Japan Personal Finance Software Market Size, Share, Trends and Forecast by Product Type, End User, and Region, 2026-2034

Japan Personal Finance Software Market Overview:

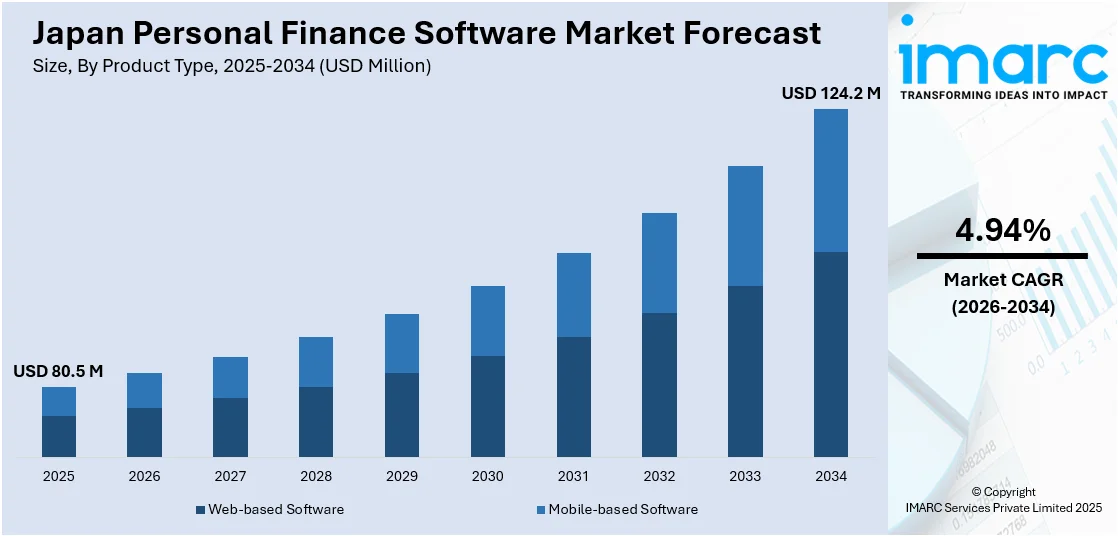

The Japan personal finance software market size reached USD 80.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 124.2 Million by 2034, exhibiting a growth rate (CAGR) of 4.94% during 2026-2034. The market is expanding attributed to the rising demand for digital financial management tools because of the increased awareness about financial wellness, the growing focus on retirement planning and wealth management, and the widespread use of smartphones and online banking services among younger demographics.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 80.5 Million |

| Market Forecast in 2034 | USD 124.2 Million |

| Market Growth Rate 2026-2034 | 4.94% |

Japan Personal Finance Software Market Trends:

Increasing Demand for Digital Financial Management Solutions

A growing number of individuals and families are becoming more aware about their financial wellness, which is driving the need for digital financial management tools. This pattern is particularly noticeable among younger groups, who are more frequently relying on software tools to handle expenses, investments, savings, and budgeting. The move towards digital tools indicates higher preferences for convenience, automation, and straightforward access to financial information, which is accelerating the uptake of personal finance applications. These tools are becoming essential for effective financial management, as they allow users to track expenditures, set financial targets, and oversee investment portfolios all on a single integrated platform. This trend is also driven by the widespread use of smartphones and the increasing comfort with online banking and financial services. According to the Statistics Handbook of Japan 2024, the status of Internet use by device and age group as of the end of August 2023 shows that smartphones had the highest usage rate (72.9 percent), with computers coming next (47.4 percent). Data on Internet usage by device across various age groups indicates that over 80 percent of individuals aged 13 to 59 use smartphones. The growing familiarity with online banking and digital financial services is also significant, as users get more used to handling their finances via mobile devices or computers. As digital tools evolve to be more advanced and accessible, personal finance software is regarded as essential for handling contemporary finances.

