Japan LED Bulb Market Size, Share, Trends and Forecast by Application and Region, 2026-2034

Japan LED Bulb Market Overview:

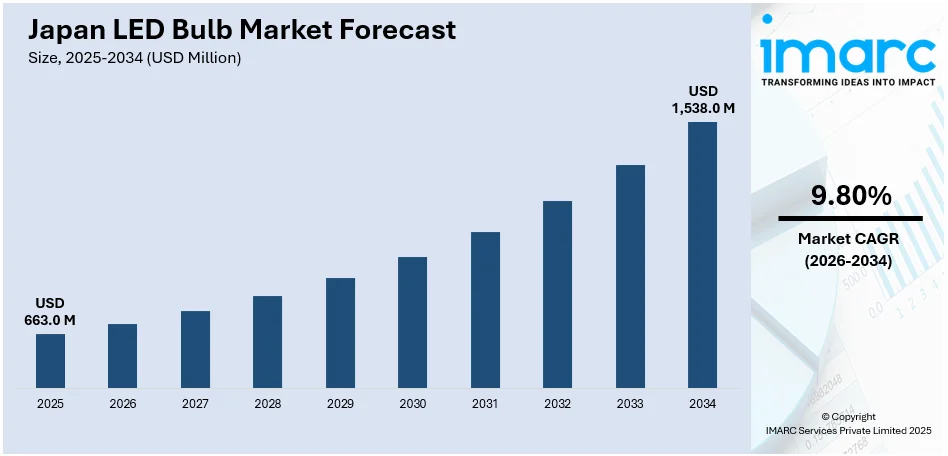

The Japan LED bulb market size reached USD 663.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,538.0 Million by 2034, exhibiting a growth rate (CAGR) of 9.80% during 2026-2034. The market is driven by national energy efficiency mandates and subsidies supporting LED upgrades in residential, commercial, and municipal infrastructure. Consumer preference for smart lighting, digital control, and aesthetic customization is encouraging widespread adoption, thereby fueling the market. Modernization of aging buildings and growing demand for safety-centric, low-maintenance lighting solutions across older demographics are further augmenting the Japan LED bulb market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 663.0 Million |

| Market Forecast in 2034 | USD 1,538.0 Million |

| Market Growth Rate 2026-2034 | 9.80% |

Japan LED Bulb Market Trends:

National Decarbonization Strategy and Lighting Efficiency Standards

Japan’s strong commitment to carbon neutrality by 2050 has made LED lighting a central component of its energy efficiency framework. Government initiatives under the Strategic Energy Plan and Top Runner Program have set stringent efficiency standards for lighting products, promoting widespread replacement of incandescent and fluorescent systems with LEDs. On October 27, 2023, Japan's Ministry of Economy, Trade and Industry (METI) issued new energy efficiency standards for transformers used in buildings and factories, set to take effect in FY2026. These regulations target 24 categories of oil-filled and molded transformers, aiming for an average efficiency improvement of 11.4% over FY2019 benchmarks. Public sector infrastructure, including schools, municipal buildings, and transit hubs, has undergone significant retrofitting to comply with these benchmarks. The Ministry of the Environment and METI have provided subsidies and tax incentives for energy-saving upgrades in residential and commercial properties. LED lighting is also prioritized in urban redevelopment schemes aligned with smart city goals. With electricity costs in Japan among the highest in the region, households and businesses seek long-term cost savings through lower energy consumption and minimal maintenance. Industrial and logistics facilities, which account for a large share of lighting demand, are rapidly transitioning to high-efficiency fixtures. Local governments, particularly in Tokyo, Osaka, and Nagoya, are enforcing lighting regulations in new construction projects. These converging policy actions and economic factors have laid a robust foundation for Japan LED bulb market growth, encouraging adoption across public, private, and mixed-use developments as the country accelerates its green transformation.

