Japan Pharmaceutical Labeling Market Size, Share, Trends and Forecast by Label Type, Material, Application, End Use, and Region, 2026-2034

Japan Pharmaceutical Labeling Market Summary:

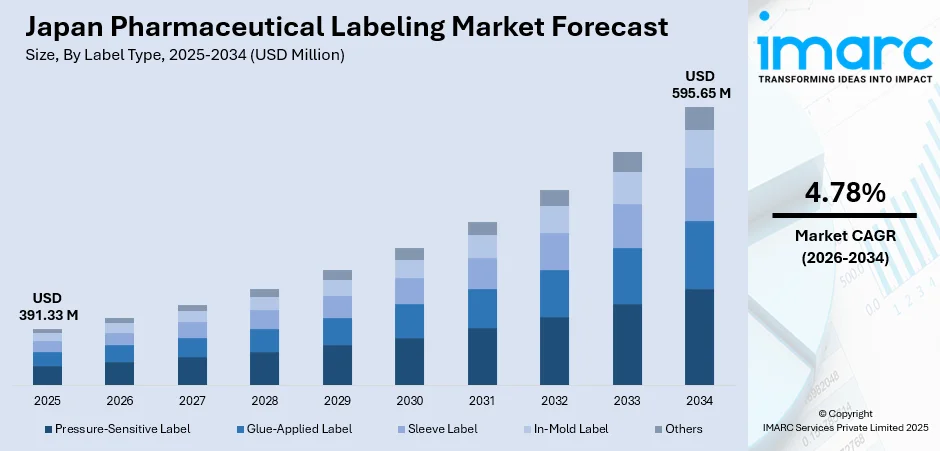

The Japan pharmaceutical labeling market size was valued at USD 391.33 Million in 2025 and is projected to reach USD 595.65 Million by 2034, growing at a compound annual growth rate of 4.78% from 2026-2034.

The market is driven by stringent regulatory compliance requirements, the growing demand for advanced packaging solutions, and the increasing focus on patient safety and drug traceability. Japan's aging population continues to fuel pharmaceutical consumption, necessitating innovative labeling technologies that ensure accurate dosage information and tamper-evident features. The adoption of smart labels and serialization technologies further propels market expansion, contributing to the Japan pharmaceutical labeling market share.

Key Takeaways and Insights:

- By Label Type: Pressure-sensitive label dominates the market with a share of 48% in 2025, driven by their versatility in adhering to various packaging surfaces, ease of application, and ability to accommodate complex information requirements mandated by Japanese pharmaceutical regulations.

- By Material: Polymer film leads the market with a share of 48% in 2025, owing to its superior durability, moisture resistance, and compatibility with high-speed labeling equipment essential for pharmaceutical manufacturing operations across Japan.

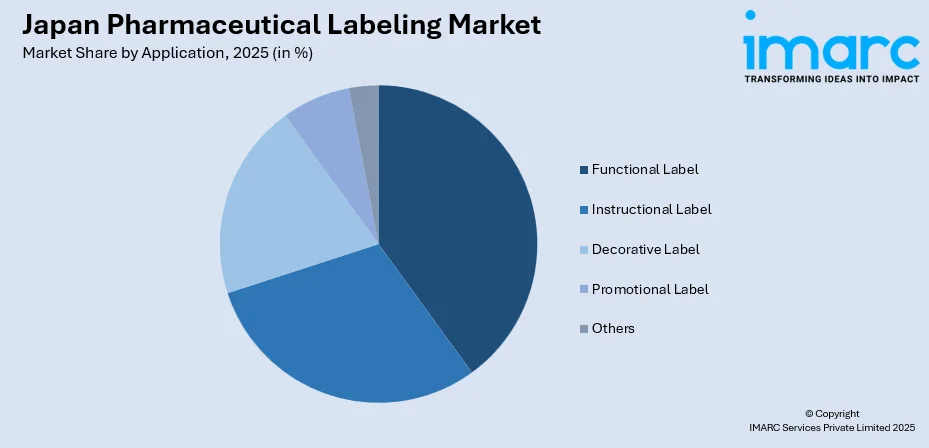

- By Application: Functional label represents the largest segment with a market share of 34% in 2025, attributed to rising demand for labels incorporating tamper-evident features, temperature indicators, and authentication elements ensuring product integrity and patient safety.

