Japan POS Device Market Size, Share, Trends and Forecast by Component, Terminal Type, Business Size, Industry Vertical, and Region, 2026-2034

Japan POS Device Market Overview:

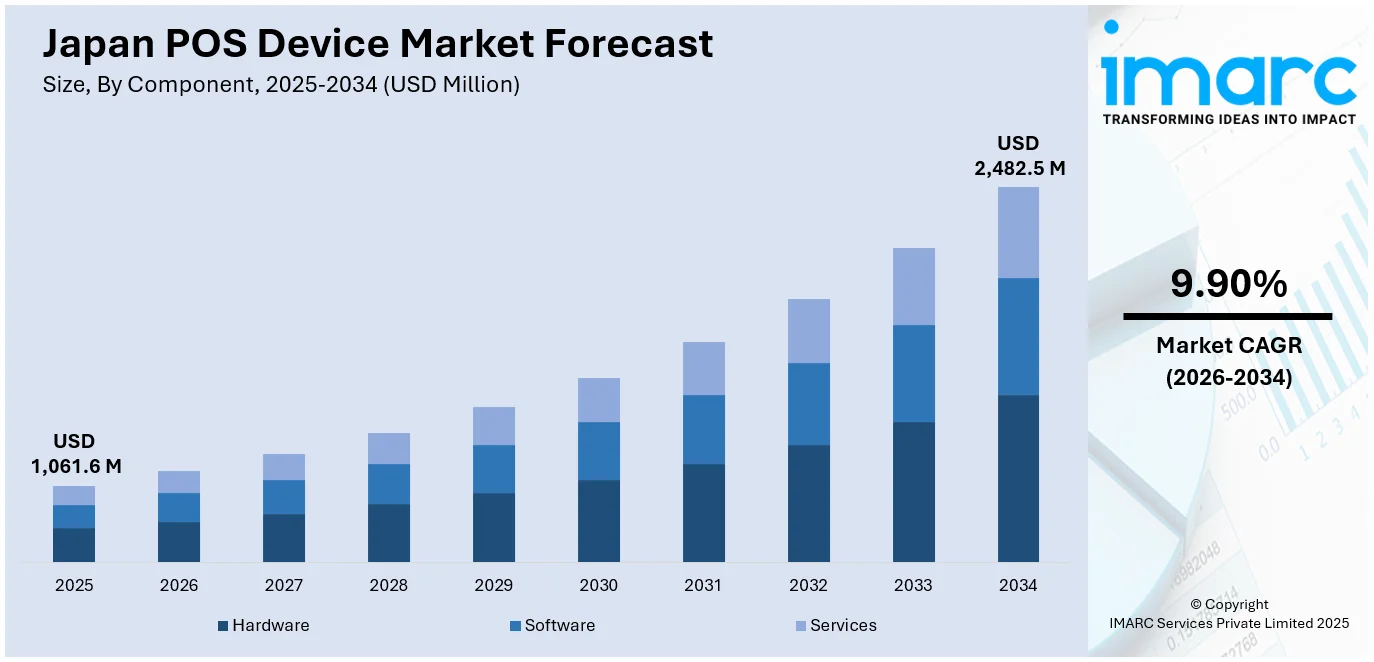

The Japan POS device market size reached USD 1,061.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 2,482.5 Million by 2034, exhibiting a growth rate (CAGR) of 9.90% during 2026-2034. The market is driven by an increase in buyer expenditure due to the adoption of digital payment methods, incorporation of sophisticated features like artificial intelligence (AI), cloud-based solutions, and integrated payment systems, and rise in financial support and incentives for cashless payment systems.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,061.6 Million |

| Market Forecast in 2034 | USD 2,482.5 Million |

| Market Growth Rate 2026-2034 | 9.90% |

Japan POS Device Market Trends:

Rise in Consumer Spending and Retail Digitization

Japan's increase in buyer expenditures on account of the adoption of digital payment methods is leading to the development of the point-of-sale (POS) devices. Since more individuals now opt for cashless transactions, the demand is growing among retailers encouraging them to shift towards contemporary POS systems with digital payment alternatives like credit cards, mobile wallets, and quick response (QR) codes. This shift toward digitalization can be seen largely in the transportation, hospitality, and retail segments, where people are looking for quicker, easier payment options. In addition to this, measures taken by the Japanese government toward cashless transactions and digital economic development is driving the adoption of POS units, keeping the businesses competitive as well as capable of fulfilling the changing needs of customers for uninterrupted, contact-free transactions. The cashless payment ratio in 2024 was recorded 42.8% and the government goal of 40% was fulfilled. The Ministry of Economy, Trade and Industry is continuing to make essential improvements to boost the ratio to 80%.

To get more information on this market Request Sample

Technological Advancements in POS Solutions

Technological innovation is acting as a driving force behind the development and uptake of POS devices in Japan. The incorporation of sophisticated features like artificial intelligence (AI), cloud-based solutions, and integrated payment systems is improving the functionality of POS devices, providing businesses with increased efficiency and flexibility in operations. The emergence of contactless payment solutions, such as near field communication (NFC) standards, is further driving the adoption of high-end POS terminals across industries. These technological developments enhance transaction velocity, security, and user experience, catering to both needs and regulatory expectations. With Japanese companies, especially small and medium-sized enterprises (SMEs), looking for low-cost options with strong features, the need for innovative POS systems is rising. In 2024, DIGI I’s declared the completion of its new southwest factory in Japan, developed specifically for the creation of POS systems, and South Factory, a hybrid facility merging manufacturing and warehouse functions.