To get more information on this market Request Sample

Rising Interest in Retirement Planning and Wealth Management

The Japan personal finance software market is growing as attention to retirement planning and wealth management rises, especially with the ongoing increase in Japan's aging population This change in demographics is motivating people to take more initiative in planning for retirement. As life expectancies rises and the demand for financial autonomy in retirement grows, there is an increase in interest in resources that aid in long-term savings and investment plans. Personal finance applications that offer features like pension monitoring, forecasting retirement needs, and diversifying investments are becoming increasingly popular. These resources assist individuals, particularly in their 30s to 50s, in preparing for a financially stable retirement by offering insights on achieving their preferred income levels after they retire. This trend is additionally fueled by the growing recognition about the importance of effective wealth management strategies. User-friendly software platforms that provide customized retirement planning and wealth-growth tools are becoming vital, allowing individuals to make informed financial choices for their future. As the need for retirement planning tools increases, personal finance software is becoming essential for people to guarantee they possess the resources necessary to support their preferred lifestyle during retirement.

Japan Personal Finance Software Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on product type, and end user.

Product Type Insights:

- Web-based Software

- Mobile-based Software

The report has provided a detailed breakup and analysis of the market based on the product type. This includes web-based software and mobile-based software.

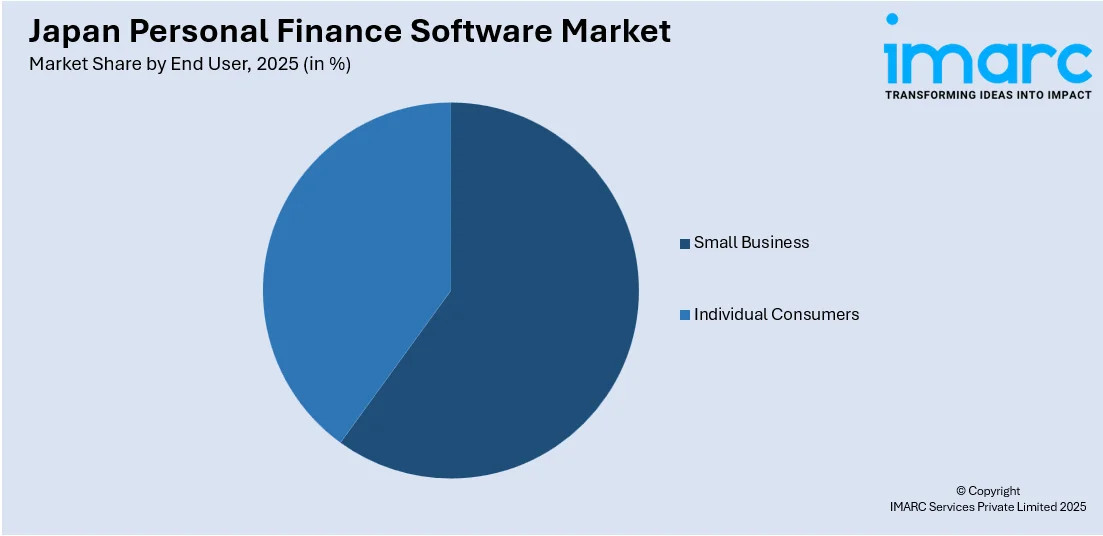

End User Insights:

Access the comprehensive market breakdown Request Sample

- Small Business

- Individual Consumers

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes small business and individual consumers.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Personal Finance Software Market News:

- In November 2024, SmartBank, a Tokyo-based fintech startup, secured $26 million in funding. The company offered a personal finance management app with prepaid cards and aimed to become a comprehensive financial platform. SmartBank planned to use the funds for expansion and AI integration to optimize financial activities for its users.

Japan Personal Finance Software Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Web-based Software, Mobile-based Software |

| End Users Covered | Small Business, Individual Consumers |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan personal finance software market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan personal finance software market on the basis of product type?

- What is the breakup of the Japan personal finance software market on the basis of end user?

- What is the breakup of the Japan personal finance software market on the basis of region?

- What are the various stages in the value chain of the Japan personal finance software market?

- What are the key driving factors and challenges in the Japan personal finance software market?

- What is the structure of the Japan personal finance software market and who are the key players?

- What is the degree of competition in the Japan personal finance software market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan personal finance software market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan personal finance software market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan personal finance software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)