Japan Potassium Iodide Market Size, Share, Trends and Forecast by Product, Type, Application, and Region, 2026-2034

Japan Potassium Iodide Market Summary:

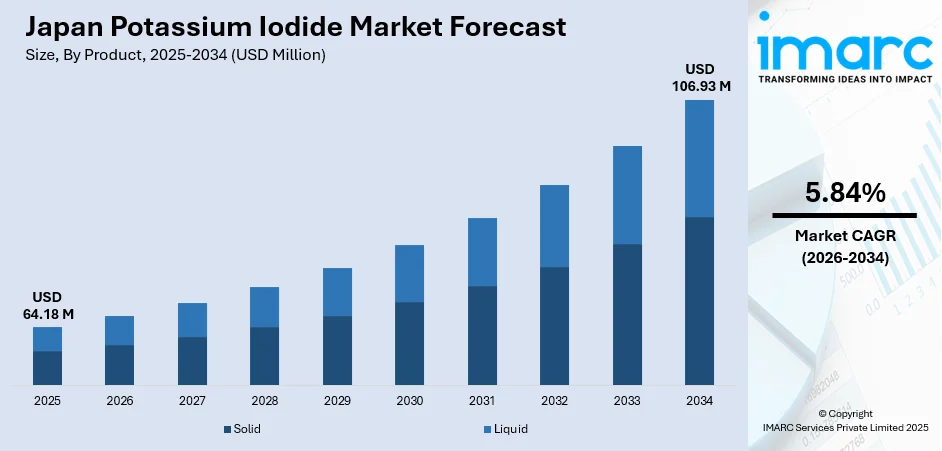

The Japan potassium iodide market size was valued at USD 64.18 Million in 2025 and is projected to reach USD 106.93 Million by 2034, growing at a compound annual growth rate of 5.84% from 2026-2034.

The market growth is primarily driven by Japan's established position as the on the largest iodine producer, supporting a robust domestic supply chain for potassium iodide manufacturing. The nation's advanced pharmaceutical industry, coupled with increasing demand for diagnostic imaging solutions and nuclear emergency preparedness measures, creates sustained demand across pharmaceutical, industrial, and healthcare applications. These converging factors are fundamentally reshaping the competitive landscape and expanding opportunities across the Japan potassium iodide market share.

Key Takeaways and Insights:

- By Product: Solid dominates the market with a share of 63.2% in 2025, owing to its extended shelf stability, ease of storage and transportation, precise dosing capabilities, and broad applicability across pharmaceutical formulations and industrial processes.

- By Type: Industrial grade leads the market with a share of 64.9% in 2025. This dominance is supported by extensive utilization in manufacturing contrast media for diagnostic imaging, LCD polarizing films for electronics, and various chemical synthesis applications.

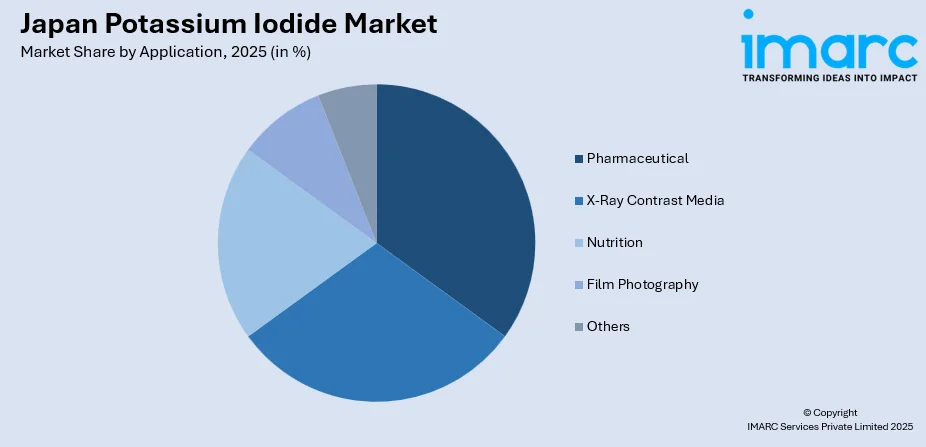

- By Application: Pharmaceutical represents the largest segment with a market share of 33.6% in 2025, due to its critical role in thyroid treatments, radioprotective therapies, and nutritional supplements.

