Japan Milk Alternatives Market Size, Share, Trends and Forecast by Source, Flavor, Packaging, Distribution Channel, and Region, 2026-2034

Japan Milk Alternatives Market Overview:

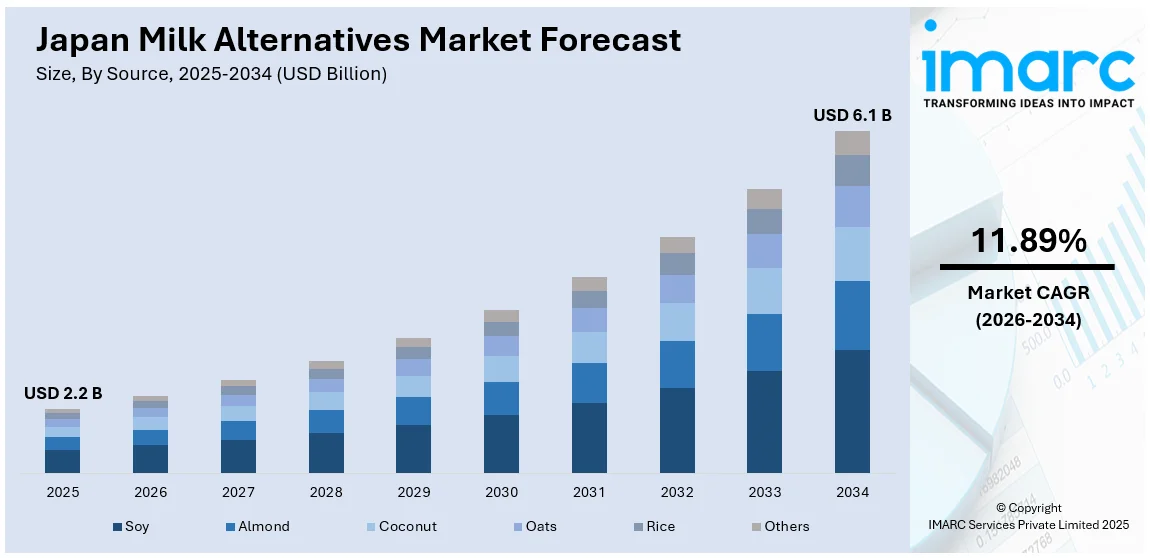

The Japan milk alternatives market size reached USD 2.2 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 6.1 Billion by 2034, exhibiting a growth rate (CAGR) of 11.89% during 2026-2034. The market is driven by rising health awareness and dietary diversification, increased sensitivity to environmental impact, and localized product innovations tailored to Japanese tastes. Continued alignment with consumer expectations and retail expansion strategies are reinforcing acceptance and accelerating purchase frequency, which is expected to further augment the Japan milk alternatives market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2.2 Billion |

| Market Forecast in 2034 | USD 6.1 Billion |

| Market Growth Rate 2026-2034 | 11.89% |

Japan Milk Alternatives Market Trends:

Changing Dietary Patterns and Health Awareness in Japan

Consumer attitudes toward food and nutrition in Japan are shifting. Traditional dietary habits, rich in fish, rice, and vegetables, are being complemented by an increased openness to non-native ingredients, particularly those seen as functional or health-supportive. Milk alternatives have found traction not only with individuals who are lactose intolerant, but also among those aiming to reduce cholesterol intake, manage weight, or avoid animal-based products. This trend is particularly noticeable among the younger demographic and working professionals who are influenced by both global health trends and local wellness movements. Convenience store chains and supermarkets in major cities now carry a variety of non-dairy milk products, reflecting growing shelf turnover and positive sales signals. Soy milk, already familiar in Japanese cuisine, serves as a natural entry point. However, newer entrants such as almond, oat, and yeast-based milk are gaining ground, especially with branding focused on clean labeling, minimal ingredients, and targeted health messaging. On April 24, 2025, Asahi Group Japan unveiled LIKE MILK, the country’s first yeast-derived milk alternative, made using proprietary fermentation technology and free from all 28 major allergens. The product offers similar protein and calcium content as cow’s milk but with 38% less fat, aiming to serve individuals with food allergies and dietary restrictions. National distribution in Japan is planned for 2026, following a limited release via the Makuake platform. Fitness culture, dietary supplementation, and personal health tracking apps are also reinforcing demand for plant-based options that support broader lifestyle goals. These consumer shifts are laying a strong foundation for sustained Japan milk alternatives market growth.

