Japan Low Voltage Electric Motor Market Size, Share, Trends and Forecast by Efficiency, Application, End-Use Industry, and Region, 2026-2034

Japan Low Voltage Electric Motor Market Overview:

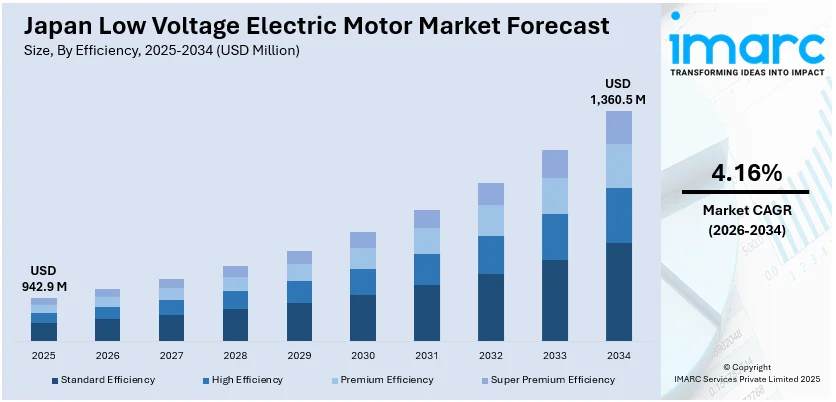

The Japan low voltage electric motor market size reached USD 942.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,360.5 Million by 2034, exhibiting a growth rate (CAGR) of 4.16% during 2026-2034. The market is driven by stringent energy efficiency regulations, such as the Top Runner Program, and the push for carbon neutrality. Rising industrial automation, IoT integration, and demand for smart manufacturing solutions further propel growth. Labor shortages and the need for precision in the automotive, robotics, and electronics industries also enhance adoption.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 942.9 Million |

| Market Forecast in 2034 | USD 1,360.5 Million |

| Market Growth Rate 2026-2034 | 4.16% |

Japan Low Voltage Electric Motor Market Trends:

Growing Demand for Energy-Efficient Motors

The rise in demand for energy-efficient models, driven by stringent government regulations and increasing sustainability initiatives, is favoring the Japan low voltage electric motor market growth. Japan has strict energy conservation laws through the Top Runner Program, which encourages manufacturers to develop motors with higher efficiency ratings. Industries, including automotive, manufacturing, and HVAC, are now moving towards IE3 and IE4 premium efficiency motors to reduce operating costs and reduce carbon emissions. Additionally, the rise of smart factories and Industry 4.0 has accelerated the adoption of advanced motor technologies that optimize energy consumption. A research report from the IMARC Group indicates that the market size for Industry 4.0 in Japan was valued at USD 9.8 Billion in 2024. It is projected to grow to USD 43.3 Billion by 2033, reflecting a compound annual growth rate (CAGR) of 17.9% from 2025 to 2033. Companies are also investing in IoT-enabled motors that provide real-time performance monitoring, further enhancing efficiency. As Japan continues to prioritize green energy and carbon neutrality by 2050, the shift toward energy-efficient low-voltage motors is growing, creating a positive Japan low voltage electric motor market outlook.

To get more information on this market Request Sample

Increasing Automation in Industrial Applications

Another key trend in the market is the rising adoption of automation across industrial sectors. Japan is currently the world leader in robotics, with a historic total of 435,299 industrial robots, driven primarily by automotive (132,766 units), electronics (143,768 units), and metal companies (64,915 units) to help modernize their factories. Yet despite a 9% decrease in installations to 46,106 units in 2023, Japan remains the second-largest robotics market globally. This growth shows an increasing demand for precision systems, such as low-voltage electric motors, to support the next generation of automation as the manufacturing industry throughout the country transitions towards both electric and hydrogen-based technologies. As labor shortages increasingly dictate precision in manufacturing, low-voltage motors are beginning to find regular use in the automated systems of a number of industries, including robotics, automotive and electronics. They are used to make conveyor belts, robotic arms, and CNC machines work quickly and accurately. The increasing number of collaborative robots (cobots) and automated guided vehicles (AGVs) has contributed to the demand for smaller, higher-performance motors as well. Moreover, advancements in motor control technologies such as variable frequency drives (VFDs) are enhancing the efficiency of automation by allowing precise control over the speed and torque. As Japan continues to lead in industrial automation, the demand for reliable and durable low-voltage motors is rising, expanding the Japan low voltage electric motor market share.

