Japan Laboratory Centrifuge Market Size, Share, Trends and Forecast by Product Type, Model Type, Rotor Design, Intended Use, Application, End-User, and Region, 2026-2034

Japan Laboratory Centrifuge Market Summary:

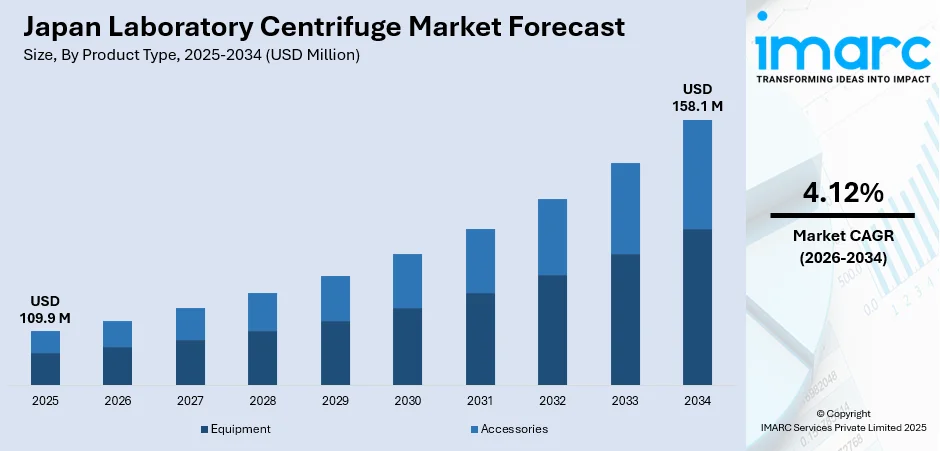

The Japan laboratory centrifuge market size was valued at USD 109.9 Million in 2025 and is projected to reach USD 158.1 Million by 2034, growing at a compound annual growth rate of 4.12% from 2026-2034.

The Japan laboratory centrifuge market is experiencing sustained expansion driven by the nation's aging population requiring comprehensive diagnostic services, robust pharmaceutical research activities, and increasing adoption of automated laboratory solutions. The convergence of advanced biotechnology initiatives, regenerative medicine programs, and expanding clinical testing facilities continues to generate consistent demand for sophisticated sample preparation equipment across hospitals, research institutions, and pharmaceutical manufacturing facilities nationwide.

Key Takeaways and Insights

-

By Product Type: Equipment dominates the market with a share of 57.65% in 2025, driven by continuous equipment upgrades across clinical laboratories and pharmaceutical research facilities requiring advanced sample separation capabilities for diagnostic and research applications.

-

By Model Type: Benchtop centrifuges lead the market with a share of 71.27% in 2025, owing to their space-efficient design, versatile functionality, and growing adoption in clinical diagnostics laboratories and academic research institutions across Japan's densely populated urban centers.

-

By Rotor Design: Fixed-angle rotors represent the largest segment with a market share of 36.58% in 2025, attributed to their widespread application in routine clinical diagnostics, blood component separation, and molecular biology workflows requiring consistent pelleting efficiency.

-

By Intended Use: General purpose centrifuges dominate with a share of 46.64% in 2025, reflecting the demand for versatile equipment capable of handling diverse sample types across multiple laboratory applications from routine diagnostics to specialized research protocols.

-

By Region: Kanto region holds the largest share of 35% in 2025, supported by the concentration of major hospitals, pharmaceutical headquarters, biotechnology clusters, and prestigious academic research institutions in the Greater Tokyo metropolitan area.

-

Key Players: The Japan laboratory centrifuge market exhibits moderate competitive intensity, characterized by established domestic manufacturers with strong local expertise competing alongside multinational corporations. Market participants focus on technological innovation, energy efficiency improvements, and service network expansion to strengthen their competitive positioning across clinical, research, and industrial segments.

