Japan Metal Fabrication Market Size, Share, Trends and Forecast by Material Type, Service Type, End-Use Industry, and Region, 2026-2034

Japan Metal Fabrication Market Summary:

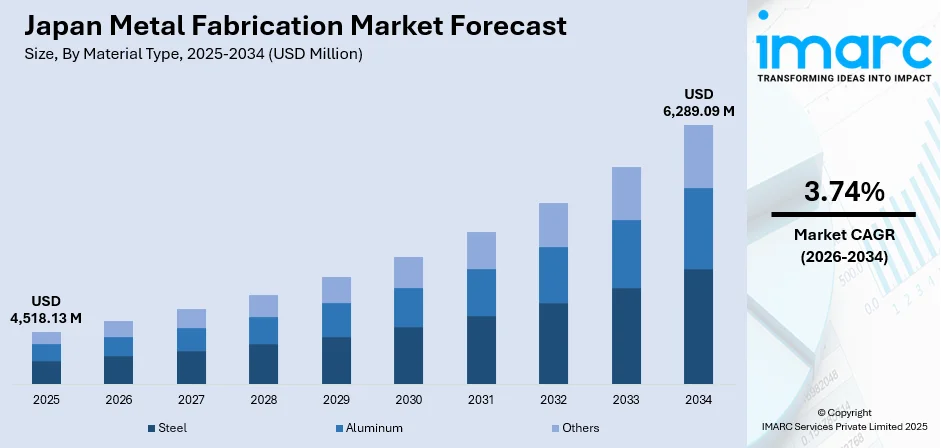

The Japan metal fabrication market size was valued at USD 4,518.13 Million in 2025 and is projected to reach USD 6,289.09 Million by 2034, growing at a compound annual growth rate of 3.74% from 2026-2034.

The Japan metal fabrication market continues to demonstrate robust growth driven by the nation's advanced manufacturing ecosystem and persistent infrastructure development initiatives. The market benefits from Japan's technological leadership in precision engineering and its established industrial base spanning automotive, electronics, and construction sectors. Growing investments in transportation infrastructure, urban redevelopment projects, and the expansion of renewable energy installations are creating sustained demand for high-quality fabricated metal components across the country.

Key Takeaways and Insights:

-

By Material Type: Steel dominates the market with a share of 63% in 2025, driven by its superior structural strength, cost-effectiveness, and widespread application across automotive manufacturing, construction, and heavy machinery production sectors.

-

By Service Type: Machining leads the market with a share of 29% in 2025, attributed to the growing demand for precision-engineered components in electronics, semiconductor equipment, and automotive parts manufacturing.

-

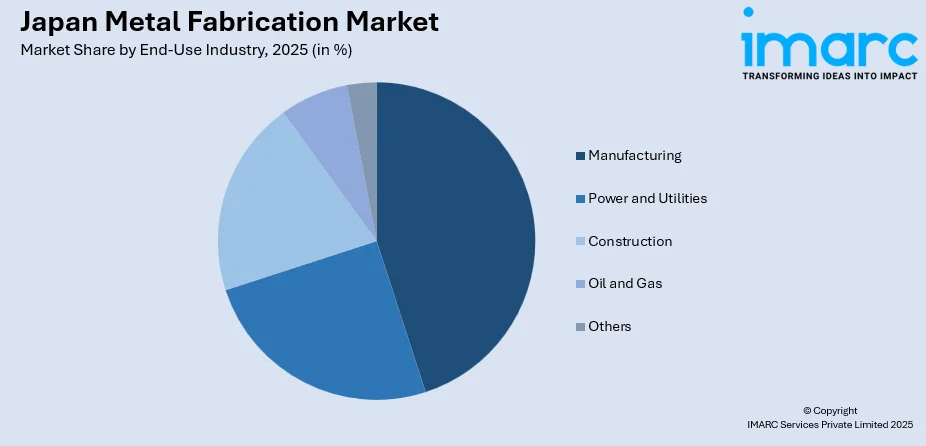

By End-Use Industry: Manufacturing represents the largest segment with a market share of 45% in 2025, supported by Japan's position as a global manufacturing powerhouse with extensive automotive, electronics, and industrial equipment production facilities.

