Japan Over-The-Counter Pain Relievers Market Size, Share, Trends and Forecast by Drug Type, Formulation, Distribution Channel, End User, and Region, 2026-2034

Japan Over-The-Counter Pain Relievers Market Summary:

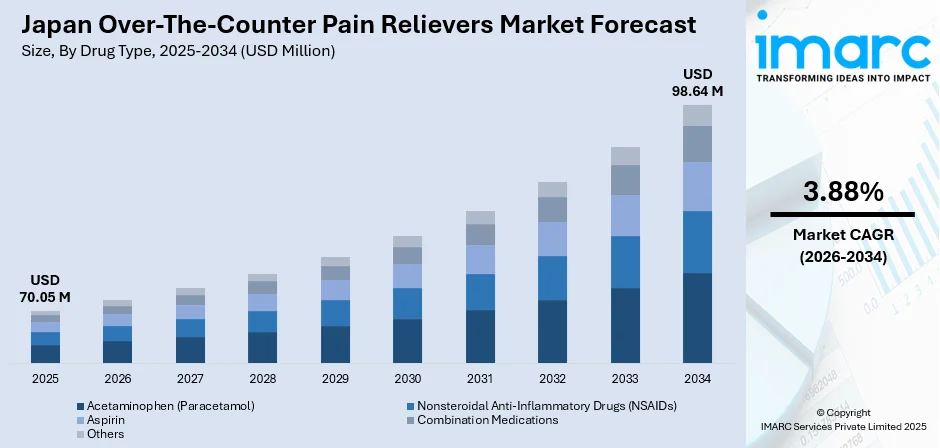

The Japan over-the-counter pain relievers market size was valued at USD 70.05 Million in 2025 and is projected to reach USD 98.64 Million by 2034, growing at a compound annual growth rate of 3.88% from 2026-2034.

The Japan over-the-counter pain relievers market is experiencing steady expansion driven by the country's rapidly aging population and evolving self-medication practices. Consumers increasingly prefer accessible, non-prescription solutions for managing everyday ailments such as headaches, muscle pain, and joint discomfort. The strong pharmaceutical retail infrastructure, coupled with growing health consciousness and government support for self-care initiatives, continues to shape market dynamics favorably.

Key Takeaways and Insights:

- By Drug Type: Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) dominate the market with a share of 36% in 2025, owing to their widespread effectiveness in treating inflammatory conditions and musculoskeletal pain prevalent among Japan's aging demographic.

- By Formulation: Tablets and capsules lead the market with a share of 52% in 2025, driven by consumer preference for convenient oral administration, precise dosing capabilities, and extended shelf stability.

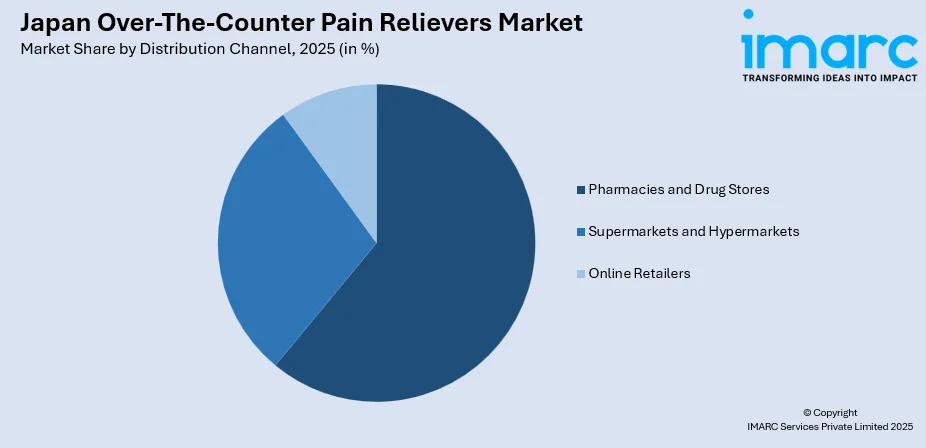

- By Distribution Channel: Pharmacies and drug stores represent the largest segment with a market share of 61% in 2025, supported by pharmacist consultation services, established consumer trust, and comprehensive product availability across urban and rural areas.

