Japan Milk Powder Market Size, Share, Trends and Forecast by Product Type, Function, Application, and Region, 2026-2034

Japan Milk Powder Market Summary:

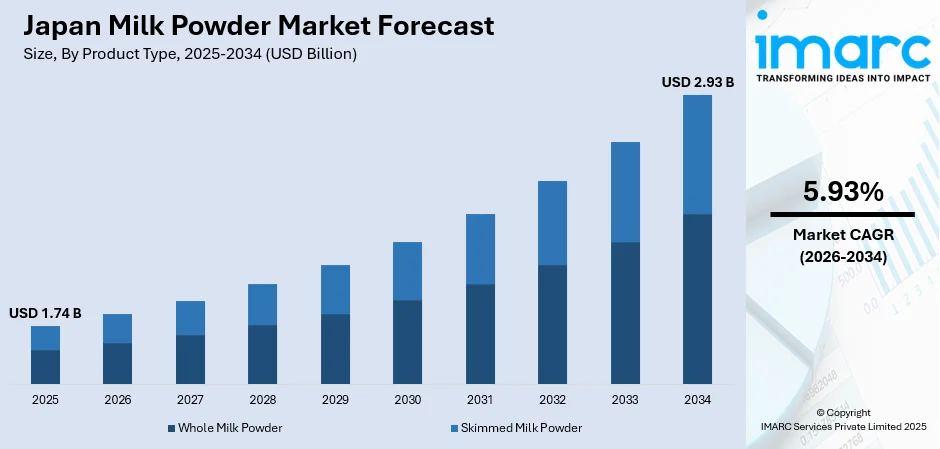

The Japan milk powder market size was valued at USD 1.74 Billion in 2025 and is projected to reach USD 2.93 Billion by 2034, expanding at a compound annual growth rate of 5.93% from 2026-2034.

The market expansion is driven by Japan's evolving demographic landscape, characterized by increasing urbanization, rising female workforce participation, and the growing demand for convenient nutrition solutions across all age segments. The country's stringent food safety regulations and emphasis on premium quality dairy products continue to reinforce consumer trust and brand loyalty. Additionally, the expanding food processing industry, coupled with the burgeoning health consciousness among Japanese consumers, creates sustained demand for milk powder applications across infant nutrition, bakery, confectionery, and sports nutrition segments. The aging population's nutritional requirements and the preference for fortified dairy products further augment the Japan milk powder market share.

Key Takeaways and Insights:

- By Product Type: Whole milk powder dominates the market with a share of 55% in 2025, driven by its versatile applications across multiple food processing categories and superior nutritional profile preferred by Japanese consumers seeking full-fat dairy ingredients for premium confectionery, bakery, and infant formula manufacturing.

- By Function: Emulsification leads the market with a share of 32% in 2025, owing to the expanding processed food industry requirements for stable, homogeneous food products and the growing demand for premium dairy-based beverages, confectionery items, and bakery products requiring enhanced texture and consistency.

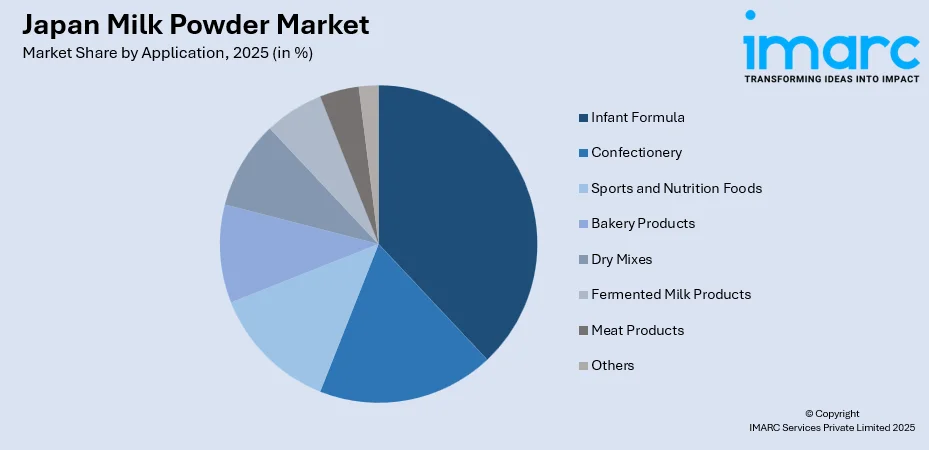

- By Application: Infant formula represents the largest segment with a market share of 38% in 2025. This dominance is driven by increasing female workforce participation, rising demand for premium and organic infant nutrition products, and the preference for scientifically formulated products enriched with probiotics and essential vitamins.