- By End Use: Bottles dominate the market with a share of 29% in 2025, supported by widespread utilization in prescription medications, over-the-counter drugs, and liquid pharmaceutical formulations requiring comprehensive labeling information.

- Key Players: The market exhibits a moderately consolidated competitive structure, with established domestic manufacturers competing alongside international labeling solution providers across various product segments. Market participants emphasize technological innovation, regulatory compliance expertise, and strategic partnerships to strengthen their market positioning and address evolving customer requirements.

To get more information on this market Request Sample

The Japan pharmaceutical labeling market is witnessing consistent growth due to a combination of regulatory, demographic, and product complexity factors. As one of the largest pharmaceutical markets globally, Japan requires advanced labeling solutions that fully comply with the stringent standards set by the Pharmaceuticals and Medical Devices Agency. As per source, Japan’s PMDA reported concluding FY 2024–25 with 148 approval decisions, including 66 new active ingredients and 82 lifecycle updates, reflecting sustained regulatory activity across multiple therapeutic areas. Moreover, the country’s rapidly geriatric population drives higher medication consumption, emphasizing the need for labels that clearly communicate dosage instructions, warnings, and safety information. At the same time, the rise of biologics and specialty medications adds complexity, necessitating labeling technologies that can manage extensive product information without compromising usability or visual clarity. This convergence of factors reinforces the critical role of precise, compliant, and functional labeling in Japan’s pharmaceutical sector.

Japan Pharmaceutical Labeling Market Trends:

Adoption of Smart Labeling Technologies and Digital Integration

The pharmaceutical labeling landscape in Japan is witnessing accelerated adoption of smart labeling technologies that incorporate near-field communication chips, quick response codes, and radio-frequency identification capabilities. According to sources, in 2024, TOPPAN Digital introduced a dual-frequency IC tag label with tamper-detection for pharmaceutical use, enabling UHF and NFC tracking to enhance traceability, authenticity verification, and operational efficiency. Moreover, these intelligent labeling solutions enable real-time product tracking throughout the supply chain, enhance traceability from manufacturing facilities to end consumers, and provide interactive platforms for patients to access comprehensive medication information. Healthcare providers and pharmaceutical manufacturers increasingly recognize the value of digitally enabled labels in combating counterfeit medications, improving supply chain transparency, and facilitating better patient engagement with their treatment regimens.

Growing Emphasis on Sustainable and Eco-Friendly Labeling Materials

Environmental sustainability considerations are reshaping material selection and manufacturing processes within the pharmaceutical labeling sector. Japanese pharmaceutical companies and labeling manufacturers are increasingly transitioning toward biodegradable substrates, recyclable adhesives, and water-based inks that minimize environmental impact while maintaining the durability and performance characteristics essential for pharmaceutical applications. In May 2025, Kaneka announced Shionogi Pharma’s adoption of its 100% biomass-based biodegradable polymer Green Planet™ for PTP banding films, marking the pharmaceutical industry’s first use of such eco-friendly material. Moreover, this sustainability-focused approach aligns with broader corporate responsibility initiatives and responds to growing consumer awareness regarding environmental stewardship. The development of thinner film constructions and linerless label technologies further contributes to waste reduction objectives throughout the pharmaceutical packaging value chain.

