Japan Medical Device Coatings Market Size, Share, Trends and Forecast by Product, Material, Application, and Region, 2026-2034

Japan Medical Device Coatings Market Size and Share:

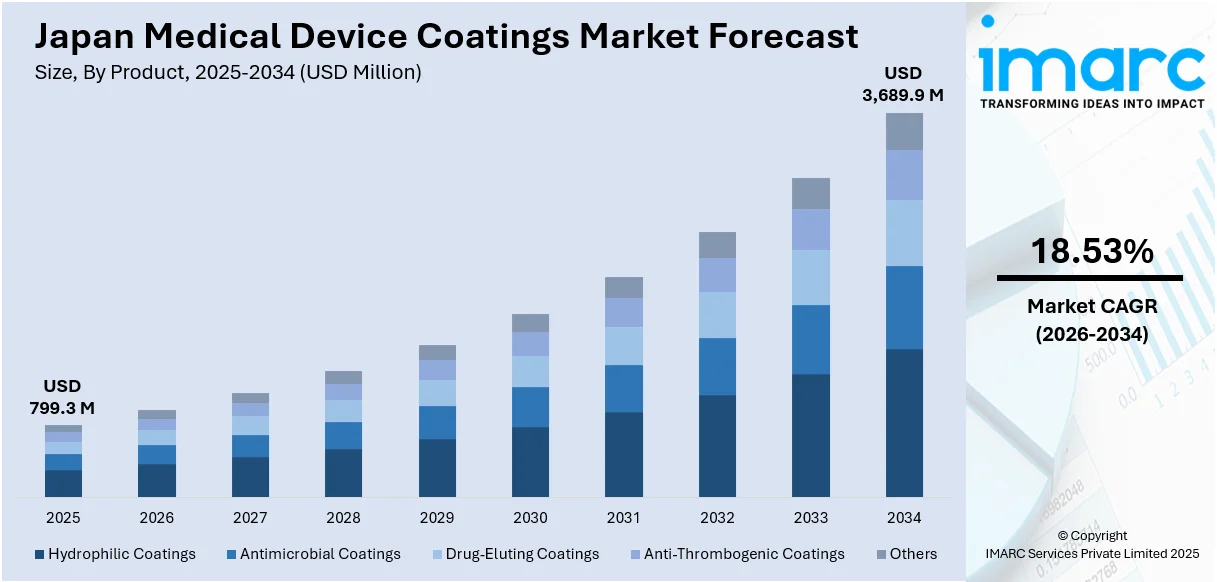

The Japan medical device coatings market size was valued at USD 799.3 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 3,689.9 Million by 2034, exhibiting a CAGR of 18.53% from 2026-2034. The significant elevation in aging population, proliferating need for leading-edge medical devices and coatings, coupled with regulatory adherence demands is impacting the market expansion. Moreover, rising inclination towards minimally invasive procedures and rapid innovations in both materials and drug delivery methods are boosting market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 799.3 Million |

| Market Forecast in 2034 | USD 3,689.9 Million |

| Market Growth Rate (2026-2034) | 18.53% |

The significant increase in healthcare expenditure in Japan, principally bolstered by government ventures and an amplifying focus on cutting-edge medical treatments, is a major driver for the medical device coatings market. An aging population, with an elevated incidents of chronic diseases like diabetes or cardiovascular conditions, is boosting need for upgraded medical devices. Coatings that improve the safety, durability, and efficacy of such devices are rapidly becoming a necessity. For instance, as per industry reports, with an aging rate of 29.3%, Japan leads globally among 200 countries and regions, holding the highest proportion of elderly individuals. Additionally, Japan’s focus on improving healthcare infrastructure is encouraging innovation and investment in cutting-edge coating technologies to meet evolving medical needs.

