Japan Lightweight Building Materials Market Size, Share, Trends and Forecast by Type of Material, Density, Application, End User, and Region, 2026-2034

Japan Lightweight Building Materials Market Overview:

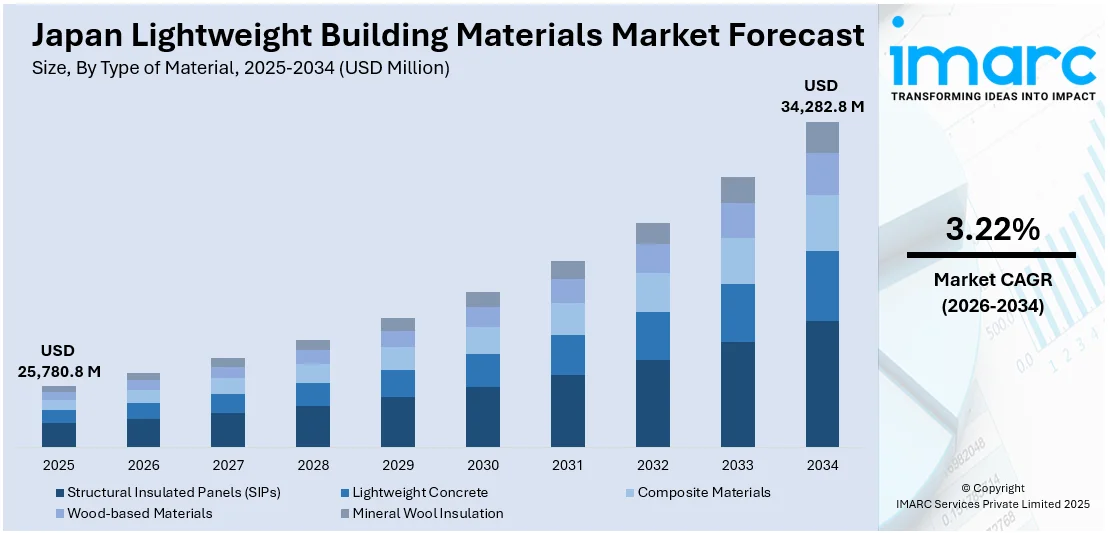

The Japan lightweight building materials market size reached USD 25,780.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 34,282.8 Million by 2034, exhibiting a growth rate (CAGR) of 3.22% during 2026-2034. The market is driven by stringent environmental regulations and the government’s carbon neutrality goals, accelerating demand for sustainable materials such as recycled steel and fiber-reinforced polymers. Rising adoption of prefabricated construction, supported by labor shortages and seismic resilience needs, further fuels demand for lightweight, high-performance solutions such as aluminum panels and aerated concrete. Continuous R&D investments in advanced composites and modular building techniques are further augmenting the Japan lightweight building materials market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 25,780.8 Million |

| Market Forecast in 2034 | USD 34,282.8 Million |

| Market Growth Rate 2026-2034 | 3.22% |

Japan Lightweight Building Materials Market Trends:

Escalating Demand for Sustainable and Eco-Friendly Lightweight Materials

The market is experiencing a rise in demand for sustainable and eco-friendly solutions, driven by strict environmental regulations and increasing awareness of carbon footprint reduction. The Japanese government’s push toward carbon neutrality by 2050 has increased the adoption of green construction materials, such as recycled steel, cross-laminated timber (CLT), and bio-based composites. Japan's Green Transformation (GX) program, supported by a JPY 2.75 Trillion (approximately USD 19.29 Billion) Green Innovation Fund, is driving a national shift toward sustainability, with renewable sources generating almost 60% of the electricity in areas such as the Goto Islands. This increased emphasis on clean energy and sustainable development is further evidence of the growing demand for green building materials and systems to improve energy efficiency and environmental performance in Japan's emerging construction sector. The focus on becoming carbon-neutral by 2050 will increasingly encourage lightweight building materials that meet stringent environmental standards and support green building activities. Lightweight materials such as magnesium alloys and fiber-reinforced polymers (FRPs) are gaining traction due to their energy efficiency, durability, and recyclability. Additionally, the construction industry is favoring materials that reduce overall building weight, lowering transportation costs and minimizing structural load. Companies are investing in R&D to develop advanced composites that meet both performance and sustainability standards. As urban development and infrastructure projects expand, the preference for lightweight, eco-conscious materials is expected to grow, positioning sustainability as a key trend in Japan’s construction sector.

