Japan Off-Grid Solar Energy Market Size, Share, Trends and Forecast by End User and Region, 2026-2034

Japan Off-Grid Solar Energy Market Overview:

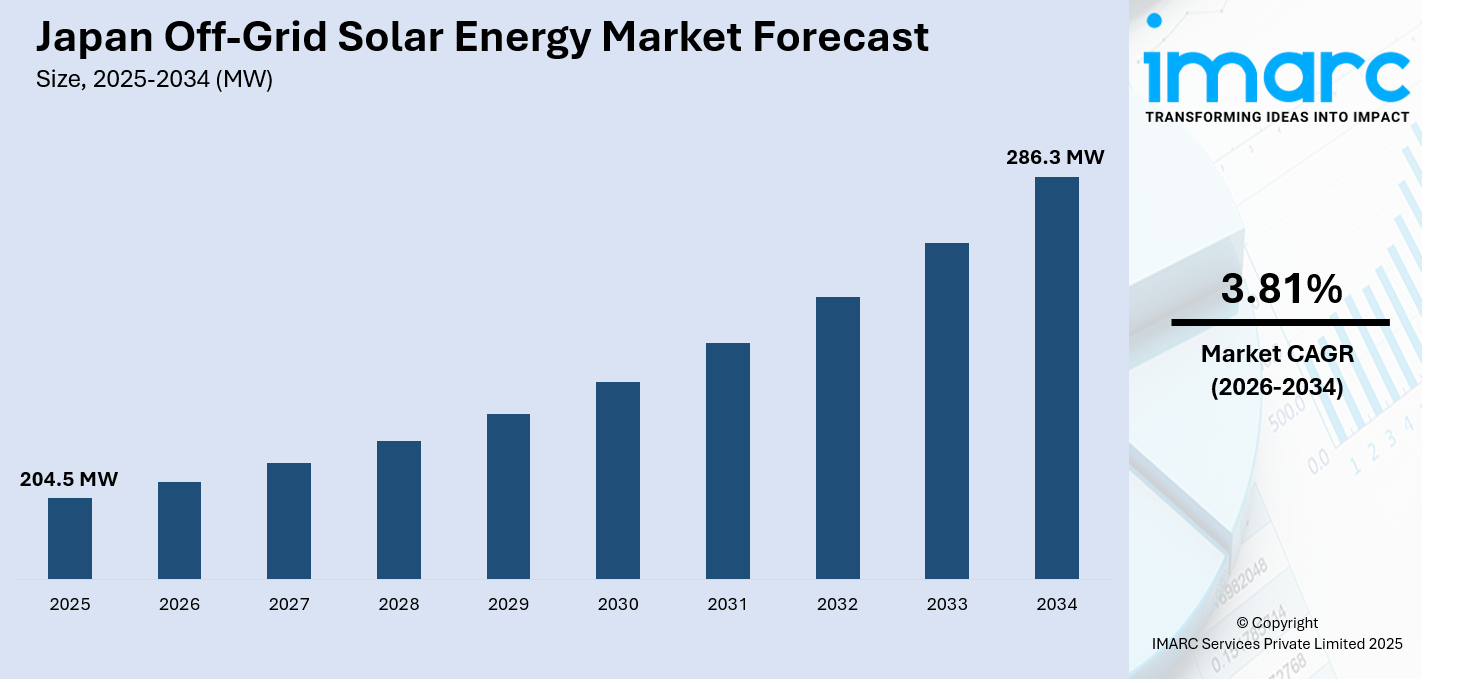

The Japan off-grid solar energy market size reached 204.5 MW in 2025. Looking forward, IMARC Group expects the market to reach 286.3 MW by 2034, exhibiting a growth rate (CAGR) of 3.81% during 2026-2034. The market is driven by various major factors. Government incentives in the form of subsidies and tax credits lower the cost of installations significantly, which makes solar power more affordable. Technological breakthroughs in photovoltaic technology and energy storage systems have led to increased efficiency and reliability. The growing energy independence and resiliency requirements, particularly for remote and disaster-risk areas, further propel Japan off-grid solar energy market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | 204.5 MW |

| Market Forecast in 2034 | 286.3 MW |

| Market Growth Rate 2026-2034 | 3.81% |

Japan Off-Grid Solar Energy Market Trends:

Government Incentives and Regulatory Support

The Japanese government plays a vital role in advancing the off-grid solar sector through targeted incentives and favorable regulatory frameworks. National and regional programs offer financial support, including subsidies, investment tax credits, and low-interest financing for renewable energy installations. These measures significantly lower the cost barriers for both individuals and businesses, encouraging broader adoption of solar energy systems. Additionally, Japan's long-term commitment to reducing carbon emissions aligns closely with promoting decentralized energy solutions. Regulatory reforms also streamline permitting processes and grid connection standards, further enhancing the feasibility of solar projects. As Japan aims to diversify its energy mix and reduce dependency on imports, such policy mechanisms continue to bolster Japan off-grid solar energy market growth by making solar power economically viable and strategically essential. For instance, starting April 2025, Tokyo will require all new detached homes to install rooftop solar panels as part of its goal to achieve net-zero emissions by 2050. This regulation applies to homes with a total floor area under 2,000 square meters. To alleviate installation costs, the government will offer a subsidy. Tokyo currently has 2.25 million buildings suitable for solar panels, but only 4.2% are equipped with them.

To get more information on this market Request Sample

Rising Demand for Energy Resilience and Decentralization

Japan’s frequent exposure to natural disasters, such as earthquakes, typhoons, and tsunamis, has underscored the urgent need for resilient and decentralized energy systems. Off-grid solar solutions offer an effective alternative to centralized grids, providing consistent and autonomous power, especially in disaster-prone and remote regions. These systems reduce dependence on national infrastructure and can be rapidly deployed in crisis scenarios, ensuring power continuity for households, healthcare facilities, and emergency response units. Moreover, increasing awareness among both private and public stakeholders about energy self-sufficiency has led to a surge in adoption. With national resilience strategies emphasizing renewable decentralization, this trend significantly contributes to Japan off-grid solar energy market growth by reinforcing the critical role of autonomous solar infrastructure in national preparedness and sustainability initiatives. For instance, in May 2024, Google signed its first renewable energy deals in Japan through two solar power purchase agreements (PPAs) with Shizen Energy and Clean Energy Connect. These projects will add 60 MW of solar capacity, supporting Google’s global 24/7 carbon-free energy goal by 2030 and demonstrating its $690 million commitment to sustainable infrastructure in Japan.

Japan Off-Grid Solar Energy Market Segmentation:

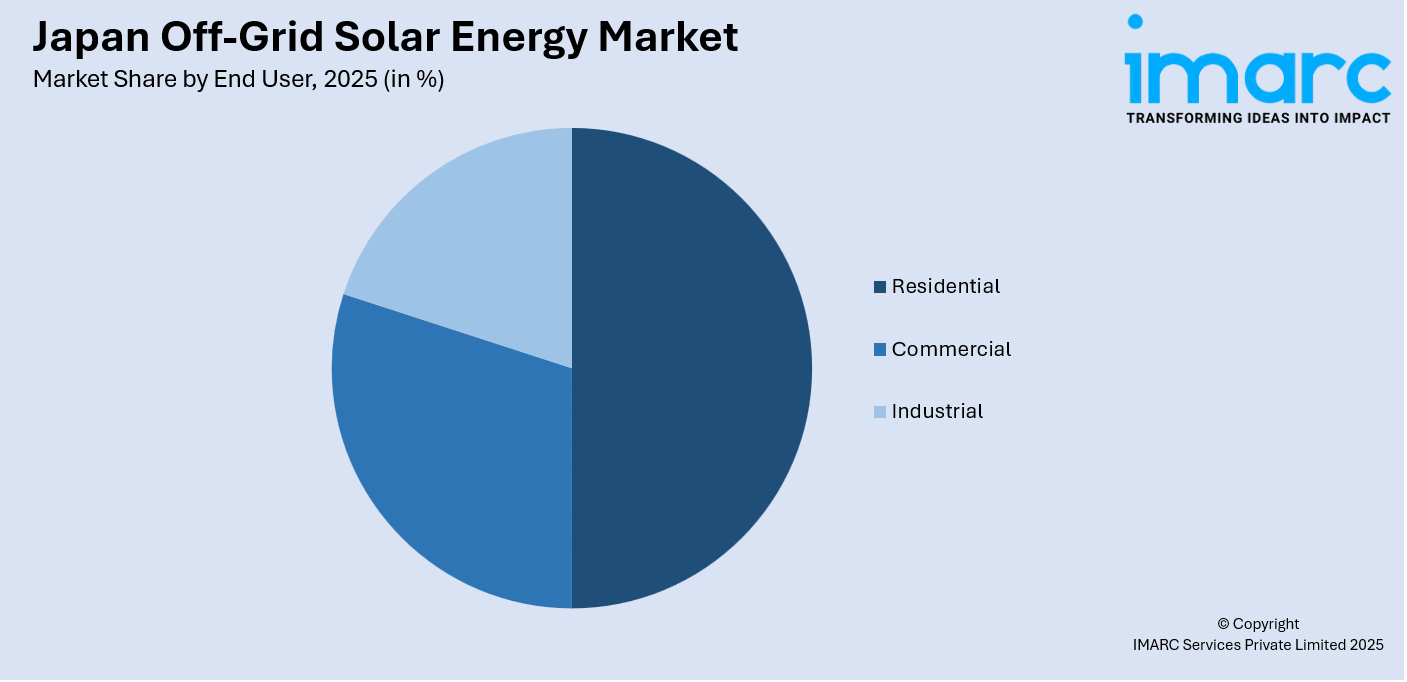

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2026-2034. Our report has categorized the market based on end user.

End User Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

- Industrial

The report has provided a detailed breakup and analysis of the market based on the end user. This includes residential, commercial, and industrial.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto, Kansai/Kinki, Central/ Chubu, Kyushu-Okinawa, Tohoku, Chugoku, Hokkaido, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Off-Grid Solar Energy Market News:

- In April 2025, Enphase Energy entered the Japanese solar market by launching its IQ8 Microinverters, in collaboration with ITOCHU Corporation. The move coincides with Tokyo’s new regulation, which mandates rooftop solar on all new homes starting April 2025. Enphase’s microinverters offer a flexible, scalable solution for small rooftops, ensuring reliable solar production. The company also benefits from Tokyo's subsidy program, which supports homeowners installing Enphase products. This partnership aims to enhance solar energy accessibility in Japan’s residential market.

- In September 2024, UNDP, with support from the Government of Japan, launched a solar project for the National Institute of Pharmacy and Medical Products (INFPM) in Timor-Leste. This initiative, part of the Pacific Green Transformation Project, aims to provide a stable energy supply for critical medical supplies like vaccines. The solar installation will reduce operational costs, lower the carbon footprint, and support sustainable development. The project is funded by Japan and includes solar energy access for rural households, health posts, and schools, contributing to climate resilience and green energy adoption in Timor-Leste.

- In March 2024, Shizen Energy and Microsoft partnered on a pioneering solar project in Japan, supported by a virtual power purchase agreement (VPPA). Societe Generale financed the 25 MW Inuyama project, marking a significant milestone in Japan's renewable energy transition. The collaboration sets a precedent for clean energy financing and future corporate-led initiatives.

Japan Off-Grid Solar Energy Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | MW |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| End Users Covered | Residential, Commercial, Industrial |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan off-grid solar energy market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan off-grid solar energy market on the basis of end user?

- What is the breakup of the Japan off-grid solar energy market on the basis of region?

- What are the various stages in the value chain of the Japan off-grid solar energy market?

- What are the key driving factors and challenges in the Japan off-grid solar energy market?

- What is the structure of the Japan off-grid solar energy market and who are the key players?

- What is the degree of competition in the Japan off-grid solar energy market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan off-grid solar energy market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan off-grid solar energy market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan off-grid solar energy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)