Japan Paper and Paperboard Packaging Market Size, Share, Trends and Forecast by Type, End User, and Region, 2025-2033

Japan Paper and Paperboard Packaging Market Overview:

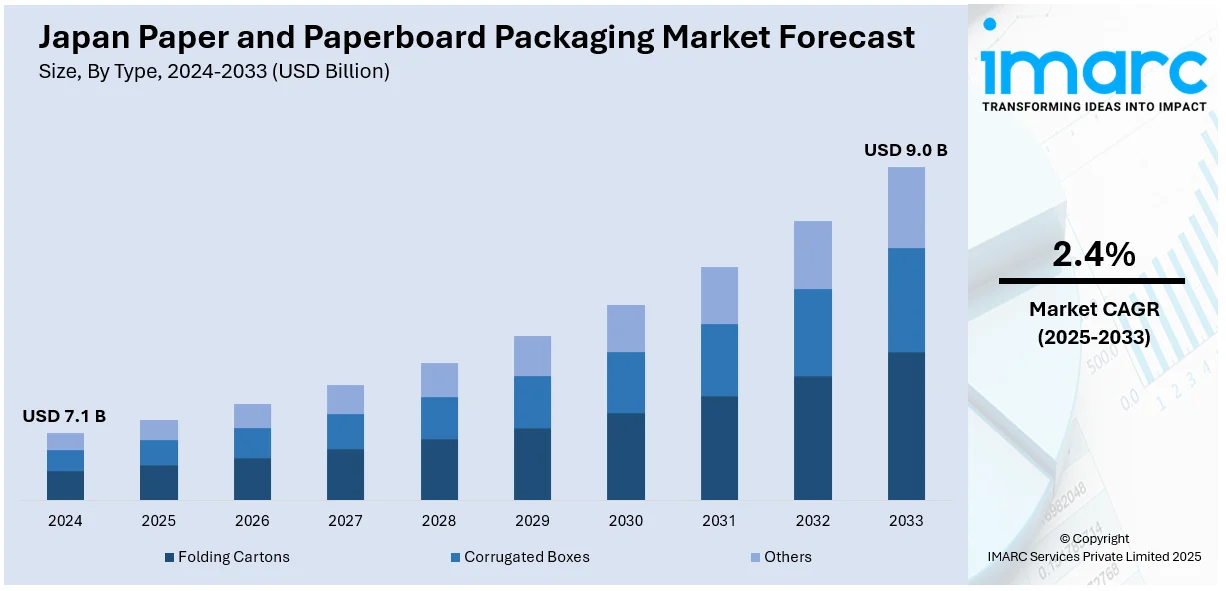

The Japan paper and paperboard packaging market size reached USD 7.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 9.0 Billion by 2033, exhibiting a growth rate (CAGR) of 2.4% during 2025-2033. The market involves increasing environmental issues, government policies driving sustainability, the growth of e-commerce necessitating effective and adaptable packaging solutions, and technology advancements that enhance packaging functionality, strength, and consumer interaction, all driving eco-friendly and better packaging options.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7.1 Billion |

| Market Forecast in 2033 | USD 9.0 Billion |

| Market Growth Rate (2025-2033) | 2.4% |

Japan Paper and Paperboard Packaging Market Trends:

Sustainability and Environmental Awareness Driving Eco-Friendly Packaging

Japan is witnessing a significant shift toward eco-conscious packaging due to growing environmental awareness and government initiatives aimed at reducing plastic waste. As a result, companies across various sectors, especially food, cosmetics, and retail, are adopting paper and paperboard alternatives to plastic. These materials are seen as more sustainable due to their recyclability and biodegradability. Government policies encouraging responsible consumption are reinforcing this trend, pushing brands to redesign packaging using renewable and responsibly sourced materials. Additionally, consumers are becoming more mindful of their environmental impact and are favoring brands that align with sustainable values. This collective movement is making eco-friendly packaging not just a regulatory requirement but also a competitive advantage in the Japan paper and paperboard packaging market outlook.

Technological Innovations Enhancing Packaging Performance

The Japan paper packaging sector is transforming through constant innovation to enhance functionality and appearance. Developments in material science have enabled the creation of paperboard that is more robust, resistant to water, and capable of meeting rigorous applications such as food packaging. The developments enable paper to match plastic in terms of durability and protecting products. Furthermore, the use of digital technologies such as QR codes or smart labels is adding value to packaging as it facilitates traceability, interactive consumer participation, and brand openness. In Japan, close to 90% of restaurants are using QR codes for menus, indicating the country's adoption of digital solutions. These advanced capabilities allow brands to connect with consumers directly, providing information and tailored experiences through packaging itself. With technology ever-evolving, these advances are being incorporated into Japanese firms to remain competitive and address shifting customer demands further fueling the Japan paper and paperboard packaging market growth.

