Japan Kitchen Fittings Market Size, Share, Trends and Forecast by Product Type, Material, Distribution Channel, End User, and Region, 2026-2034

Japan Kitchen Fittings Market Summary:

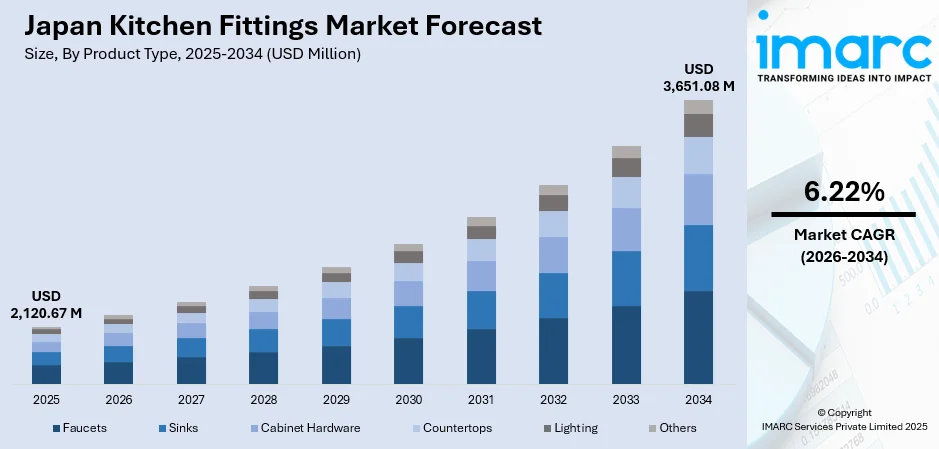

The Japan kitchen fittings market size was valued at USD 2,120.67 Million in 2025 and is projected to reach USD 3,651.08 Million by 2034, growing at a compound annual growth rate of 6.22% from 2026-2034.

The market for kitchen fittings in Japan is expanding significantly due to a number of factors, including an increase in residential development, a growing demand for contemporary kitchen solutions, and a growing customer desire for smart, space-efficient goods. Purchase decisions are changing as a result of technological developments in touchless faucets, water-saving devices, and Internet of Things-enabled kitchen equipment. Japan's kitchen fittings market share is being strengthened by the growing restoration and remodeling industry, urbanization trends, and government programs encouraging energy-efficient homes.

Key Takeaways and Insights:

- By Product Type: Faucets hold the largest market share at 32% in 2025, establishing themselves as the leading product category in Japan's kitchen fittings landscape, driven by increasing demand for touchless and water-efficient fixtures.

- By Material: Stainless steel dominates the market with 41% share in 2025, reflecting strong consumer preference for durable, corrosion-resistant, and easy-to-maintain kitchen fixtures that complement modern minimalist designs.

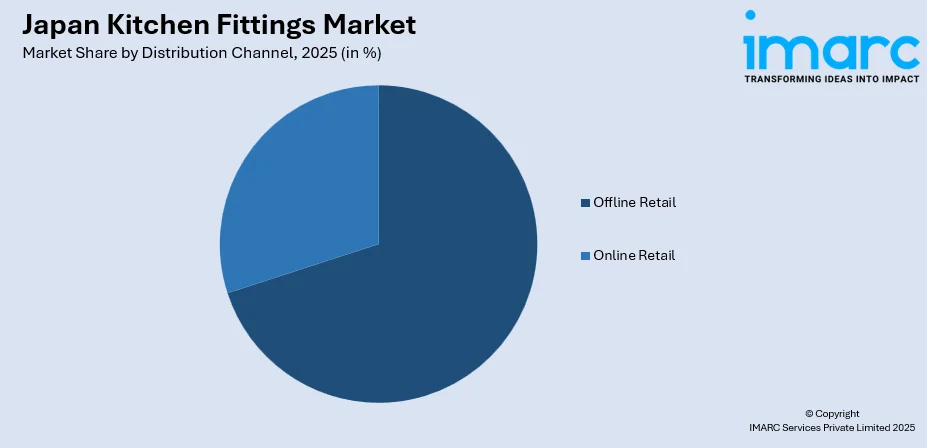

- By Distribution Channel: Offline retail leads with 70% share in 2025, driven by consumer preference for physical product evaluation, professional consultation, and established trust in home improvement centers.

- By End User: Residential holds the largest share at 75% in 2025, underscoring the strong demand for kitchen upgrades in single-family homes and urban apartments across Japan's housing market.

- By Region: Kanto Region dominates the market with 34% share in 2025, sustained by dense employment hubs, premium housing developments, and continuous in-migration to the greater Tokyo metropolitan area.