To get more information on this market Request Sample

Technological advancements in coating formulations, including nanotechnology and smart materials, are accelerating the adoption of medical device coatings in Japan. These innovations enhance performance by improving biocompatibility, wear resistance, and antimicrobial properties. For instance, according to a research article published in July 2024, titanium nanotubular surfaces, leveraged in orthopedic implants, were found to exhibit antimicrobial activity. Growth of Staphylococcus aureus and Pseudomonas aeruginosa is reduced by 50-60% and 80-90%, respectively. Concurrently, stringent regulatory requirements emphasize safety and efficacy, prompting manufacturers to adopt high-quality coatings that comply with these standards. The push for precision and reliability in medical devices further underscores the importance of advanced coatings, fostering strong market growth. Additionally, partnerships between academic organizations and the private sector[cs1] players are also driving innovation and expanding application areas.

Japan Medical Device Coatings Market Trends:

Rising Demand for Antimicrobial Coatings

The Japan medical device coatings market is experiencing elevated utilization of antimicrobial coatings primarily because of magnified awareness regarding healthcare-associated infections (HAIs). For instance, according to a research article published in the journal Infection Control & Hospital Epidemiology in October 2024, a survey found that 6.6% of the patients in the 27 hospitals across Japan were suffering with HAIs, with pneumonia being the most prevalent, affecting 1.83% patients. As a result, such coatings, formulated to impede bacterial growth, are rapidly being leveraged in various medical devices, including implants, catheters, and surgical instruments, to navigate through these infection challenges. Moreover, strict regulatory policies and the increasing focus on patient safety are bolstering advancements in this segment. Furthermore, the constant rise of aging population in Japan has fueled the demand for advanced medical solutions, further accelerating the need for antimicrobial-coated devices to significantly improve patient outcomes and minimize durations of hospital stay.

Integration of Smart Coating Technologies

The Japan medical device coatings market is notably observing the increasing incorporation of smart coating technologies developed to improve device real-time monitoring abilities as well as efficacy. Such advanced coatings can respond to environmental stimuli, establishing them as requisite component for uses in both drug delivery methodologies and diagnostics. For instance, drug-eluting coatings, which release therapeutic agents gradually, are becoming crucial in orthopedic and cardiovascular devices. As per industry reports, drug-eluting stents, typically coated with drug-eluting coatings, are prominent in Japanese market and anticipated to grow at 2% during 2023 to 2030. Furthermore, several research institutions in Japan are rapidly partnering with leading international technology enterprises to formulate coatings integrated with sensors that facilitate constant health monitoring. This advancement not only addresses Japan’s innovations in digital healthcare but also aid its rapidly expanding aging population by offering customized and more accurate medical care. For instance, as per industry reports, number of Japanese individuals aged 65 or older reached 36.25 million in 2024.

Shift Towards Sustainable Coating Solutions

Sustainability is rising as a critical emphasis in Japan’s medical device coatings market, chiefly impacted by corporate responsibility ventures and stringent environmental frameworks. For instance, as per industry reports, 78% of nursing professionals in Japan believe that sustainable healthcare solutions should be actively embraced if they are accessible and less taxing on the environment. Consequently, manufacturers are shifting towards to environmentally friendly methodologies and materials, including solvent-free and water-based coatings, to substantially lower environmental impact. This trend caters to the Japan’s commitment to sustainability and its robust emphasis on developing greener healthcare solutions. Additionally, end-use segment, such as clinics or hospitals, are rapidly preferring devices with sustainable coatings, improving market prospects for suppliers that focus on environmental management while maintaining performance benchmarks.

Japan Medical Device Coatings Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Japan medical device coatings market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on product, material, and application.

Analysis by Product:

- Hydrophilic Coatings

- Antimicrobial Coatings

- Drug-Eluting Coatings

- Anti-Thrombogenic Coatings

- Others

Hydrophilic coatings are prominent in the Japan medical device coatings market due to their widespread application in catheters, guidewires, and minimally invasive surgical devices. These coatings enhance the wettability and lubricity of devices, minimizing friction and tissue damage during insertion or use. The widespread adoption of minimally invasive procedures, along with significant advancements in hydrophilic technology, further drive their market share. Moreover, with increasing demand from both domestic manufacturers and global suppliers operating in Japan, this segment remains a pivotal contributor to the overall market growth, supported by stringent regulatory requirements emphasizing patient safety.

