Japan Maritime Freight Market Size, Share, Trends and Forecast by Transport Type, Application, and Region, 2026-2034

Japan Maritime Freight Market Overview:

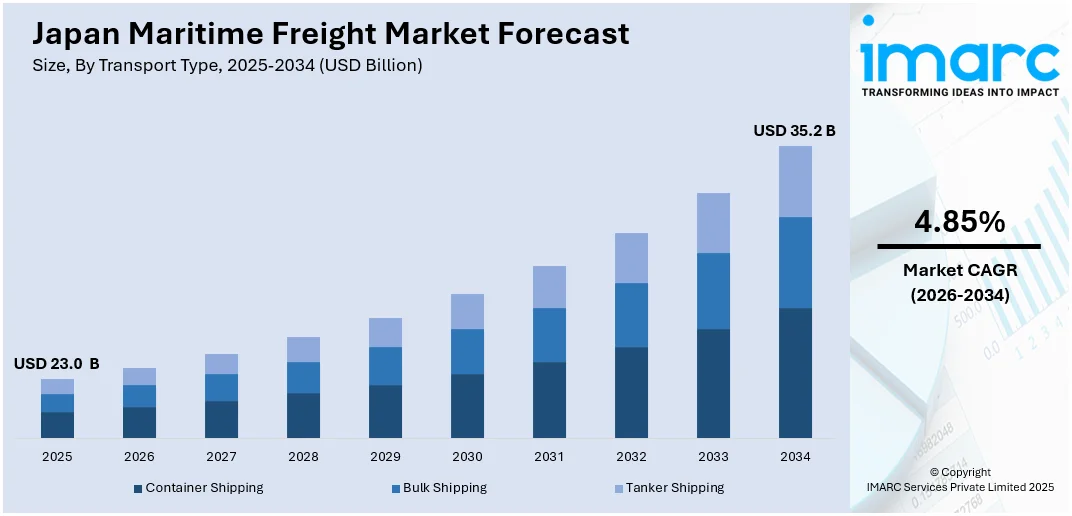

The Japan maritime freight market size reached USD 23.0 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 35.2 Billion by 2034, exhibiting a growth rate (CAGR) of 4.85% during 2026-2034. The demand is spurred by growth in international trade, growing e-commerce, and port infrastructure construction. Japan's strategic location, developing demand for products, and logistics innovation with technology together enhance Japan maritime freight market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 23.0 Billion |

|

Market Forecast in 2034

|

USD 35.2 Billion |

| Market Growth Rate 2026-2034 | 4.85% |

Japan Maritime Freight Market Trends:

Technological Innovations in Shipping and Logistics

Technology innovation, including automation, artificial intelligence, and Internet of Things (IoT) usage, is transforming the Japan maritime freight market. These technologies are being applied to shipping ships and port facilities for improved efficiency, cost reduction, and safety. The utilization of intelligent containers, real-time monitoring, and predictive analysis is revolutionizing the way commodities are tracked and shipped, allowing shipping lines to streamline routes and timetables. Additionally, advances in fuel efficiency are advancing sustainability for the shipping industry. Japan's strategic position as an island country and emphasis on developing port infrastructure have had a major influence on its sea freight market. For instance, in May 2025, NYK Line unveiled Japan’s first fully battery-driven work vessel, “e-Crea,” built by Keihin Dock Co. The vessel is designed for tugboat docking operations at the Koyasu Shipyard and operates without carbon emissions, contributing to maritime decarbonization. It features fully electric propulsion, a compact design, and advanced safety measures, highlighting NYK’s commitment to sustainable shipping. The adoption of these technological innovations is expected to continue driving Japan maritime freight market growth by offering more scalable and cost-effective solutions.

To get more information on this market Request Sample

Expansion of Port Infrastructure and Connectivity

The private sector and government are making massive investments in upgrading and increasing ports like Tokyo, Yokohama, and Osaka, enhancing the ease of trade flows and enhancing cargo handling capabilities. These are essential in making Japan a key location on world shipping routes, especially in the Asia-Pacific region. In addition, Japan's trade negotiations and logistics alliances with other countries are increasing its connectivity that in turn is fueling the demand for maritime freight transport. Steady development of port facilities will account for constant Japan maritime freight market share increase, as well as strengthen its competitive stance in global trade. For instance, in June 2025, India and Japan strengthened their maritime partnership with a focus on shipbuilding, green ports, and smart islands. In a recent meeting held in Oslo, Norway, India’s Minister of Ports, Shipping & Waterways and Japan’s Vice Minister for International Affairs discussed potential Japanese investments in Indian shipyards. The talks highlighted collaborations in areas such as port digitization, green port initiatives, and the development of smart islands in India’s Andaman & Nicobar and Lakshadweep regions. Both nations also committed to expanding their collaboration on sustainable technologies and disaster-resilient infrastructure.

