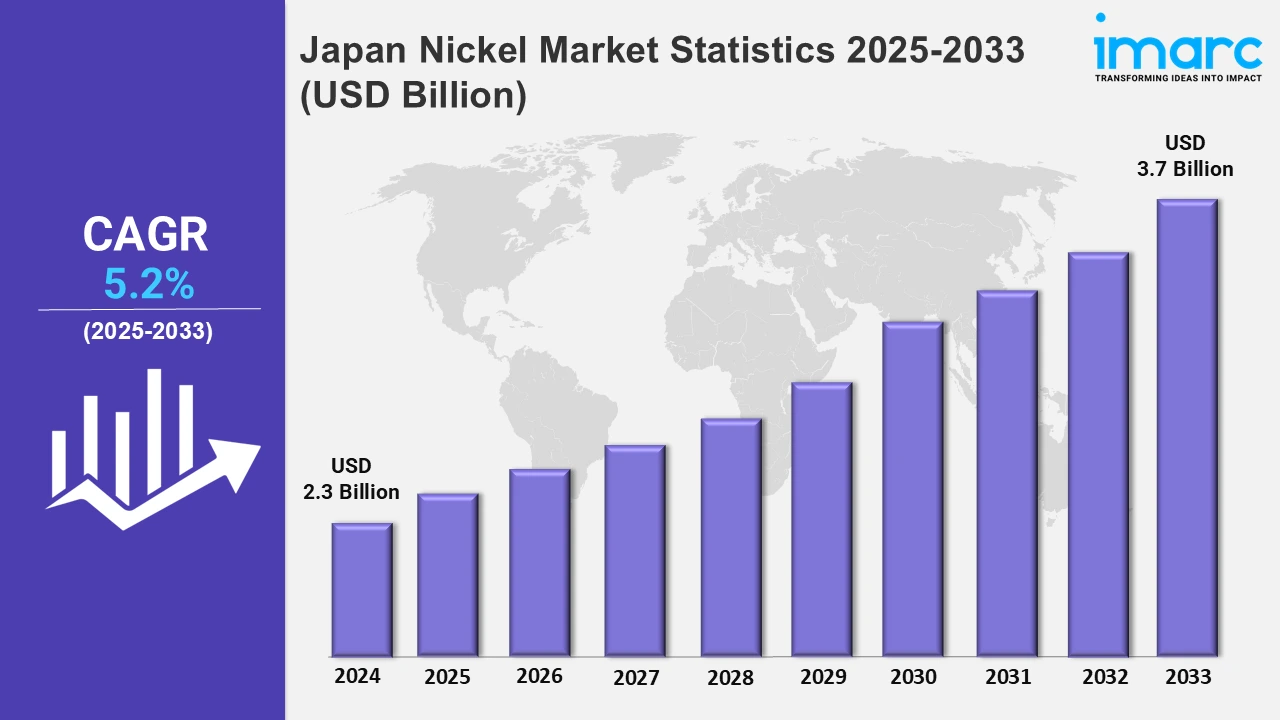

Japan Nickel Market Expected to Reach USD 3.7 Billion by 2033 - IMARC Group

Japan Nickel Market Statistics, Outlook and Regional Analysis 2025-2033

The Japan nickel market size was valued at USD 2.3 Billion in 2024, and it is expected to reach USD 3.7 Billion by 2033, exhibiting a growth rate (CAGR) of 5.2% from 2025 to 2033.

To get more information on this market, Request Sample

Japan's nickel market has been influenced by policy agreements aimed at lowering import duties to improve access to electric vehicle battery components. This reflects a growing focus on supply chain optimization for advanced battery technology. For instance, in September 2024, Vedanta requested the government in Japan to amend trade accords with the goal of eliminating import levies on nickel sulfate for EV batteries.

Additionally, prominent players in Japan are enhancing their focus on securing stable nickel supplies by participating in overseas projects and providing government grants. These efforts aim to ensure resource stability, support industrial growth, and adapt to shifting supply chains, thereby reflecting the country's commitment to strengthening its position in the critical minerals sector. For instance, in April 2024, Sumitomo Metal Mining and Mitsubishi Corporation collaborated with Ardea Resources on the Kalgoorlie nickel project, supported by a grant given by the government in Japan to ensure supply stability. Besides this, the surge in demand for electric vehicles across the country has bolstered the market expansion. Nickel is a critical component in lithium-ion batteries, which power EVs. Japan's strong automotive industry and investments in battery technology are driving demand for high-purity nickel. As EV adoption accelerates, the country’s nickel supply chain is expected to expand significantly.

Japan Nickel Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Kanto region, Kinki region, Central/ Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region. The rising use of nickel across various industries, including consumer electronics and automotive, is driving the market in Japan.

