Japan Luxury Bath Fixtures Market Size, Share, Trends and Forecast by Product Type, Material, Distribution Channel, End User, and Region, 2026-2034

Japan Luxury Bath Fixtures Market Summary:

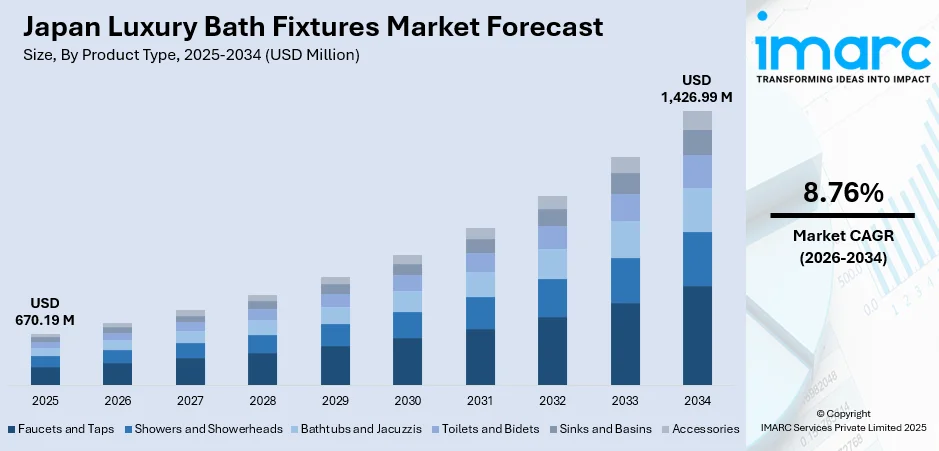

The Japan luxury bath fixtures market size was valued at USD 670.19 Million in 2025. Looking forward, the market is projected to reach USD 1,426.99 Million by 2034, growing at a compound annual growth rate of 8.76% from 2026-2034.

The market is propelled by Japan's cultural emphasis on bathing as a holistic wellness ritual, rising demand for spa-inspired residential bathrooms, and the integration of advanced smart technologies into premium bathroom fixtures. The aging population is accelerating investments in barrier-free and accessible bathroom designs, while the hospitality sector's expansion following record tourist arrivals is creating substantial opportunities for high-end bathroom installations. Additionally, consumer preferences for minimalist aesthetics combined with functional innovation continue to strengthen the market share.

Key Takeaways and Insights:

-

By Product Type: Faucets and taps dominate the market with a share of 28.12% in 2025, driven by strong demand for technologically advanced touchless and water-saving faucet systems that align with Japanese design preferences for sleek, minimalist bathroom aesthetics.

-

By Material: Metal leads the market with a share of 42.08% in 2025, owing to its exceptional durability, corrosion resistance, and versatility in accommodating both traditional and contemporary design styles preferred in Japanese premium bathroom spaces.

-

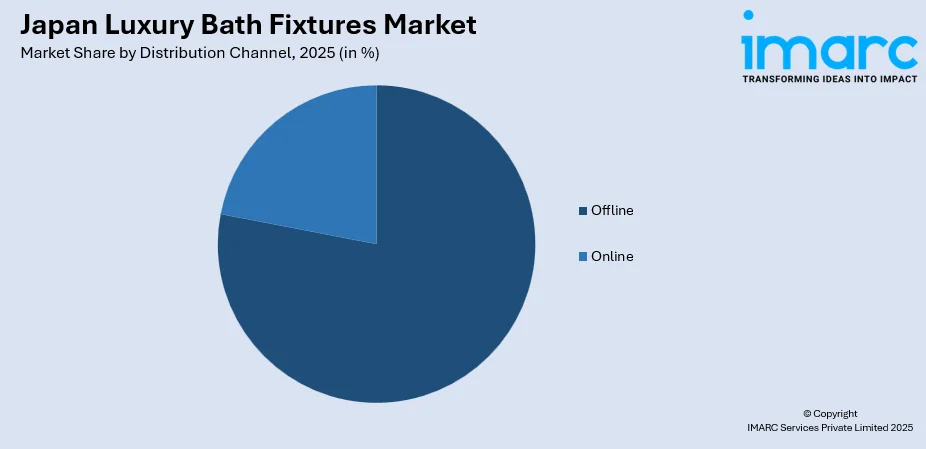

By Distribution Channel: Offline represents the largest segment with a market share of 78.14% in 2025, reflecting Japanese consumer preference for experiential purchasing where tactile assessment of quality and expert consultation from specialized showrooms and home improvement retailers remain essential.