Enhanced Focus on Serialization and Anti-Counterfeiting Features

Pharmaceutical serialization requirements and anti-counterfeiting measures continue to drive innovation in labeling technologies across the Japanese market. Manufacturers are implementing sophisticated security features including holographic elements, tamper-evident closures, color-shifting inks, and unique identification codes that enable product authentication at every stage of distribution. These advanced security labeling solutions protect patient safety by ensuring medication authenticity, while simultaneously safeguarding brand reputation and intellectual property. The integration of track-and-trace capabilities within labeling systems supports regulatory compliance objectives and enables rapid response to potential product recalls or quality concerns. In December 2025, Fujitsu launched multi-AI agent collaboration technology with Rohto Pharmaceutical, enabling secure, real-time supply chain tracking and serialization, enhancing anti-counterfeiting measures and regulatory compliance across Japanese pharmaceutical distribution.

Market Outlook 2026-2034:

The Japan pharmaceutical labeling market revenue is projected to demonstrate consistent growth throughout the forecast period, supported by sustained pharmaceutical industry expansion and evolving regulatory requirements. Technological advancements in printing capabilities, substrate materials, and functional label applications are expected to create new revenue opportunities for market participants. The increasing prevalence of chronic diseases among Japan's geriatric population will continue driving pharmaceutical consumption and corresponding labeling demand. Strategic investments in automation, quality control systems, and innovative labeling technologies will position market leaders to capitalize on emerging opportunities. The market generated a revenue of USD 391.33 Million in 2025 and is projected to reach a revenue of USD 595.65 Million by 2034, growing at a compound annual growth rate of 4.78% from 2026-2034.

Japan Pharmaceutical Labeling Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Label Type | Pressure-Sensitive Label | 48% |

| Material | Polymer Film | 48% |

| Application | Functional Label | 34% |

| End Use | Bottles | 29% |

Label Type Insights:

- Pressure-Sensitive Label

- Glue-Applied Label

- Sleeve Label

- In-Mold Label

- Others

Pressure-sensitive label dominates with a market share of 48% of the total Japan pharmaceutical labeling market in 2025.

Pressure-sensitive label maintains dominant market positioning within Japan's pharmaceutical labeling sector due to their exceptional versatility and application efficiency. These self-adhesive labeling solutions offer pharmaceutical manufacturers significant operational advantages including high-speed application compatibility, minimal equipment requirements, and adaptability to diverse container shapes and materials. The multi-layered construction comprising facestock, adhesive, and release liner provides reliable performance across varying storage and transportation conditions. According to sources, in Japanese PSA manufacturers increasingly adopted APEO-free water-based emulsions, reducing environmental impact by eliminating toxic alkylphenol compounds and aligning pressure-sensitive adhesive production with global green chemistry principles.

The continued preference for pressure-sensitive labels reflects their ability to accommodate extensive pharmaceutical information requirements while maintaining visual clarity and aesthetic appeal. These labels support various finishing options including lamination, embossing, and specialty coatings that enhance durability and protect printed content from environmental degradation. Japanese pharmaceutical companies particularly value pressure-sensitive labels for their compatibility with automated labeling equipment and consistent application quality across high-volume production environments.

Material Insights:

- Paper

- Polymer Film

- Others

Polymer film leads with a share of 48% of the total Japan pharmaceutical labeling market in 2025.

Polymer film materials command significant market share within the Japanese pharmaceutical labeling industry owing to their superior functional properties compared to traditional paper-based alternatives. As of October 2024, TOPPAN, RM Tocello, and Mitsui Chemicals began offering pouch samples made from horizontally recycled printed OPP film, suitable for mass production. These synthetic substrates offer exceptional moisture resistance, chemical stability, and dimensional consistency essential for maintaining label integrity throughout pharmaceutical product lifecycles. The inherent durability of polymer films ensures label legibility and adhesion performance under diverse storage conditions including refrigeration and humidity exposure.

Pharmaceutical manufacturers increasingly specify polymer film labels for products requiring extended shelf stability and resistance to handling wear. Polyethylene, polypropylene, and polyester variants provide distinct performance characteristics suitable for specific application requirements. The conformability of certain polymer films enables seamless application to curved container surfaces, while transparent film options create no-label-look aesthetics valued for premium pharmaceutical products. Advanced polymer formulations support high-resolution printing and security feature integration demanded by contemporary pharmaceutical labeling applications.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Instructional Label

- Decorative Label

- Functional Label

- Promotional Label

- Others

Functional label exhibits a clear dominance with a 34% share of the total Japan pharmaceutical labeling market in 2025.