The antimicrobial coatings segment represents a significant share of the Japan medical device coatings market, driven by the rising focus on infection control. These coatings are extensively applied to surgical instruments, implants, and wound care products to inhibit microbial growth and reduce the risk of hospital-acquired infections (HAIs). Technological advancements in antimicrobial formulations and Japan's aging population, which necessitates more frequent medical interventions, further fuel demand. In addition, as healthcare providers prioritize infection prevention, manufacturers continue to innovate, making antimicrobial coatings a critical component of market expansion.

Drug-eluting coatings play a vital role in the Japan medical device coatings market, particularly in cardiovascular and orthopedic applications. These coatings enable the controlled release of therapeutic agents, enhancing the effectiveness of stents, catheters, and other implantable devices. Moreover, growing incidences of chronic diseases, such as cardiovascular disorders, and an aging demographic underscore their importance. Furthermore, stringent regulatory standards and continuous research into biocompatible and efficient drug delivery methods ensure sustained market growth, positioning this segment as a cornerstone of innovative medical technologies in Japan.

Anti-thrombogenic coatings hold a substantial share of the Japan medical device coatings market due to their essential role in preventing blood clot formation on devices such as vascular grafts, hemodialysis catheters, and heart valves. With cardiovascular diseases still being a major health issue, the need for these coatings continues to grow Additionally, Japan's advanced healthcare infrastructure and focus on high-quality medical technologies drive innovations in this segment. Moreover, enhanced biocompatibility and performance of anti-thrombogenic coatings meet the critical needs of healthcare providers, solidifying their prominence in the market.

Analysis by Material:

- Metals

- Silver

- Titanium

- Others

- Ceramics

- Polymers

- Silicone

- Parylene

- Fluoropolymers

Metals, particularly silver and titanium, constitute a significant segment of the Japan medical device coatings market due to their unique properties and versatile applications. Silver coatings are widely used for their exceptional antimicrobial properties, effectively reducing infections in medical devices such as catheters and implants. Whereas, titanium, known for its biocompatibility and corrosion resistance, is preferred in orthopedic and dental implants to enhance durability and patient safety. The growing demand for advanced coatings to improve device performance positions metals as a key material category in this market segment.

Ceramic coatings hold a prominent share in the Japan medical device coatings market, driven by their high wear resistance, bioinertness, and thermal stability. These coatings are essential for applications such as orthopedic implants and dental restorations, where they provide a robust, long-lasting surface. Additionally, ceramic materials are used to create barriers against corrosion and abrasion, enhancing device longevity. Innovations in bioactive ceramics, such as hydroxyapatite coatings, further propel their adoption by promoting osseointegration and improving implant outcomes in medical and dental fields.

Polymers, including silicone, parylene, and fluoropolymers, dominate a substantial share of the Japan medical device coatings market due to their diverse functionalities. Silicone coatings are extensively deployed, pertaining to its exceptional biocompatibility and flexibility, particularly in urological and cardiovascular devices. Parylene, known for its excellent moisture and chemical resistance, is applied in electronic medical devices for protective encapsulation. Whereas, fluoropolymers, with their nonstick properties and high chemical resistance, are extensively utilized in catheters and guidewires to ensure smooth operation and patient comfort. Moreover, their adaptability to various applications reinforces polymers’ significance in this sector.

