Japan Laboratory Automation Market Size, Share, Trends and Forecast by Type, Equipment and Software Type, End User, and Region, 2026-2034

Japan Laboratory Automation Market Overview:

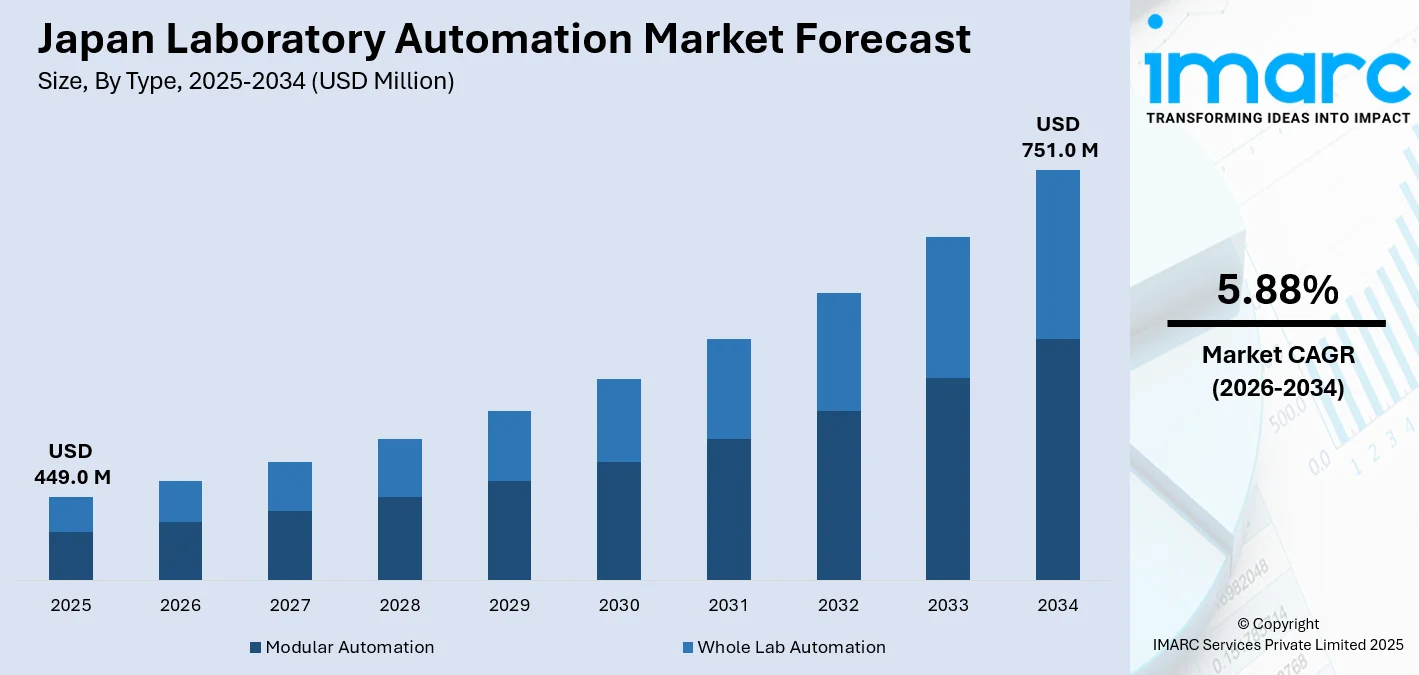

The Japan laboratory automation market size reached USD 449.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 751.0 Million by 2034, exhibiting a growth rate (CAGR) of 5.88% during 2026-2034. The increased demand for high-throughput testing, rising focus on research efficiency to reduce manual workload and enhance experimental precision, rapid adoption of automation to streamline drug discovery and development processes, and deployment of robotics in clinical and pharmaceutical labs are some of the factors contributing to a steady rise in the Japan laboratory automation market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 449.0 Million |

| Market Forecast in 2034 | USD 751.0 Million |

| Market Growth Rate 2026-2034 | 5.88% |

Japan Laboratory Automation Market Trends:

Pharmaceutical R&D Automation

In Japan pharmaceutical companies are increasingly adopting automation to streamline drug discovery and development processes . Automated liquid handling systems, robotic compound libraries and integrated screening platforms are now widely used to reduce manual workload and enhance experimental precision. These technologies allow researchers to conduct high-throughput screening, data analysis and sample management with minimal human intervention significantly speeding up early-stage drug development. This trend is particularly important as competition in the pharmaceutical sector intensifies and regulatory demands for accuracy increase. As automation becomes a core component of research operations the market forecast anticipates strong adoption among domestic pharma giants and biotech startups. For instance, in July 2023, Chugai Pharmaceutical unveiled its new research center, Chugai Life Science Park Yokohama. The facility emphasizes laboratory automation and AI in drug discovery featuring mobile and dual-armed robots to enhance efficiency and reduce human involvement in routine experimental tasks starting with cell culture experiments. This shift not only boosts efficiency but also reduces operational costs and human error key priorities for research-focused firms. Automation in pharmaceutical labs is expected to remain a critical driver of Japan laboratory automation market growth.

To get more information on this market Request Sample

Adoption of Robotics and AI

Laboratories across Japan are increasingly deploying robotic arms, automated sample handlers, and AI-driven software to streamline workflows and minimize human error. In clinical labs, robotics is improving sample processing speed, especially in high-volume diagnostic settings. For instance, in January 2025, Japanese pharmaceutical company Daiichi Sankyo opened a state-of-the-art research lab in San Diego to enhance drug discovery using robotics and automation. This facility aims to streamline data collection and analysis, allowing scientists to focus on innovation and accelerate the development of transformative medicines for global patients. Research institutions are also integrating AI platforms to manage complex datasets, guide experimental planning, and support decision-making in real time. These technologies not only boost precision but also allow labs to handle a higher volume of tests without increasing staff. Japanese firms, backed by a strong robotics manufacturing base, are at the forefront of developing lab-specific automation systems tailored to local needs. Additionally, collaborations between tech companies and life science institutions are accelerating the deployment of AI-enabled solutions. This growing reliance on robotics and AI reflects a strategic shift toward long-term efficiency and scalability in lab operations. As this transformation continues, it is expected to strongly shape the market outlook.

Japan Laboratory Automation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, equipment and software type, and end user.

Type Insights:

- Modular Automation

- Whole Lab Automation

The report has provided a detailed breakup and analysis of the market based on the type. This includes modular automation and whole lab automation.

Equipment and Software Type Insights:

- Automated Clinical Laboratory Systems

- Workstations

- LIMS (Laboratory Information Management Systems)

- Sample Transport Systems

- Specimen Handling Systems

- Storage Retrieval Systems

- Automated Drug Discovery Laboratory Systems

- Plate Readers

- Automated Liquid Handling Systems

- LIMS (Laboratory Information Management Systems)

- Robotic Systems

- Storage Retrieval Systems

- Dissolution Testing Systems

A detailed breakup and analysis of the market based on the equipment and software type have also been provided in the report. This includes automated clinical laboratory systems (workstations, LIMS (laboratory information management systems), sample transport systems, specimen handling systems, and storage retrieval systems) and automated drug discovery laboratory systems (plate readers, automated liquid handling systems, LIMS (laboratory information management systems), robotic systems, storage retrieval systems, and dissolution testing systems).