- Key Players: The Japan kitchen fittings market exhibits strong competitive intensity, with established domestic manufacturers competing alongside international brands through product innovation, sustainability initiatives, and expanding distribution networks to capture greater market share.

To get more information on this market Request Sample

The Japan kitchen fittings market is advancing as consumers increasingly seek products that combine functionality with aesthetic appeal and environmental responsibility. The integration of smart home technology is transforming traditional kitchen fixtures into connected devices offering touchless operation, water consumption monitoring, and app-enabled controls. Manufacturers are developing innovative faucets featuring advanced sensors that enable completely touchless experiences for enhanced hygiene and convenience, while also committing to water-saving technologies across their product portfolios. This technological evolution, combined with Japan's focus on energy efficiency and compact urban living solutions, is creating substantial opportunities for manufacturers offering innovative, space-efficient, and eco-friendly kitchen fittings.

Japan Kitchen Fittings Market Trends:

Integration of Smart and IoT-Enabled Kitchen Technologies

Japan's kitchen fittings market is witnessing significant integration of intelligent technology as consumers demand fixtures offering convenience, efficiency, and automation. Smart faucets with touchless operation, temperature control, and water usage monitoring are becoming increasingly popular. Manufacturers are developing products compatible with voice-controlled home systems and smartphone applications, while also forming strategic partnerships to deliver AI-powered solutions for kitchen appliances. This demonstrates the industry's commitment to connected kitchen ecosystems that support Japan kitchen fittings market growth.

Rising Demand for Compact and Space-Efficient Solutions

With limited living space in Japanese urban centers, there is increasing demand for compact and functional kitchen fittings that maximize utility without consuming excessive space. Space-saving products such as modular storage systems, multi-functional sinks, and streamlined cabinet hardware are gaining traction. This trend aligns with Japan's minimalist culture where simplicity and efficiency are highly valued. Manufacturers are responding by creating products that are not only space-efficient but also aesthetically appealing, featuring clean lines and integrated designs that complement contemporary Japanese kitchen interiors.

Growing Focus on Sustainability and Water Conservation

Sustainability is emerging as a major driver in Japan's kitchen fittings market as consumers become increasingly environmentally conscious. Energy-efficient appliances and water-saving fixtures are becoming popular choices among Japanese households. Government incentives and policies promoting energy efficiency are accelerating this transition. In March 2025, the Tokyo Metropolitan Waterworks Bureau introduced its Environmental Five-Year Plan with ambitious goals including reducing greenhouse gas emissions by 50% by 2030. This regulatory environment is encouraging manufacturers to develop innovative products incorporating water-saving mechanisms and sustainable materials.

Market Outlook 2026-2034:

The Japan kitchen fittings market is poised for sustained growth through the forecast period, with revenue projected to expand significantly as residential construction activities continue and renovation demand strengthens. The market generated a revenue of USD 2,120.67 Million in 2025 and is projected to reach a revenue of USD 3,651.08 Million by 2034, growing at a compound annual growth rate of 6.22% from 2026-2034. This can be accredited to technological innovation, urbanization trends, and evolving consumer preferences for smart and sustainable kitchen solutions. The Osaka Expo 2025 infrastructure development and Japan's mandatory energy conservation standards effective from April 2025 will create additional opportunities for market participants offering compliant, high-performance products.

Japan Kitchen Fittings Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Faucets | 32% |

| Material | Stainless Steel | 41% |

| Distribution Channel | Offline Retail | 70% |

| End User | Residential | 75% |

| Region | Kanto Region | 34% |

Product Type Insights:

- Faucets

- Sinks

- Cabinet Hardware

- Countertops

- Lighting

- Others

Faucets lead with a 32% share of Japan kitchen fittings market in 2025.

Faucets dominate the Japan kitchen fittings market, driven by increasing adoption of smart and touchless solutions that enhance hygiene and convenience. Japanese consumers are gravitating toward fixtures featuring adjustable water flow, temperature control, and water-saving mechanisms. Deck-mounted kitchen fixtures have gained significant traction due to their versatility and aesthetic appeal, with manufacturers introducing innovative features like sensor-based operation and modular attachments.

The segment's growth is further propelled by technological advancements and rising urbanization, with demand concentrated in modern kitchen designs that prioritize both functionality and visual appeal. Japanese households increasingly view faucets as central design elements that reflect personal style while delivering practical performance benefits. The emphasis on minimalist aesthetics and space efficiency in contemporary Japanese kitchens has encouraged manufacturers to develop sleek, streamlined faucet designs that complement compact living environments. Additionally, the broader industry trend toward sustainable and high-performance water solutions continues to drive innovation in kitchen faucet development, with manufacturers focusing on eco-friendly technologies that reduce water consumption without compromising user experience.