- By End User: Adults account for the largest share of 54% in 2025, reflecting the high prevalence of chronic pain conditions among working-age populations and increased reliance on self-medication for productivity maintenance.

- Key Players: The Japan over-the-counter pain relievers market exhibits moderate competitive intensity, with established domestic pharmaceutical companies competing alongside multinational corporations. Market participants focus on product innovation, formulation enhancement, and strategic distribution partnerships to strengthen their positioning across diverse consumer segments.

To get more information on this market Request Sample

The Japan over-the-counter pain relievers market benefits from a robust healthcare ecosystem characterized by high consumer literacy and strong regulatory frameworks ensuring product safety. Japan's demographic transformation, with over 36.25 million elderly individuals comprising nearly 29.3% of the total population as of September 2024, significantly influences demand patterns. Age-related conditions such as arthritis, chronic back pain, and neuropathic disorders are driving sustained interest in accessible pain management solutions. Furthermore, the Japanese government's promotion of self-medication practices to reduce healthcare system burden has created favorable conditions for market expansion. Companies are actively responding with innovative formulations including rapid-dissolve tablets, transdermal patches, and topical applications that address specific consumer needs while minimizing systemic side effects.

Japan Over-The-Counter Pain Relievers Market Trends:

Expansion of E-commerce and Digital Health Platforms

Digital transformation is reshaping how Japanese consumers access pain relief products. Online pharmacies and e-commerce platforms are experiencing substantial growth, offering convenient purchasing options with detailed product information and user reviews. The Japan e-commerce market size reached USD 258.0 Billion in 2024. Looking forward, the market is expected to reach USD 692.8 Billion by 2033, exhibiting a growth rate (CAGR) of 11.02% during 2025-2033. The integration of artificial intelligence-powered recommendation systems and virtual pharmacist consultations is building consumer confidence in digital channels. Japan's tech-savvy population embraces loyalty programs, subscription services, and mobile health applications that enhance the overall purchasing experience while ensuring medication adherence.

Innovation in Formulations and Targeted Delivery Systems

Pharmaceutical companies are prioritizing product innovation to differentiate their offerings in a competitive marketplace. Advanced formulations, including transdermal patches, rapid-absorption gels, and extended-release tablets, are gaining popularity among consumers seeking precise and sustained pain relief. Manufacturers are developing age-appropriate products with easy-to-swallow formats, clear labeling, and reduced side effect profiles specifically designed for elderly users. Natural and herbal-derived pain relief alternatives are also emerging as preferred options among health-conscious consumers seeking gentler treatment approaches.

Regulatory Reforms Enhancing Market Accessibility

Recent regulatory developments are transforming the over-the-counter drug landscape in Japan. In May 2025, Japan's parliament passed legislation enabling OTC drugs to be sold at convenience stores without on-site pharmacists, provided consumers complete online consultations first. This landmark amendment to the Pharmaceuticals and Medical Devices Act aims to improve accessibility, particularly in remote areas with limited pharmacy services. The implementation, expected around spring 2027, will potentially revolutionize distribution channels and significantly expand consumer access to pain relief products.

Market Outlook 2026-2034:

The Japan over-the-counter pain relievers market is positioned for sustained growth throughout the forecast period, supported by favorable demographic trends and evolving consumer preferences. The continued expansion of retail and digital distribution channels will enhance product accessibility across diverse geographic regions. Government initiatives promoting self-medication practices and regulatory reforms facilitating broader retail participation will further strengthen market fundamentals. The market generated a revenue of USD 70.05 Million in 2025 and is projected to reach a revenue of USD 98.64 Million by 2034, growing at a compound annual growth rate of 3.88% from 2026-2034.

Japan Over-The-Counter Pain Relievers Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Drug Type | Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) | 36% |

| Formulation | Tablets and Capsules | 52% |

| Distribution Channel | Pharmacies and Drug Stores | 61% |

| End User | Adults | 54% |

Drug Type Insights:

- Acetaminophen (Paracetamol)

- Nonsteroidal Anti-Inflammatory Drugs (NSAIDs)

- Aspirin

- Combination Medications

- Others

The Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) segment dominates with a market share of 36% of the total Japan over-the-counter pain relievers market in 2025.