-

By Region: Kanto Region exhibits clear dominance with a 34% share of the market in 2025, owing to the concentration of major industrial facilities, corporate headquarters, and ongoing large-scale urban redevelopment projects in the greater Tokyo metropolitan area.

-

Key Players: The Japan metal fabrication market exhibits a moderately fragmented competitive structure characterized by a mix of established domestic manufacturers and specialized fabrication service providers. Market participants are increasingly investing in automation technologies, precision machining capabilities, and sustainable manufacturing practices to maintain competitive positioning.

To get more information on this market Request Sample

Japan's metal fabrication industry operates within one of the world's most sophisticated manufacturing environments, characterized by stringent quality standards and advanced technological integration. The market is benefiting from significant infrastructure investments, including the Tokyo Outer Ring Road expansion project aimed at completing an 85-kilometer expressway loop around Tokyo to enhance regional connectivity and support economic activities. The nation's commitment to Industry 4.0 adoption is transforming fabrication processes, with manufacturing companies increasingly deploying robotics, artificial intelligence, and IoT technologies to address labor shortages and improve operational efficiency. In 2024, automotive manufacturers in Japan deployed roughly 13,000 industrial robots, marking an 11% rise from the prior year and representing the highest installation volume seen since 2020, reflecting the industry's progressive automation trajectory. The convergence of traditional precision engineering expertise with digital manufacturing technologies positions Japan's metal fabrication sector for sustained growth throughout the forecast period.

Japan Metal Fabrication Market Trends:

Accelerating Adoption of Smart Manufacturing and Industry 4.0 Technologies

Japanese metal fabrication companies are increasingly integrating advanced digital technologies to enhance production efficiency and maintain global competitiveness. The use of IoT-enabled machines, artificial intelligence-based quality control, and real-time production tracking is becoming routine among top fabricators. The Japan International Machine Tool Fair 2024 showcased unprecedented adoption of autonomous robots for peripheral manufacturing tasks, including automated chip removal and tool changing operations. This digital transformation enables fabricators to optimize resource utilization, reduce material waste, and achieve consistent quality standards across high-volume production runs.

Growing Focus on Sustainable and Energy-Efficient Fabrication Processes

Environmental sustainability is emerging as a critical consideration in Japan's metal fabrication sector, with manufacturers prioritizing energy-efficient equipment and eco-friendly processing methods. Leading equipment manufacturers are developing advanced machinery designed for high-speed, stable cutting operations while minimizing energy consumption. The industry is witnessing increased adoption of recycled metal materials and implementation of closed-loop manufacturing systems to reduce environmental footprint. Government initiatives promoting carbon neutrality are accelerating investments in green fabrication technologies and sustainable supply chain practices across the sector. For instance, in June 2025, Atmix, a subsidiary of Seiko Epson Corporation, completed a new metal recycling facility at its Kita-Inter Plant No. 2 site. The project, which began in October 2023 and involved an investment of about 5.5 billion yen in construction and equipment, will process discarded metals from Epson operations and nearby communities to create raw materials for Atmix’s metal powder products. By substituting recycled metals for conventional virgin inputs, the plant supports resource conservation and lower CO₂ emissions.

Rising Demand for Precision Components in Electronics and Semiconductor Manufacturing

Japan's thriving electronics and semiconductor industries are driving significant demand for ultra-precision metal fabrication services. The Japan semiconductor manufacturing equipment market size reached USD 7.0 Billion in 2025. Looking forward, the market is expected to reach USD 15.2 Billion by 2034, exhibiting a growth rate (CAGR) of 8.93% during 2026-2034. The miniaturization of electronic components requires increasingly sophisticated fabrication capabilities, including micro-machining and advanced surface treatment technologies. Metal fabricators are investing in high-precision equipment capable of achieving tolerances measured in micrometers to serve semiconductor equipment manufacturers and consumer electronics producers. The continued expansion of data center construction and telecommunications infrastructure further amplifies demand for specialized metal components with exacting specifications.

