Japan Logistics Automation Market Report by Component (Hardware, Software, Services), Function (Warehouse and Storage Management, Transportation Management), Enterprise Size (Small and Medium-sized Enterprises, Large Enterprises), Industry Vertical (Manufacturing, Healthcare and Pharmaceuticals, Fast-Moving Consumer Goods (FMCG), Retail and E-Commerce, 3PL, Aerospace and Defense, Oil, Gas and Energy, Chemicals, and Others), and Region 2026-2034

Market Overview:

Japan logistics automation market size reached USD 5.8 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 19.2 Billion by 2034, exhibiting a growth rate (CAGR) of 14.35% during 2026-2034. The expanding e-commerce sector, along with the numerous advancements in the manufacturing technologies, is primarily driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 5.8 Billion |

| Market Forecast in 2034 | USD 19.2 Billion |

| Market Growth Rate (2026-2034) | 14.35% |

Logistics automation entails the utilization of control systems, machinery, and software to enhance the efficiency of logistics operations, particularly those conducted within warehouses or distribution centers with limited human involvement. Its advantages encompass the enhancement of customer service quality, scalability, operational speed, organizational oversight, and error reduction. Logistics automation plays a pivotal role in minimizing manual data inaccuracies, ensuring adequate insurance coverage, and facilitating automated notifications. As a result, it is progressively supplanting conventional logistics procedures across both small and large businesses, streamlining and mechanizing a range of tasks including freight handling, tracking, and documentation. Consequently, logistics automation finds widespread application in industries such as retail, automotive, and the food and beverage (F&B) sector.

Japan Logistics Automation Market Trends:

The Japan logistics automation market is primarily influenced by the widespread adoption of high-speed internet and smartphones, driven by the rapid pace of digitization on a global scale. Furthermore, the substantial expansion of the e-commerce sector is generating increased demand for logistics automation solutions. These systems exhibit the capability to automate a wide range of tasks, including container loading and unloading, palletizing, de-palletizing, commissioning, and the efficient feeding of production lines. Additionally, the emergence of the industrial internet of things (IIoT) and the introduction of network-connected systems that enhance task performance across diverse industries are further facilitating market growth. As the number of warehouses continues to rise, organizations are increasingly investing in warehouse automation solutions. This trend, coupled with ongoing advancements in manufacturing and industrial robotics, has led to the development of innovative robotic technologies such as automated guided vehicles, which are expected to create a positive market outlook.

Japan Logistics Automation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on component, function, enterprise size, and industry vertical.

Component Insights:

- Hardware

- Mobile Robots (AGV, AMR)

- Automated Storage and Retrieval Systems (AS/RS)

- Automated Sorting Systems

- De-palletizing/Palletizing Systems

- Conveyor Systems

- Automatic Identification and Data Collection (AIDC)

- Order Picking

- Software

- Warehouse Management Systems (WMS)

- Warehouse Execution Systems (WES)

- Services

- Value Added Services

- Maintenance

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware (mobile robots (AGV, AMR), automated storage and retrieval systems (AS/RS), automated sorting systems, de-palletizing/palletizing systems, conveyor systems, automatic identification and data collection (AIDC), and order picking), software (warehouse management systems (WMS) and warehouse execution systems (WES), and services (value added services and maintenance).

Function Insights:

- Warehouse and Storage Management

- Transportation Management

A detailed breakup and analysis of the market based on the function have also been provided in the report. This includes warehouse and storage management and transportation management.

Enterprise Size Insights:

- Small and Medium-sized Enterprises

- Large Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes small and medium-sized enterprises and large enterprises.

Industry Vertical Insights:

- Manufacturing

- Healthcare and Pharmaceuticals

- Fast-Moving Consumer Goods (FMCG)

- Retail and E-Commerce

- 3PL

- Aerospace and Defense

- Oil, Gas and Energy

- Chemicals

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes manufacturing, healthcare and pharmaceuticals, fast-moving consumer goods (FMCG), retail and e-commerce, 3PL, aerospace and defense, oil, gas and energy, chemicals, and others.