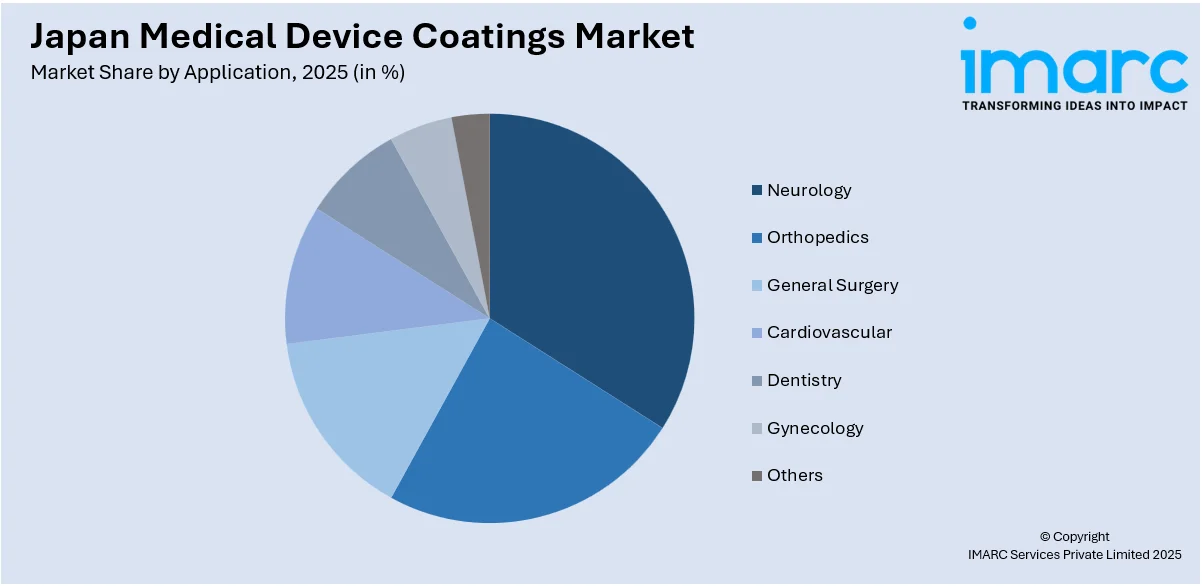

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Neurology

- Orthopedics

- General Surgery

- Cardiovascular

- Dentistry

- Gynecology

- Others

The neurology segment represents a notable share of the Japan medical device coatings market, majorly propelled by the elevating incidents of neurological conditions, typically including epilepsy, stroke, and Parkinson’s disease. Advanced coatings are utilized in devices like neurostimulators, deep brain stimulation electrodes, and catheters to enhance biocompatibility and durability. Moreover, with rising investments in minimally invasive surgical techniques and an aging population, demand for coated neurology devices continues to grow. Innovations in hydrophilic and antimicrobial coatings further bolster this segment's expansion, ensuring enhanced safety and performance in neurological applications.

Orthopedic applications hold a significant position in the Japan medical device coatings market due to the high incidence of bone fractures, arthritis, and age-related degenerative conditions. Coatings are crucial for implants, prosthetics, and surgical instruments, improving wear resistance and osseointegration. Titanium-based and hydroxyapatite coatings are especially favored for joint replacements and spinal implants. In addition to this, the rising popularity and adoption of robotic-assisted surgeries and bioactive coatings underscores the orthopedic segment’s potential, addressing the increasing demand for effective, long-lasting solutions in Japan’s advanced healthcare landscape.

General surgery contributes substantially to the Japan medical device coatings market, supported by rising procedural volumes for abdominal, thoracic, and laparoscopic surgeries. Coatings on surgical instruments and devices, such as retractors, sutures, and staplers, ensure enhanced functionality, corrosion resistance, and patient safety. Moreover, hydrophobic and antimicrobial coatings play a pivotal role in reducing surgical site infections and improving outcomes. Furthermore, technological advancements in minimally invasive techniques and government efforts to improve healthcare access are key drivers of growth in this segment.