-

By End User: Residential prevails the market with a share of 65.12% in 2025, supported by increasing home renovation activities, rising disposable incomes among urban households, and growing consumer interest in creating personal wellness sanctuaries within homes.

-

Key Players: The Japan luxury bath fixtures market exhibits intense competitive dynamics, with established domestic manufacturers leveraging decades of technological innovation expertise alongside international brands competing through design differentiation and smart technology integration across diverse price segments.

To get more information on this market Request Sample

In Japan, the luxury bath fixtures market benefits from the country's position as a global leader in bathroom technology innovation, where smart toilets with bidet functions were present in more than 80% of Japanese homes in 2024, as per government survey. The convergence of traditional Japanese bathing culture with cutting-edge technology creates unique opportunities for manufacturers to deliver products that enhance both functional performance and emotional well-being in bathroom spaces. The growing interest in spa-like bathrooms, smart bathing technologies, and high-quality materials is encouraging homeowners to invest in sophisticated fixtures, such as digital showers, hydrotherapy bathtubs, and designer faucets. The aging population further boosts demand for ergonomic, safe, and user-friendly luxury products that enhance convenience and relaxation. High-end residential developments, hotel renovations, and premium real estate projects continue to incorporate luxury fixtures as value-enhancing elements.

Japan Luxury Bath Fixtures Market Trends:

Innovations in Products

Product innovations are significantly driving the market expansion in Japan by elevating functionality, design, and user experience in line with evolving lifestyle expectations. In November 2024, LIXIL Corporation, a leader in innovative water and housing solutions, was set to launch ‘bathtope,’ a bathroom space featuring a foldable fabric bathtub. Inspired by classic Japanese kimono and origami, the fabric bath offered a versatile idea that departed from standard bathtubs, resulting in bathrooms brimming with creativity and diversity. This item was available exclusively in Japan. Manufacturers are launching smart fixtures that include attributes, such as automated climate regulation, water-conserving systems, touch-free functions, and improved ergonomics, resulting in more comfortable bathrooms.

Space-Efficient Design for Urban Living

Compact yet luxurious bathroom solutions are gaining prominence, as Japanese manufacturers address the spatial constraints of urban living environments. Fixtures are designed to deliver functionality without bulk, creating visual openness and easy flow through bathroom spaces. The minimalist style central to Japanese design philosophy is enhanced through neutral color palettes, hidden fittings, and natural textures that create subtle yet sophisticated atmospheres. This trend, supported by increasing disposable incomes, appeals particularly to sophisticated urban homeowners who appreciate refinement that adapts to spatial constraints while maintaining the aesthetic standards expected in upscale residential settings. Japan noted a rise of 2.0% in household disposable incomes, as of January 2023.

Zen-Inspired Wellness Bathroom Concepts

Japanese luxury bathrooms are increasingly embodying timeless Zen philosophies that emphasize harmony, simplicity, and mindfulness. Homeowners are adopting peaceful design styles, featuring simple lines, natural finishes like bamboo and stone, and warm ambient lighting, to create spaces that support relaxation and mental wellness. Elements, such as deep-soaking tubs (ofuro), heated floors, and rain showerheads, are being incorporated to recreate spa-like ambiances within residential settings. This approach aligns with Japan's broader cultural emphasis on balance and wellness in daily life, driving investment in premium bath fixtures that support both physical rejuvenation and mental clarity.

Market Outlook 2026-2034:

The market growth will be driven by sustained renovation activities in the residential sector, continued expansion of luxury hospitality infrastructure ahead of major international events, and increasing adoption of smart bathroom technologies across consumer segments. The market generated a revenue of USD 670.19 Million in 2025 and is projected to reach a revenue of USD 1,426.99 Million by 2034, growing at a compound annual growth rate of 8.76% from 2026-2034. The aging population's demand for accessible bathroom solutions, combined with environmental consciousness driving preference for water-efficient fixtures, will create sustained opportunities for manufacturers offering innovative, design-forward products.