To get more information on this market Request Sample

Japan's laboratory centrifuge market demonstrates consistent growth momentum underpinned by the nation's advanced healthcare infrastructure and commitment to medical innovation. The country's demographic profile, with nearly 29.3% of the population aged sixty-five and older, creates substantial demand for diagnostic testing and disease monitoring services. Government initiatives supporting pharmaceutical research and development, including the Japan Agency for Medical Research and Development programs, continue to drive equipment procurement across academic and commercial laboratories. The Greater Tokyo Biocommunity initiative exemplifies Japan's strategic approach to fostering biotechnology innovation, with designated research corridors from Tsukuba to Shonan supporting collaborative research activities. Recent advancements in regenerative medicine and cell therapy research have particularly increased demand for specialized centrifugation equipment capable of handling sensitive biological materials while maintaining precise temperature control and processing parameters.

Japan Laboratory Centrifuge Market Trends:

Automation and Digital Integration in Laboratory Operations

Japanese laboratories are increasingly adopting automated centrifugation systems featuring digital interfaces, programmable protocols, and remote monitoring capabilities. This shift towards laboratory automation reflects broader healthcare digitalization efforts aimed at improving operational efficiency and reducing manual handling errors. The Japan laboratory automation market size reached USD 422.86 Million in 2024. Looking forward, the market is expected to reach USD 726.02 Million by 2033, exhibiting a growth rate (CAGR) of 6.19% during 2025-2033. Advanced centrifuge models now incorporate smart sensors for rotor identification, automatic imbalance detection, and integrated data management systems that seamlessly connect with laboratory information management platforms. The Tokyo metropolitan area has witnessed the adoption of these technologies, with major clinical laboratories implementing fully automated sample processing workflows to handle growing diagnostic volumes efficiently.

Sustainability and Energy Efficiency Focus

Environmental consciousness is increasingly influencing equipment procurement decisions across Japanese research institutions and healthcare facilities. Manufacturers are responding by developing centrifuges featuring hydrocarbon-based refrigeration systems with reduced global warming potential, energy-efficient motors, and improved thermal insulation. Several leading Japanese manufacturers have introduced F-gas-free refrigerated centrifuge models specifically designed to support laboratories pursuing carbon neutrality objectives. This sustainability trend aligns with Japan's broader environmental policy framework and resonates strongly with academic institutions emphasizing responsible research practices. For instance, in November 2025, HOSHIZAKI CORPORATION planned to broaden its range of products utilizing HFC-free, environmentally friendly natural refrigerants. Beyond the standard commercial refrigerators and select ice maker models already converted, the company will upgrade 66 additional models across four product lines, including cubelet ice makers, to natural refrigerants. The rollout of these enhanced models will begin gradually from mid-December 2025 through Hoshizaki’s 15 sales subsidiaries nationwide.

Compact High-Performance Equipment Development

Space constraints in Japanese laboratories, particularly in urban clinical settings and smaller research facilities, are driving demand for compact centrifuge designs that maintain high-performance capabilities. Manufacturers are developing miniaturized equipment with enhanced speed capabilities, quieter operation, and improved ergonomic features suitable for point-of-care and bedside testing applications. The introduction of multi-functional compact centrifuges compatible with various tube formats and adapter configurations enables laboratories to maximize processing flexibility within limited floor space while maintaining compliance with stringent quality control requirements.

Market Outlook 2026-2034:

The Japan laboratory centrifuge market outlook remains positive through the forecast period, supported by sustained healthcare expenditure, expanding diagnostic testing volumes, and continued pharmaceutical research investments. Emerging applications in precision medicine, companion diagnostics, and liquid biopsy testing are expected to create new equipment demand across clinical laboratory settings. The aging demographic profile will continue driving routine diagnostic testing requirements, while government initiatives supporting drug discovery innovation will sustain research equipment procurement. The market generated a revenue of USD 109.9 Million in 2025 and is projected to reach a revenue of USD 158.1 Million by 2034, growing at a compound annual growth rate of 4.12% from 2026-2034.

Japan Laboratory Centrifuge Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Equipment | 57.65% |

| Model Type | Benchtop Centrifuges | 71.27% |

| Rotor Design | Fixed-Angle Rotors | 36.58% |

| Intended Use | General Purpose Centrifuges | 46.64% |

| Region | Kanto Region | 35% |

Product Type Insights:

- Equipment

- Multipurpose Centrifuges

- Microcentrifuges

- Ultracentrifuges

- Minicentrifuges

- Others

- Accessories

- Rotors

- Tubes

- Centrifuge Bottles

- Buckets

- Plates

- Others

The equipment segment dominates with a market share of 57.65% of the total Japan laboratory centrifuge market in 2025.