Market Outlook 2026-2034:

The Japan metal fabrication market is positioned for steady expansion throughout the forecast period, underpinned by robust manufacturing activity and sustained infrastructure investments. Major urban redevelopment projects, including Tokyo's comprehensive transformation initiatives and preparations for hosting international events, are creating substantial demand for structural metal components. The automotive sector's evolution toward electric and hybrid vehicles presents new opportunities for specialized fabrication services, while the aerospace and defense industries continue to require high-specification metal products. The market generated a revenue of USD 4,518.13 Million in 2025 and is projected to reach a revenue of USD 6,289.09 Million by 2034, growing at a compound annual growth rate of 3.74% from 2026-2034.

Japan Metal Fabrication Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Material Type |

Steel |

63% |

|

Service Type |

Machining |

29% |

|

End-Use Industry |

Manufacturing |

45% |

|

Region |

Kanto Region |

34% |

Material Type Insights:

- Steel

- Aluminum

- Others

The steel segment dominates with a market share of 63% of the total Japan metal fabrication market in 2025.

Steel maintains its commanding position in Japan's metal fabrication landscape due to its exceptional versatility, structural integrity, and cost-effectiveness across diverse industrial applications. The material's widespread utilization spans automotive body panels and chassis components, construction structural elements, heavy machinery manufacturing, and shipbuilding applications. Japanese steel fabricators have developed specialized capabilities in processing high-tensile strength steel variants that meet the demanding specifications of automotive manufacturers transitioning toward lighter vehicle designs without compromising safety standards.

The segment benefits from Japan's sophisticated steel production infrastructure and established supply chains connecting primary steel producers with downstream fabrication facilities. The Japan steel market size reached USD 84.3 Billion in 2024. Looking forward, the market is expected to reach USD 101.4 Billion by 2033, exhibiting a growth rate (CAGR) of 2.13% during 2025-2033. Advancements in steel processing technologies, including laser cutting and advanced welding techniques, enable fabricators to achieve complex geometries and tight tolerances required by precision-oriented industries. The construction sector's sustained activity, particularly in seismic-resistant building projects, continues to drive demand for specialized steel fabrication services capable of producing reinforced structural components meeting Japan's stringent building codes.

Service Type Insights:

- Casting

- Forging

- Machining

- Welding and Tubing

- Others

The machining segment leads with a share of 29% of the total Japan metal fabrication market in 2025.

Machining services command the largest share among fabrication service types, reflecting Japan's strong orientation toward precision manufacturing and high-value-added component production. The segment encompasses CNC milling, turning, grinding, and electrical discharge machining operations serving demanding applications in semiconductor equipment, medical devices, and aerospace components. Japanese machining facilities are renowned globally for their ability to achieve exceptional dimensional accuracy and surface finish quality, attributes that command premium positioning in international supply chains.

Investment in advanced multi-axis machining centers and automated production cells continues to expand the segment's capabilities while addressing persistent labor constraints. The proliferation of electric vehicle production is creating new machining requirements for battery housings, motor components, and specialized drivetrain parts with unique geometric specifications. Integration of AI-powered process monitoring and predictive maintenance systems is enhancing machining productivity and reducing unplanned downtime across leading fabrication facilities.

End-Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Manufacturing

- Power and Utilities

- Construction

- Oil and Gas

- Others

The manufacturing segment exhibits clear dominance with a 45% share of the total Japan metal fabrication market in 2025.

Japan's manufacturing sector represents the primary consumption base for metal fabrication services, encompassing automotive production, electronics assembly, industrial machinery manufacturing, and consumer goods production. The segment's dominance reflects Japan's position as a global manufacturing leader with extensive production facilities operated by multinational corporations and their extensive supplier networks. Automotive manufacturers alone account for substantial fabrication demand through their requirements for body stampings, chassis components, engine parts, and transmission elements.