Japan Luxury Bath Fixtures Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Faucets and Taps | 28.12% |

| Material | Metal | 42.08% |

| Distribution Channel | Offline | 78.14% |

| End User | Residential | 65.12% |

Product Type Insights:

- Faucets and Taps

- Showers and Showerheads

- Bathtubs and Jacuzzis

- Toilets and Bidets

- Sinks and Basins

- Accessories

Faucets and taps dominate with a market share of 28.12% of the total Japan luxury bath fixtures market in 2025.

The faucets and taps segment maintains its leadership position through continuous technological advancements and design innovations that address evolving consumer preferences. Japanese manufacturers have developed sophisticated water-saving mechanisms, touchless operation systems, and enhanced ergonomic designs that combine traditional aesthetics with modern functionality. The segment benefits from the residential renovation boom where homeowners prioritize upgrading faucet systems as cost-effective ways to enhance bathroom aesthetics and functionality.

The growing hospitality sector, with major real estate companies investing significantly in hotel development to accommodate returning foreign tourists, creates additional demand for premium faucet installations. In 2023, Nittetsu Kowa Real Estate announced plans to invest 40-50 Billion Yen in hotels over five years, exemplifying the infrastructure expansion driving commercial demand for high-quality faucet systems in the Japan luxury bath fixtures market.

Material Insights:

- Metal

- Ceramic

- Glass

- Stone

- Others

Metal leads with a share of 42.08% of the total Japan luxury bath fixtures market in 2025.

The metal segment commands market leadership owing to brass and stainless steel's exceptional properties that make them preferred choices for both residential and commercial applications. Japanese manufacturers have mastered crafting high-quality metal fixtures incorporating traces of other metals to enhance performance while maintaining minimal iron content. The segment's strength is further reinforced by metal's versatility in design, allowing for both traditional and contemporary aesthetics that appeal to diverse consumer preferences.

Metal fixtures particularly resonate with the luxury market segment where durability and premium appearance are paramount considerations. The development of advanced finishing techniques, including brushed nickel, matte black, and rose gold options, has expanded design possibilities, enabling metal fixtures to accommodate evolving interior design trends while maintaining the functional excellence that Japanese consumers expect from premium bathroom products.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Offline

- Online

Offline exhibits a clear dominance with a 78.14% share of the total Japan luxury bath fixtures market in 2025.

The offline distribution channel maintains dominance in the Japan luxury bath fixtures market through specialized showrooms and home improvement retailers that provide essential tactile purchasing experiences. Japanese consumers placing significant emphasis on quality assessment and expert consultation favor physical retail environments where they can evaluate product craftsmanship, finish quality, and functional features before making substantial purchases.

Specialty bathroom showrooms operated by major manufacturers and dedicated home improvement retailers serve as primary touchpoints for consumers seeking premium fixtures. These venues offer comprehensive product assortments, professional installation guidance, and design consultation services that support informed purchasing decisions in the high-involvement luxury bathroom category.

End User Insights:

- Residential

- Commercial

Residential represents the leading segment with a 65.12% share of the total Japan luxury bath fixtures market in 2025.

The residential segment drives market growth through increasing home renovation activities and rising consumer investment in creating personalized wellness spaces. Japanese homeowners increasingly view bathrooms as retreats for relaxation and rejuvenation rather than purely functional spaces, driving demand for premium fixtures that enhance daily bathing rituals. In the first half of 2023, home renovation orders in Japan surpassed 1.5 Trillion Yen, expanding opportunities for bathroom fixture upgrades.

The segment benefits particularly from Japan's aging population, which accelerates demand for barrier-free bathroom designs featuring accessible fixtures and safety-focused installations. Additionally, the trend of second-hand home purchases, where buyers invest in renovations to meet modern standards, creates sustained demand for luxury bathroom fixture replacements and upgrades across the residential market.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto Region holds prominence due to its dense urban population, higher disposable incomes, and strong preference for modern home upgrades. Tokyo and surrounding prefectures drive consistent demand for premium, space-efficient, and technology-integrated bathroom solutions. Renovation activities in apartments and condominiums further accelerate adoption, as consumers seek enhanced comfort and minimalist aesthetics.