- By Region: Kanto Region leads the market with a share of 41.0% in 2025, driven by the concentration of pharmaceutical manufacturing facilities in Tokyo, Kanagawa, and surrounding prefectures, along with superior healthcare infrastructure enabling premium product adoption.

- Key Players: The Japan potassium iodide market exhibits moderate competitive intensity, with established domestic iodine producers and specialty chemical manufacturers competing alongside multinational pharmaceutical corporations across various application segments.

To get more information on this market Request Sample

The Japan potassium iodide market is primarily driven by heightened concerns over nuclear safety and the protection of public health in the event of radiation exposure. The country’s reliance on nuclear energy, alongside its susceptibility to natural disasters like earthquakes and tsunamis, necessitates robust radiation protection measures. For instance, in 2025, Japan was struck by a powerful 6.7 magnitude earthquake off the coast of Iwate Prefecture, triggering a tsunami warning. As a result, potassium iodide, a key preventive measure against radiation-induced thyroid disorders, is increasingly prioritized. Japan's aging population further drives the need for potassium iodide, as older individuals are more susceptible to radiation-related illnesses. The government’s regulatory efforts to stockpile potassium iodide for emergency preparedness, especially in areas near nuclear plants, continue to shape market dynamics. Public health initiatives and the growing awareness of radiation risks are leading to the widespread adoption of potassium iodide, driving both production and demand across multiple sectors in Japan.

Japan Potassium Iodide Market Trends:

Aging Population and Healthcare System Strain

The growing geriatric population in Japan is catalyzing the demand for potassium iodide, especially in healthcare. Older individuals are more vulnerable to radiation-related illnesses, such as thyroid cancer, heightening the need for potassium stockpiling. The National Institute of Population and Social Security Research forecasts that by 2040, elderly individuals will represent 34.8% of Japan's population. As Japan’s healthcare system faces growing strain due to demographic changes, ensuring the availability of potassium iodide as a preventive measure is becoming critical. Furthermore, the elderly are often located near nuclear plants, intensifying the demand for effective radiation protection, which fuels the potassium iodide market.

Advancements in Radiological Research and Monitoring

Advancements in radiological research and monitoring technologies is significantly increasing the need for potassium iodide in Japan. In 2025, Fukui University opened the Advanced Radiation Emergency Medical Support Center to enhance radiation preparedness, supported by Mirion Japan's contribution of advanced radiation measurement systems, such as whole-body counters and thyroid monitors. These innovations enable quicker and more accurate responses during potential nuclear incidents. Furthermore, as radiation detection systems and real-time monitoring capabilities improve, awareness about the need for potassium iodide in emergency preparedness is growing. Research into the long-term effects of radiation exposure also underscores the importance of potassium iodide in preventing thyroid diseases, further drives its demand in Japan.

Growing Applications in Environmental Engineering

Potassium plays a crucial role in environmental engineering, particularly in the removal of pollutants through processes that neutralize harmful substances. Potassium compounds, such as potassium permanganate, are commonly used to treat water and air pollutants by breaking down contaminants like heavy metals, organic toxins, and bacteria. These compounds facilitate oxidation and filtration, enhancing water quality and reducing pollution in industrial waste streams. As environmental regulations tighten, the demand for potassium-based solutions in pollution control continues to rise. This was highlighted at the International Workshop on Environmental Engineering 2025 (IWEE2025), held from July 18-21, 2025, at the Kitami Institute of Technology in Hokkaido, Japan, where discussions focused on sustainable engineering practices and future regulatory trends.

Market Outlook 2026-2034:

The Japan potassium iodide market is poised for notable growth, driven by a well-established domestic iodine production infrastructure and rising demand from the pharmaceutical industry. The market generated a revenue of USD 64.18 Million in 2025 and is projected to reach a revenue of USD 106.93 Million by 2034, growing at a compound annual growth rate of 5.84% from 2026-2034. This growth reflects increasing applications in pharmaceuticals and health-related sectors, highlighting Japan’s strategic position as a key market for potassium iodide and its continued potential for sustained expansion.

