Japan Mobile Phone Insurance Market Size, Share, Trends and Forecast by Phone Type, Coverage, Distribution Channel, End User, and Region, 2026-2034

Japan Mobile Phone Insurance Market Overview:

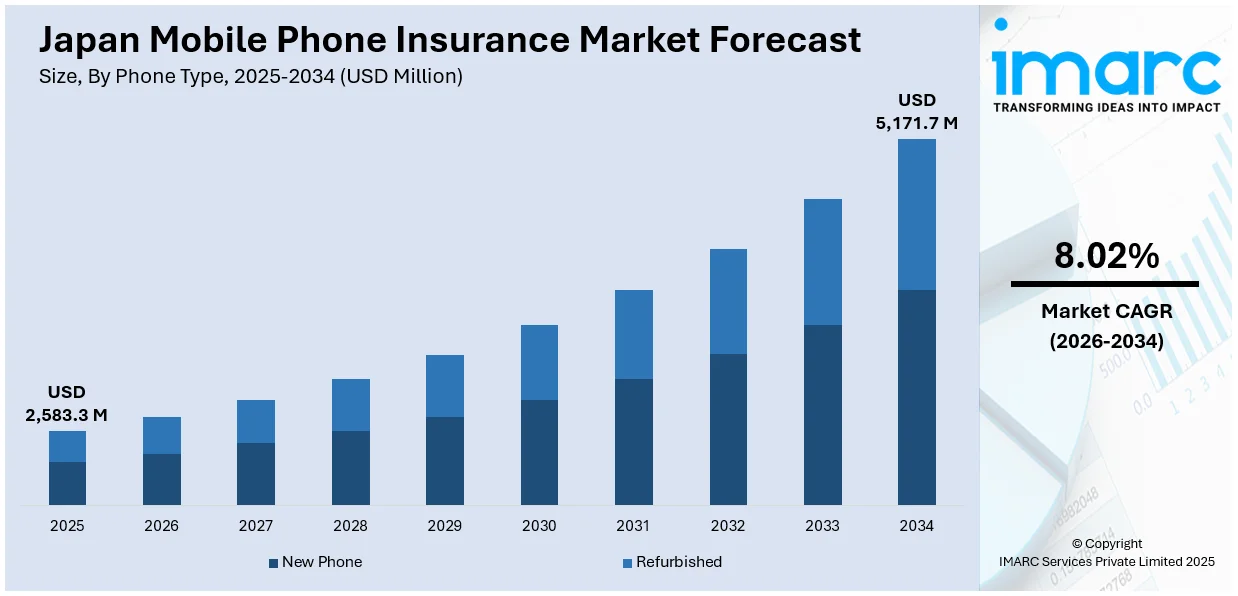

The Japan Mobile phone insurance market size reached USD 2,583.3 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 5,171.7 Million by 2034, exhibiting a growth rate (CAGR) of 8.02% during 2026-2034. The market is being driven by high smartphone penetration, increasing adoption of expensive flagship devices, rising consumer awareness of device protection, growing dependence on mobile services across age groups, and the expansion of tech-savvy insurance solutions that offer personalized, app-based coverage with streamlined claims and customer support systems.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2,583.3 Million |

| Market Forecast in 2034 | USD 5,171.7 Million |

| Market Growth Rate 2026-2034 | 8.02% |

Japan Mobile Phone Insurance Market Trends:

High Smartphone Penetration Coupled with Premium Device Adoption

One of the main drivers of the expansion of the mobile phone insurance segment in Japan is the high penetration of smartphones, particularly of high-end and high-priced phones. Japan is among the leading nations by smartphone penetration, with most of its citizens possessing a mobile phone. Japanese customers are generally technologically inclined, and they regularly change to latest models with more features and higher retail prices. Such premium devices carry higher risks regarding financial loss due to unintentional damage, theft, or malfunction, thus rendering insurance not just desirable but also highly prudent. In addition to this, Japanese consumer culture places high value on product durability and safety. This compels users to pursue mobile phone insurance to protect their valuable investment. Premium phones tend to be more likely to involve expensive repairs, particularly as a result of proprietary hardware. For example, replacement screens or water damage repair on newer devices can be prohibitively costly without coverage. This environment has caused both manufacturer-offered and third-party insurance to become more prevalent.

To get more information on this market Request Sample

Increased Dependence on Mobile Services

Another driver shaping the Japanese mobile phone insurance sector is the ageing population in Japan and the high use of digital services in the country. Japan possesses among the world's highest ratios of elderly members in society, with more than 28% of the country's population over 65 years. Interestingly, this age group has extensively adopted smartphones to stay socially connected, manage health services, access government assistance, and conduct financial transactions. For most older users, mobile phones are not merely communication devices, they are lifelines. As smartphone reliance grows among this older generation, so does worry about device mishandling, technical malfunction, or accidental destruction. The elderly can be more likely to drop gadgets or face technical problems because of less dexterity or unfamiliarity with current technology. Subsequently, there's a heightened need for mobile insurance that not only compensates for physical damage but also offers extended after-sales services such as technical support, replacement of the device, and even customer service in easier forms especially for the elderly.