Japan Maritime Freight Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional level for 2026-2034. Our report has categorized the market based on transport type and application.

Transport Type Insights:

- Container Shipping

- Bulk Shipping

- Tanker Shipping

The report has provided a detailed breakup and analysis of the market based on the transport type. This includes container shipping, bulk shipping, and tanker shipping.

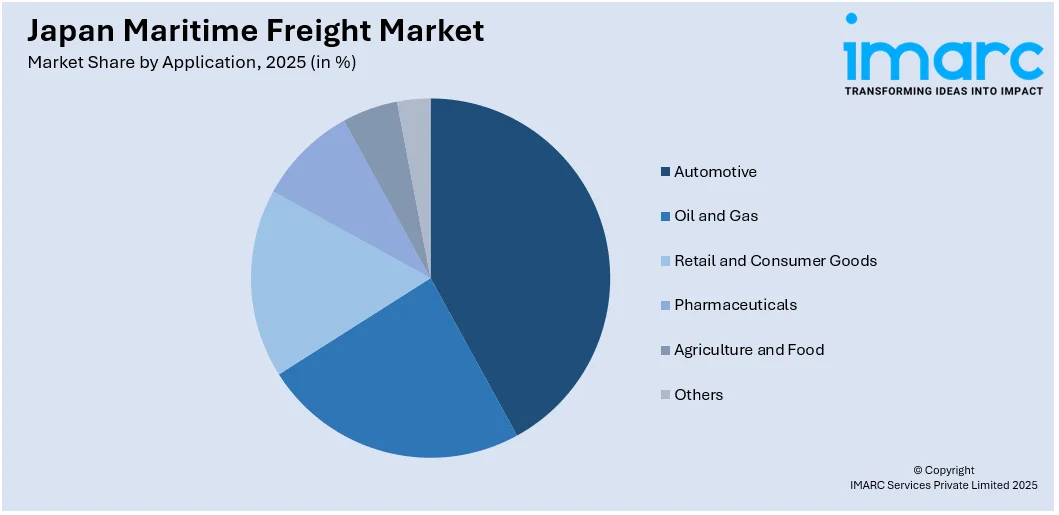

Application Insights:

Access the comprehensive market breakdown Request Sample

- Automotive

- Oil and Gas

- Retail and Consumer Goods

- Pharmaceuticals

- Agriculture and Food

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes automotive, oil and gas, retail and consumer goods, pharmaceuticals, agriculture and food, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Maritime Freight Market News:

- In May 2025, Mitsubishi Heavy Industries tested a new catalyst system on the LNG bunker vessel KEYS Azalea to reduce methane slip from LNG dual-fuel engines. The system, developed in collaboration with Daihatsu Infinearth, has shown a 70% reduction in methane emissions during land-based tests. Methane slip, a potent greenhouse gas, is a significant concern in maritime regulations, and this technology aims to help meet global sustainability standards in LNG-fueled shipping.

- In March 2025, Knutsen NYK Carbon Carriers (KNCC) and NYK Line, in collaboration with ENEOS Xplora, obtained Approval in Principle (AiP) from ClassNK for their liquefied CO2 carrier design and floating liquefied storage unit (FLSU), both of which are intended for transporting CO2 via maritime vessels. This groundbreaking project seeks to enhance carbon capture, utilization, and storage (CCUS) by cutting liquefaction costs and reducing site area needs. The carrier and FLSU, designed for transporting CO2 at ambient temperatures, are set to revolutionize the CCUS value chain.

Japan Maritime Freight Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Transport Types Covered | Container Shipping, Bulk Shipping, Tanker Shipping |

| Applications Covered | Automotive, Oil and Gas, Retail and Consumer Goods, Pharmaceuticals, Agriculture and Food, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan maritime freight market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan maritime freight market on the basis of transport type?

- What is the breakup of the Japan maritime freight market on the basis of application?

- What is the breakup of the Japan maritime freight market on the basis of region?

- What are the various stages in the value chain of the Japan maritime freight market?

- What are the key driving factors and challenges in the Japan maritime freight market?

- What is the structure of the Japan maritime freight market and who are the key players?

- What is the degree of competition in the Japan maritime freight market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan maritime freight market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan maritime freight market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan maritime freight industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)