Japan Potato Chips Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2026-2034

Japan Potato Chips Market Overview:

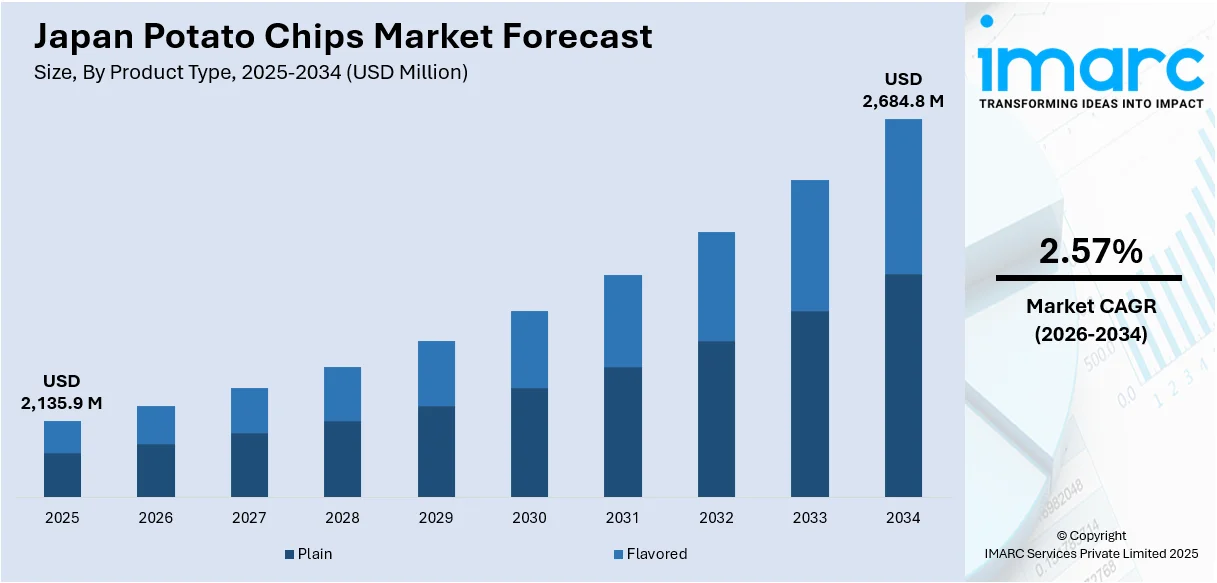

The Japan potato chips market size reached USD 2,135.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 2,684.8 Million by 2034, exhibiting a growth rate (CAGR) of 2.57% during 2026-2034. The market is driven by the rising demand for convenient snacks, innovative flavors tailored to local tastes, premium product offerings, and strong retail distribution networks. Additionally, increasing consumer preference for indulgent yet familiar snacks boost the Japan potato chips market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2,135.9 Million |

| Market Forecast in 2034 | USD 2,684.8 Million |

| Market Growth Rate 2026-2034 | 2.57% |

Japan Potato Chips Market Trends:

Rising Demand for Convenient and On-the-Go Snacks

In today’s fast-paced Japanese lifestyle, consumers progressively seek convenient, ready-to-eat food options. Potato chips fit this demand perfectly, offering a portable and satisfying snack that requires no preparation. This trend is especially prevalent among busy professionals, students, and commuters, which is fueling the Japan potato chips market share. Additionally, the expansion of convenience stores (konbini) across Japan ensures widespread accessibility. These retail outlets frequently update product offerings, encouraging impulse purchases and brand switching. As convenience continues to drive consumer choices, potato chips remain a staple snack, benefiting from their long shelf life, lightweight packaging, and appeal across various age groups. For instance, in June 2024, Samyang Foods revealed that it plans to introduce three new flavors of Buldak Potato Chips—Original, Four Cheese, and Habanero & Lime—aimed at the Japanese snack market. This innovative product series under the Buldak brand seeks to embody the distinct umami and spicy taste of the widely favored Buldak Bokkeum Myun, which has reached total sales surpassing 5.7 billion units across more than 100 countries by the close of 2023.

