Japan LED Lights Market Size, Share, Trends and Forecast by Product Type, Application, Import and Domestic Manufacturing, and Region, 2026-2034

Japan LED Lights Market Summary:

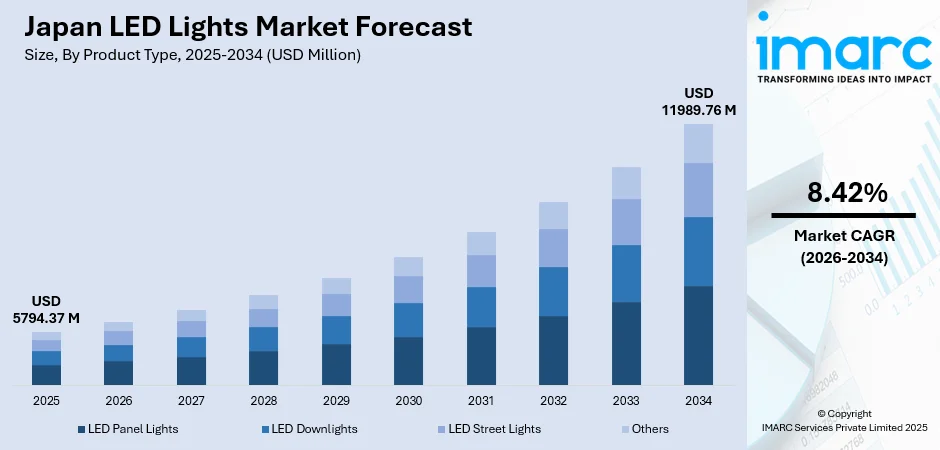

The Japan LED lights market size was valued at USD 5794.37 Million in 2025 and is projected to reach USD 11989.76 Million by 2034, growing at a compound annual growth rate of 8.42% from 2026-2034.

The Japan LED lights market is experiencing robust growth driven by government energy efficiency initiatives, increasing adoption of smart lighting solutions, and the ongoing transition from conventional lighting technologies. The market benefits from Japan's strong commitment to carbon neutrality goals, technological innovation in lighting systems, and growing demand across commercial, industrial, and residential sectors seeking sustainable and cost-effective illumination solutions.

Key Takeaways and Insights:

-

By Product Type: LED panel lights dominate the market with a share of 30% in 2025, driven by their widespread adoption in commercial and office environments where uniform illumination, slim profiles, and energy efficiency are paramount considerations.

-

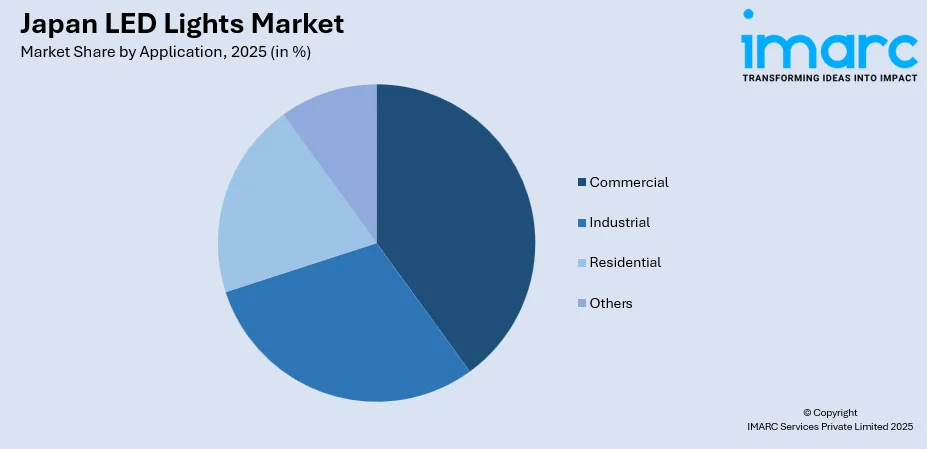

By Application: Commercial leads the market with a share of 40% in 2025, owing to extensive LED adoption in retail spaces, office buildings, hospitality venues, and healthcare facilities seeking energy savings and enhanced lighting quality.