The Kansai/Kinki Region represents a strong market segment, driven by a large urban base in Osaka, Kyoto, and Kobe, where consumers prioritize modern comforts and premium designs. Growing renovation of older homes and rising investment in boutique hotels stimulate demand for luxury bath fixtures. The region’s cultural blend of tradition and modern living encourages adoption of high-quality materials and elegant aesthetics.

The Central/Chubu Region contributes significantly due to its mix of industrial cities and affluent residential areas. Rising home improvements among working professionals and families encourage investments in durable, stylish, and technologically advanced bath fixtures. Luxury hotels and business travel infrastructure upgrades also support demand.

The Kyushu–Okinawa Region shows steady growth, fueled by expanding tourism, hotel renovations, and increasing preference for relaxing, resort-style bathroom environments. Consumers here often seek spa-like luxury features inspired by local hospitality trends. Rising disposable incomes in urban centers like Fukuoka drive adoption of premium fixtures, while Okinawa’s resort developments encourage high-quality installations with durability suited for coastal conditions.

The Tohoku Region’s luxury bath fixtures market is shaped by rising residential upgrades, demand for durable installations, and growing interest in energy-efficient and water-saving technologies. Households prefer functional yet premium fixtures that withstand colder climates, promoting adoption of heated, insulated, and smart bathroom systems. Renovation of older homes and ongoing infrastructure modernization support stable demand.

The Chugoku Region experiences growing demand, driven by rising interest in stylish, long-lasting bathroom enhancements among homeowners. Urban areas like Hiroshima encourage adoption of compact, technology-rich fixtures that suit modern apartments. The region values practicality blended with aesthetic appeal, pushing manufacturers to offer mid-to-premium solutions tailored to diverse home layouts.

In the Hokkaido Region, the luxury bath fixtures market is shaped by its cold climate, encouraging demand for insulated, heated, and high-quality bathroom systems. Homeowners and hotels often prioritize comfort-enhancing features such as advanced bathtubs, temperature-control showers, and moisture-resistant materials. The region’s hospitality sector, particularly in hot spring destinations, drives adoption of premium fixtures to elevate guest experiences.

The Shikoku Region shows gradual but steady demand for luxury bath fixtures, driven by rising home improvements and lifestyle upgrades in urban centers. Consumers prefer durable, low-maintenance, and aesthetically pleasing fixtures that fit compact home layouts. Tourism-related developments, boutique hotels, and traditional inns adopting modern amenities also contribute to market growth.

Market Dynamics:

Growth Drivers:

Why is the Japan Luxury Bath Fixtures Market Growing?

Aging Population Driving Accessible Bathroom Demand

Japan’s aging population is significantly driving the market expansion, as seniors increasingly prioritize comfort, safety, and wellness-focused home environments. According to government data, as of September 2024, Japan's senior population reached an all-time high of 36.25 Million, with individuals aged 65 and above making up nearly one-third of the country's total population. With more elderly individuals living independently, demand rises for premium fixtures featuring anti-slip surfaces, ergonomic designs, easy-to-reach controls, and temperature-regulated systems. Luxury bathtubs with therapeutic functions, such as hydrotherapy and deep soaking styles, gain popularity for their health and relaxation benefits. Families upgrading homes to support senior living also invest in high-quality, durable fixtures that enhance accessibility while maintaining aesthetic appeal. Additionally, healthcare facilities, senior residences, and wellness centers incorporate upscale bathroom solutions to provide safer, more comfortable experiences.

Expansion of Hospitality Sector

Japan's hospitality sector expansion, following record tourist arrivals, is creating substantial opportunities for luxury bath fixture installations in hotels, resorts, and boutique accommodations. Major real estate developers are significantly increasing hotel investments to accommodate growing international visitor demand, with plans for substantial capital deployment over multi-year periods. The development of new luxury properties, including projects like Capella Kyoto designed by renowned architect Kengo Kuma scheduled to open in Spring 2026, drives demand for premium bathroom fixtures that meet international luxury standards. Hotels increasingly prioritize bathroom experiences as key differentiators in guest satisfaction, investing in sophisticated fixtures that communicate brand identity and enhance memorable accommodation experiences. This hospitality sector growth provides consistent commercial demand complementing residential market expansion.

