Japan Online Furniture Market Size, Share, Trends and Forecast by Raw Material, Product, Application, and Region, 2026-2034

Japan Online Furniture Market Overview:

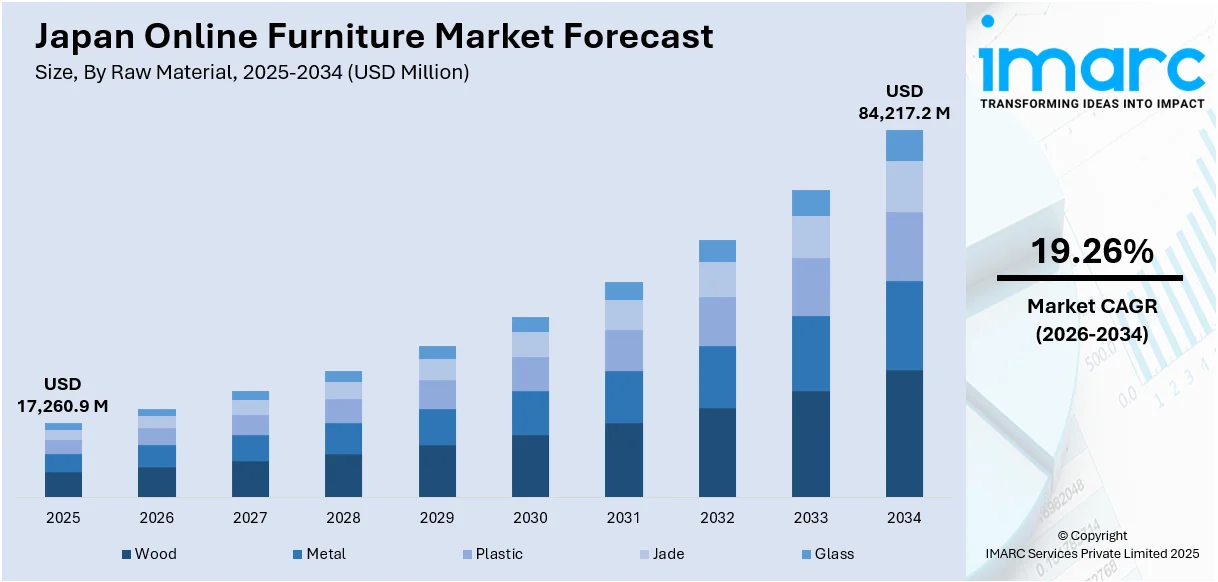

The Japan online furniture market size reached USD 17,260.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 84,217.2 Million by 2034, exhibiting a growth rate (CAGR) of 19.26% during 2026-2034. The market is fueled by changing lifestyles, urbanization, and the ease of e-commerce websites. Minimalist design trends, green purchasing, and individualized shopping experiences are transforming the way furniture is chosen and bought online. Technological innovations, such as augmented reality (AR) technology and customization interfaces, continue to drive user interaction. All these factors together contribute to the upward trend of the Japan online furniture market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 17,260.9 Million |

| Market Forecast in 2034 | USD 84,217.2 Million |

| Market Growth Rate 2026-2034 | 19.26% |

Japan Online Furniture Market Trends:

Aesthetic Driving Product Design

The demand for minimalism continues to influence consumer decisions in Japan's online furniture market. Drawn from classic Japanese culture, the minimalist style focuses on simplicity, clean lines, and utilitarian design. Consumers become more interested in furniture that is versatile for small urban living environments, driving demand for multi-functional products like fold-down tables, beds with storage integration, and modular seating. Internet sites are curating collections that mirror these tastes, and neutral hues and clean profiles are emerging as design touchstones. The ease of viewing well-maintained virtual catalogs with AR previews has also shaped buying habits, harmonizing form and function with digital use. With visual continuity and spatial potency becoming lifestyle imperatives, minimalist aesthetics are likely to be leaders in design trends. Japan's online furniture industry has seen significant growth, driven in part by the increasing popularity of such space-efficient, visually minimalist furniture pieces designed to meet the demands of modern living.

To get more information on this market Request Sample

Eco-Conscious Consumer Behavior Driving Purchases

Sustainability is at the forefront of driving consumer demand in Japan's online furniture market. Environmentally conscious consumers are increasingly looking for materials and manufacturing processes that reflect their green values. For example, in November 2023, Spanish furniture brand esPattio entered Japan with Mediterranean-themed office designs. This entry is part of Japan's expanding online furniture market to meet the demand for distinctive, practical workspace solutions. Furthermore, online stores are reacting by promoting furniture that uses responsibly harvested wood, recycled metals, and biodegradable plastics. Eco-friendly certifications and complete information on the origin of the products are highly becoming key considerations in buying. This is indicative of wider society consciousness regarding carbon footprints and conservation of resources. As consumers in Japan opt for ethical consumption, demand for sustainable, durable, and fixable furniture is on the rise. Transparency throughout product lifecycle and packaging has become a quality benchmark in the online marketplace as well. Japan's e-furniture market has witnessed significant growth as platforms incorporate sustainability as part of their core offering, targeting customers who appreciate design and eco-responsibility in home furnishings.