Functional label represents the fastest-growing application segment within Japan pharmaceutical labeling market, driven by increasing emphasis on product security, patient safety, and supply chain visibility. These specialized labeling solutions extend beyond basic identification to incorporate active functionality including tamper-evidence indication, temperature monitoring, and authentication verification. Moreover, the integration of functional elements within pharmaceutical labels addresses critical regulatory requirements and consumer protection concerns.

Japanese pharmaceutical regulations increasingly mandate functional labeling features that demonstrate product integrity and enable traceability throughout distribution channels. Tamper-evident labels provide visible indication of potential product interference, while temperature-sensitive indicators alert handlers to potential cold chain breaches affecting medication efficacy. The convergence of functional requirements with digital technologies enables sophisticated labeling solutions that support authentication, track-and-trace compliance, and patient engagement initiatives across the pharmaceutical sector.

End Use Insights:

- Bottles

- Blister Packs

- Parenteral Containers

- Pre-Fillable Syringes

- Pre-Fillable Inhalers

- Pouches

- Others

Bottles dominate with a market share of 29% of the total Japan pharmaceutical labeling market in 2025.

Bottle labeling applications maintain leading market share within Japan's pharmaceutical sector, reflecting the continued predominance of bottle packaging across prescription medications, over-the-counter products, and liquid formulations. Pharmaceutical bottles require comprehensive labeling that communicates product identification, dosage instructions, warning statements, and regulatory compliance information within constrained surface areas. The cylindrical geometry of bottle containers presents unique labeling challenges demanding specialized adhesive formulations and application techniques.

Label manufacturers serving the bottle segment emphasize wraparound designs, booklet labels, and multi-panel constructions that maximize information capacity while maintaining application efficiency. The diversity of bottle materials including glass, polyethylene terephthalate, and high-density polyethylene necessitates adhesive systems engineered for specific substrate characteristics. Japanese pharmaceutical manufacturers prioritize bottle labels offering consistent performance across automated filling and labeling operations, ensuring production efficiency and quality standards compliance.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

Kanto Region represents the dominant pharmaceutical labeling market in Japan, anchored by Tokyo's concentration of major pharmaceutical headquarters, research institutions, and manufacturing facilities. This economically vibrant region benefits from superior infrastructure, advanced technological capabilities, and proximity to regulatory authorities facilitating compliance activities. The region's robust healthcare ecosystem and substantial patient population create sustained demand for pharmaceutical products and corresponding labeling requirements.

Kansai/Kinki Region maintains significant pharmaceutical labeling market presence, supported by the industrial capabilities concentrated around Osaka and Kyoto. This region has historically been recognized for pharmaceutical and biotechnology innovation, with numerous manufacturers and research organizations contributing to industry advancement. The Kansai area's strong manufacturing infrastructure and skilled workforce enable competitive labeling production serving both domestic and export pharmaceutical markets.

Central/Chubu Region centered around Nagoya contributes meaningfully to Japan's pharmaceutical labeling sector, leveraging manufacturing excellence developed across industrial sectors. This region benefits from well-established infrastructure, advanced production technologies, and strategic geographic positioning enabling efficient distribution nationwide. Pharmaceutical labeling operations in Chubu capitalize on the region's precision manufacturing heritage and quality-focused production culture.

Kyushu-Okinawa Region represents an emerging pharmaceutical labeling market characterized by competitive operational costs and strategic positioning for Asian market access. This southern region increasingly attracts pharmaceutical manufacturing investment seeking alternatives to congested metropolitan areas while maintaining quality standards. The region's improving infrastructure and supportive business environment facilitate labeling industry growth serving both domestic requirements and export-oriented pharmaceutical operations.