NSAIDs maintain their dominant position in the Japanese market due to their proven efficacy in addressing inflammation-related pain conditions commonly experienced by the aging population. Products containing ibuprofen and naproxen are particularly popular for managing arthritis symptoms, muscle strains, and post-exercise soreness. Japanese consumers demonstrate a strong preference for NSAIDs because of their dual action in providing pain relief while reducing inflammation, making them suitable for various musculoskeletal conditions that increase in prevalence with age.

Pharmaceutical manufacturers continue investing in NSAID product development with improved formulations that minimize gastrointestinal side effects, a significant concern among elderly users. The availability of diverse NSAID options across multiple price points enables broad market penetration, while ongoing pharmacist education programs enhance consumer confidence in appropriate product selection. Strategic marketing emphasizing safety profiles and efficacy supports sustained demand across demographic segments. For instance, in November 2023, Japan’s Hisamitsu Pharmaceutical introduced the Salonpas® Diclofenac Patch 1% in Singapore, marking the brand’s first product formulated with diclofenac. This clinically trusted active ingredient is known for its strong therapeutic effect, delivering deep penetration to target and relieve pain at its source.

Formulation Insights:

- Tablets and Capsules

- Gels and Ointments

- Sprays

- Liquids and Syrups

The tablets and capsules segment leads with a share of 52% of the total Japan over-the-counter pain relievers market in 2025.

Tablets and capsules maintain overwhelming market dominance owing to their convenience, portability, and familiar administration route among Japanese consumers. These oral formulations offer precise dosing control essential for safe self-medication practices, while their extended shelf life and easy storage requirements align with practical consumer needs. The Japanese pharmaceutical industry has developed numerous tablet innovations, including rapid-dissolve variants and film-coated options that improve palatability and absorption characteristics.

Consumer acceptance of tablet and capsule formulations remains exceptionally high due to decades of established usage patterns and strong pharmacist recommendations. Manufacturers continuously refine product sizes and swallowability features to accommodate elderly consumers who may have trouble with larger tablets. The segment benefits from efficient manufacturing processes that enable competitive pricing while maintaining consistent quality standards expected by discerning Japanese consumers.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Pharmacies and Drug Stores

- Supermarkets and Hypermarkets

- Online Retailers

The pharmacies and drug stores segment exhibits a clear dominance with a 61% share of the total Japan over-the-counter pain relievers market in 2025.

Pharmacies and drug stores command the largest market share due to their integral role in Japan's healthcare delivery system and the trust consumers place in pharmacist guidance. These establishments offer comprehensive product selections, professional consultation services, and personalized recommendations that particularly appeal to elderly consumers managing chronic pain conditions. The extensive network of drugstore chains throughout Japan, including both urban centers and suburban areas, ensures widespread product accessibility.

Japanese drugstores have evolved beyond simple retail outlets into health consultation destinations where consumers receive medication counseling and lifestyle advice. Retail sales in Japan advanced consistently, marking sustained growth in the drugstore sector. Store pharmacists play crucial roles in educating consumers about appropriate product selection, dosage guidelines, and potential drug interactions, reinforcing the channel's position as the preferred purchasing destination for pain relief products.

End User Insights:

- Adults

- Pediatric

- Geriatric

The adults segment dominates with a 54% share of the total Japan over-the-counter pain relievers market in 2025.

Adults constitute the largest end-user segment reflecting the high incidence of work-related stress, lifestyle-induced pain conditions, and the need for quick relief solutions that support productivity. Working-age Japanese consumers frequently experience headaches, muscle tension, and chronic pain associated with sedentary office work and demanding professional schedules. The preference for self-medication among this demographic stems from time constraints that limit clinic visits and the convenience of readily available OTC solutions.

Manufacturers target the adult segment with diverse product portfolios addressing specific pain types, including tension headaches, menstrual discomfort, and sports-related injuries. Marketing strategies emphasize rapid relief, convenient packaging suitable for workplace use, and formulations that minimize drowsiness or other side effects that could impact work performance. The segment's sustained growth reflects broader societal trends toward independent health management among Japan's working population.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto region’s OTC pain reliever demand is fueled by its dense population, fast-paced urban lifestyles, and rising self-medication habits among working professionals. High healthcare accessibility encourages consumers to treat headaches, muscle pain, and menstrual discomfort with OTC options. Strong retail penetration. convenience stores, drugstores, and e-commerce support rapid product uptake. Growing awareness of non-prescription analgesics and preference for quick relief solutions further accelerate market expansion.