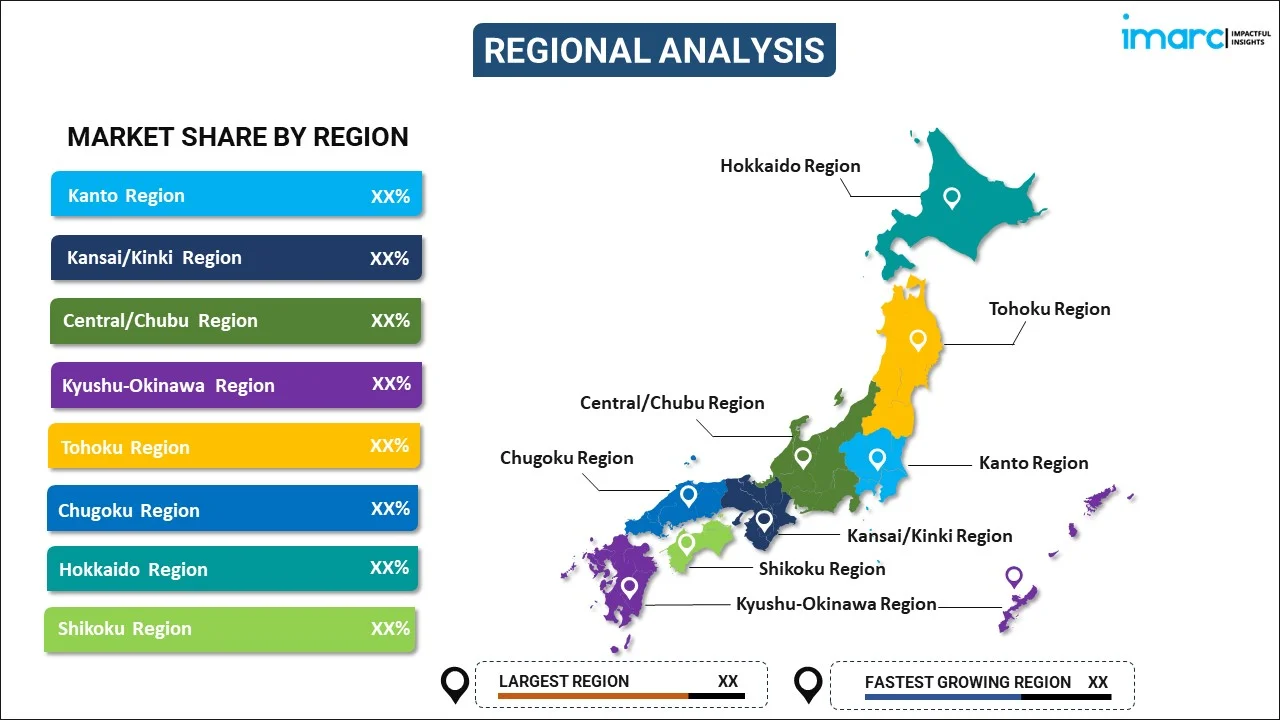

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Logistics Automation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Functions Covered | Warehouse and Storage Management, Transportation Management |

| Enterprise Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Industry Verticals Covered | Manufacturing, Healthcare and Pharmaceuticals, Fast-Moving Consumer Goods (FMCG), Retail and E-Commerce, 3PL, Aerospace and Defense, Oil, Gas and Energy, Chemicals, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan logistics automation market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Japan logistics automation market?

- What is the breakup of the Japan logistics automation market on the basis of component?

- What is the breakup of the Japan logistics automation market on the basis of function?

- What is the breakup of the Japan logistics automation market on the basis of enterprise size?

- What is the breakup of the Japan logistics automation market on the basis of industry vertical?

- What are the various stages in the value chain of the Japan logistics automation market?

- What are the key driving factors and challenges in the Japan logistics automation?

- What is the structure of the Japan logistics automation market and who are the key players?

- What is the degree of competition in the Japan logistics automation market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan logistics automation market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan logistics automation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan logistics automation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)