Tohoku Region in northeastern Japan contributes to the pharmaceutical labeling market through specialized manufacturing capabilities and regional healthcare service requirements. This area's pharmaceutical industry focuses on serving local population needs while participating in national supply chains through strategic partnerships. The region's labeling sector emphasizes reliability and quality consistency essential for pharmaceutical applications serving distributed healthcare facilities.

Chugoku Region maintains pharmaceutical labeling operations serving western Honshu's healthcare requirements and supporting broader national distribution networks. This region's industrial base provides manufacturing infrastructure capable of producing quality labeling solutions meeting pharmaceutical industry specifications. Regional labeling manufacturers leverage established business relationships and logistical capabilities to serve pharmaceutical customers across diverse product categories.

Hokkaido Region pharmaceutical labeling market serves the northernmost prefecture's healthcare sector while maintaining connections to national pharmaceutical supply chains. The region's aging demographic profile creates sustained pharmaceutical consumption requiring comprehensive labeling solutions. Local labeling operations focus on meeting regional healthcare facility requirements while larger pharmaceutical manufacturers coordinate labeling through national distribution frameworks.

Shikoku Region labeling sector addresses the island region's healthcare requirements through localized production and national supply chain integration. This smallest of Japan's main islands maintains pharmaceutical distribution networks requiring appropriate labeling solutions for diverse medication categories. Regional healthcare facilities rely on properly labeled pharmaceutical products ensuring patient safety and regulatory compliance across medical service delivery.

Market Dynamics:

Growth Drivers:

Why is the Japan Pharmaceutical Labeling Market Growing?

Stringent Regulatory Requirements and Compliance Mandates

Japan's pharmaceutical regulatory framework establishes rigorous labeling requirements that drive continuous investment in advanced labeling solutions and quality systems. The Pharmaceuticals and Medical Devices Agency mandates comprehensive product information disclosure, standardized formatting conventions, and specific warning statement placements that necessitate sophisticated labeling capabilities. Serialization and track-and-trace requirements further compel pharmaceutical manufacturers to adopt technologically advanced labeling systems capable of incorporating unique identification codes and authentication features. According to sources, Japan’s PMDA (MHLW) issued updated guidelines for labeling codes on prescription drug containers, enhancing traceability, safety, and proper handling across medical and pharmaceutical products. Moreover, these regulatory dynamics create sustained demand for compliant labeling solutions while encouraging innovation in security features, printing technologies, and material specifications that satisfy evolving government requirements.

Geriatric Population and Increasing Pharmaceutical Consumption

Japan's demographic profile characterized by one of the world's highest proportions of elderly citizens generates substantial pharmaceutical consumption requiring extensive labeling production. As per sources, Japan’s elderly population reached 36.25 Million, accounting for 29.3 % of the total population, significantly influencing pharmaceutical consumption and demand for geriatricfriendly labeling solutions. The prevalence of chronic conditions including cardiovascular disease, diabetes, and neurological disorders among aging populations drives medication utilization across therapeutic categories. This demographic reality creates baseline demand for pharmaceutical products and corresponding labeling requirements that support market stability and growth. Furthermore, elderly patients require labels featuring enhanced readability characteristics including appropriate font sizes, clear contrast ratios, and intuitive information organization that facilitate proper medication management and adherence to treatment protocols.

Technological Advancements in Labeling Materials and Printing

Continuous innovation in labeling materials, adhesive formulations, and printing technologies expands market opportunities while enabling superior labeling performance characteristics. Advanced polymer substrates offer enhanced durability, chemical resistance, and environmental stability supporting demanding pharmaceutical applications. Digital printing technologies enable economical short-run production, variable data printing, and rapid design changes facilitating pharmaceutical industry flexibility. As per sources, in Label Forum Japan 2024 highlighted Japanese digital printing innovations, featuring Epson’s SurePress L5034 water-based inkjet press and advanced polymer label materials for enhanced pharmaceutical labeling performance. These technological advancements support sophisticated labeling solutions incorporating security features, smart functionality, and aesthetic enhancements that differentiate products and enhance patient experiences while meeting stringent quality requirements established for pharmaceutical labeling applications.