Cardiovascular is crucial application in the Japan medical device coatings market, mainly influenced by the notable increase in aging population and amplifying incidents of cardiovascular disorders. Coatings are widely used on stents, catheters, pacemakers, and guidewires to improve biocompatibility, reduce thrombosis risks, and ensure drug delivery efficiency. Drug-eluting and hydrophilic coatings are particularly prominent in interventional cardiology. Ongoing innovations in nanotechnology-based coatings and the growing focus on preventive cardiovascular care further boost the adoption of coated medical devices in this sector.

The dentistry segment plays an integral role in the Japan medical device coatings market, reflecting advancements in dental implants, orthodontics, and prosthetics. Coatings enhance the durability, aesthetics, and antimicrobial properties of dental tools and materials. Moreover, titanium-based coatings are widely used in implants for improved osseointegration, while hydrophobic coatings offer better plaque resistance for orthodontic devices. With increasing awareness about oral health and rising demand for cosmetic dentistry, this segment is poised for sustained growth, supported by technological innovations and an expanding elderly population.

The gynecology segment exhibits robust potential within the Japan medical device coatings market, propelled by advancements in diagnostic and therapeutic devices for women’s health. Coated devices such as hysteroscopes, catheters, and contraceptive implants benefit from antimicrobial and hydrophilic coatings to reduce infection risks and improve patient outcomes. Furthermore, the rising adoption of minimally invasive procedures and increased focus on maternal health care drive the segment's growth. Additionally, with ongoing research into biocompatible materials, gynecological applications are likely to witness continued market expansion in Japan’s healthcare ecosystem.

Regional Analysis:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto Region represents a substantial share of the Japan medical device coatings market due to its robust healthcare infrastructure and high concentration of medical research institutions. Home to Tokyo, Japan's economic and innovation hub, the region attracts numerous domestic and international manufacturers. The demand for advanced medical technologies, driven by the region’s aging population, has propelled the growth of medical device coatings. Additionally, the proximity to cutting-edge universities and research centers fosters innovation, enabling the development of specialized coatings tailored to meet stringent medical standards.

The Kansai Region holds a significant share of the market, leveraging its strong industrial base and well-established medical manufacturing sector. With cities like Osaka, Kyoto, and Kobe serving as key centers for healthcare innovation, the region benefits from its strategic location and collaborative industry-academia partnerships. Demand for coatings that enhance device functionality and biocompatibility is particularly strong here, supported by investments in life sciences. Kansai’s diverse industrial ecosystem further supports the production and export of high-quality coated medical devices.

The Chubu Region is a growing market for medical device coatings, bolstered by its industrial and technological capabilities. With Nagoya as its core economic center, the region is recognized for its advanced manufacturing expertise, particularly in precision engineering. This industrial strength translates into a competitive advantage for medical device production. Furthermore, the region’s commitment to innovation and quality aligns with the rising demand for durable, high-performance coatings that improve device reliability and patient outcomes, positioning it as a key player in the national market.

The Kyushu-Okinawa Region, while traditionally recognized for its agricultural and tourism sectors, is emerging as a contributor to the medical device coatings market. With government initiatives aimed at fostering regional industrial diversification, the healthcare sector has gained momentum. Moreover, the presence of specialized medical device manufacturers and increasing demand for healthcare innovations are driving the need for advanced coatings. Kyushu’s strategic geographic location also supports export opportunities to nearby Asian markets, enhancing its role in the national medical device coatings industry.

The Tohoku Region’s market share in the medical device coatings industry is growing, supported by regional revitalization efforts and investments in technological development. Known for its strong research facilities, particularly in materials science, the region is advancing its capabilities in medical device manufacturing. In addition, post-disaster recovery programs have stimulated industrial growth, with healthcare emerging as a priority sector. This has spurred demand for high-performance coatings that ensure safety and efficiency in medical devices, contributing to the region’s increasing prominence in the industry.

