Japan Limestone Market Size, Share, Trends and Forecast by Type, Size, End Use Industry, and Region, 2026-2034

Japan Limestone Market Overview:

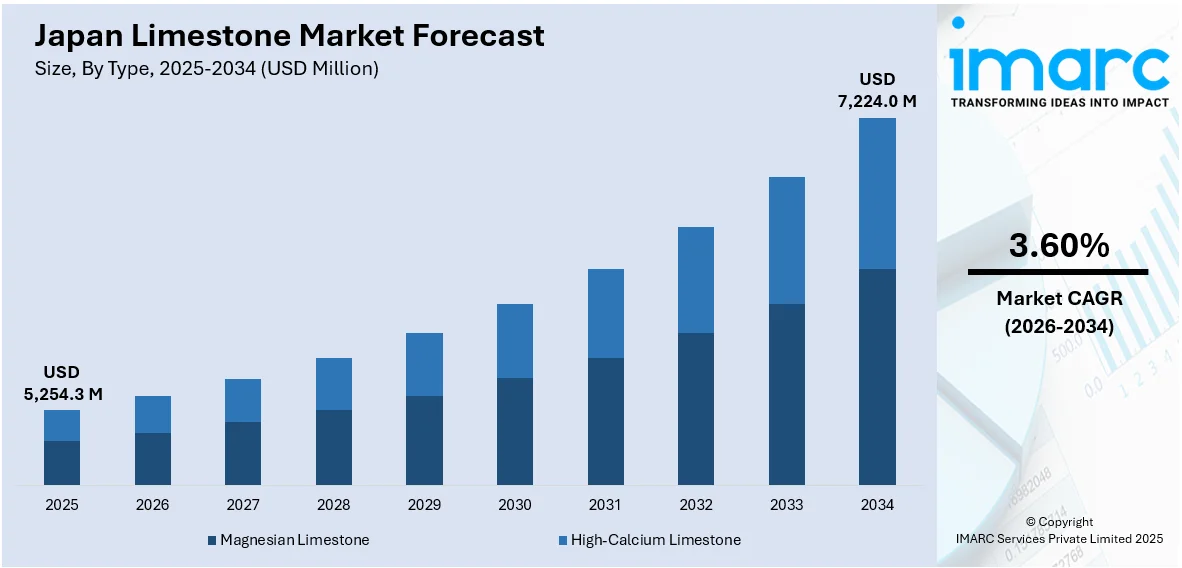

The Japan limestone market size reached USD 5,254.3 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 7,224.0 Million by 2034, exhibiting a growth rate (CAGR) of 3.60% during 2026-2034. The market is driven by comprehensive infrastructure upgrades and stringent seismic building standards that require high-quality construction materials. Industrial consumption, especially from the steel sector and manufacturing industries, sustains consistent limestone demand, thereby fueling the market. Expanding agricultural use for soil treatment and environmental applications in water and pollution control further augment Japan limestone market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 5,254.3 Million |

| Market Forecast in 2034 | USD 7,224.0 Million |

| Market Growth Rate 2026-2034 | 3.60% |

Japan Limestone Market Trends:

Construction and Infrastructure Modernization

Japan’s limestone market benefits significantly from sustained construction activities focused on infrastructure modernization, earthquake-resistant structures, and urban redevelopment. The government’s investment in rebuilding aging transport networks, including highways, bridges, and rail systems, necessitates large quantities of limestone for cement production and concrete aggregates. Urban areas like Tokyo, Osaka, and Nagoya are witnessing ongoing residential and commercial projects emphasizing durable and environmentally friendly materials. Limestone’s role in producing high-quality cement that meets strict seismic standards is crucial in this earthquake-prone country. A recent study found that uncalcined limestone and granite powders (used at 30% by weight) can be reused in cement-treated clay without significant loss in strength. Granite powder improved UCS more than limestone, with granite composites showing higher strength after 7 and 28 days, unlike limestone, which matched control samples at those stages. Japan consumes 390 million tons of crushed rock aggregates annually, generating up to 25% waste as stone powder. Additionally, Japan’s green building codes promote the use of materials with thermal efficiency and longevity, further boosting limestone demand. The material’s versatility in landscaping and architectural finishes also complements aesthetic and functional requirements of new developments. Regional limestone quarries in Hokkaido, Chubu, and Kyushu provide a reliable local supply, helping reduce logistics expenses and ensuring project timelines are met. These infrastructure and urban growth initiatives underpin Japan limestone market growth by steadily increasing demand for construction-grade limestone.