-

By Import and Domestic Manufacturing: Import represents the largest segment with a market share of 52% in 2025, reflecting Japan's reliance on cost-competitive overseas manufacturing while maintaining domestic production for premium and specialized lighting solutions.

-

By Region: Kanto Region dominates the market with a share of 28% in 2025, driven by Tokyo's massive commercial real estate sector, high concentration of corporate offices, and leading adoption of energy-efficient building technologies.

-

Key Players: The Japan LED lights market features a competitive landscape with established domestic lighting manufacturers competing alongside international brands, characterized by continuous technological innovation, smart lighting integration, and comprehensive product portfolios addressing diverse application requirements.

To get more information on this market Request Sample

The Japan LED lights market continues to evolve driven by technological advancements, regulatory support for energy efficiency, and growing environmental consciousness among consumers and businesses. In fact, as of 2025, the shift away from fluorescent lighting is being actively accelerated, with the manufacture, import, and export of general-lighting fluorescent lamps in Japan scheduled to be banned by the end of 2027, pushing organizations and households to move swiftly toward LED adoption. The transition from traditional lighting to LED solutions is accelerating across all sectors as organizations recognize the long-term cost benefits and sustainability advantages. The market is witnessing significant innovation in smart lighting systems, human-centric lighting designs, and connected lighting solutions that integrate with building management systems and Internet of Things platforms.

Japan LED Lights Market Trends:

Accelerating Smart Lighting Adoption

Japanese consumers and businesses are increasingly adopting smart LED lighting systems featuring wireless connectivity, automated controls, and integration with smart home and building management platforms. This trend is evident in the growth of the smart lighting segment: in 2024, the Japan Smart Lighting Market reached a value of about USD 1,135 million. These intelligent solutions enable remote operation, scheduling, dimming capabilities, and energy monitoring that optimize consumption patterns while enhancing user convenience and comfort across residential and commercial environments.

Growing Focus on Human-Centric Lighting

The market is witnessing increased emphasis on human-centric lighting designs that adjust color temperature and intensity to support natural circadian rhythms. According to sources, in 2024 Signify launched its “NatureConnect” lighting system, described as an “industry‑first” solution that mimics the natural rhythm of sunlight indoors, aiming to enhance well‑being, improve mood and focus, and regulate sleep‑wake cycles in office spaces, healthcare settings, and other interiors. Office environments and healthcare facilities are particularly interested in tunable LED systems that enhance occupant wellbeing, productivity, and comfort by mimicking natural daylight patterns throughout the day.

Expansion of Connected Lighting Infrastructure

LED lighting is increasingly serving as infrastructure for connected building systems, incorporating sensors for occupancy detection, daylight harvesting, and environmental monitoring. This convergence of lighting with building automation and data collection capabilities is transforming LED fixtures into multifunctional nodes within smart building ecosystems across Japan's commercial real estate sector. Notably, in 2025, Panasonic began demonstrating how lighting‑equipment beacon data can be used to enable service robots to self‑localize and operate in offices, illustrating how lighting networks double as infrastructure for broader building automation.

Market Outlook 2026-2034:

The Japan LED lights market is positioned for sustained growth through the forecast period, supported by government energy efficiency mandates, ongoing commercial building renovations, and residential sector adoption. The market is expected to benefit from continued technological advancement in LED efficiency, expanding smart lighting applications, and growing replacement demand as early LED installations reach end-of-life cycles. The market generated a revenue of USD 5794.37 Million in 2025 and is projected to reach a revenue of USD 11989.76 Million by 2034, growing at a compound annual growth rate of 8.42% from 2026-2034.

Japan LED Lights Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

LED Panel Lights |

30% |

|

Application |

Commercial |

40% |

|

Import and Domestic Manufacturing |

Import |

52% |

|

Region |

Kanto Region |

28% |

Product Type Insights:

- LED Panel Lights

- LED Downlights

- LED Street Lights

- Others

The LED panel lights dominate with a market share of 30% of the total Japan LED lights market in 2025.