The Chugoku Region is gradually expanding its presence in the medical device coatings market, driven by its manufacturing and logistical advantages. With Hiroshima serving as a key hub, the region benefits from its industrial diversity and growing emphasis on healthcare innovation. Furthermore, the local production of medical devices is supported by collaborations between universities and manufacturers, fostering advancements in coating technologies. This aligns with the region’s strategic goals of enhancing its competitiveness in high-value sectors, including medical devices and coatings.

The Hokkaido Region, while primarily known for its agricultural and natural resources, is making strides in the medical device coatings market through targeted industrial development. With a focus on fostering biotechnology and healthcare-related sectors, the region is witnessing increased collaboration between academic institutions and manufacturers. Moreover, the growing demand for advanced healthcare solutions in rural and aging communities drives the need for medical devices with specialized coatings. Hokkaido’s expanding research capabilities and government-backed incentives further contribute to its role in the national market.

The Shikoku Region, though smaller in economic scale compared to other regions, plays a niche role in Japan's medical device coatings market. Its focus on precision manufacturing and specialty industries supports the production of high-quality medical devices. Regional initiatives aimed at fostering innovation in healthcare technologies have spurred interest in advanced coatings. Additionally, Shikoku’s emphasis on leveraging its local expertise to meet national healthcare demands positions it as a valuable contributor to the industry, with potential for growth in specialized market segments.

Competitive Landscape:

The competitive landscape is shaped by the established presence of both global and domestic players striving to meet the stringent quality and regulatory standards. Key industry participants focus on innovation in biocompatible, antimicrobial, and drug-eluting coatings to cater to the rising demand for advanced medical devices. Apart from this, the market is favored by rapid technological advancements and increasing healthcare expenditures. Additionally, heavy competition facilitates strategic acquisitions, increased investments in research and development initiatives, and product line proliferation. For instance, in November 2023, Kaneka Corporation, a Japan-based hydrophilic-coated catheter producer, announced tactical acquisition of Japan Device Technology Ltd., a well-established medical devices company. Furthermore, regulatory compliance and adaptability to evolving market needs are critical factors shaping the competitive dynamics in this sector.

The report provides a comprehensive analysis of the competitive landscape in the Japan medical device coatings market with detailed profiles of all major companies.

Latest News and Developments:

- In August 2024, Kaneka Corporation, a leading Japan-based catheters manufacturer featuring its own hydrophilic coatings, unveiled its new manufacturing site for medical devices in Hokkaido. This development marks the strategic expansion of company's product portfolio.

- In July 2024, iVascular announced that its Luminor 18 drug-coated balloon, developed for the treatment of femoropopliteal arteries in Japan's demographic, showed successful results in the SOL Japan clinical trial, conducted in partnership with Medico's Hirata, a Japan-based medical equipment manufacturer.

Japan Medical Device Coatings Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Hydrophilic Coatings, Antimicrobial Coatings, Drug-Eluting Coatings, Anti-Thrombogenic Coatings, Others |

| Materials Covered |

|

| Applications Covered | Neurology, Orthopedics, General Surgery, Cardiovascular, Dentistry, Gynecology, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan medical device coatings market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Japan medical device coatings market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan medical device coatings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Medical device coatings are specialized surface treatments or layers applied to medical instruments and implants to enhance functionality, biocompatibility, and durability. These coatings provide benefits such as reduced friction, antimicrobial protection, improved corrosion resistance, and drug delivery capabilities, supporting diverse applications in orthopedics, cardiology, and surgical instruments.

The Japan medical device coatings market was valued at USD 799.3 Million in 2025.

IMARC estimates the Japan medical device coatings market to exhibit a CAGR of 18.53% during 2026-2034.

The market is driven by advancements in healthcare technology, increasing demand for minimally invasive procedures, and the growing prevalence of chronic diseases. Rising healthcare expenditure, regulatory emphasis on biocompatibility, and expanding applications of antimicrobial and drug-eluting coatings further propel market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)