Equipment procurement remains the primary revenue contributor within Japan's laboratory centrifuge market, reflecting continuous investment in advanced sample processing capabilities across healthcare and research sectors. Japanese clinical laboratories maintain rigorous equipment replacement cycles to ensure diagnostic accuracy and operational reliability, while pharmaceutical companies invest in specialized centrifugation systems supporting drug development pipelines. The equipment segment benefits from government funding allocated through programs supporting medical research infrastructure modernization and academic laboratory upgrades.

The demand for multipurpose centrifuges has particularly strengthened as laboratories seek versatile equipment capable of accommodating diverse sample types and processing protocols within constrained budgets. Japanese manufacturers have responded by developing modular equipment platforms featuring interchangeable rotor systems and adaptable programming interfaces. The growing emphasis on laboratory automation has increased interest in centrifuge systems offering seamless integration with robotic sample handling platforms and automated pre-analytical workflows deployed in high-volume clinical testing environments.

Model Type Insights:

- Benchtop Centrifuges

- Floor-Standing Centrifuges

Benchtop centrifuges lead with a share of 71.27% of the total Japan laboratory centrifuge market in 2025.

Benchtop centrifuges maintain overwhelming market dominance attributed to their practical advantages in space-constrained Japanese laboratory environments. The compact footprint of benchtop models aligns with the physical limitations common in urban clinical settings and smaller research facilities prevalent throughout Japan's metropolitan areas. These systems deliver performance capabilities sufficient for most routine clinical diagnostic applications while offering significantly lower acquisition costs compared to floor-standing alternatives.

Recent technological advancements have substantially enhanced benchtop centrifuge capabilities, narrowing the performance gap with larger floor-standing systems. Japanese laboratories increasingly favor refrigerated benchtop models featuring precise temperature control for processing heat-sensitive biological samples in molecular diagnostics and cell biology applications. The introduction of quiet-operation motors and vibration-dampening systems has further expanded benchtop centrifuge adoption in patient-proximate settings, including hospital wards and outpatient clinics, where noise reduction enhances patient comfort.

Rotor Design Insights:

- Fixed-Angle Rotors

- Swinging-Bucket Rotors

- Vertical Rotors

- Others

Fixed-angle rotors exhibit clear dominance with a 36.58% share of the total Japan laboratory centrifuge market in 2025.

Fixed-angle rotors represent the preferred configuration across Japanese clinical and research laboratories owing to their efficiency in pelleting applications fundamental to routine diagnostic testing and sample preparation workflows. The design characteristics enable rapid sedimentation of cellular components and particulate matter, making them indispensable for blood banking, clinical chemistry sample preparation, and microbiological applications requiring consistent separation outcomes.

Japanese laboratories demonstrate a preference for fixed-angle rotors due to their durability, straightforward maintenance requirements, and cost-effectiveness over extended operational lifespans. The rotor segment continues to evolve with manufacturers introducing corrosion-resistant materials and aerodynamic designs that reduce noise and energy consumption during high-speed operation. Swinging-bucket rotors maintain significance in specialized applications requiring density gradient separations, particularly in research settings focused on cell biology and virology studies.

Intended Use Insights:

- General Purpose Centrifuges

- Clinical Centrifuges

- Preclinical Centrifuges

General purpose centrifuges dominate with a 46.64% share of the total Japan laboratory centrifuge market in 2025.

General purpose centrifuges command the largest market share, reflecting Japanese laboratory preferences for versatile equipment accommodating diverse application requirements. These systems provide the flexibility essential for facilities handling varied sample types across clinical diagnostics, research investigations, and quality control testing. The capability to process everything from routine blood samples to cell cultures using interchangeable rotors and adapters delivers operational efficiency valued by budget-conscious laboratory managers.

The segment benefits from ongoing equipment modernization initiatives across Japanese hospitals and diagnostic centers, upgrading legacy systems to contemporary platforms featuring enhanced programmability and safety features. Academic research institutions particularly favor general purpose centrifuges, enabling students and researchers to access reliable sample processing capabilities supporting diverse experimental protocols. Clinical centrifuges maintain strong positioning in hospital laboratory settings where standardized workflows and regulatory compliance requirements necessitate specialized equipment configurations.