LED panel lights maintain their dominant market position due to widespread adoption across commercial office environments, retail spaces, and institutional facilities. Their slim profile design enables seamless integration with suspended ceiling systems commonly found in Japanese commercial buildings. The uniform light distribution eliminates harsh shadows and provides comfortable illumination that reduces eye strain during extended working hours in office environments.

The segment's leadership is reinforced by superior energy efficiency compared to traditional fluorescent panel fixtures, delivering substantial operational cost savings for building owners. Many LED panels now quote lifespans of 50,000 hours or more, significantly reducing maintenance requirements and replacement frequency in large commercial installations. LED panels offer extended lifespans that minimize maintenance requirements and replacement frequency in large commercial installations. Additionally, their compatibility with dimming controls and building management systems supports smart lighting implementations increasingly demanded in modern Japanese office developments.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Commercial

- Industrial

- Residential

- Others

The commercial leads with a share of 40% of the total Japan LED lights market in 2025.

The commercial segment dominates the market driven by extensive LED adoption across office buildings, retail establishments, hospitality venues, healthcare facilities, and educational institutions throughout Japan. Commercial property owners and facility managers prioritize LED lighting for its significant energy cost reductions and alignment with corporate sustainability objectives. This leadership is strengthened by regulation: the Building Energy Conservation Act in Japan was revised, making energy‑conservation standards mandatory for all new residential and non‑residential buildings starting FY2025. The segment benefits from regulatory requirements encouraging energy-efficient building systems in new construction and renovation projects.

Commercial applications demand sophisticated lighting solutions offering precise control over illumination levels, color temperatures, and automated scheduling capabilities. Retail environments particularly value LED technology for its superior color rendering that enhances merchandise presentation and customer experience. The segment's growth is sustained by ongoing building modernization programs and tenant requirements for contemporary, energy-efficient workspace environments across Japan's major metropolitan areas.

Import and Domestic Manufacturing Insights:

- Import

- Domestic Manufacturing

The import dominates with a market share of 52% of the total Japan LED lights market in 2025.

Imported LED products dominate the market as Japanese buyers leverage cost-competitive manufacturing capabilities in overseas production centers, particularly for standard commercial and residential lighting applications. The import segment benefits from established global supply chains delivering quality products at competitive price points. Japanese distributors and retailers source extensively from international manufacturers to meet price-sensitive market segments while maintaining acceptable quality standards.

The segment's leadership reflects the globalized nature of LED component and fixture manufacturing where economies of scale favor concentrated production facilities. Japanese importers have developed robust quality assurance processes ensuring imported products meet domestic safety and performance standards. However, premium and specialized lighting applications continue to support domestic manufacturing where technical expertise, customization capabilities, and local service requirements justify higher price positioning.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto Region exhibits a clear dominance with a 28% share of the total Japan LED lights market in 2025.

The Kanto Region dominates the Japan LED lights market driven by Tokyo's massive commercial real estate sector and high concentration of corporate headquarters requiring modern lighting infrastructure. This economically vital region features the highest density of office buildings, retail complexes, and hospitality venues in Japan, creating substantial demand for energy-efficient LED solutions. The region leads in smart building implementations integrating advanced lighting control systems.

The region's market leadership is reinforced by stringent energy efficiency requirements for commercial buildings and strong corporate commitment to sustainability goals. Tokyo's ongoing urban development projects incorporate state-of-the-art LED lighting systems as standard specifications. Additionally, the region serves as the primary market for new product introductions and innovative lighting technologies targeting discerning commercial and residential consumers across the greater metropolitan area.

Market Dynamics:

Growth Drivers:

Why is the Japan LED Lights Market Growing?

Government Energy Efficiency Initiatives

Japanese government policies promoting energy efficiency and carbon neutrality are driving accelerated LED adoption across all sectors. Regulatory requirements for building energy performance, subsidies supporting lighting upgrades, and public sector procurement mandates favoring LED solutions create sustained market demand. For instance, under the “Lighting Future Plan” launched by Japan’s Ministry of the Environment, public buildings and offices are encouraged to replace conventional lighting with high‑efficiency LED systems through guidance and incentive programs. These initiatives align with Japan's broader commitment to reducing energy consumption and greenhouse gas emissions through widespread adoption of efficient lighting technologies.