Growth of E-commerce Fueling Customized Packaging Solutions

Japan's vibrant e-commerce scene has given rise to new packaging requirements that are not only protective but also interactive. Paper and paperboard packaging are being customized more and more to suit the particular requirements of online shopping from effective storage and secure transportation to improving the customer's unboxing experience. Companies are emphasizing making lightweight yet resilient packaging that optimizes protection along with eco-friendliness. At the same time, Japan paper and paperboard packaging market share surge owing to the rising digital printing and design technologies are enabling greater personalization. Brands are crafting unique packaging styles to build stronger emotional connections with customers and strengthen brand identity. This trend is redefining paper packaging not just as a protective layer, but as a vital part of the customer journey in an online-driven economy.

Japan Paper and Paperboard Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type and end user.

Type Insights:

- Folding Cartons

- Corrugated Boxes

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes folding cartons, corrugated boxes, and others.

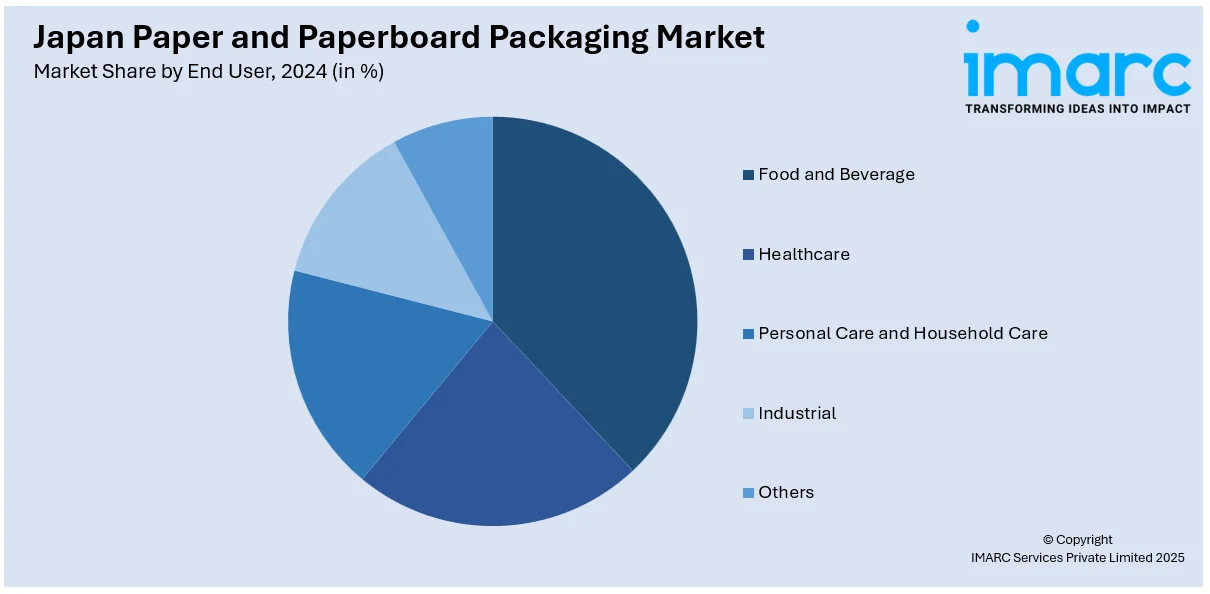

End User Insights:

- Food and Beverage

- Healthcare

- Personal Care and Household Care

- Industrial

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes food and beverage, healthcare, personal care and household care, industrial, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto, Kansai/Kinki, Central/ Chubu, Kyushu-Okinawa, Tohoku, Chugoku, Hokkaido, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Paper and Paperboard Packaging Market News:

- In October 2024, Japan Pulp & Paper Co., Ltd. announced that BJ Ball Limited, a subsidiary of its Ball & Doggett Group, has acquired a flexible packaging business in New Zealand. Additionally, Ball & Doggett Pty Ltd, also part of the Group, has acquired a sign & display business in Australia, strengthening its position in both sectors in Oceania.

- In July 2024, Rengo Co., Ltd. acquired 100% of Shibata Cardboard Co., Ltd., making it a subsidiary. Established in 1962, Shibata Cardboard is a corrugated box manufacturer with a strong local customer base in Toyohashi, Aichi Prefecture. Rengo plans to enhance cooperation between Shibata Cardboard and its own plants, as well as other Rengo Group companies, to strengthen its corrugated packaging business in eastern Aichi and surrounding areas.

Japan Paper and Paperboard Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Folding Cartons, Corrugated Boxes, Others |

| End Users Covered | Food and Beverage, Healthcare, Personal Care and Household Care, Industrial, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan paper and paperboard packaging market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan paper and paperboard packaging market on the basis of type?

- What is the breakup of the Japan paper and paperboard packaging market on the basis of end user?

- What is the breakup of the Japan paper and paperboard packaging market on the basis of region?

- What are the various stages in the value chain of the Japan paper and paperboard packaging market?

- What are the key driving factors and challenges in the Japan paper and paperboard packaging?

- What is the structure of the Japan paper and paperboard packaging market and who are the key players?

- What is the degree of competition in the Japan paper and paperboard packaging market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan paper and paperboard packaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan paper and paperboard packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan paper and paperboard packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)