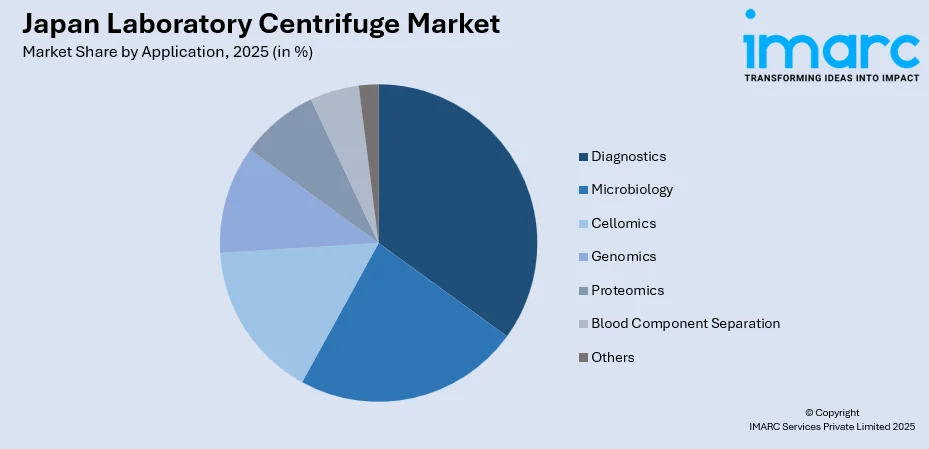

Application Insights:

Access the comprehensive market breakdown Request Sample

- Diagnostics

- Microbiology

- Cellomics

- Genomics

- Proteomics

- Blood Component Separation

- Others

Diagnostic laboratories form the backbone of clinical testing in Japan, driving steady demand for centrifuges. These systems are essential for blood separation, urinalysis, and sample preparation prior to biochemical and immunological assays. With an aging population and rising chronic disease prevalence, routine screening volumes remain high. Centrifuges that deliver reliable, reproducible results are preferred in hospital and reference labs, reinforcing diagnostics as a major market segment.

Microbiology applications rely heavily on centrifugation for tasks such as separating bacterial cultures, concentrating pathogens, and preparing samples for microscopy. Japan’s focus on infection control, antimicrobial resistance monitoring, and clinical microbiological testing fuels consistent centrifuge usage. Research laboratories also depend on centrifuges for nucleic acid extraction and pathogen purification, making microbiology a sustained demand driver supporting equipment acquisition across hospital labs and academic institutions.

Cellomics involves detailed cellular analysis, imaging, and high-content screening, requiring precise sample preparation. Centrifuges are crucial in isolating cells, fractionating subcellular components, and preparing samples for flow cytometry or fluorescent imaging. Japan’s expanding research in cell biology and pharmaceutical discovery bolsters demand for advanced centrifugation instruments. High-performance models that ensure gentle, accurate separation support the stringent requirements of cellomics workflows, contributing to the segment’s strong market share.

Genomics workflows, including DNA and RNA extraction, rely on centrifugation for purification and concentration steps. As genomic sequencing and personalized medicine gain prominence in Japan, laboratories are investing in reliable centrifuge systems to support high-throughput processing. Research institutions and clinical genetic testing centers require equipment capable of handling delicate nucleic acid samples while maintaining integrity, making genomics a key application area with sustained centrifuge demand.

Proteomics involves protein separation, fractionation, and analysis, which depend on precise motion control and temperature regulation. Centrifuges play a central role in sample preparation for mass spectrometry and 2D gel electrophoresis. With growing interest in biomarker discovery, therapeutic target research, and systems biology, Japanese research facilities are increasingly adopt centrifuges tailored for proteomic studies. Their ability to handle complex biological samples efficiently supports this application’s large market share.

Blood component separation is a routine, high‑volume application in clinical laboratories and blood banks. Centrifuges are essential for separating plasma, serum, red cells, and platelets for diagnostic testing and therapeutic use. Japan’s robust healthcare system and regular screening programs create continuous demand for centrifuge systems optimized for blood processing. Reliability, speed, and reproducibility make centrifuges indispensable for maintaining quality and safety in blood component workflows.