- Key Players: The Japan milk powder market exhibits moderate competitive intensity, with established domestic dairy corporations competing alongside international manufacturers across premium and mass-market price segments, leveraging advanced processing technologies and extensive distribution networks.

To get more information on this market Request Sample

The market demonstrates robust growth potential, driven by multiple converging factors supporting long-term expansion. Japan's senior citizen population is increasing, highlighting the importance of healthy aging and nutrition-focused wellness. This demographic transition is creating substantial demand for fortified milk powder products catering to elderly nutritional requirements, including calcium-enriched formulations supporting bone health and products containing probiotics for digestive wellness. The processed food sector's continued expansion positions milk powder as an essential ingredient across diverse food manufacturing applications. The broadening of retail channels is fueling the market expansion by enhancing the accessibility of products. As per Trading Economics, in October 2025, Japan's retail sales rose by 1.7% compared to October 2024.

Japan Milk Powder Market Trends:

Rising Demand for Functional and Fortified Formulations

Japanese consumers are increasingly gravitating towards milk powder products offering functional health benefits beyond basic nutrition. Manufacturers are responding by incorporating probiotics, prebiotics, and lactoferrin into their formulations to address specific health concerns. In August 2024, Morinaga developed a milk formula for the elderly population, designed to support overall nutrition. This innovation trend reflects the broader movement towards evidence-based nutritional products targeting age-specific health requirements.

Stringent Regulatory Framework Driving Quality Standards

Japan maintains one of the world's most rigorous regulatory environments for dairy products, ensuring consumer safety and product integrity. In February 2025, Japan updated its approval procedure for condensed and powdered milk products after a regulatory change in April 2024, shifting responsibility from the Ministry of Health, Labour and Welfare to the Consumer Affairs Agency, which required extensive documentation for product approvals and public disclosure of approved products. These regulatory enhancements are encouraging manufacturers to invest substantially in advanced processing technologies, contamination control systems, and traceability mechanisms.

E-commerce Expansion Transforming Distribution Channels

The rapid growth of e-commerce platforms is revolutionizing how Japanese consumers access milk powder products. As per IMARC Group, the Japan e-commerce market size reached USD 258.0 Billion in 2024. Digital retail channels offer consumers convenience, product variety, and the ability to compare specialized formulations such as lactose-free, organic, and age-specific variants. This channel expansion enables manufacturers to reach broader consumer segments while providing detailed product information supporting informed purchasing decisions.

Market Outlook 2026-2034:

The market expansion will be underpinned by demographic transitions, driving the demand across both infant nutrition and elderly care segments. The increasing adoption of Western dietary habits, expanding food processing industry, and rising health awareness among consumers will continue to support the market growth. The market generated a revenue of USD 1.74 Billion in 2025 and is projected to reach a revenue of USD 2.93 Billion by 2034, growing at a compound annual growth rate of 5.93% from 2026-2034. Innovations in portioned packaging, single-serve formats, and functional formulations will create new consumption occasions while addressing convenience requirements of urban Japanese households. The competitive landscape will witness continued investments in research and development (R&D) activities, strategic partnerships, and capacity expansion, as manufacturers position themselves to capture emerging growth opportunities across premium market segments.

Japan Milk Powder Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Whole Milk Powder | 55% |

| Function | Emulsification | 32% |

| Application | Infant Formula | 38% |

Product Type Insights:

- Whole Milk Powder

- Skimmed Milk Powder

Whole milk powder dominates with a market share of 55% of the total Japan milk powder market in 2025.

Whole milk powder maintains its dominant position in the Japanese market due to its comprehensive nutritional profile and versatile applications across food manufacturing sectors. The product's rich fat content delivers superior taste characteristics and functional properties essential for premium confectionery, bakery, and dairy beverage production. Japanese consumers' preference for full-fat dairy ingredients in traditional and Western-style food preparations sustains consistent demand across retail and foodservice channels. The segment benefits from established supply chains connecting domestic dairy producers with food processing facilities nationwide.

The expanding infant formula market significantly drives whole milk powder consumption, as manufacturers utilize this ingredient to create nutritionally complete formulations mimicking breast milk composition. Additionally, the growing bakery and confectionery industries require whole milk powder for achieving desired texture, flavor, and browning characteristics in their products, further reinforcing segment leadership.

Function Insights:

- Emulsification

- Foaming

- Flavouring

- Thickening

Emulsification leads with a share of 32% of the total Japan milk powder market in 2025.

The emulsification function segment's market leadership reflects the critical role milk powder plays in creating stable, homogeneous food products across Japan's sophisticated food processing industry. Milk proteins act as natural emulsifiers, enabling the combination of oil and water phases essential for producing premium dairy beverages, processed cheese products, ice cream, and confectionery items.

