Japan Office Real Estate Market Expected to Reach USD 31.55 Billion by 2033 - IMARC Group

Japan Office Real Estate Market Statistics, Outlook and Regional Analysis 2025-2033

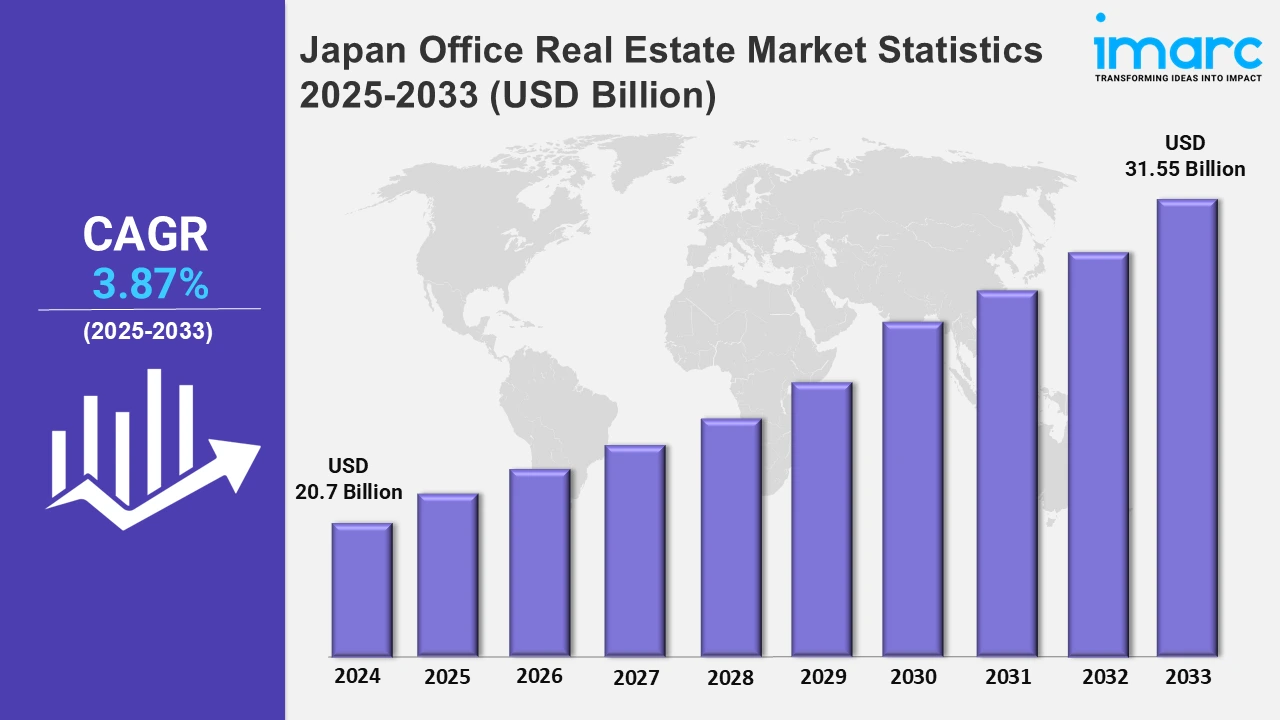

The Japan office real estate market size was valued at USD 20.7 Billion in 2024, and it is expected to reach USD 31.55 Billion by 2033, exhibiting a growth rate (CAGR) of 3.87% from 2025 to 2033.

To get more information on this market, Request Sample

The Japan office real estate market is largely driven by the emerging trend of digital transformation, the inflating investments in the real estate sector by leading players, and the increasing integration of advanced technologies like the Internet of Things (IoT) sensors, as well as AI-based security systems. For example, foreign investors' sales of Japanese real estate doubled during the year 2023 to USD 7.1 Billion. Besides this, the elevating demand for renovation and development projects across the country and the rising number of startups are bolstering the growth of the office real estate market in Japan. For instance, according to an industry report, 61 new investment funds with a total capital of approximately USD 1.5 Billion were formed during the 1st half of 2023. Within this were seven private startup funds, each exceeding USD 70 Million. Apart from this, the widespread development of public transport networks, like high-speed rail connections and urban road systems, make office locations more accessible to employees and clients. This increased connectivity impels the need for workplace spaces in areas well-served by public transport.

Moreover, the rising trend of green buildings and the escalating focus on sustainability by numerous investors and businesses are augmenting the Japan office real estate market forward. For example, the buildings in the Otemachi business district, in January 2023, became green and lush as developers resorted to farms, plants, and trees, for attracting office employees who seek refreshing work surroundings. At the forefront of this movement were Mitsui & Co. and Mitsui Fudosan Co., creating one of the district's most prominent green areas.

Japan Office Real Estate Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include the Kanto region, Kansai/Kinki region, Central/ Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region. The rising trend of corporate development and the influx of foreign direct investment (FDI) are elevating the market.

Kanto Region Office Real Estate Market Trends:

The Kanto region, particularly Tokyo, continues to be Japan's most competitive office market, with corporate headquarters, finance, and technology industries driving demand. Even as rents rise, vacancy rates in Marunouchi and Shibuya remain low. New projects, such as the Toranomon-Azabudai Project, demonstrate the need for luxury office spaces that incorporate sustainability elements. After the pandemic, hybrid work styles have affected demand for flexible office design, although prime sites remain robust.

