Japan Medical Robots Market Size, Share, Trends and Forecast by Product, Application, End User, and Region, 2026-2034

Japan Medical Robots Market Overview:

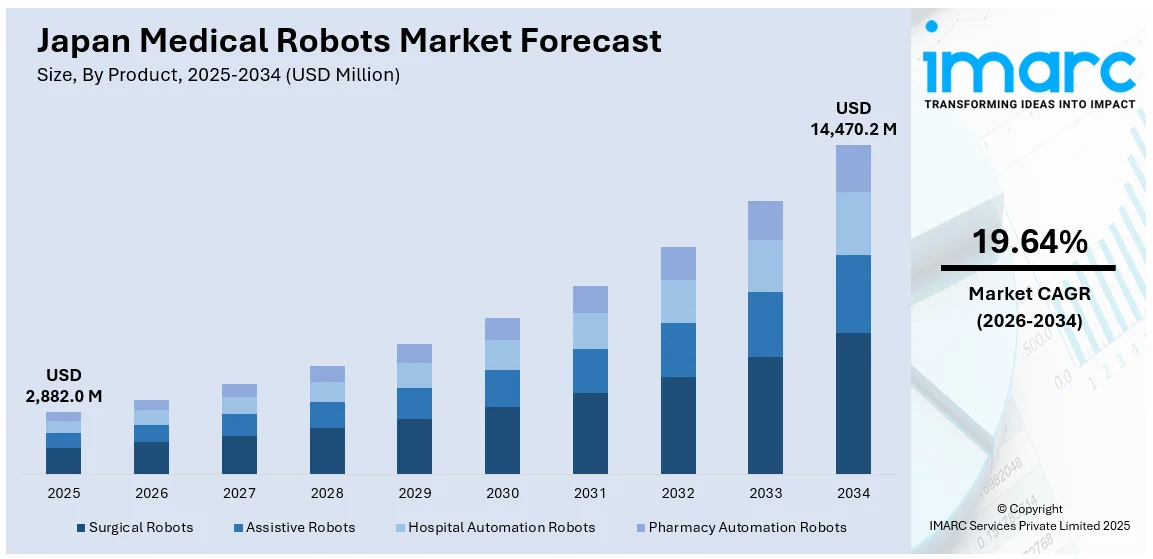

The Japan medical robots market size reached USD 2,882.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 14,470.2 Million by 2034, exhibiting a growth rate (CAGR) of 19.64% during 2026-2034. Key drivers in the market include the growing need to support an aging population and address healthcare workforce shortages. Advances in robotics and AI are enabling more precise, less invasive procedures, improving patient outcomes and surgical efficiency. There’s also a rising preference for minimally invasive (MI) treatments, prompting wider robotic adoption in hospitals. Government support, favorable regulations, and strong investment in healthcare technology further impelling the Japan medical robots market share, positioning medical robots as vital tools in modern Japanese healthcare.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2,882.0 Million |

| Market Forecast in 2034 | USD 14,470.2 Million |

| Market Growth Rate 2026-2034 | 19.64% |

Japan Medical Robots Market Trends:

Adoption of Medical Robots and Innovation Initiatives

As of 2023, Japan employed about 2.15 million people in its care sector, yet it faces a projected shortfall of 570,000 caregivers by 2040 due to its aging population. This growing workforce gap drives the adoption of medical robots and innovation initiatives to support elderly care. Medical robots assist with lifting patients, guiding rehabilitation, monitoring vital signs, and handling repetitive tasks, reducing physical strain on caregivers and ensuring consistent care. These technologies operate safely alongside humans in hospitals, clinics, and care homes, boosting efficiency and safety. Strong government policies and private sector investment promote the development and integration of advanced robotics. This automation helps sustain high-quality care despite a shrinking labor pool, making robotics and innovation essential solutions for Japan’s workforce challenges and the effective delivery of elderly care services.

To get more information on this market Request Sample

Technological Advancements in Surgical Robotics

The rapid advancement of technology is reshaping how surgeries are performed in Japan. Robotics has emerged as a key component in modern operating rooms, offering enhanced precision, control, and consistency that exceed traditional methods. These robotic systems are capable of performing complex procedures with minimal disruption to surrounding tissues, leading to better surgical outcomes. Surgeons benefit from features such as high-definition three-dimensional (3D) visualization, motion scaling, and tremor reduction, which allow for greater accuracy during operations. Hospitals are increasingly integrating these systems into their surgical departments to improve patient care and streamline workflows. Japan medical robots market trends reflect this transformation with continued investment in research and development (R&D) is driving the evolution of these machines, making them more intuitive, compact, and adaptable to various medical specialties. As trust and familiarity with robotic systems grow, their role in Japan's healthcare system is becoming more prominent and indispensable.