Kanto Region Nickel Market Trends:

Growing research activities in superconducting materials in the Kanto region are influencing the nickel market. As scientists explore new nickel-based compounds for improved efficiency in energy and technology applications, demand for high-quality nickel is expected to rise, thereby impacting market dynamics. In April 2024, researchers at Tokyo Metropolitan University unveiled a new superconducting material. By combining iron, nickel, and zirconium in varying ratios, they created a novel transition metal zirconide.

Kinki Region Nickel Market Trends:

Nickel use is growing in Osaka, especially for making stainless steel, which is propelling the market growth in Kinki. The region also has many heavy machinery companies, so the need for good-quality nickel is rising. Various companies across this area, like Nippon Yakin Kogyo, are expanding their refining operations to meet this higher demand.

Central/Chubu Region Nickel Market Trends:

The Central/Chubu region is using more nickel in the automotive industry. Toyota and Honda, some of the most prominent automobile companies in Japan, are investing in nickel-based batteries to improve electric vehicles. For instance, Toyota Industries introduced an on-site battery manufacturing line of bipolar nickel-metal hydride batteries in August 2022 at its Ishihama Plant.

Kyushu-Okinawa Region Nickel Market Trends:

The increasing demand for high-performance alloys across the Kyushu-Okinawa region is fueling the market expansion. The aerospace industry needs strong and high-quality materials for advanced equipment. Additionally, improvements in local refining operations, particularly in cities like Fukuoka, are helping meet this growing demand.

Tohoku Region Nickel Market Trends:

Tohoku, known for its heavy industries, is focusing on sustainable nickel supply. The region is developing environmentally sustainable alternatives to address the need for nickel, particularly for EV batteries. The usage of recycled nickel from old batteries is growing, with local companies such as the Japan Environmental Management Association looking at ways to extract nickel through urban mining projects.

Chugoku Region Nickel Market Trends:

A noticeable trend towards the usage of nickel in marine applications in Hiroshima is escalating the market growth in Chugoku. This region is a major shipbuilding center, and nickel is used to make corrosion-resistant alloys for ships and offshore constructions. Recent trends show that as maritime activities across the country surge, demand for nickel in this sector propels.

Hokkaido Region Nickel Market Trends:

In Hokkaido, particularly in the city of Sapporo, nickel is becoming more important for renewable energy. The region has many natural resources and is working on projects to extract and process nickel for energy storage systems used in wind and solar power. For instance, in October 2024, the government of Japan announced the launch of a 300 MW wind farm off the coast of Hokkaido, which is fostering the demand for nickel.

Shikoku Region Nickel Market Trends:

In the Shikoku region, the escalating efforts to recycle nickel from used lithium-ion batteries are propelling the market expansion. For instance, in April 2024, Sumitomo Metal Mining planned to launch a recycling facility to recover nickel from used lithium-ion batteries in Japan. This initiative supports sustainable resource management and addresses the rising demand for nickel in battery production, aligning with environmental goals.

Top Companies Leading in the Japan Nickel Industry

The market encompasses important players. In June 2024, authorities in Japan announced the introduction of mining cobalt and nickel from a significant deep-water deposit near the remote Ogasawara Islands in 2026. Apart from this, in April 2024, Sumitomo Metal Mining and Mitsubishi Corporation collaborated with Ardea Resources on the Kalgoorlie nickel project, supported by a grant given by the government in the country to ensure supply stability.

Japan Nickel Market Segmentation Coverage

- On the basis of the product type, the market has been bifurcated into class I products and class II products. Class I nickel is primarily used for stainless steel production, which includes high-purity electrolytic nickel. In contrast, Class II products, like nickel matte and ferronickel, are utilized in alloy and battery applications.

- Based on the application, the market has been bifurcated into stainless steel and alloy steel, non-ferrous alloys and superalloys, electroplating, casting, batteries, and others. In stainless steel and alloy steel, nickel provides strength, corrosion resistance, durability, etc. Also, it is essential in non-ferrous alloys and superalloys, particularly for aerospace and high-temperature applications. Besides this, nickel is also used in electroplating and other applications to enhance surface properties and in casting for precision parts.

- On the basis of the end use industry, the market has been bifurcated into transportation and defense, fabricated metal products, electrical and electronics, chemical, petrochemical, construction, consumer durables, industrial machinery, and others. In the transportation and defense industry, nickel is used in alloys for vehicles and military applications. It is also crucial for fabricated metal products. Furthermore, the inflating investments in sourcing the chemical element are anticipated to augment the segment over the forecasted period.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 2.3 Billion |

| Market Forecast in 2033 | USD 3.7 Billion |

| Market Growth Rate 2025-2033 | 5.2% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Class I Products, Class II Products |

| Applications Covered | Stainless Steel and Alloy Steel, Non-Ferrous Alloys and Superalloys, Electroplating, Casting, Batteries, Others |

| End Use Industries Covered | Transportation and Defense, Fabricated Metal Products, Electrical and Electronics, Chemical, Petrochemical, Construction, Consumer Durables, Industrial Machinery, Others |

| Regions Covered | Kanto Region, Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Nickel Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)