End-User Insights:

- Hospitals

- Biotechnology and Pharmaceutical Companies

- Academic and Research Institutions

Hospitals are major users of centrifuges due to high volumes of routine diagnostic testing, blood analysis, and sample processing necessary for clinical decision‑making. Japan’s aging population and expanding healthcare utilization increase demand for reliable centrifugation systems capable of fast and accurate separation of patient specimens. Centrifuges support emergency services, outpatient labs, and specialty departments, making hospitals a leading and consistent revenue contributor in the centrifuge market.

Biotechnology and pharmaceutical firms drive strong demand for centrifuges through extensive research, drug development, and bioprocessing activities. These organizations require advanced centrifugation for cell culture separation, protein purification, biomolecule extraction, and preparative workflows in research and development (R&D) and manufacturing. Japan’s robust biopharmaceutical ecosystem and significant investment in regenerative medicine, biologics, and precision therapies reinforce the need for high‑performance centrifuges, positioning this segment as a key market share holder.

Academic and research institutions represent a major segment due to their continuous use of centrifuges across diverse scientific disciplines, including molecular biology, cell biology, and systems research. These labs demand versatile centrifugation systems for teaching, experimentation, and grant‑funded projects, often requiring specialized features like refrigerated operation or high‑speed performance. Japan’s strong emphasis on innovation and research output sustains long‑term investment in centrifuge equipment in university and institutional settings.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

Kanto region holds the largest share with 35% of the total Japan laboratory centrifuge market in 2025.

The Kanto region, home to Tokyo and major research institutions, hospitals, and pharmaceutical companies, drives strong demand for laboratory centrifuges due to its concentration of biomedical research and clinical testing facilities. Increasing emphasis on accurate sample processing and high-throughput testing in laboratories encourages the adoption of advanced centrifuge models with enhanced speed, precision, and safety features. The presence of leading equipment suppliers and distributors in the region ensures timely availability, technical support, and integration with laboratory workflows, further stimulating market growth.

Sustainability and energy efficiency are increasingly influencing centrifuge procurement decisions in Kanto laboratories. Manufacturers are introducing models with hydrocarbon-based, low-global-warming refrigerants, energy-efficient motors, and improved thermal insulation to align with environmental policies and institutional carbon reduction goals. Additionally, compact and high-performance centrifuges are preferred in urban labs with limited space, allowing researchers to conduct versatile applications while maintaining operational efficiency, safety, and compliance with stringent quality standards.

Market Dynamics:

Growth Drivers

Why is the Japan Laboratory Centrifuge Market Growing?

Aging Population and Expanding Healthcare Demands

Japan's demographic profile presents a fundamental market growth driver, with approximately twenty-nine percent of the population aged sixty-five and older representing the highest proportion among developed economies globally. This aging demographic requires comprehensive and frequent medical testing for chronic disease management, cancer screening, and preventive health monitoring. Clinical laboratories across the nation face sustained pressure to expand testing capacities, driving continuous investment in sample processing equipment, including centrifuges essential for blood analysis, biomarker detection, and disease monitoring protocols. Healthcare facilities serving elderly populations particularly require reliable centrifugation systems supporting daily diagnostic workflows involving serum separation, plasma preparation, and urinalysis sample processing. The government's emphasis on preventive healthcare and regular health screenings further amplifies testing volumes, creating persistent equipment demand growth.

Pharmaceutical Research and Biopharmaceutical Development Investments

Japan maintains its position among global pharmaceutical research leaders, with substantial government and private sector investments supporting drug discovery and development activities. The Japan Agency for Medical Research and Development continues allocating significant funding for pharmaceutical startup ecosystem strengthening and innovative drug development programs. Major pharmaceutical corporations headquartered in Japan conduct extensive research activities requiring advanced laboratory equipment for cell culture processing, protein purification, and biological sample preparation. The growing emphasis on regenerative medicine and cell therapy research creates demand for specialized centrifugation equipment capable of handling sensitive biological materials under precisely controlled conditions. Strategic collaborations between pharmaceutical companies and academic institutions generate additional equipment procurement across university research laboratories participating in collaborative drug development programs.