Preference for Minimally Invasive Procedures

In Japan, both patients and healthcare providers are showing a strong preference for minimally invasive procedures, which typically involve less pain, quicker recovery, and shorter hospital stays. Medical robots have become a vital enabler of this shift, offering the precision and control needed to perform delicate surgeries through tiny incisions. These robotic systems provide surgeons with a detailed internal view of the patient’s body and fine motor control that allows for highly accurate movements. As a result, procedures once considered too complex for minimally invasive approaches are now possible. This trend reflects a broader cultural and medical preference for low-impact treatments that support a faster return to daily life. Healthcare facilities are increasingly adopting robotic technology to meet this demand, while medical training programs are evolving to include robotic techniques, ensuring that the next generation of surgeons can fully leverage these advanced tools, significantly contributing to Japan medical robots market growth.

Japan Medical Robots Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product, application, and end user.

Product Insights:

- Surgical Robots

- Assistive Robots

- Hospital Automation Robots

- Pharmacy Automation Robots

The report has provided a detailed breakup and analysis of the market based on the product. This includes surgical robots, assistive robots, hospital automation robots, and pharmacy automation robots.

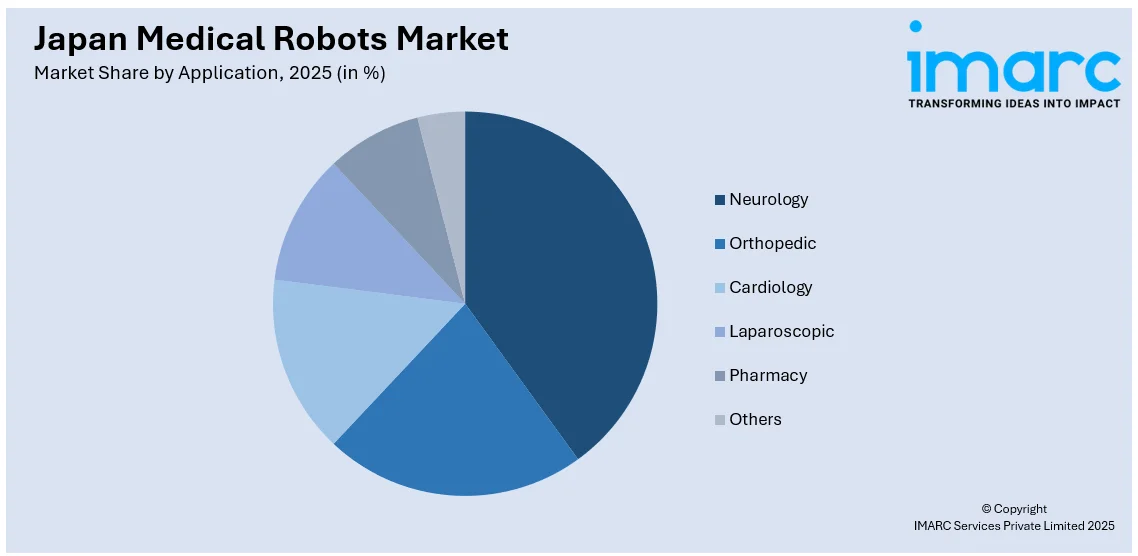

Application Insights:

Access the comprehensive market breakdown Request Sample

- Neurology

- Orthopedic

- Cardiology

- Laparoscopic

- Pharmacy

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes neurology, orthopedic, cardiology, laparoscopic, pharmacy, and others.

End User Insights:

- Hospitals

- Ambulatory Surgery Centers

- Rehabilitation Centers

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals, ambulatory surgery centers, rehabilitation centers, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Medical Robots Market News:

- In April 2025, Ainos and Japan’s top service robotics firm ugo completed the world’s first integration of an AI-powered olfaction system AI Nose into a humanoid robot. This breakthrough enables robots to detect and interpret smells using volatile organic compound (VOC) data, enhancing real-world environmental awareness. The milestone marks a significant leap in sensory robotics, with pilot deployments of the smell-enabled robot set to begin soon across commercial and service applications in Japan.

- In November 2024, Sysmex Corporation announced the successful first overseas clinical use of the Japan-made hinotori™ Surgical Robot System at Singapore General Hospital. This marks the start of its expansion into the Asia-Pacific region. Developed by Medicaroid and approved in Japan in 2020, hinotori™ supports minimally invasive surgeries. With regulatory approvals in Singapore and Malaysia, Sysmex aims to improve surgical precision and patient outcomes globally through advanced robotic technology.

Japan Medical Robots Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Surgical Robots, Assistive Robots, Hospital Automation Robots, Pharmacy Automation Robots |

| Applications Covered | Neurology, Orthopedic, Cardiology, Laparoscopic, Pharmacy, Others |

| End Users Covered | Hospitals, Ambulatory Surgery Centers, Rehabilitation Centers, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan medical robots market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan medical robots market on the basis of product?

- What is the breakup of the Japan medical robots market on the basis of application?

- What is the breakup of the Japan medical robots market on the basis of end user?

- What is the breakup of the Japan medical robots market on the basis of region?

- What are the various stages in the value chain of the Japan medical robots market?

- What are the key driving factors and challenges in the Japan medical robots market?

- What is the structure of the Japan medical robots market and who are the key players?

- What is the degree of competition in the Japan medical robots market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan medical robots market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan medical robots market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan medical robots industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)