In Kansai, demand is driven by an aging population and rising incidents of chronic pain linked to lifestyle-related conditions. Urban centers like Osaka and Kyoto support strong pharmacy networks and high product visibility. Consumers increasingly favor OTC options for everyday ailments to avoid clinic visits. Marketing campaigns highlighting safety, fast action, and combination formulations also strengthen uptake, alongside greater trust in Japanese pharmaceutical brands.

The Chubu market benefits from a large manufacturing workforce experiencing muscle strain and fatigue, boosting purchases of OTC pain relievers for quick recovery. Rising tourist inflows in areas like Nagoya and the Alps region also contribute to strong retail sales. Increased use of topical analgesics and multi-symptom medications reflects consumer preference for targeted relief. The market continues to grow thanks to extensive distribution across pharmacies, grocery stores, and travel retail outlets.

OTC pain reliever use in Kyushu–Okinawa is propelled by a growing elderly demographic and high prevalence of joint pain and inflammatory conditions. Rural communities rely heavily on self-care due to limited specialist access, increasing dependence on OTC solutions. Tourism-heavy Okinawa boosts demand for convenient, travel-friendly products. Expansion of regional pharmacy chains and greater awareness of herbal and mild formulations also support market momentum.

The Tohoku region sees rising demand due to an aging population and colder climate, which contributes to muscular stiffness and seasonal pain issues. Limited medical infrastructure in remote areas encourages frequent reliance on OTC analgesics. Consumers prefer affordable, easy-to-access pain solutions, with topical patches and heat-based products particularly popular. Growing digital health engagement and expanding e-commerce availability further drive adoption.

In the Chugoku region, self-medication trends continue to strengthen as people manage headaches, muscle pain, and fatigue without visiting clinics. The region’s industrial workforce often seeks fast-acting OTC analgesics to maintain productivity. Enhanced distribution networks and promotional activities in drugstores boost visibility. Increasing preference for trusted domestic brands and combination pain-relief formulas tailored to multiple symptoms further reinforces regional market growth.

Hokkaido’s colder climate leads to higher instances of muscle stiffness, joint discomfort, and seasonal pain, driving strong demand for OTC pain relievers, especially topical warm patches. An aging population further contributes to consistent consumption. Rural areas with limited healthcare access rely more heavily on OTC products. Growth in winter tourism boosts sales of convenient pain-relief options through pharmacies, convenience stores, and resort retail channels.

The Shikoku market is driven by a sizable elderly population seeking accessible solutions for chronic and age-related pain. Limited access to specialist clinics increases reliance on OTC analgesics for routine pain management. Consumers show a strong preference for gentle, non-invasive formulations such as topical creams and heat patches. Improved pharmacy penetration and rising health awareness campaigns by local retailers continue to support market expansion across the region.

Market Dynamics:

Growth Drivers:

Why is the Japan Over-The-Counter Pain Relievers Market Growing?

Rapidly Aging Population Driving Healthcare Demand

Japan’s demographic transformation is a key driver of ongoing market growth. The country has a notably aging population, which is closely linked to a higher incidence of age-related pain conditions such as osteoarthritis, chronic back pain, and neuropathic disorders. Older consumers increasingly favor convenient OTC solutions that allow them to manage pain independently. In response, pharmaceutical companies are developing senior-friendly formulations with easy-to-use packaging, clear instructions, and minimized side effects tailored to elderly users.

Government Support for Self-Medication Practices

Japanese government initiatives actively promote self-medication as a strategy for reducing healthcare system burden and controlling escalating medical costs. Regulatory bodies have implemented supportive policies that facilitate broader access to OTC medications while ensuring product safety standards. The Ministry of Health, Labour and Welfare has acknowledged self-medication promotion as a key healthcare policy objective, encouraging consumers to manage minor ailments independently. Tax incentives for self-medication purchases and expanded insurance coverage for OTC drugs further reinforce the government's commitment to fostering a self-care culture that benefits both individual health outcomes and healthcare system sustainability.