Kansai/Kinki Region Office Real Estate Market Trends:

Osaka, in the Kanto/Kinki region of Japan, is a primary economic center, housing various kinds of businesses, including manufacturing and technology. The region is supported by government-led urban redevelopment initiatives such as Umekita 2nd Phase. Companies are decentralizing from Tokyo to reduce operating expenses while preserving accessibility. Vacancy rates in Umeda and Nakanoshima remain reasonable when compared to Tokyo, and MNCs prefer Grade A office space.

Central/Chubu Region Office Real Estate Market Trends:

The Central/Chubu region, with Nagoya as its major city, is an important commercial and industrial hub. The inflating economy of this region, as well as its strategic location between Tokyo and Osaka, is fueling the demand for office spaces bolstered by its close links to automotive production, with Toyota's headquarters nearby. While vacancy rates have marginally increased during the pandemic, demand for office space near Nagoya Station remains strong. The city's continuing renovation initiatives, like the Nagoya Twin Towers, strengthen its appeal.

Kyushu-Okinawa Region Office Real Estate Market Trends:

The Kyushu-Okinawa region provides lower-cost spaces and access to Southeast Asia. In addition, Fukuoka is developing as a tech and startup hub, attracting businesses with tax incentives and office rent subsidies. The city's young population and strategic position near Asian markets increase office space demand. The Hakata and Tenjin districts are undergoing considerable improvements, including the Tenjin Big Bang Project, increasing premium office supply. Meanwhile, the market in Okinawa market remains a niche, catering mostly to tourism-related enterprises.

Tohoku Region Office Real Estate Market Trends:

With the increasing need for conventional offices and flexible workplaces from cities like Sendai, the Tohoku region of northern Japan has emerged as an important market for office real estate. Following the 2011 earthquake, investments in infrastructure resilience resulted in new buildings, such as the Sendai Trust Tower, which improved office quality. In this region, business relocations are rare, and office demand is regional rather than national. Government-backed rehabilitation projects assist in keeping demand stable, but substantial private-sector development remains delayed.

Chugoku Office Real Estate Market Trends:

The ongoing economic growth in Chugoku and the increasing popularity of numerous regional development projects, especially in Hiroshima and Okayama cities, play an important role in Japan’s office real estate market. Significant reconstruction initiatives surrounding Hiroshima Station are improving urban functioning and luring companies. For example, JR West Japan is developing a new station building that will open in spring 2025, which is projected to improve the local office real estate market.

Hokkaido Region Office Real Estate Market Trends:

The Hokkaido region has a smaller and more localized market for office real estate, with Sapporo as its largest contributor. Sapporo is experiencing a rise in office space construction, with approximately 11,000 tsubo (391,414 sq ft) supplied in 2023 and more anticipated for 2024 and 2025. Strong tenant demand has resulted in rising office rentals, reflecting the city's increased economic activity.

Shikoku Region Office Real Estate Market Trends:

As regional infrastructure improves, particularly in cities like Takamatsu, there is a gradual increase in demand for affordable office spaces in the Shikoku region. In Kochi Prefecture, apartments typically cost roughly JPY 185,000 (USD 1,688) per square meter, indicating stable property values. This balance helps to sustain occupancy rates and rental levels, ensuring a stable environment for investors.

Top Companies Leading in the Japan Office Real Estate Industry

There are several companies in the Japan office real estate market. For instance, in December 2024, TE Capital Partners and Tokyo Trust Capital acquired a nearly complete 12-storey office building near the Tokyo Station in a forward purchase agreement. Moreover, Blackstone obtained the Tokyo Garden Terrace Kioicho for USD 2.6 Billion, marking Japan's largest-ever foreign real estate investment.

Japan Office Real Estate Market Segmentation Coverage

- Based on property type, the market has been segmented into high-rise commercial buildings, business parks, mixed-use developments, and coworking spaces. High-rise commercial buildings serve large corporations looking for an exclusive address and state-of-the-art amenities besides closeness to financial hubs. Business parks are popular in suburban or less congested areas, where they offer large and affordable office spaces to industries. Mixed-use development integrates space for residential and leisure facilities, which are especially attractive to companies that value employee convenience and work-life balance. Coworking space is ideal for startups and freelancers looking for flexible and affordable working places.

- Based on the rental model, the market has been categorized into traditional long-term leases, flexible lease arrangements, and coworking/shared office spaces. Traditional long-term leases provide cost predictability and long-term security, suitable for organizations with steady staffing and operations. Flexible lease arrangements cater to companies seeking shorter-term commitments and adaptability to market changes. Coworking and shared office spaces are well-suited for startups and freelancers looking for networking opportunities and operational flexibility.

- Based on the classification, the market has been divided into class A, class B, and Class C. Class A office buildings are usually set up in prime urban locations with access to excellent transportation and amenities. Class B office buildings are referred to as mid-budget properties, offering good quality spaces at a more affordable rental rate. Class C office spaces are old buildings, typically having outdated facilities, and are located in less desirable areas.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 20.7 Billion |

| Market Forecast in 2033 | USD 31.55 Billion |

| Market Growth Rate 2025-2033 | 3.87% |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Property Types Covered | High-Rise Commercial Buildings, Business Parks, Mixed-Use Developments, Coworking Spaces |

| Rental Models Covered | Traditional Long-Term Leases, Flexible Lease Arrangements, Coworking/Shared Office Spaces |

| Classifications Covered | Class A, Class B, Class C |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Office Real Estate Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)