To get more information on this market Request Sample

Increasing Adoption of Lightweight Materials in Prefabricated Construction

The rise in the use of prefabricated construction methods, enhancing demand for high-performance lightweight materials is propelling the Japan lightweight building materials market growth. Prefabrication offers faster project completion, cost efficiency, and reduced on-site waste, aligning with Japan’s labor shortage and need for efficient housing solutions. Japan's Housing Index rose to 129.97 points in March 2025, an increase of 0.71% from February, indicating sustained demand for residential properties despite fluctuations in housing starts. While housing starts declined by 26.6% year-over-year in April, the light building material industry has much to benefit from increased interest in affordable and eco-friendly alternatives for construction. This trend presents an opportunity for creative building material providers to meet the changing needs of Japan's property industry. Lightweight materials such as aluminum panels, aerated concrete, and composite sandwich panels are increasingly used in modular construction due to their ease of transport, assembly, and seismic resistance—a critical factor in earthquake-prone Japan. The government’s support for off-site construction techniques to address housing shortages further propels this trend. Manufacturers are focusing on developing ultra-light yet durable materials that enhance structural integrity while reducing overall building weight. As prefabrication gains momentum in residential and commercial projects, the demand for innovative lightweight materials is set to rise, shaping the future of Japan’s construction industry.

Japan Lightweight Building Materials Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type of material, density, application, and end user.

Type of Material Insights:

- Structural Insulated Panels (SIPs)

- Lightweight Concrete

- Composite Materials

- Wood-based Materials

- Mineral Wool Insulation

The report has provided a detailed breakup and analysis of the market based on the type of material. This includes structural insulated panels (SIPs), lightweight concrete, composite materials, wood-based materials, and mineral wool insulation.

Density Insights:

- Low Density

- Medium Density

- High Density

- Ultra Lightweight

A detailed breakup and analysis of the market based on the density have also been provided in the report. This includes low density, medium density, high density, and ultra lightweight.

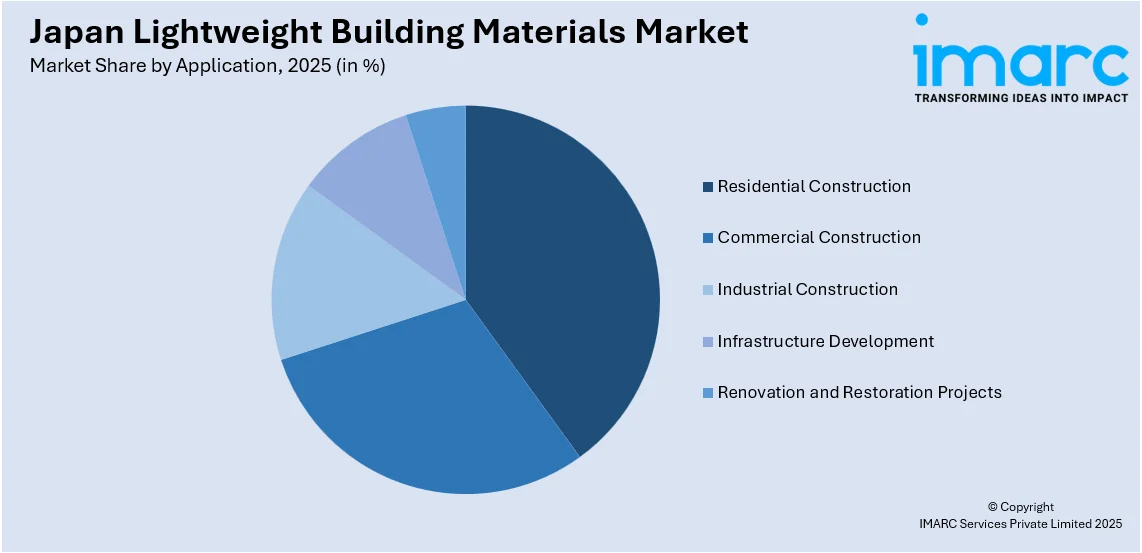

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential Construction

- Commercial Construction

- Industrial Construction

- Infrastructure Development

- Renovation and Restoration Projects

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential construction, commercial construction, industrial construction, infrastructure development, and renovation and restoration projects.

End User Insights:

- Contractors

- Construction Companies

- Architects and Designers

- Homeowners

- Real Estate Developers

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes contractors, construction companies, architects and designers, homeowners, and real estate developers.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Lightweight Building Materials Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types of Material Covered | Structural Insulated Panels (SIPs), Lightweight Concrete, Composite Materials, Wood-based Materials, Mineral Wool Insulation |

| Densities Covered | Low Density, Medium Density, High Density, Ultra Lightweight |

| Applications Covered | Residential Construction, Commercial Construction, Industrial Construction, Infrastructure Development, Renovation and Restoration Projects |

| End Users Covered | Contractors, Construction Companies, Architects and Designers, Homeowners, Real Estate Developers |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan lightweight building materials market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan lightweight building materials market on the basis of type of material?

- What is the breakup of the Japan lightweight building materials market on the basis of density?

- What is the breakup of the Japan lightweight building materials market on the basis of application?

- What is the breakup of the Japan lightweight building materials market on the basis of end user?

- What is the breakup of the Japan lightweight building materials market on the basis of region?

- What are the various stages in the value chain of the Japan lightweight building materials market?

- What are the key driving factors and challenges in the Japan lightweight building materials market?

- What is the structure of the Japan lightweight building materials market and who are the key players?

- What is the degree of competition in the Japan lightweight building materials market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan lightweight building materials market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan lightweight building materials market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan lightweight building materials industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)