The manufacturing segment is experiencing transformation as companies adapt production systems for electric and hybrid vehicle platforms while maintaining traditional combustion engine vehicle lines. Electronics manufacturing continues to generate consistent demand for precision sheet metal enclosures, heat management components, and structural frames for computing equipment and telecommunications hardware. The segment benefits from ongoing capital investments as manufacturers upgrade facilities with automated fabrication systems to maintain competitiveness amid rising labor costs and persistent workforce constraints.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto Region exhibits clear dominance with a 34% share of the total Japan metal fabrication market in 2025.

The Kanto Region's market leadership stems from its concentration of manufacturing facilities, corporate headquarters, and ongoing large-scale construction activities in the greater Tokyo metropolitan area. The region hosts numerous automotive component suppliers, electronics manufacturers, and construction material fabricators serving both domestic consumption and export markets. Tokyo's ambitious urban redevelopment programs, characterized as "once-in-a-century" transformation initiatives, are generating sustained demand for structural steel fabrication and specialized metal components for commercial and residential construction projects.

Infrastructure expansion projects, including transportation network improvements and data center construction, continue to drive fabrication demand within the Kanto Region. The presence of major ports and logistics hubs facilitates efficient distribution of fabricated products to domestic and international markets. Additionally, the region's concentration of research institutions and technology companies supports innovation in fabrication processes and creates demand for prototype and small-batch precision metal components serving emerging technology applications.

Market Dynamics:

Growth Drivers:

Why is the Japan Metal Fabrication Market Growing?

Sustained Infrastructure Development and Urban Redevelopment Initiatives

Japan's commitment to infrastructure modernization and urban development represents a fundamental driver of metal fabrication demand across the country. The government continues to allocate substantial funding toward transportation improvements, disaster resilience infrastructure, and urban renewal projects aimed at enhancing livability and economic competitiveness. Major initiatives include the completion of expressway networks, the expansion of high-speed rail connections, and the comprehensive redevelopment of commercial districts in Tokyo, Osaka, and other major urban centers. The construction of new data centers, logistics facilities, and renewable energy installations further expands demand for fabricated metal structural components, equipment housings, and specialized infrastructure elements. These long-term capital projects provide fabricators with predictable demand visibility and opportunities for sustained business development.

Technological Evolution in Automotive and Transportation Industries

The automotive industry's transition toward electrification and advanced mobility solutions is generating new requirements for specialized metal fabrication capabilities. Electric vehicle production demands unique components including battery enclosures, electric motor housings, and thermal management system elements that differ substantially from traditional internal combustion engine vehicle parts. In 2024, electric vehicles (EVs) represented just 1.35% of all new vehicle sales in Japan. A total of 59,736 EVs were sold, reflecting a 32.5% decrease compared to 2023, according to the Japan Automobile Dealers Association and the Japan Light Motor Vehicle & Motorcycle Association. Hybrid and plug-in hybrid vehicles require integration of both powertrain technologies, expanding the variety of fabricated components needed for each vehicle platform. Japanese automakers are investing heavily in production facilities capable of manufacturing both conventional and electrified vehicles, creating opportunities for fabricators to develop new capabilities and expand service offerings. The aerospace sector similarly requires advanced fabrication services for lightweight structural components and precision-machined parts meeting stringent quality certifications.

Expansion of Electronics and Semiconductor Manufacturing Capacity

Japan's electronics and semiconductor industries continue to drive substantial demand for precision metal fabrication services capable of producing ultra-accurate components with exacting specifications. The global semiconductor supply chain reorganization is prompting increased domestic manufacturing investment, creating demand for cleanroom-compatible fabricated parts, equipment frames, and specialized processing fixtures. Consumer electronics production requires consistent supplies of sheet metal enclosures, heat sinks, connectors, and structural components meeting aesthetic and functional requirements. The proliferation of telecommunications infrastructure supporting fifth-generation wireless networks generates demand for antenna components, equipment cabinets, and tower structural elements. Fabricators serving electronics customers must maintain stringent quality management systems and invest in precision equipment capable of achieving tolerances measured in micrometers.