Japan Potassium Iodide Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product | Solid | 63.2% |

| Type | Industrial Grade | 64.9% |

| Application | Pharmaceutical | 33.6% |

| Regional | Kanto Region | 41.0% |

Product Insights:

- Solid

- Liquid

Solid dominates with a market share of 63.2% of the total Japan potassium iodide market in 2025.

Solid holds the biggest market share owing to its stability, ease of handling, and longer shelf life compared to liquid or other forms. It is widely preferred in pharmaceutical formulations, nutritional supplements, and industrial applications requiring precise dosing and storage reliability.

Additionally, solid potassium iodide offers superior convenience for transportation and regulatory compliance. Its compact packaging reduces storage costs and simplifies inventory management, making it the preferred choice for manufacturers and distributors in Japan’s growing pharmaceutical and chemical sectors, further reinforcing its leading position in the domestic market.

Type Insights:

- Industrial Grade

- Non-Industrial Grade

The industrial grade leads with a market share of 64.9% of the total Japan potassium iodide market in 2025.

Industrial grade represents the largest segment due to its high purity, consistent quality, and suitability for large-scale chemical and manufacturing applications. It is widely used in industrial processes, laboratory reagents, and pharmaceutical intermediate production.

Moreover, industrial grade potassium iodide provides cost-efficiency and scalability for manufacturers, supporting bulk production and meeting stringent quality standards. Its reliability and versatility make it the preferred type for industrial applications, reinforcing its dominant position in the market and driving continued adoption across multiple sectors.

Application Insights:

Access the comprehensive market breakdown Request Sample

- X-Ray Contrast Media

- Pharmaceutical

- Nutrition

- Film Photography

- Others

Pharmaceutical exhibits a clear dominance with a 33.6% share of the total Japan potassium iodide market in 2025.

Pharmaceutical dominates the market owing to its critical role in thyroid treatments, radioprotective therapies, and nutritional supplements. Its high efficacy and safety profile make it a preferred ingredient for healthcare and medical formulations.

Additionally, the growing demand for preventive healthcare and increased awareness about iodine deficiency support the widespread use of potassium iodide in pharmaceutical products. Consistent quality, regulatory compliance, and ease of formulation further reinforce its dominance, making the pharmaceutical sector the leading segment in the market.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto Region leads with a market share of 41.0% of the total Japan potassium iodide market in 2025.

The Kanto Region dominates the market, driven by the presence of pharmaceutical manufacturers, research institutions, and chemical production facilities. The region’s robust industrial infrastructure supports high demand and efficient distribution of potassium iodide products. The concentration of pharmaceutical manufacturers and robust industrial infrastructure, is being further strengthened by advancements like the 2025 launch of a smart factory project by JDSC Co., Ltd. in collaboration with Taiho Pharmaceutical, aimed at improving pharmaceutical manufacturing through real-time monitoring and automation.

Additionally, the presence of major ports and logistics networks in Kanto facilitates domestic and international supply chain operations. Strong regional investment in healthcare, chemical research, and manufacturing further reinforces Kanto’s leading position, making it the primary hub for potassium iodide production, distribution, and usage in Japan.

Market Dynamics:

Growth Drivers:

Why is the Japan Potassium Iodide Market Growing?

Rising Use in Renewable Energy Sector

Potassium iodide plays a crucial role in the renewable energy sector, particularly in research and development applications such as photovoltaic cells and energy storage solutions. Potassium iodide is utilized in the creation of specific semiconductors that enhance the efficiency of solar energy conversion. As the country shift toward renewable energy accelerates, materials like potassium iodide are integral to advancing energy technologies. This growing demand for sustainable energy solutions is further expanding the role of potassium iodide in the industry. A notable example is Japan's NEDO initiative, which in 2025 launched a six-year R&D program under the Green Innovation Fund, focusing on tandem perovskite solar cells to improve mass production technologies and scalability from fiscal 2025 to 2030.

Increasing Threat of Natural Disasters and Earthquakes

Japan's susceptibility to natural disasters, particularly earthquakes and tsunamis, increases the potential for nuclear accidents, particularly in its nuclear power plants. Situated along the Pacific Ring of Fire, Japan is highly prone to seismic activity, which can disrupt nuclear facilities. In light of this, the Japanese government and public are adopting a more precautionary approach to nuclear safety, emphasizing disaster preparedness and the stockpiling of potassium iodide. A significant example occurred in 2025, when a 5.8 magnitude earthquake struck off the coast of Iwate province at a depth of 11.2 km, with a seismic intensity of three on the Japan Meteorological Agency's scale of seven. Such events are catalyzing the demand for potassium iodide as an emergency resource in case of nuclear incidents triggered by natural disasters.