To get more information on this market Request Sample

Growing Premium and Health-Conscious Segments

Japanese consumers are increasingly prioritizing quality, health, and authenticity in their snack choices. This has led to a rising demand for premium potato chips made with natural ingredients, artisanal methods, or gourmet seasonings. Products labeled as organic, non-GMO, or cooked in healthier oils are gaining traction, which is creating a positive impact on the Japan potato chips market outlook. Some brands also highlight local or traceable potato sourcing. Additionally, baked and low-fat options cater to health-conscious demographics, particularly middle-aged and older consumers. This shift toward better-for-you snacking is expanding the market beyond traditional indulgent offerings and allowing both mass-market and niche brands to introduce higher-margin, differentiated products. For instance, in July 2024, Japanese potato chip leader Calbee collaborated with Silicon Valley venture capital firm Pegasus Tech Ventures to integrate artificial intelligence into snack production, Nikkei Asia had discovered. According to Nikkei staff writer Yifan Yu, Calbee aims to put money into startups, particularly U.S. food tech firms, to assist in creating healthier snacks, optimizing production lines, and exploring new business models.

Japan Potato Chips Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Plain

- Flavored

The report has provided a detailed breakup and analysis of the market based on the product type. This includes plain and flavored.

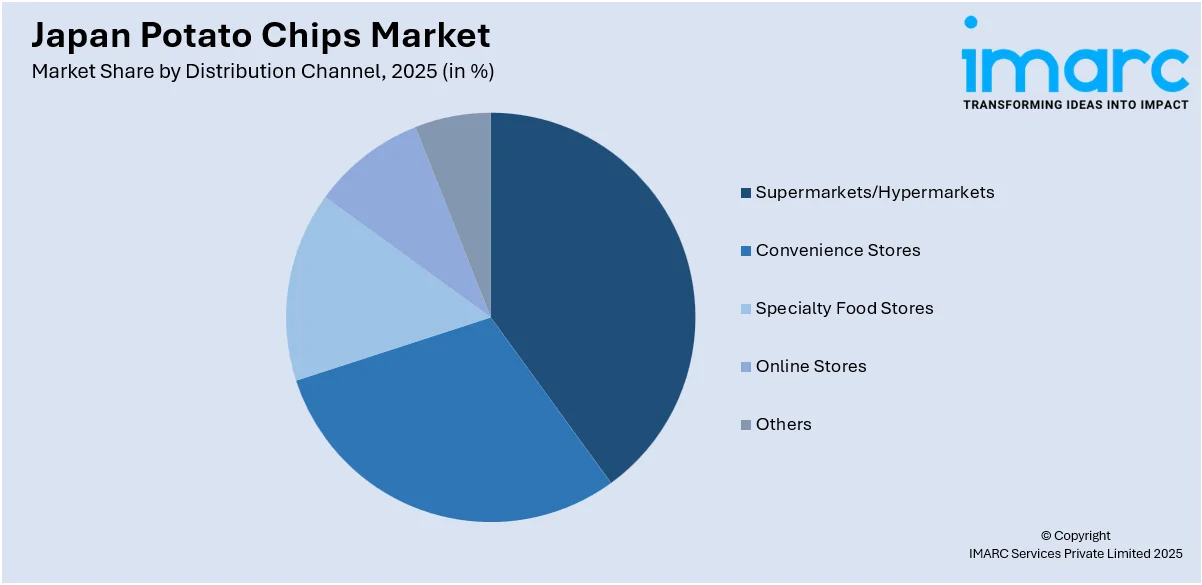

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Food Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets/hypermarkets, convenience stores, specialty food stores, online stores, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Potato Chips Market News:

- In May 2023, Calbee, Inc. launched potato chips made solely with nori seaweed sourced from Saga Prefecture. A product introduced by the company in August has been updated with seaweed from Saga Prefecture, harvested in the Ariake Sea. The new item is available exclusively in the Kyushu area and Okinawa Prefecture.

Japan Potato Chips Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Plain, Flavoured |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Convenience Stores, Specialty Food Stores, Online Stores, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan potato chips market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan potato chips market on the basis of product type?

- What is the breakup of the Japan potato chips market on the basis of distribution channel?

- What is the breakup of the Japan potato chips market on the basis of region?

- What are the various stages in the value chain of the Japan potato chips market?

- What are the key driving factors and challenges in the Japan potato chips?

- What is the structure of the Japan potato chips market and who are the key players?

- What is the degree of competition in the Japan potato chips market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan potato chips market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan potato chips market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan potato chips industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)