Market Restraints:

What Challenges the Japan Pharmaceutical Labeling Market is Facing?

High Implementation Costs for Advanced Labeling Technologies

The capital investment required for implementing advanced labeling technologies including serialization systems, smart label integration, and automated application equipment represents a significant barrier particularly for smaller pharmaceutical manufacturers. These sophisticated labeling solutions demand substantial upfront expenditure along with ongoing operational costs for specialized consumables and system maintenance that may challenge budget-constrained organizations.

Complex Regulatory Navigation and Approval Processes

Navigating Japan's intricate pharmaceutical regulatory landscape presents challenges for labeling solution providers seeking approval for innovative materials and technologies. The approval processes for new labeling substrates, adhesive formulations, and printing inks require extensive documentation, testing, and review cycles that can delay market introduction. This regulatory complexity may discourage innovation or limit the availability of advanced labeling solutions within the Japanese market.

Price Pressure from Healthcare Cost Containment Initiatives

Government initiatives aimed at controlling healthcare expenditures create downstream pricing pressure throughout the pharmaceutical value chain including labeling components. Periodic pharmaceutical price revisions and promotion of generic medications compress profit margins, potentially limiting resources available for premium labeling solutions. This cost-conscious environment challenges labeling manufacturers to deliver value while maintaining competitive pricing structures.

Competitive Landscape:

Japan pharmaceutical labeling market exhibits a competitive landscape characterized by the presence of established domestic manufacturers alongside international labeling solution providers competing across various product segments and price points. Market participants differentiate through technological capabilities, regulatory compliance expertise, quality assurance systems, and customer service excellence. Strategic partnerships between labeling manufacturers and pharmaceutical companies facilitate customized solution development addressing specific product requirements and production workflows. Investment in research and development enables market leaders to introduce innovative materials, printing technologies, and functional labeling features that address evolving industry needs. The competitive environment encourages continuous improvement in production efficiency, quality consistency, and sustainability practices as organizations seek to strengthen market positioning and capture emerging opportunities.

Recent Developments:

-

In July 2025, IL Group showcased advanced pharmaceutical labeling solutions at Interphex Japan 2025 in Tokyo, featuring tamper-evident, light-protection, and specialty labels, high-performance labeling equipment, and contract packaging services, emphasizing compliance, operational efficiency, and product protection across Japan’s pharmaceutical, medical device, and life sciences industries.

Japan Pharmaceutical Labeling Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Label Types Covered | Pressure-Sensitive Label, Glue-Applied Label, Sleeve Label, In-Mold Label, Others |

| Materials Covered | Paper, Polymer Film, Others |

| Applications Covered | Instructional Label, Decorative Label, Functional Label, Promotional Label, Others |

| End Uses Covered | Bottles, Blister Packs, Parenteral Containers, Pre-Fillable Syringes, Pre-Fillable Inhalers, Pouches, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan pharmaceutical labeling market size was valued at USD 391.33 Million in 2025.

The Japan pharmaceutical labeling market is expected to grow at a compound annual growth rate of 4.78% from 2026-2034 to reach USD 595.65 Million by 2034.

Pressure-sensitive label dominated the market due to their versatility, quick application, and strong compatibility with high-speed automated labeling systems widely used in Japan’s pharmaceutical manufacturing facilities, ensuring efficiency, accuracy, and consistent adherence to stringent regulatory and production requirements.

Key factors driving the Japan pharmaceutical labeling market include strict regulatory compliance needs, rising medication use from an aging population, technological advancements in labeling materials and printing processes, and increasing demand for smart, digitally enabled labeling solutions that enhance safety, traceability, and patient communication.

Major challenges include high costs of advanced labeling technologies, complex regulatory approval processes, pricing pressures from healthcare cost-containment measures, and the ongoing need for continuous investment in quality, validation, and compliance systems across pharmaceutical labeling operations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)