Expanding Distribution Networks and Channel Innovation

The continuous expansion and modernization of distribution channels significantly enhances product accessibility throughout Japan. Traditional pharmacy networks maintain comprehensive geographic coverage while embracing digital transformation through online ordering systems and delivery services. The recent legislative approval enabling OTC drug sales at convenience stores marks a transformative development that will substantially increase consumer touchpoints. This regulatory evolution reflects government recognition that improved accessibility, particularly in underserved rural areas, serves public health objectives. Digital platforms complement physical retail through detailed product information, personalized recommendations, and seamless purchasing experiences that appeal to technology-oriented consumers.

Market Restraints:

What Challenges the Japan Over-The-Counter Pain Relievers Market is Facing?

Stringent Regulatory Requirements

Japan's pharmaceutical regulatory framework imposes rigorous compliance standards that can constrain market entry and product innovation timelines. The approval process for new OTC formulations involves extensive documentation, clinical evidence requirements, and prolonged review periods. Companies must navigate complex categorization systems that determine permissible sales channels and marketing approaches, creating operational complexities particularly for international manufacturers seeking market access.

Concerns Over Medication Misuse

Growing awareness of potential medication misuse, particularly among younger populations, has prompted regulatory scrutiny and potential sales restrictions. The Japanese government has implemented measures including purchase quantity limits and age verification requirements for certain products to address social concerns regarding drug abuse. These precautionary measures, while important for public health protection, can create operational challenges and consumer inconvenience that may impact sales volumes.

Intense Competitive Pressure

The mature Japanese OTC market features established domestic players and multinational corporations competing intensively across product categories. Price sensitivity among consumers, combined with proliferation of comparable products, compresses profit margins and challenges brand differentiation strategies. Companies must continuously invest in marketing, product development, and distribution optimization to maintain competitive positioning in this crowded marketplace.

Competitive Landscape:

The Japan over-the-counter pain relievers market exhibits moderate competitive intensity characterized by the presence of established domestic pharmaceutical companies alongside significant multinational participation. Market leaders focus on continuous product innovation, brand building, and distribution expansion to maintain competitive advantages. Strategic partnerships between manufacturers and retail chains enable optimized product placement and promotional effectiveness. Companies increasingly invest in research and development for advanced formulations that address specific consumer needs while differentiating from generic alternatives. The competitive landscape rewards organizations that successfully balance product quality, pricing competitiveness, and distribution reach while maintaining strong pharmacist relationships and consumer brand loyalty.

Recent Developments:

- April 2024: Hisamitsu Pharmaceutical Co., Ltd. introduced its flagship Salonpas pain management solution in Nigeria, demonstrating the international expansion strategies of Japanese healthcare brands.

Japan Over-The-Counter Pain Relievers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Drug Types Covered | Acetaminophen (Paracetamol), Nonsteroidal Anti-Inflammatory Drugs (NSAIDs), Aspirin, Combination Medications, Others |

| Formulations Covered | Tablets and Capsules, Gels and Ointments, Sprays, Liquids and Syrups |

| Distribution Channels Covered | Pharmacies and Drug Stores, Supermarkets and Hypermarkets, Online Retailers |

| End Users Covered | Adult, Pediatric, Geriatric |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan over-the-counter pain relievers market size was valued at USD 70.05 Million in 2025.

The Japan over-the-counter pain relievers market is expected to grow at a compound annual growth rate of 3.88% from 2026-2034 to reach USD 98.64 Million by 2034.

Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) held the largest share at 36% in 2025, driven by their effectiveness in treating inflammation-related pain conditions prevalent among Japan's aging population and their dual action, providing pain relief while reducing inflammation.

Key factors driving the Japan over-the-counter pain relievers market include the rapidly aging population with increased prevalence of chronic pain conditions, government support for self-medication practices, expanding distribution networks including digital channels, and continuous product innovation in formulations and delivery systems.

Major challenges include stringent regulatory requirements that constrain market entry and product innovation timelines, concerns over medication misuse prompting sales restrictions, intense competitive pressure from established domestic and multinational players, and price sensitivity among consumers affecting profit margins.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)