To get more information on this market Request Sample

Agricultural Usage and Environmental Sustainability

Limestone use in agriculture and environmental management is expanding in Japan, supporting soil amendment and ecological protection efforts. Acidic soils, common in certain regions of Japan like Hokkaido and Kyushu, require agricultural lime to maintain pH balance and enhance crop productivity, particularly for rice, vegetables, and fruit orchards. The country’s commitment to sustainable farming practices and food security has heightened demand for soil conditioners derived from crushed limestone. Additionally, limestone is employed in environmental applications such as water purification, wastewater treatment, and flue gas desulfurization to comply with Japan’s strict environmental regulations. On February 20, 2024, a study revealed evidence of natural denitrification in the Ryukyu limestone aquifer in southern Okinawa Island, Japan, where nitrate concentrations fell to as low as 0.1 mg/L in several wells. Groundwater samples from 150 locations showed δ¹⁵NNO₃ and δ¹⁸ONO₃ enrichment up to +59.7‰ and +21‰ respectively, confirming nitrate reduction under conditions of low dissolved oxygen (<2 mg/L), high dissolved organic carbon (>1.2 mg/L), and minimal groundwater flow. The findings highlight the limestone aquifer’s natural capacity to mitigate nitrate contamination, emphasizing its ecological value and relevance to sustainable groundwater management in Japan's limestone market. Municipal and industrial wastewater treatment facilities frequently use limestone-based filtration to stabilize pH and remove harmful contaminants. These applications align with national policies promoting pollution reduction and resource conservation. Together, agricultural and environmental uses broaden the market base for limestone and contribute to the sustainable development agenda, reinforcing steady demand across Japan.

Japan Limestone Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, size, and end use industry.

Type Insights:

- Magnesian Limestone

- High-Calcium Limestone

The report has provided a detailed breakup and analysis of the market based on the type. This includes magnesian limestone and high-calcium limestone.

Size Insights:

- Crushed Limestone

- Calcined Limestone (PCC)

- Ground Limestone (GCC)

The report has provided a detailed breakup and analysis of the market based on the size. This includes crushed limestone, calcined limestone (PCC), and ground limestone (GCC).

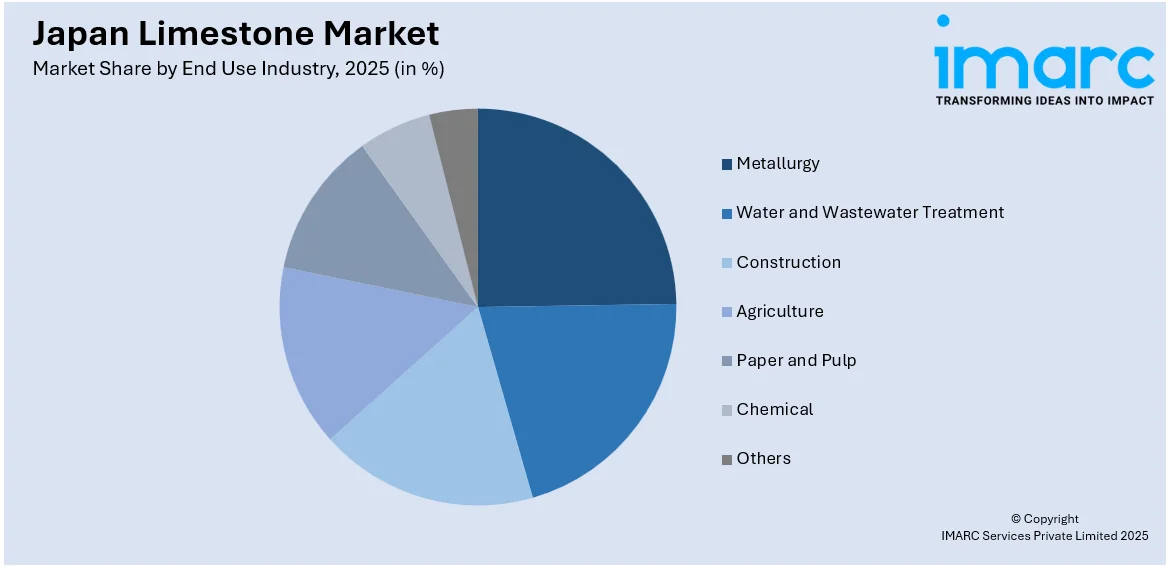

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Metallurgy

- Water and Wastewater Treatment

- Construction

- Agriculture

- Paper and Pulp

- Chemical

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes metallurgy, water and wastewater treatment, construction, agriculture, paper and pulp, chemical, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all major regional markets. This includes Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Limestone Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Magnesian Limestone, High Calcium Limestone |

| Sizes Covered | Crushed Limestone, Calcined Limestone (PCC), Ground Limestone (GCC) |

| End Use Industries Covered | Metallurgy, Water and Wastewater Treatment, Construction, Agriculture, Paper and Pulp, Chemical, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan limestone market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan limestone market on the basis of type?

- What is the breakup of the Japan limestone market on the basis of size?

- What is the breakup of the Japan limestone market on the basis of end use industry?

- What is the breakup of the Japan limestone market on the basis of region?

- What are the various stages in the value chain of the Japan limestone market?

- What are the key driving factors and challenges in the Japan limestone market?

- What is the structure of the Japan limestone market and who are the key players?

- What is the degree of competition in the Japan limestone market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan limestone market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan limestone market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan limestone industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)