Cultural Emphasis on Bathing as Wellness Practice

Japan's deep-rooted bathing culture positions bathrooms as essential spaces for physical and emotional rejuvenation, driving investments in fixtures that enhance wellness experiences. The traditional emphasis on thorough cleansing and relaxation rituals creates consumer expectations for sophisticated bathroom products that support daily wellness practices. Modern interpretations incorporate spa-inspired elements, including deep-soaking tubs, rainfall showers, and therapeutic water features that transform residential bathrooms into personal sanctuaries. This cultural foundation generates sustained demand for premium fixtures across demographic segments, as Japanese consumers consistently prioritize bathroom quality as integral to overall home value and daily living satisfaction. The integration of wellness-focused design with advanced functionality continues to position luxury bath fixtures as essential investments rather than discretionary upgrades.

Market Restraints:

What Challenges the Japan Luxury Bath Fixtures Market is Facing?

High Product Costs Limiting Broader Market Penetration

Premium pricing of luxury bath fixtures presents accessibility challenges for middle-income consumers seeking quality bathroom upgrades. The sophisticated technology integration and premium materials characterizing luxury fixtures command significant price premiums that may constrain market expansion beyond affluent demographic segments. Economic uncertainties affecting household discretionary spending can delay renovation decisions and fixture upgrade timelines.

Labor Shortages Impacting Installation Services

Acute labor shortages in Japan's construction and installation sectors constrain the delivery capacity for bathroom renovation projects requiring specialized fitting expertise. Rising installation costs associated with limited skilled labor availability can increase total project costs, potentially deterring consumers from undertaking comprehensive bathroom upgrades. These workforce constraints affect both project timelines and service quality expectations.

Slow Replacement Cycles in Household Bathrooms

Luxury bath fixtures face sluggish demand due to long product lifespans and infrequent bathroom renovations in Japan. Many homeowners delay upgrades unless major repairs are needed, reducing annual replacement volume. High installation costs and the inconvenience of remodeling further discourage quick turnover. As a result, manufacturers rely heavily on new construction projects and high-end real estate developments to drive sales. This dependency makes the market sensitive to construction trends and slows year-round demand growth for luxury bath products.

Competitive Landscape:

The Japan luxury bath fixtures market features intense competition among established domestic manufacturers and international players pursuing market share through technological innovations, design differentiation, and strategic distribution partnerships. Domestic leaders leverage decades of manufacturing expertise and deep understanding of Japanese consumer preferences to maintain competitive advantages in product development and market positioning. These manufacturers invest substantially in research and development (R&D) activities to introduce advanced features, including smart technology integration, water-saving mechanisms, and innovative design elements that address evolving consumer expectations. International competitors contribute design diversity and global brand recognition while adapting product offerings to meet Japanese quality standards and aesthetic preferences. The market rewards continuous innovations and design excellence, with industry recognition through prestigious awards validating manufacturer commitment to advancing bathroom technology and aesthetics.

Recent Developments:

-

In July 2025, Aston Martin debuted N°001 Minami Aoyama, the first luxury residence crafted by Aston Martin in Tokyo, Japan. The quality of fixtures and fittings was top-notch throughout. On the first floor, the spa featured a sauna and spa bath adorned with natural Hinoki wood paneling and a custom audio system.

Japan Luxury Bath Fixtures Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | USD Million |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Faucets and Taps, Showers and Showerheads, Bathtubs and Jacuzzis, Toilets and Bidets, Sinks and Basins, Accessories |

| Materials Covered | Metal, Ceramic, Glass, Stone, Others |

| Distribution Channels Covered | Offline, Online |

| End Users Covered | Residential, Commercial |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan luxury bath fixtures market size was valued at USD 670.19 Million in 2025.

The Japan luxury bath fixtures market is expected to grow at a compound annual growth rate of 8.76% from 2026-2034 to reach USD 1,426.99 Million by 2034.

Faucets and taps held the largest market share of 28.12%, driven by strong demand for technologically advanced and design-forward faucet systems that align with Japanese consumer preferences for minimalist aesthetics and functional innovation.

Key factors driving the Japan luxury bath fixtures market include aging population demand for accessible bathroom solutions, expansion of luxury hospitality infrastructure, cultural emphasis on bathing as wellness practice, smart technology integration in premium fixtures, and sustained residential renovation activity.

Major challenges include high product costs limiting broader market penetration, labor shortages impacting installation services, regional economic disparities affecting demand distribution, and competition from imported products in certain price segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)