To get more information on this market Request Sample

Smart Home Integration and Consumer Demand for Customization

Japan’s advanced digital infrastructure and high rate of tech-savvy consumers have made smart home ecosystems an ideal channel for LED lighting innovation. Japan’s smart home market is projected to generate USD 11.0 Billion in revenue in 2025, with a year-on-year increase of 16.6%. The market is expected to expand at a 12.21% CAGR between 2025 and 2029, reaching USD 17.5 Billion by 2029. Household penetration of smart home technologies will rise from 77.2% in 2025 to 99.0% by 2029. Households are rapidly adopting app-controlled, voice-activated LED bulbs that allow for color tuning, brightness modulation, and energy tracking via integration with devices such as Amazon Alexa and Google Nest. The demand is particularly strong among younger homeowners and tech-forward urban dwellers who prioritize convenience and sustainability. Smart lighting is also being incorporated into Japan’s growing base of condominiums and multi-family residences, supported by developers aiming to deliver premium energy-efficient living environments. On the commercial side, hospitality and retail chains are using programmable LED lighting for mood setting, energy optimization, and operational scheduling. This shift has led to higher demand for dimmable and multi-spectral lighting options with IoT compatibility. Moreover, design-conscious consumers are exploring LED fixtures that match minimalistic interior styles and architectural aesthetics, with Japanese lighting designers collaborating on custom solutions. As energy monitoring and home automation gain relevance in urban policy and consumer behavior, LED bulbs remain at the center of these upgrades. The appeal of intelligent lighting is expanding steadily into secondary cities, adding new layers of product diversification and regional penetration.

Japan LED Bulb Market Segmentation:

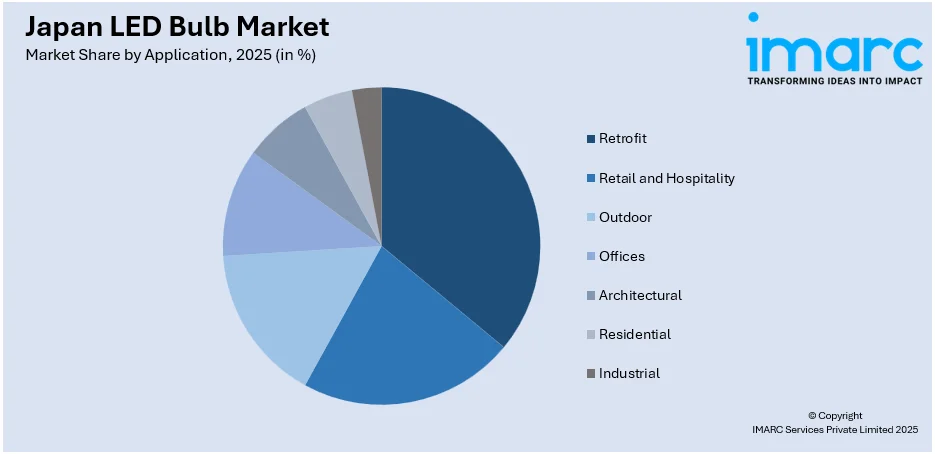

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on application.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Retrofit

- Retail and Hospitality

- Outdoor

- Offices

- Architectural

- Residential

- Industrial

The report has provided a detailed breakup and analysis of the market based on the application. This includes retrofit, retail and hospitality, outdoor, offices, architectural, residential, and industrial.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all major regional markets. This includes Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan LED Bulb Market News:

- On March 6, 2024, Nichia Corporation announced the mass production of its UV-B (308nm) and UV-A (330nm) LEDs within the compact 434 Series. These high-output LEDs achieve top-tier power conversion efficiencies of 5.1% and 5.7%, supporting the shift away from mercury-based lighting technologies.

Japan LED Bulb Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Retrofit, Retail and Hospitality, Outdoor, Offices, Architectural, Residential, Industrial |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan LED bulb market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan LED bulb market on the basis of application?

- What is the breakup of the Japan LED bulb market on the basis of region?

- What are the various stages in the value chain of the Japan LED bulb market?

- What are the key driving factors and challenges in the Japan LED bulb market?

- What is the structure of the Japan LED bulb market and who are the key players?

- What is the degree of competition in the Japan LED bulb market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan LED bulb market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan LED bulb market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan LED bulb industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)