Material Insights:

- Stainless Steel

- Brass

- Ceramic

- Glass

- Wood

- Others

Stainless steel dominates with a 41% share of Japan kitchen fittings market in 2025.

Stainless steel remains the preferred material for kitchen fittings in Japan due to its exceptional durability, ease of maintenance, and resistance to rust and staining. Japanese consumers value these qualities particularly in compact kitchen environments where longevity and hygiene are paramount. The material's sleek appearance complements contemporary kitchen aesthetics, aligning with the minimalist design philosophy prevalent in Japanese homes.

The enduring popularity of stainless steel in Japan reflects a deep-rooted appreciation for materials that combine practical functionality with visual refinement. Manufacturers continue to innovate within this material category, focusing on enhanced surface finishes that resist fingerprints and water spots while maintaining their lustrous appearance over time. Noise reduction properties have become an important consideration, with producers developing advanced dampening technologies that minimize sound during kitchen activities. Additionally, sustainable production methods are gaining prominence as environmental consciousness grows among Japanese consumers. The versatility of stainless steel allows it to seamlessly integrate with various kitchen design themes, from traditional to ultra-modern, making it a reliable choice across diverse residential and commercial applications.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Offline Retail

- Online Retail

Offline retail holds 70% share of Japan kitchen fittings market in 2025.

Offline retail maintains dominance in the Japan kitchen fittings market as consumers value the ability to physically inspect products for quality, craftsmanship, and compatibility with their kitchen spaces. Home improvement centers offer extensive product selections with professional consultation services, enabling customers to make informed purchasing decisions. These retailers provide installation support and after-sales services that enhance consumer confidence.

The offline retail network benefits from Japan's well-established home center infrastructure, with numerous stores operating across urban and suburban areas nationwide. Consumers favor these physical retail locations for their comprehensive product assortments, knowledgeable staff, and reliable service quality. The in-store experience allows shoppers to compare different materials, finishes, and designs side by side, which proves particularly valuable when selecting kitchen fittings that must harmonize with existing décor and spatial constraints. While online channels are experiencing growth, particularly among younger demographics seeking convenience, the tactile nature of kitchen fittings continues to drive foot traffic to physical retail locations where customers can assess product weight, texture, and overall build quality before committing to purchase.

End User Insights:

- Residential

- Commercial

Residential dominates with a 75% share of Japan kitchen fittings market in 2025.

The residential segment dominates the Japan kitchen fittings market, driven by ongoing housing construction activities and growing renovation demand. Japanese homeowners increasingly view kitchen fixtures as essential design elements reflecting personal lifestyles and preferences. Apartments and condominiums continue to lead residential construction, with vertical expansion and space-efficient floor plans sustaining new-build activity in major metropolitan areas.

The renovation market is experiencing steady growth, driven by energy-efficiency mandates and seismic-retrofit subsidies introduced under recent building code revisions. This regulatory environment encourages homeowners to upgrade their existing kitchen spaces with modern, compliant fixtures that meet enhanced performance standards. Additionally, rising consumer interest in smart home integration and sustainable living solutions is creating sustained demand for contemporary kitchen fittings across both new construction and remodeling projects. The shift toward multi-generational living arrangements and work-from-home lifestyles has further elevated the importance of functional, well-designed kitchens within Japanese households. Manufacturers are responding by developing products that address diverse residential needs, from compact urban apartments to larger suburban family homes, ensuring broad market appeal across different housing segments.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

Kanto Region leads with a 34% share of Japan kitchen fittings market in 2025.

The Kanto Region dominates the Japan kitchen fittings market, sustained by dense employment hubs, premium housing developments, and continuous in-migration to the greater Tokyo metropolitan area. Tokyo captures the largest share of residential construction activity, attracting substantial domestic and international investment in luxury condominium developments. Developers are responding with high-rise towers engineered for net-zero energy performance and vertical greening, creating demand for premium kitchen fittings that align with sustainable building standards. The concentration of affluent consumers, corporate headquarters, and world-class amenities in this region drives preferences for sophisticated, technology-enabled kitchen solutions. Additionally, the region's role as Japan's economic and cultural center ensures continued housing demand from young professionals, families, and foreign residents seeking modern living spaces equipped with high-quality kitchen fixtures.

Market Dynamics:

Growth Drivers:

Why is the Japan Kitchen Fittings Market Growing?