Japanese food manufacturers increasingly prioritize natural emulsification solutions over synthetic alternatives, aligning with clean-label trends and consumer preferences for recognizable ingredients. Milk powder's emulsification capabilities enable reduced additive usage while maintaining product stability and shelf-life characteristics. The growing demand for premium processed foods requiring superior texture and consistency continues to strengthen the emulsification segment's market position.

Application Insights:

Access the Comprehensive Market Breakdown Request Sample

- Infant Formula

- Confectionery

- Sports and Nutrition Foods

- Bakery Products

- Dry Mixes

- Fermented Milk Products

- Meat Products

- Others

Infant formula exhibist a clear dominance with a 38% share of the total Japan milk powder market in 2025.

The infant formula segment's dominant position reflects Japan's sustained demand for premium infant nutrition products. Japanese parents demonstrate strong preference for scientifically formulated products incorporating advanced nutritional components supporting infant development. The rate of female employment in Japan is steadily rising, driving the demand for convenient infant formula as working mothers depend on formula as a practical alternative to breastfeeding.

Japanese consumers place exceptional importance on quality, safety, and scientific formulation, which strengthens trust in branded infant formulas over generic milk powders. Hospitals and pediatricians also play a key role by recommending specific formulas, reinforcing consumer confidence. In addition, premiumization helps this segment dominate, as many parents are willing to spend more on advanced formulas enriched with probiotics and immunity-supporting ingredients. While birth rates are low, households continue to prioritize high-grade nutrition for children, increasing spending per infant and supporting category leadership.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto Region holds prominence due to its massive population concentration, including Tokyo and Yokohama metropolitan areas. The region's dense distribution network, broadening e-commerce portals and retail channels, and high disposable incomes support premium product consumption.

The Kansai/Kinki region represents a significant market hub, driven by Osaka's thriving food processing industry and established dairy manufacturing infrastructure. The region's strong confectionery and bakery sectors create substantial demand for milk powder ingredients across multiple applications.

The Central/Chubu Region maintains consistent market presence through its diversified food manufacturing base and strategic geographic positioning, connecting major urban centers. Industrial demand from bakery and confectionery manufacturers supports steady milk powder consumption.

The Kyushu-Okinawa region demonstrates strong growth potential, driven by food processing innovation and rising demand for nutritious packaged foods. Regional manufacturers focus on functional food development targeting health-conscious consumers.

The Tohoku region contributes to the market growth through its agricultural heritage and dairy processing capabilities. Regional producers supply milk powder ingredients for local food manufacturing while serving broader national distribution networks.

The Chugoku region maintains moderate market presence supported by regional food processing facilities and established retail distribution channels connecting consumers with diverse milk powder products.

The Hokkaido Region serves as Japan's primary dairy production hub, supplying raw materials for milk powder manufacturing facilities nationwide. The thriving food processing industry is fueling the market expansion in the area.

The Shikoku region represents a smaller but stable market segment, with regional dairy processors and food manufacturers contributing to local consumption patterns and specialized product development.

Market Dynamics:

Growth Drivers:

Why is the Japan Milk Powder Market Growing?

Increasing Female Workforce Participation Driving Infant Formula Demand

Japan's rising female workforce participation rate represents a fundamental demographic driver supporting sustained milk powder market expansion, particularly within the infant formula segment. As more mothers balance professional responsibilities with childcare, the demand for convenient, nutritionally complete infant feeding solutions continues to increase. As per industry reports, in 2024, the participation rate of women in Japan's labor force is 55.3%, an increase from 54.85% in 2023. This structural shift is creating sustained demand for premium infant nutrition products, as working parents are seeking high-quality formula alternatives supporting infant development. Manufacturers are responding by developing formulations increasingly similar to breast milk composition while incorporating functional ingredients addressing specific developmental needs. The trend of delayed parenthood among career-focused professionals is further amplifying the demand for premium, science-backed infant nutrition products.

Expanding Food Processing Industry Creating Industrial Demand

Japan's sophisticated food processing industry represents a substantial demand driver for milk powder across multiple applications, including bakery, confectionery, dairy beverages, and prepared foods. As per IMARC Group, the Japan bakery products market size reached USD 31.5 Billion in 2024. The industry's emphasis on product quality, consistency, and functional performance drives demand for premium milk powder ingredients delivering superior emulsification, flavor enhancement, and textural properties. Food manufacturers increasingly utilize milk powder to achieve specific product characteristics while meeting stringent food safety requirements. The growing popularity of Western-style bakery products, premium confectionery, and dairy-based beverages among Japanese consumers creates additional industrial demand for high-quality milk powder ingredients supporting diverse food formulation requirements.