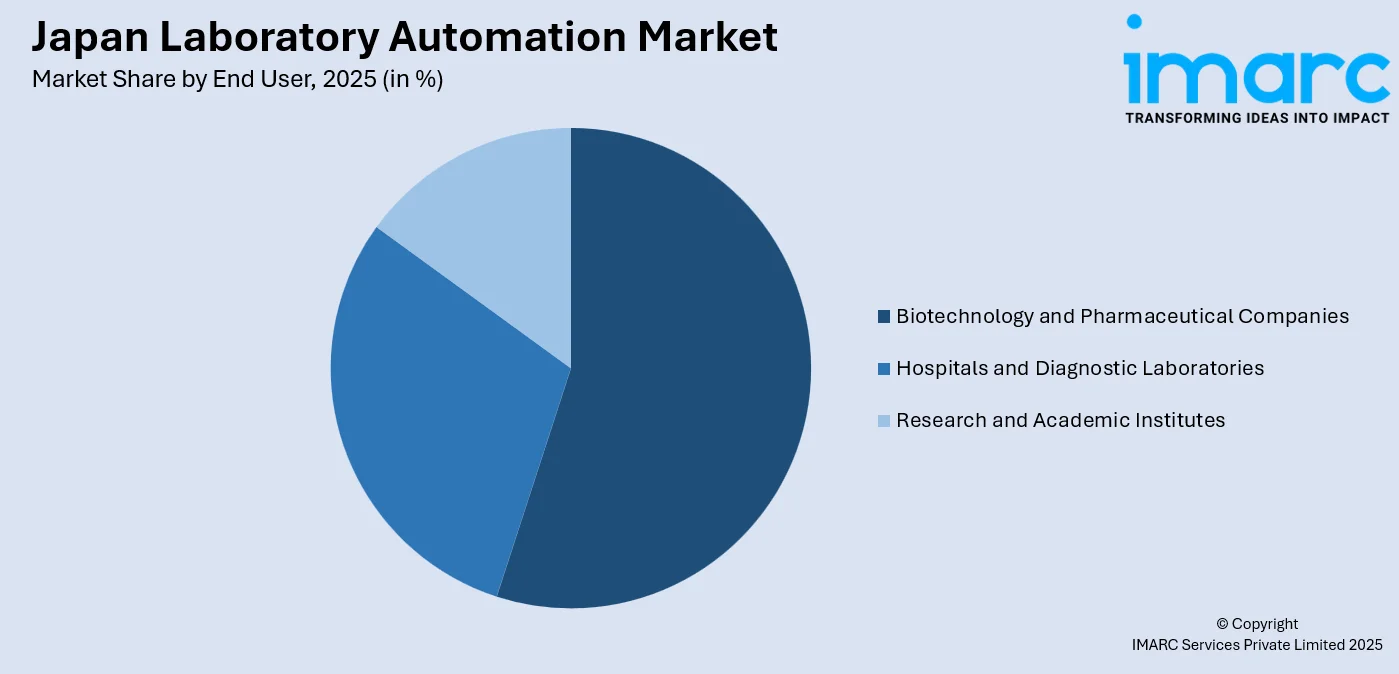

End User Insights:

Access the comprehensive market breakdown Request Sample

- Biotechnology and Pharmaceutical Companies

- Hospitals and Diagnostic Laboratories

- Research and Academic Institutes

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes biotechnology and pharmaceutical companies, hospitals and diagnostic laboratories, and research and academic institutes.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Laboratory Automation Market News:

- In April 2025, Torch Corporation and ChromaJean Inc. announced its partnership with Nihon Waters K.K. to develop an automated liquid chromatography platform. This collaboration aims to optimize research processes, enhance lab automation, and improve system integration, benefiting various industries while promoting efficient and innovative research and development.

- In January 2025, Yamaha Motor Co., Ltd. announced its plans to showcase its CELL HANDLER™ 2, a next-generation cell handling system, at an upcoming major life sciences exhibition in San Diego. The system enhances laboratory automation for cell research and aims to streamline processes in drug development.

Japan Laboratory Automation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Modular Automation, Whole Lab Automation |

| Equipment and Software Types Covered |

|

| End Users Covered | Biotechnology and Pharmaceutical Companies, Hospitals and Diagnostic Laboratories, Research and Academic Institutes |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan laboratory automation market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan laboratory automation market on the basis of type?

- What is the breakup of the Japan laboratory automation market on the basis of equipment and software type?

- What is the breakup of the Japan laboratory automation market on the basis of end user?

- What is the breakup of the Japan laboratory automation market on the basis of region?

- What are the various stages in the value chain of the Japan laboratory automation market?

- What are the key driving factors and challenges in the Japan laboratory automation market?

- What is the structure of the Japan laboratory automation market and who are the key players?

- What is the degree of competition in the Japan laboratory automation market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan laboratory automation market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan laboratory automation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan laboratory automation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)