Personalization Boosting Digital Shopping Experience

Customization is becoming a dominant trend in Japan's internet furniture industry, with shoppers looking for goods that mirror their personal tastes and home surroundings. Highly sophisticated digital interfaces now enable users to choose size, color, material, and composition on the internet retail site. This interactive process not only enables the buyer but also solves the challenge of furniture that adapts to the varied configurations of Japanese interiors. With the addition of AI-based suggestions and virtual room displays, consumers are more confident in customizing their selections prior to purchase. These capabilities close the sensory divide inherent in online shopping, providing a customized path from selection through delivery. According to the reports, in January 2024, Fujitsu, Nitori Holdings, and Home Logistics introduced a quantum-inspired delivery optimization system using Fujitsu's Digital Annealer at 80 distribution centers in Japan, improving last-mile delivery efficiency. Moreover, amplifying demand for one-of-a-kind and real-time adjustable design is transforming consumer expectations. Japan's online furniture industry has seen significant growth, partially fueled by this trend toward individualization, where convenience and personal expression meet in the digital marketplace.

Japan Online Furniture Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on raw material, product, and application.

Raw Material Insights:

- Wood

- Metal

- Plastic

- Jade

- Glass

The report has provided a detailed breakup and analysis of the market based on the raw material. This includes wood, metal, plastic, jade, and glass.

Product Insights:

- Living Room Furniture

- Bedroom Furniture

- Office Furniture

- Kitchen Furniture

- Others

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes living room furniture, bedroom furniture, office furniture, kitchen furniture, and others.

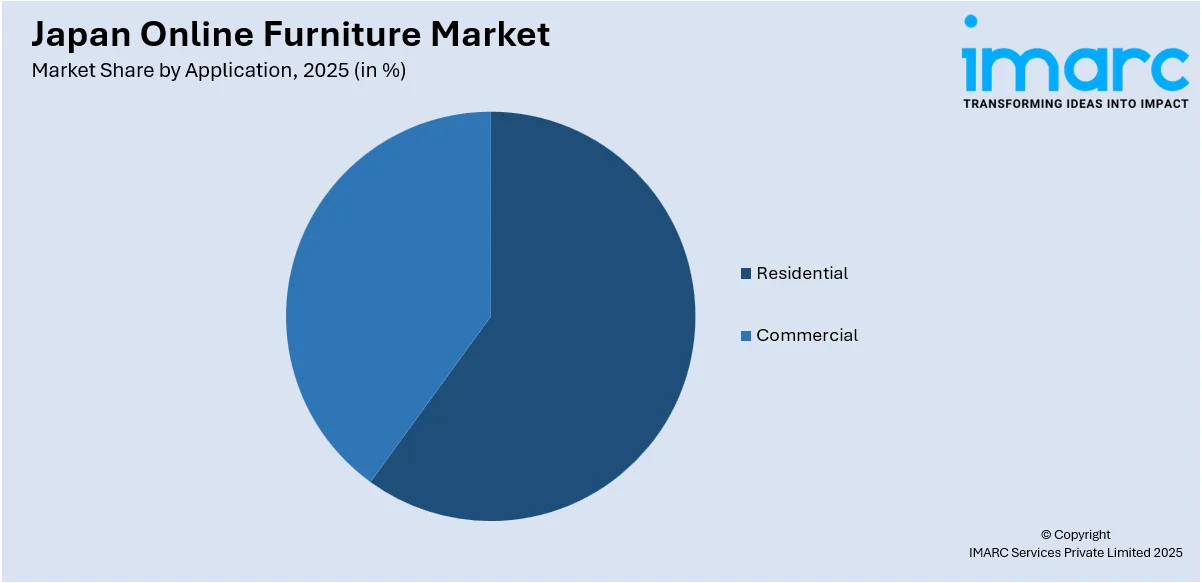

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential and commercial.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto region, Kansai/Kinki region, Central/Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Online Furniture Market News:

- In February 2025, Nitori Furniture, one of Japan's leading online furniture companies, is accelerating its strategic push in Asia, targeting up-and-coming markets like India and the Middle East. In pursuit of this vision, the company will exhibit its most recent innovations at HawaExpo 2025, highlighting its focus on quality, affordability, and digital excellence in Japan's dynamic e-commerce-led furniture market.

- In December 2024, ITOKI launched “Centra,” a multifunctional office table designed for hybrid workspaces, alongside the Levi One-Tone chair. As Japan’s online furniture market grows with demand for flexible, design-forward solutions, ITOKI’s release reflects a shift toward adaptable, collaborative office environments with e-commerce appeal.

Japan Online Furniture Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | Wood, Metal, Plastic, Jade, Glass |

| Products Covered | Living Room Furniture, Bedroom Furniture, Office Furniture, Kitchen Furniture, Others |

| Applications Covered | Residential, Commercial |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan online furniture market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan online furniture market on the basis of raw material?

- What is the breakup of the Japan online furniture market on the basis of product?

- What is the breakup of the Japan online furniture market on the basis of application?

- What is the breakup of the Japan online furniture market on the basis of region?

- What are the various stages in the value chain of the Japan online furniture market?

- What are the key driving factors and challenges in the Japan online furniture?

- What is the structure of the Japan online furniture market and who are the key players?

- What is the degree of competition in the Japan online furniture market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan online furniture market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan online furniture market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan online furniture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)