Aging Population Driving Nutritional Product Demand

Japan's rapidly aging population is creating substantial market opportunities for milk powder products formulated to address senior nutritional requirements. As of 2024, Japan had a record 36.25 Million people aged 65 and over, accounting for 29.3% of the total population, with this share projected to rise to 34.8% in 2040. This demographic reality is driving innovations in functional milk powder products, targeting age-related health concerns, including bone health, immune function, and cognitive wellness. Manufacturers are developing specialized formulations, incorporating calcium, probiotics, and other functional ingredients, to support healthy aging. The elderly population's familiarity with dairy products and recognition of their nutritional benefits creates receptive consumer segments for fortified milk powder offerings. Government programs encouraging healthy aging and preventive health measures are further fueling the market expansion within the senior nutrition segment.

Market Restraints:

What Challenges the Japan Milk Powder Market is Facing?

High Production and Operating Costs

Milk powder production in Japan is burdened by elevated costs related to dairy farming, labor, energy, and logistics. Local milk sourcing is expensive due to limited land and feed reliance, while labor shortages raise wages in farming and processing. Energy-intensive drying processes add another layer of cost pressure. As a result, domestic producers struggle to offer competitively priced products, making profit margins thin and forcing many companies to either increase prices or absorb losses.

Declining Preference for Powdered Milk Over Fresh and Alternatives

Urban consumers increasingly prefer fresh milk, ready-to-drink beverages, and plant-based alternatives over powdered products. Perception issues around powdered milk being ‘less natural’ also affect demand. Health-conscious consumers gravitate towards almond, oat, and soy drinks, while convenience-seeking shoppers favor packaged liquid dairy. This shift in consumer behavior pressures milk powder manufacturers to reposition products, invest in value-added nutrition, or risk losing relevance to modern consumption trends.

Supply Constraints and Declining Dairy Farming Base

Japan’s number of dairy farms continues to decline due to aging farmers, succession problems, and rising operational costs. This shrinking farming base reduces raw milk availability for milk powder production. Any disruption in milk supply can severely impact output. The market becomes increasingly vulnerable to volatility, while dependence on limited domestic sources restricts scalability and challenges manufacturers aiming for consistent long-term production planning.

Competitive Landscape:

The Japan milk powder market exhibits a moderately consolidated competitive structure, characterized by established domestic dairy corporations maintaining significant market presence alongside international manufacturers serving specialized segments. Domestic market leaders leverage deep-rooted distribution networks, strong brand recognition, and established relationships with local dairy farmers to maintain competitive advantages. Companies compete across multiple dimensions, including product innovations, quality certification, pricing strategies, and distribution coverage. The competitive environment demonstrates increasing emphasis on functional product development, targeting specific demographic requirements, particularly elderly nutrition and premium infant formula segments. Strategic partnerships, research collaborations, and capacity investments characterize competitive strategies, as manufacturers position themselves to capture emerging growth opportunities within evolving market segments.

Recent Developments:

-

In May 2025, Asahi Group Japan utilized its knowledge in yeast R&D to create a unique product in the company's 135-year history: a milk substitute. Engineered to deliver comparable performance to dairy milk in food and beverage (F&B) uses, Asahi’s Like Milk utilized yeast extract powder and included vegetable oil, sugar, powdered caramel sauce, salt, calcium carbonate, cellulose, antioxidants (Vitamin C, tea extract), emulsifier, flavoring, and calcium hydroxide.

Japan Milk Powder Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Whole Milk Powder, Skimmed Milk Powder |

| Functions Covered | Emulsification, Foaming, Flavouring, Thickening |

| Applications Covered | Infant Formula, Confectionery, Sports and Nutrition Foods, Bakery Products, Dry Mixes, Fermented Milk Products, Meat Products, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan milk powder market size was valued at USD 1.74 Billion in 2025.

The Japan milk powder market is expected to grow at a compound annual growth rate of 5.93% from 2026-2034 to reach USD 2.93 Billion by 2034.

Whole milk powder dominates the market with 55% share, driven by its versatile applications across food processing sectors and preferred use in premium confectionery, bakery, and infant formula manufacturing.

Key factors driving the Japan milk powder market include increasing female workforce participation boosting infant formula demand, expanding food processing industry requirements, aging population, stringent food safety standards reinforcing product quality, and the growing health consciousness among Japanese consumers.

Major challenges include declining birth rates affecting infant formula volume growth, stringent regulatory compliance requirements increasing operational costs, the growing competition from plant-based dairy alternatives, import dependency for certain dairy ingredients, and price pressures from fluctuating raw material costs.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)