Laboratory Automation and Modernization Initiatives

Japanese healthcare institutions and research facilities are actively pursuing laboratory automation and digital transformation to address operational efficiency challenges and workforce constraints. The shortage of skilled laboratory personnel, combined with increasing testing volumes, motivates investment in automated systems that reduce manual handling requirements while improving throughput and reproducibility. Modern centrifuge systems featuring programmable protocols, automatic rotor recognition, and integrated sample tracking capabilities align with laboratory information management system implementations. Government healthcare policy supporting medical digital transformation encourages equipment upgrades, incorporating connectivity features and data management capabilities. Academic research institutions similarly prioritize laboratory modernization to enhance research productivity and maintain competitiveness in international collaborative projects requiring standardized equipment and protocols.

Market Restraints

What Challenges is the Japan Laboratory Centrifuge Market Facing?

High Equipment Acquisition and Maintenance Costs

Laboratory centrifuge equipment, particularly advanced refrigerated and high-speed models, requires substantial capital investment that strains procurement budgets at smaller healthcare facilities and academic research laboratories. Ongoing maintenance requirements, including rotor certification, calibration services, and replacement component costs, contribute to elevated total ownership expenses that influence equipment selection decisions and replacement timing.

Space Constraints in Urban Laboratory Facilities

Physical space limitations common in Japanese urban healthcare settings and research facilities constrain equipment deployment options and influence purchasing decisions. Laboratory floor space premiums in metropolitan areas like Tokyo and Osaka restrict the number and size of centrifuge systems that facilities can accommodate, potentially limiting testing capacity expansion despite growing demand for diagnostic services.

Skilled Operator Availability and Training Requirements

Advanced centrifugation systems require trained operators capable of programming complex protocols, maintaining equipment according to manufacturer specifications, and troubleshooting operational issues. Japan's laboratory workforce constraints, exacerbated by demographic trends affecting all employment sectors, create challenges in staffing positions requiring specialized technical competencies essential for optimal equipment utilization.

Competitive Landscape:

The Japan laboratory centrifuge market exhibits a moderately competitive structure characterized by the presence of established domestic manufacturers alongside prominent multinational corporations. Japanese manufacturers maintain competitive advantages through localized service networks, cultural alignment with customer preferences, and strong relationships with domestic healthcare institutions developed over decades of market presence. International suppliers compete through technological innovation, comprehensive product portfolios spanning entry-level to ultra-high-performance systems, and strategic partnerships with Japanese distributors providing market access. Competition increasingly centers on value-added services including application support, preventive maintenance programs, and equipment financing arrangements that complement hardware offerings. Market participants invest in developing energy-efficient designs, quiet-operation features, and compact form factors addressing specific Japanese market requirements while pursuing product certifications necessary for institutional procurement processes.

Japan Laboratory Centrifuge Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Model Types Covered | Benchtop Centrifuges, Floor-Standing Centrifuges |

| Rotor Designs Covered | Fixed-Angle Rotors, Swinging-Bucket Rotors, Vertical Rotors, Others |

| Intended Uses Covered | General Purpose Centrifuges, Clinical Centrifuges, Preclinical Centrifuges |

| Applications Covered | Diagnostics, Microbiology, Cellomics, Genomics, Proteomics, Blood Component Separation, Others |

| End-Users Covered | Hospitals, Biotechnology and Pharmaceutical Companies, Academic and Research Institutions |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan laboratory centrifuge market size was valued at USD 109.9 Million in 2025.

The Japan laboratory centrifuge market is expected to grow at a compound annual growth rate of 4.12% from 2026-2034 to reach USD 158.1 Million by 2034.

The equipment segment dominated the market with a share of 57.65% in 2025, driven by continuous investment in advanced sample processing capabilities across clinical laboratories and pharmaceutical research facilities requiring reliable centrifugation systems for diagnostic and research applications.

Key factors driving the Japan laboratory centrifuge market include the aging population requiring comprehensive diagnostic services, sustained pharmaceutical research investments, laboratory automation initiatives, and expanding clinical testing volumes across hospitals and diagnostic centers.

Major challenges include high equipment acquisition and maintenance costs, space constraints in urban laboratory facilities, skilled operator availability, regulatory compliance requirements for medical devices, and intense competition among domestic and international manufacturers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)