Japan Low Voltage Electric Motor Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on efficiency, application, and end-use industry.

Efficiency Insights:

- Standard Efficiency

- High Efficiency

- Premium Efficiency

- Super Premium Efficiency

The report has provided a detailed breakup and analysis of the market based on the efficiency. This includes standard efficiency, high efficiency, premium efficiency, and super premium efficiency.

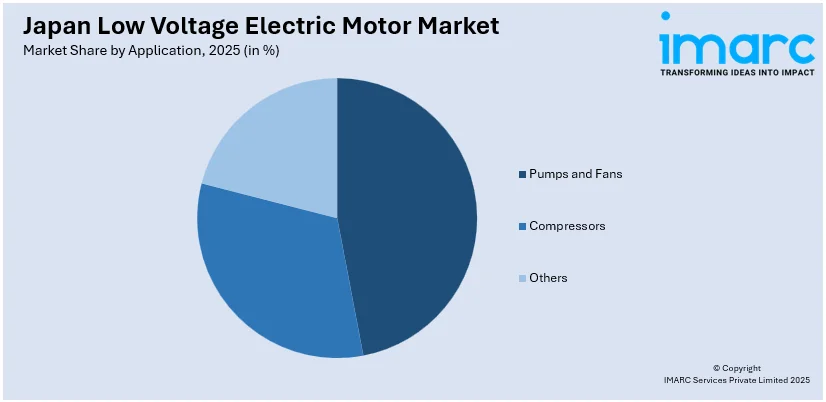

Application Insights:

Access the comprehensive market breakdown Request Sample

- Pumps and Fans

- Compressors

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes pumps and fans, compressors, and others.

End-Use Industry Insights:

- Commercial HVAC Industry

- Food, Beverage and Tobacco Industry

- Mining Industry

- Utilities

- Others

The report has provided a detailed breakup and analysis of the market based on the end-use industry. This includes commercial HVAC industry, food, beverage and tobacco industry, mining industry, utilities, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Low Voltage Electric Motor Market News:

- March 12, 2025: Toshiba started mass production of the TB9103FTG gate driver IC for automotive brushed DC motors used in critical functions such as power windows, seats, and door locks, all of which are core applications for the low voltage electric motor market, at the company's production facility in Japan. This IC also integrates the charge pump and sleep mode into a 4.0×4.0mm VQFN24, which doesn't take up much space, is compatible with H-bridge or half-bridge configurations, and will bring quieter and more efficient operation. An AEC-Q100 Grade 1-certified product, it supports Japan's actions to advance vehicle electrification and reduce the size of systems.

- July 8, 2024: Nuvoton Technology Japan launched the KA44370A, a 48V direct drive motor driver IC tailored for high-speed and low-vibration fan motors used in space-saving 1U servers. This new driver cuts fan power consumption by 30% and vibration by 20 dB. Releases December 2023Housed in a 4×4mm QFN package. The chip answers Japan's growing demand for low-voltage electric motor solutions for compact data centers and industrial machinery.

Japan Low Voltage Electric Motor Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Efficiencies Covered | Standard Efficiency, High Efficiency, Premium Efficiency, Super Premium Efficiency |

| Applications Covered | Pumps and Fans, Compressors, Others |

| End-Use Industries Covered | Commercial HVAC Industry, Food, Beverage and Tobacco Industry, Mining Industry, Utilities, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan low voltage electric motor market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan low voltage electric motor market on the basis of efficiency?

- What is the breakup of the Japan low voltage electric motor market on the basis of application?

- What is the breakup of the Japan low voltage electric motor market on the basis of end-use industry?

- What is the breakup of the Japan low voltage electric motor market on the basis of region?

- What are the various stages in the value chain of the Japan low voltage electric motor market?

- What are the key driving factors and challenges in the Japan low voltage electric motor market?

- What is the structure of the Japan low voltage electric motor market and who are the key players?

- What is the degree of competition in the Japan low voltage electric motor market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan low voltage electric motor market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan low voltage electric motor market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan low voltage electric motor industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)