Expanding Residential Construction and Renovation Activities

Japan's residential construction sector continues to drive substantial demand for kitchen fittings as new housing developments and renovation projects expand nationwide. The residential arena captures the largest share of construction market activity, with demand concentrated in greater Tokyo where vertical expansion and space-efficient floor plans sustain new-build activity. The renovation market is advancing steadily, supported by government initiatives promoting seismic upgrades and energy-efficient retrofits. Recent building code revisions mandate energy conservation compliance for all new construction, creating additional demand for modern, compliant kitchen fixtures. Broader infrastructure investment trends, including significant commitments to hospitality and commercial developments, further support market growth by generating demand across both residential and commercial segments.

Growing Adoption of Smart Home Technologies

The integration of smart home technology is transforming Japan's kitchen fittings market as consumers increasingly demand connected, intelligent solutions. IoT-enabled devices allow remote monitoring and control of kitchen appliances, while AI-powered voice assistants offer hands-free operation and personalized user experiences. Japanese manufacturers are developing sophisticated sensor-based faucets offering features like temperature control, water usage monitoring, and integration with building management systems. Touchless kitchen faucets using state-of-the-art sensors enable completely touchless operation for enhanced hygiene and convenience, while also helping prevent unnecessary water consumption to support eco-living objectives. This shift toward smart, automated fixtures is particularly appealing to dual-income families and younger consumers seeking time-saving innovative solutions.

Rising Environmental Awareness and Energy Efficiency Standards

Growing environmental consciousness among Japanese consumers is accelerating demand for sustainable, energy-efficient kitchen fittings. Government policies and incentives promoting water conservation and energy efficiency are nudging the market toward eco-friendly solutions. Compliance with energy conservation standards has become mandatory for all new construction, reflecting the nation's commitment to reducing greenhouse gas emissions and achieving carbon neutrality goals. Municipal authorities have introduced environmental plans targeting significant reductions in greenhouse gas emissions over the coming years. Manufacturers are responding by incorporating water-saving mechanisms, sustainable materials, and energy-efficient designs into their product offerings. Industry leaders have pledged to ensure their faucets and fixtures achieve complete water-saving compliance, demonstrating the sector's commitment to environmental sustainability.

Market Restraints:

What Challenges the Japan Kitchen Fittings Market is Facing?

Rising Material and Construction Costs

Increasing material costs, particularly for stainless steel and brass, combined with rising construction expenses due to inflation and supply chain pressures, are impacting market growth. The weak yen has elevated import costs for raw materials and components, squeezing manufacturer margins and potentially limiting consumer affordability for premium kitchen fittings.

Labor Shortages in Construction Sector

Japan's construction industry faces persistent labor shortages exacerbated by an aging workforce and declining population. These constraints are lengthening project timelines, increasing installation costs, and limiting the industry's capacity to meet housing and renovation demand, thereby affecting downstream demand for kitchen fittings.

Declining Household Formation and Demographic Changes

Japan's demographic shift toward smaller household sizes and an aging population is tempering long-term housing demand. Average household size continues to decline, with single-person households comprising a growing proportion of the total. This demographic transition may reduce aggregate demand for new residential construction and associated kitchen fittings

Competitive Landscape:

The Japan kitchen fittings market exhibits strong competitive dynamics with established domestic manufacturers competing alongside international brands. Market participants are focusing on product innovation, technological differentiation, and sustainability initiatives to strengthen market positioning. Companies are investing in research and development to introduce smart faucets, water-efficient fixtures, and eco-friendly materials that align with evolving consumer preferences and regulatory requirements. Strategic partnerships, expanded distribution networks, and enhanced after-sales services are becoming critical competitive differentiators as manufacturers seek to capture greater market share in both residential and commercial segments.

Japan Kitchen Fittings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Faucets, Sinks, Cabinet Hardware, Countertops, Lighting, Others |

| Materials Covered | Stainless Steel, Brass, Ceramic, Glass, Wood, Others |

| Distribution Channels Covered | Offline Retail, Online Retail |

| End Users Covered | Residential, Commercial |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central /Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan kitchen fittings market size was valued at USD 2,120.67 Million in 2025.

The Japan kitchen fittings market is expected to grow at a compound annual growth rate of 6.22% from 2026-2034 to reach USD 3,651.08 Million by 2034.

Faucets, holding the largest revenue share of 32%, remain pivotal for Japan's kitchen fittings market, driven by increasing demand for touchless operation, water-saving mechanisms, and smart connectivity features.

Key factors driving the Japan kitchen fittings market include expanding residential construction, growing adoption of smart home technologies, rising environmental awareness, mandatory energy conservation standards, renovation and remodeling activities, and increasing demand for space-efficient kitchen solutions.

Major challenges include rising material and construction costs, labor shortages in the construction sector, declining household formation due to demographic changes, and the need to balance premium product features with affordability in a cost-conscious market environment.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)