Market Restraints:

What Challenges the Japan Metal Fabrication Market is Facing?

Persistent Labor Shortages and Aging Workforce Demographics

Japan's metal fabrication industry faces significant workforce challenges stemming from the country's aging population and declining birth rates. Skilled welders, machinists, and fabrication technicians are increasingly difficult to recruit as younger generations show limited interest in manufacturing careers. The average age of workers in fabrication facilities continues to rise, creating concerns about knowledge transfer and succession planning. Companies must balance investments in automation with the need to maintain skilled human operators capable of handling complex fabrication tasks and quality assurance responsibilities.

Rising Raw Material Costs and Supply Chain Volatility

Metal fabricators face ongoing margin pressure from fluctuating raw material prices and supply chain disruptions affecting steel, aluminum, and specialty metal availability. Global commodity market volatility, geopolitical tensions, and logistics constraints create uncertainty in procurement planning and pricing strategies. Energy costs represent another significant input expense, with electricity and natural gas prices affecting operational economics across fabrication processes including heat treatment, welding, and surface finishing operations.

Intense Competition and Pricing Pressure from Regional Markets

Japanese metal fabricators face competitive pressure from manufacturers in other Asian countries offering lower production costs for standardized components. Customers seeking to optimize procurement expenses increasingly evaluate offshore sourcing options for less complex fabrication requirements. Domestic fabricators must differentiate through quality, reliability, technical capabilities, and customer service to justify premium pricing relative to regional alternatives. The need to maintain price competitiveness while investing in advanced equipment and workforce development creates challenging business dynamics.

Competitive Landscape:

The Japan metal fabrication market exhibits a moderately fragmented competitive structure comprising large integrated manufacturing companies, specialized fabrication service providers, and regional job shops serving local customer bases. Market participants differentiate through technical capabilities, quality certifications, customer relationship depth, and geographic coverage. Leading fabricators are investing strategically in automation technologies, digital manufacturing systems, and sustainable production processes to enhance competitive positioning. The industry is witnessing consolidation activity as companies seek scale economies and expanded service portfolios. Strategic partnerships between fabricators and end-use industry customers are becoming more prevalent, enabling deeper collaboration on product development and supply chain optimization. Competitive success increasingly depends on the ability to combine traditional fabrication expertise with advanced digital capabilities and flexible production systems.

Recent Developments:

-

In June 2025, Amada Machinery unveiled its latest band-saw model, the PCSAW-430AXII, designed for high-speed, stable cutting while reducing energy consumption. This launch reflects Japan's commitment to advanced metalworking solutions amid growing demand for efficient, eco-friendly processing tools.

-

In February 2025, Nikon launched its 922 square-meter Nikon Additive Manufacturing Technology Center in Japan designed to advance research and development of metal additive manufacturing technologies and offer design services to clients across Asia.

Japan Metal Fabrication Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered | Steel, Aluminum, Others |

| Service Types Covered | Casting, Forging, Machining, Welding and Tubing, Others |

| End-Use Industries Covered | Manufacturing, Power and Utilities, Construction, Oil and Gas, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan metal fabrication market size was valued at USD 4,518.13 Million in 2025.

The Japan metal fabrication market is expected to grow at a compound annual growth rate of 3.74% from 2026-2034 to reach USD 6,289.09 Million by 2034.

Steel dominated the market with a 63% share in 2025, driven by its superior structural properties, widespread industrial applications across automotive, construction, and manufacturing sectors, and established domestic supply infrastructure.

Key factors driving the Japan metal fabrication market include sustained infrastructure development and urban redevelopment projects, technological evolution in automotive and transportation industries toward electrification, expansion of electronics and semiconductor manufacturing capacity, and growing adoption of automation technologies.

Major challenges include persistent labor shortages and aging workforce demographics limiting production capacity, rising raw material costs and supply chain volatility affecting operational margins, and intense competition from regional markets offering lower-cost fabrication alternatives for standardized components.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)