Government Support for Cashless Payment Systems

The government of Japan is encouraging the fast-paced adoption of POS devices by providing financial support and incentives for cashless payment systems. The government initiated its "Cashless Vision" to expand cashless payment usage, a dramatic shift from the nation's cash-oriented past. As per an article by Equinix, the government of Japan plans to double cashless transactions to 40% between now and 2027. This has spurred businesses, particularly SMEs, to use POS devices and electronic payment systems. Also, the government's launch of several subsidy programs, including the "Cashless Payment Point Program," which rewards cashless payments with discounts and rebates, is encouraging people and merchants to adopt cashless systems. As such policies continue to drive for greater adoption of cashless transactions, demand for contemporary POS systems that can accommodate multiple modes of payment is increasing.

Japan POS device Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on component, terminal type, business size and industry vertical.

Component Insights:

- Hardware

- Software

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, software, and services.

Terminal Type Insights:

- Fixed POS Terminals

- Mobile POS Terminals

A detailed breakup and analysis of the market based on the terminal type have also been provided in the report. This includes fixed POS terminals and mobile POS terminals.

Business Size Insights:

- Turnover<5 Million INR

- Turnover 5 Million INR–50 Million INR

- Turnover 50 Million INR and Above

A detailed breakup and analysis of the market based on the business size have also been provided in the report. This includes turnover<5 million INR, turnover 5 million INR–50 million INR, and turnover 50 million INR and above.

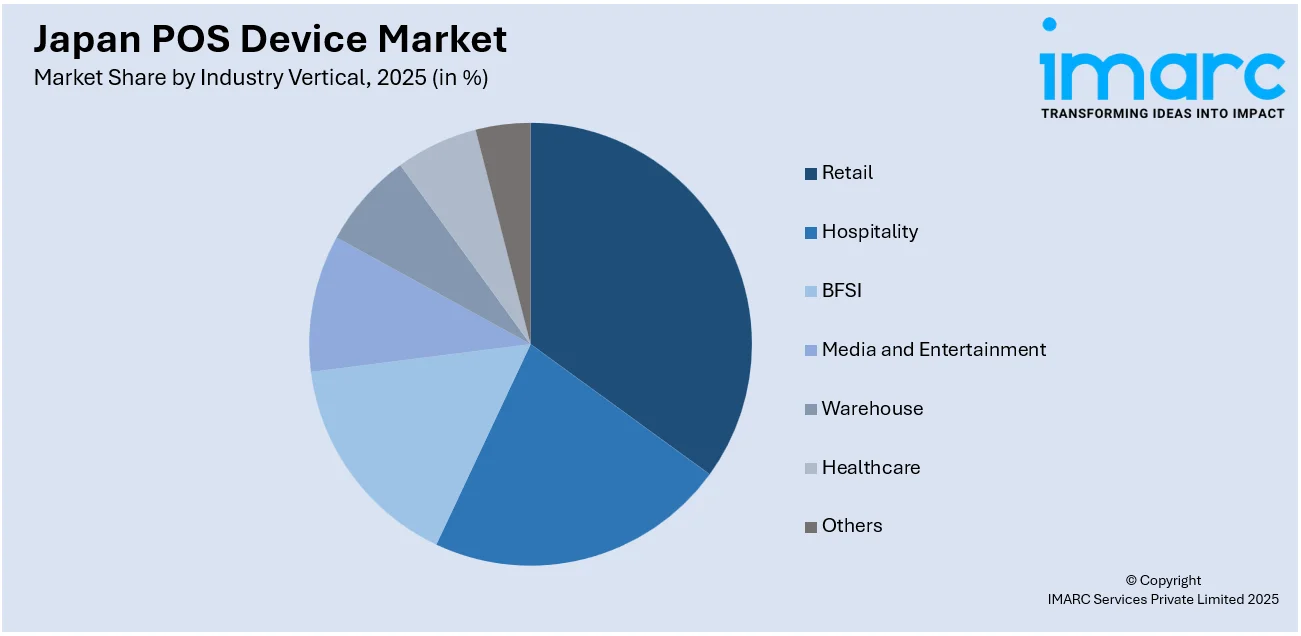

Industry Vertical Insights:

Access the comprehensive market breakdown Request Sample

- Retail

- Hospitality

- BFSI

- Media and Entertainment

- Warehouse

- Healthcare

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes retail, hospitality, BFSI, media and entertainment, warehouse, healthcare, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan POS Device Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software, Services |

| Terminal Types Covered | Fixed POS Terminals, Mobile POS Terminals |

| Business Sizes Covered | Turnover<5 Million INR, Turnover 5 Million INR–50 Million INR, Turnover 50 Million INR and Above |

| Industry Verticals Covered | Retail, Hospitality, BFSI, Media and Entertainment, Warehouse, Healthcare, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan POS device market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan POS device market on the basis of component?

- What is the breakup of the Japan POS device market on the basis of terminal type?

- What is the breakup of the Japan POS device market on the basis of business size?

- What is the breakup of the Japan POS device market on the basis of industry vertical?

- What is the breakup of the Japan POS device market on the basis of region?

- What are the various stages in the value chain of the Japan POS device market?

- What are the key driving factors and challenges in the Japan POS device market?

- What is the structure of the Japan POS device market and who are the key players?

- What is the degree of competition in the Japan POS device market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan POS device market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan POS device market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan POS device industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)