Commercial Building Renovation and Modernization

Ongoing renovation programs across Japan's aging commercial building stock are generating substantial LED lighting demand as property owners upgrade from conventional fixtures. Building modernization projects prioritize energy-efficient lighting systems that reduce operational costs, improve tenant satisfaction, and enhance property values. In 2025, Nikken Sekkei renovated the 57-year-old Nikken Building No.1 under its ZEBReady project, replacing old lighting with LED systems, maintaining 500 lx while cutting power use ≈27%. This renovation cycle provides consistent market growth as buildings progressively transition to contemporary LED solutions.

Smart Building and IoT Integration

The convergence of LED lighting with smart building technologies and Internet of Things platforms is creating new market opportunities and driving premium product adoption. Connected lighting systems offering occupancy sensing, daylight harvesting, and centralized control capabilities are increasingly specified in commercial developments. This integration positions LED fixtures as essential infrastructure components within intelligent building ecosystems.

Market Restraints:

What Challenges the Japan LED Lights Market is Facing?

Market Saturation in Certain Segments

High LED penetration rates in certain commercial and residential segments are limiting growth potential as initial conversion from conventional lighting approaches completion. Market saturation in early-adopting sectors shifts demand toward replacement and upgrade cycles rather than new installations, potentially moderating overall market expansion rates in mature application categories.

Price Competition from Imported Products

Intense price competition from imported LED products pressures profit margins across the industry, particularly affecting domestic manufacturers competing in standard product categories. The commoditization of basic LED lighting solutions challenges differentiation strategies and may limit investment in advanced technology development for certain market segments.

Extended Product Lifespans Reducing Replacement Frequency

The inherent longevity of LED lighting products, while a consumer benefit, extends replacement cycles compared to conventional lighting technologies. This characteristic may moderate recurring demand volumes as installed LED systems continue operating effectively for extended periods, shifting market dynamics toward fewer but potentially higher-value transactions.

Competitive Landscape:

The Japan LED lights market features a competitive landscape shaped by established domestic lighting manufacturers with strong brand recognition competing alongside international players that offer cost-competitive and increasingly sophisticated solutions. Leading companies differentiate themselves through continuous technological innovation, diversified and comprehensive product portfolios, advanced smart-lighting capabilities, and extensive nationwide distribution networks that enhance market reach. Competition primarily centers on energy-efficiency performance, lighting quality, connectivity options, and integration with smart-home or building-management systems. In addition, companies compete on durability, design flexibility, and overall total cost-of-ownership positioning across commercial, industrial, and residential segments, where customer expectations for reliability, sustainability, and long-term value continue to rise.

Recent Developments:

-

In May 2025, Kyocera Corporation unveiled its new air-cooled G7A Series UV-LED light sources. The compact lineup delivers the highest irradiance in its class, enabling efficient industrial applications such as ink and resin curing with improved stability and reduced equipment footprint.

Japan LED Lights Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | LED Panel Lights, LED Downlights, LED Street Lights, Others |

| Applications Covered | Commercial, Industrial, Residential, Others |

| Import and Domestic Manufacturings Covered | Import, Domestic Manufacturing |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan LED lights market size was valued at USD 5794.37 Million in 2025.

The Japan LED lights market is expected to grow at a compound annual growth rate of 8.42% from 2026-2034 to reach USD 11989.76 Million by 2034.

LED panel lights dominated the Japan LED lights market with a share of 30%, driven by widespread adoption in commercial office environments where uniform illumination, slim profiles, and energy efficiency are paramount considerations.

Key factors driving the Japan LED lights market include government energy efficiency initiatives, commercial building renovation programs, smart building and IoT integration, growing adoption of human-centric lighting, and expanding connected lighting infrastructure across commercial, industrial, and residential sectors.

Major challenges include market saturation in certain segments limiting growth potential, intense price competition from imported products pressuring margins, and extended LED product lifespans reducing replacement frequency compared to conventional lighting technologies.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)