Japan Mobile Phone Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on phone type, coverage, distribution channel, and end user.

Phone Type Insights:

- New Phone

- Refurbished

The report has provided a detailed breakup and analysis of the market based on the phone type. This includes new phone and refurbished.

Coverage Insights:

- Physical Damage

- Electronic Damage

- Virus Protection

- Data Protection

- Theft Protection

A detailed breakup and analysis of the market based on the coverage have also been provided in the report. This includes physical damage, electronic damage, virus protection, data protection, and theft protection.

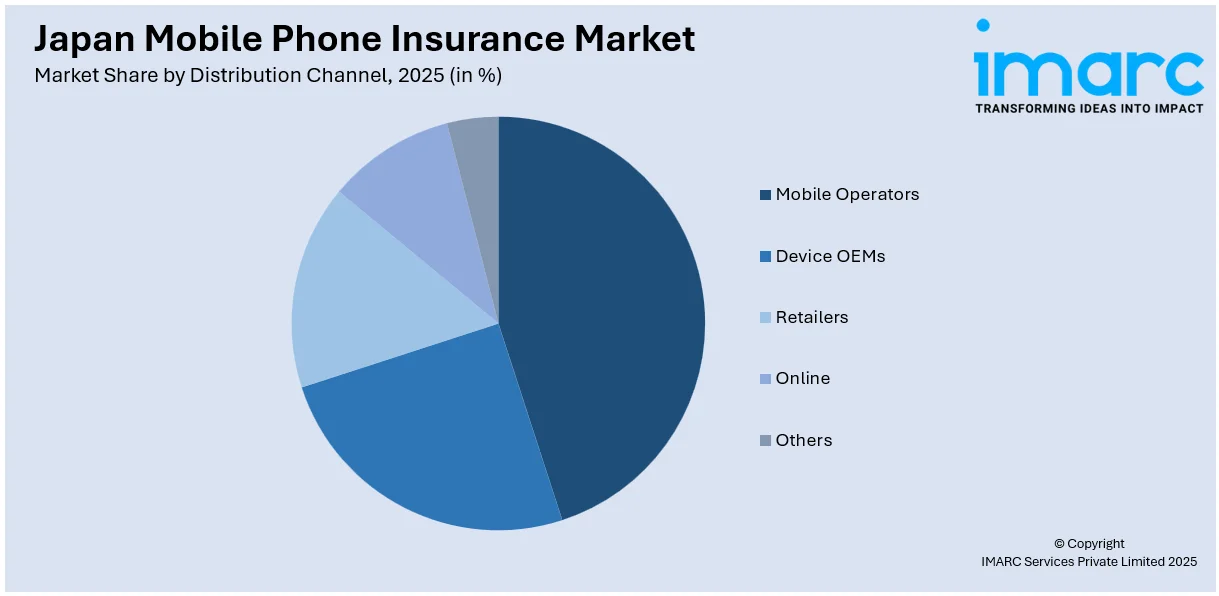

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Mobile Operators

- Device OEMs

- Retailers

- Online

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes mobile operators, device OEMs, retailers, online, and others.

End User Insights:

- Corporate

- Personal

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes corporate and personal.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Mobile Phone Insurance Market News:

- March 2025: Smartpay Corporation partnered with Chubb Insurance Japan to launch the country's first embedded insurance service within Buy Now, Pay Later (BNPL) platforms. This initiative aims to modernize Japan's traditional, paper-based insurance sector by integrating digital, real-time, and personalized insurance solutions into the payment process. The embedded insurance model is designed to extend to various sectors, including mobile phone insurance.

- March 2024: bolttech partnered with refurbished device marketplace Back Market to launch 'Back Up', an embedded device protection service. This offering provides coverage for breakage, corrosion, and liquid damage in mobile phones, along with complimentary data recovery services. It aims to enhance the longevity of refurbished devices and supports sustainability by reducing electronic waste.

Japan Mobile Phone Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Phone Types Covered | New Phone, Refurbished |

| Coverages Covered | Physical Damage, Electronic Damage, Virus Protection, Data Protection, Theft Protection |

| Distribution Channels Covered | Mobile Operators, Device OEMs, Retailers, Online, Others |

| End Users Covered | Corporate, Personal |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan Mobile phone insurance market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan Mobile phone insurance market on the basis of phone type?

- What is the breakup of the Japan Mobile phone insurance market on the basis of coverage?

- What is the breakup of the Japan Mobile phone insurance market on the basis of distribution channel?

- What is the breakup of the Japan Mobile phone insurance market on the basis of end user?

- What is the breakup of the Japan Mobile phone insurance market on the basis of region?

- What are the various stages in the value chain of the Japan Mobile phone insurance market?

- What are the key driving factors and challenges in the Japan Mobile phone insurance market?

- What is the structure of the Japan Mobile phone insurance market and who are the key players?

- What is the degree of competition in the Japan Mobile phone insurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan mobile phone insurance market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan mobile phone insurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan mobile phone insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)