Growing Demand in Electronics and Semiconductor Industry

Potassium iodide plays a vital role in the electronics industry, particularly in manufacturing processes such as the production of semiconductors and integrated circuits. Potassium iodide is used in photoresist chemistry, a key component of the photolithography process, enabling the creation of intricate patterns on semiconductor wafers. Additionally, it is involved in producing optical lenses and coatings for devices like cameras, smartphones, and medical equipment. With the Japanese semiconductor market valued at USD 40.4 billion in 2024, as per the IMARC Group, the demand for potassium iodide is growing as the electronics industry innovates and expands, maintaining its importance across various high-tech applications.

Market Restraints:

What Challenges the Japan Potassium Iodide Market is Facing?

Raw Material Price Volatility Affecting Manufacturing Costs

Volatility in global iodine prices creates ongoing cost uncertainty for potassium iodide manufacturers, directly influencing production budgets, supply planning, and profit margins. Shifts in international supply conditions and variations in extraction-related economics can disrupt raw material availability, forcing producers to navigate unpredictable pricing environments. This volatility increases financial risk and requires strategic sourcing, inventory management, and long-term procurement planning to maintain stable operations in a competitive market.

Stringent Regulatory Compliance Requirements Increasing Operational Complexity

Stringent quality and safety regulations imposed by Japan’s pharmaceutical authorities significantly elevate operational complexity for potassium iodide manufacturers. Extensive documentation, detailed purity specifications, and rigorous testing protocols extend product approval timelines and increase compliance-related expenses. These demanding regulatory expectations create barriers for new entrants while imposing substantial ongoing responsibilities on established producers, ultimately requiring continuous investment in quality systems, specialized personnel, and regulatory oversight to ensure market access.

Competition from Alternative Iodine Sources and Substitute Products

Expanding iodine production capacity in competing global regions places increasing pricing pressure on Japanese potassium iodide manufacturers, challenging their cost competitiveness. Moreover, the emergence of alternative iodine compounds and substitute technologies in various industrial applications threatens traditional demand patterns. To remain competitive, producers must invest in product differentiation, application diversification, and innovation initiatives designed to strengthen their market position and mitigate the risks posed by evolving competitive dynamics.

Competitive Landscape:

The Japan potassium iodide market exhibits moderate competitive intensity characterized by established domestic iodine producers vertically integrated into potassium iodide manufacturing alongside multinational specialty chemical corporations serving pharmaceutical and industrial segments. Market dynamics reflect strategic positioning ranging from pharmaceutical-grade products emphasizing purity and regulatory compliance to industrial-grade offerings targeting cost-conscious manufacturing applications. The competitive landscape is increasingly shaped by supply chain integration, manufacturing efficiency improvements, and expanding application portfolios addressing emerging electronics and healthcare sector requirements.

Japan Potassium Iodide Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Solid, Liquid |

| Types Covered | Industrial Grade, Non-Industrial Grade |

| Applications Covered | X-Ray Contrast Media, Pharmaceutical, Nutrition, Film Photography, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan potassium iodide market size was valued at USD 64.18 Million in 2025.

The Japan potassium iodide market is expected to grow at a compound annual growth rate of 5.84% from 2026-2034 to reach USD 106.93 Million by 2034.

Solid dominates with a market share of 63.2% of the total Japan potassium iodide market in 2025, owing to its stability, ease of handling, and longer shelf life compared to liquid or other forms. It is widely preferred in pharmaceutical formulations, nutritional supplements, and industrial applications requiring precise dosing and storage reliability.

Key factors driving the Japan potassium iodide market include the growing aging population in the country, which is driving the market demand, especially in healthcare. By 2040, elderly individuals are projected to make up 34.8% of Japan's population. Older adults, more vulnerable to radiation illnesses, require increased potassium iodide stockpiling, particularly near nuclear plants.

Major challenges include raw material price volatility affecting manufacturing costs, stringent regulatory compliance requirements, competition from alternative iodine sources, and substitute product development in certain industrial applications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)