferences ensures they remain central to Japan’s growing keto snack market.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto Region dominates with a market share of 33.8% of the total Japan keto friendly snacks market in 2025.

The Kanto Region represents the largest market for keto snacks in Japan, driven by Tokyo’s dense population, high disposable incomes, and fast-paced urban lifestyle. Consumers in this region show strong preference for convenient, on-the-go snack options that align with health-conscious and low-carb trends. Retail channels, including convenience stores, supermarkets, and e-commerce platforms, support widespread product availability, enabling rapid adoption of diverse snack formats, from savory crisps to nut-based and sweet keto offerings.

Urban lifestyle patterns in the Kanto Region further reinforce its market leadership. Busy professionals and younger demographics increasingly seek functional snacks that provide energy, satiety, and nutritional benefits without sugar overload. Local food culture and regional taste preferences influence product innovation, encouraging manufacturers to integrate traditional Japanese flavors into keto-friendly formulations. Continuous promotional campaigns, coupled with high consumer awareness of health and wellness trends, sustain demand and strengthen the region’s dominant position in the national market.

Market Dynamics:

Growth Drivers:

Why is the Japan Keto Friendly Snacks Market Growing?

Escalating Health Consciousness and Preventive Wellness Focus

Japanese consumers are increasingly prioritizing preventive health measures through dietary modifications, driving substantial demand for keto friendly snacks that support metabolic wellness objectives. In February 2025, Japanese snack brand Hananomi launched its Samurai-inspired Power Chips, emphasizing balanced fat and protein for moderately active consumers, featuring culturally themed packaging to enhance appeal and energy perception. Additionally, growing awareness about the relationship between carbohydrate consumption and various health conditions, including obesity, diabetes, and cardiovascular concerns, motivates consumers to seek low-carb alternatives that enable proactive health management. This wellness-oriented mindset extends beyond individuals with existing health concerns to encompass broader population segments seeking to maintain optimal health through nutrition. The cultural shift toward viewing food as medicine rather than merely sustenance creates favorable conditions for ketogenic products positioned as functional health solutions.

Expansion of Fitness Culture and Active Lifestyle Adoption

The proliferation of fitness facilities, wellness communities, and active lifestyle movements across Japan generates significant demand for nutritional products that support physical performance and body composition goals. Keto friendly snacks align perfectly with fitness-focused dietary approaches emphasizing fat adaptation, sustained energy release, and muscle preservation. Urban professionals and younger demographics increasingly incorporate exercise routines into daily life, creating corresponding demand for convenient snacking options that complement their nutritional strategies. In July 2024, Anytime Fitness Japan surpassed 900,000 members nationwide, driven by TV and online promotions that significantly boosted new memberships during June–July 2024. Moreover, social media amplification of fitness content and dietary recommendations further accelerates awareness and adoption of ketogenic eating patterns among health-aspiring consumers seeking to optimize their physical wellness through informed food choices.

Innovation in Taste and Texture Development

Continuous advancement in food science and product development enables manufacturers to create keto friendly snacks that overcome historical barriers related to taste satisfaction and textural appeal. Japanese consumers maintain high expectations for sensory quality, and manufacturers are investing substantially in research to develop products that deliver genuine enjoyment rather than mere dietary compliance. Breakthroughs in ingredient processing, flavor enhancement, and formulation techniques produce snacks that rival conventional options in satisfaction while maintaining strict carbohydrate restrictions. In August 2024, Pegasus Tech Ventures partnered with Japanese snack giant Calbee to connect it with global start-ups, aiming to develop innovative healthy snacks, production techniques, and next-generation food products. This innovation trajectory addresses the primary obstacle preventing mainstream adoption, as consumers increasingly discover that ketogenic eating need not compromise culinary pleasure.

Market Restraints:

What Challenges the Japan Keto Friendly Snacks Market is Facing?

Premium Pricing Limiting Mass Market Accessibility

Keto friendly snacks typically command significantly higher price points compared to conventional snacking alternatives, creating accessibility barriers for price-sensitive consumer segments. The specialized ingredients, smaller production scales, and additional processing requirements contribute to elevated manufacturing costs that translate into retail pricing challenges. This premium positioning limits market penetration beyond affluent urban consumers, restricting growth potential in budget-conscious demographics and regional markets.

Limited Consumer Understanding of Ketogenic Principles

Despite growing awareness, substantial portions of the Japanese population remain unfamiliar with ketogenic dietary concepts and the specific benefits of low-carbohydrate eating patterns. This knowledge gap creates adoption hesitancy, as consumers may not recognize the value proposition of keto friendly snacks or understand how these products differ from conventional alternatives. Educational requirements place additional burdens on manufacturers to communicate complex nutritional information effectively.

Taste Preference Resistance and Dietary Habit Inertia

Japanese consumers maintain strong attachments to traditional snacking options and may resist dietary modifications that require significant behavioral changes. The cultural significance of certain conventional snacks and deeply ingrained consumption patterns create natural resistance to adopting unfamiliar product categories. Overcoming established preferences requires sustained marketing efforts and continuous product refinement to deliver satisfaction levels that justify transition from familiar favorites.

Competitive Landscape:

The Japan keto friendly snacks market exhibits a dynamic competitive environment characterized by diverse participant profiles ranging from established food manufacturers to specialized health-focused brands. Market participants compete through product innovation, ingredient quality differentiation, and strategic distribution partnerships that enhance market accessibility. Companies invest substantially in research and development to create distinctive formulations that address specific consumer preferences while maintaining strict ketogenic compliance standards. Brand positioning strategies emphasize various attributes including functional health benefits, ingredient transparency, taste excellence, and alignment with Japanese culinary traditions. Distribution channel expansion, particularly through convenience store networks and e-commerce platforms, represents a critical competitive battleground as participants seek to maximize product availability. Marketing approaches increasingly leverage digital channels and influencer partnerships to reach health-conscious consumer segments effectively.

Recent Developments:

- In April 2025, Sunstar’s ANDFASTING brand will launch a new Nuts and Refreshing Berry flavor in its “Delicious Fasting for the Body” series. The keto-friendly fasting-support snack is designed for meal replacement, combining nuts and berries to provide a low-carbohydrate, health-conscious option for convenient and satisfying snacking.

Japan Keto Friendly Snacks Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Flavours Covered | Savory, Sweet, Mild, Spicy |

| Ingredient Types Covered | Nuts And Seeds, Low-Carb Vegetables, Meat And Poultry, Dairy, Plant-Based |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online Retailers, Specialty Stores, Pharmacies |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan keto friendly snacks market size was valued at USD 149.54 Million in 2025.

The Japan keto friendly snacks market is expected to grow at a compound annual growth rate of 8.45% from 2026-2034 to reach USD 310.21 Million by 2034.

The savory segment leads the market, driven by deep-rooted Japanese preference for umami-rich flavors. Traditional seasonings like soy sauce, miso, and seaweed align with local tastes, driving widespread adoption and reinforcing the segment’s dominant position in the snacking market.

Key factors driving the Japan keto friendly snacks market include rising health consciousness among consumers, growing fitness culture and active lifestyle adoption, increasing demand for functional and clean-label snacking options, and continuous innovation in product development and taste adaptation.

Major challenges include premium pricing limiting mass market accessibility, limited consumer understanding of ketogenic dietary principles, taste preference resistance among traditional snack consumers, restricted distribution in rural areas, and the need for sustained consumer education efforts.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)