To get more information on this market Request Sample

Environmental Awareness and Institutional Influence

Japan’s growing environmental consciousness has filtered into food consumption habits, particularly among younger consumers and urban dwellers. Public campaigns around climate change, plastic waste, and energy use have prompted many consumers to consider the broader environmental costs of their purchasing decisions. As information becomes more accessible through digital media, comparisons between dairy and non-dairy products in terms of land use, water consumption, and emissions are receiving more attention. Major Japanese food and beverage companies are responding by diversifying their product lines and publishing sustainability commitments. Retailers and foodservice providers, too, are adapting by introducing plant-based options and reducing their reliance on dairy-intensive offerings. On February 21, 2025, Tokyo-based startup Kinish announced it had raised JPY 120 million (USD 800,000) to develop casein, a primary milk protein, grown inside rice grains using molecular farming and vertical farming methods. The company’s rice-derived casein aims to match the functional properties of animal-based dairy, including protein and emulsification, while using a fraction of the water and land required by conventional dairy or rice production. Japan’s declining milk consumption, shrinking dairy farmer population, and climate-related rice shortages form the backdrop for Kinish’s efforts to create sustainable, allergen-free dairy alternatives. Schools, hospitals, and company cafeterias have started offering milk alternatives, often as part of broader wellness or carbon-reduction initiatives. This institutional backing lends credibility to the category and encourages trial among demographics that might not seek out these products independently. The integration of sustainability into both consumer mindset and corporate strategy is now a meaningful driver of market performance.

Japan Milk Alternatives Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on source, flavor, packaging, and distribution channel.

Source Insights:

- Soy

- Almond

- Coconut

- Oats

- Rice

- Others

The report has provided a detailed breakup and analysis of the market based on the source. This includes soy, almond, coconut, oats, rice, and others.

Flavor Insights:

- Flavored

- Unflavored

The report has provided a detailed breakup and analysis of the market based on the flavor. This includes flavored and unflavored.

Packaging Insights:

- Cartons

- Glass bottles

- Others

The report has provided a detailed breakup and analysis of the market based on the packaging. This includes cartons, glass bottles, and others.

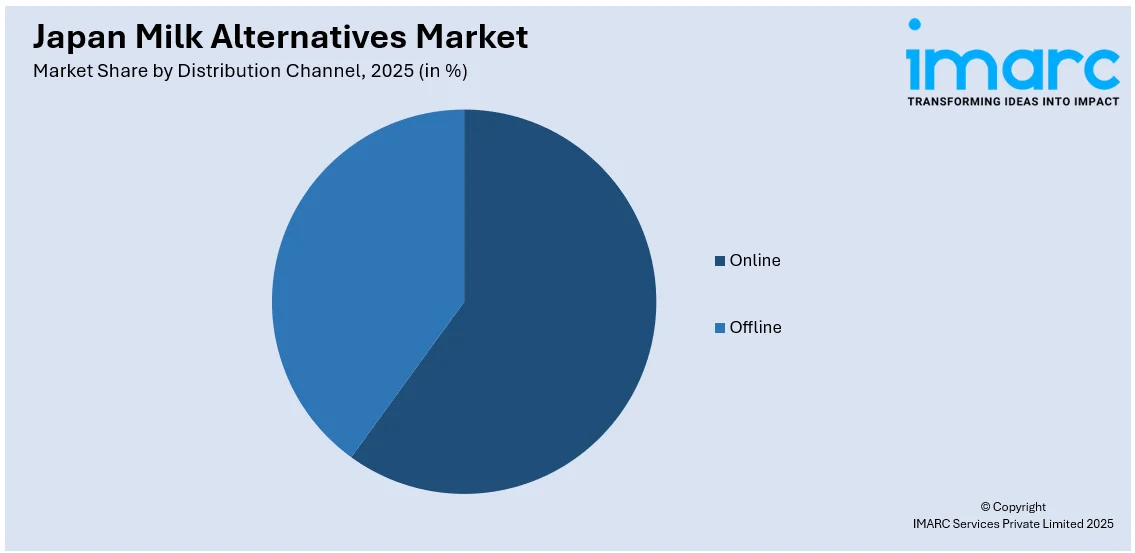

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online and offline.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all major regional markets. This includes Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Milk Alternatives Market News:

- On April 28, 2025, Leave a Nest Co., Ltd. announced a Research Capital Alliance with Thai biotech startup MUU to support the R&D and expansion of precision-fermented milk proteins in Southeast Asia and Japan. MUU’s technology produces bio-identical milk protein without using cows, achieving over 90% reductions in land, water use, and greenhouse gas emissions compared to traditional dairy. The collaboration aims to address Japan’s declining dairy sector and rising demand for lactose-free, sustainable milk alternatives.

Japan Milk Alternatives Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Soy, Almond, Coconut, Oats, Rice, Others |

| Flavors Covered | Flavored, Unflavored |

| Packagings Covered | Cartons, Glass bottles, Others |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan milk alternatives market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan milk alternatives market on the basis of source?

- What is the breakup of the Japan milk alternatives market on the basis of flavor?

- What is the breakup of the Japan milk alternatives market on the basis of packaging?

- What is the breakup of the Japan milk alternatives market on the basis of distribution channel?

- What is the breakup of the Japan milk alternatives market on the basis of region?

- What are the various stages in the value chain of the Japan milk alternatives market?

- What are the key driving factors and challenges in the Japan milk alternatives market?

- What is the structure of the Japan milk alternatives market and who are the key players?

- What is the degree of competition in the Japan milk alternatives market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan milk alternatives market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan milk alternatives market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan milk alternatives industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)