Japan Power Grids Market Size, Share, Trends and Forecast by Type, Energy Source, and Region, 2026-2034

Japan Power Grids Market Overview:

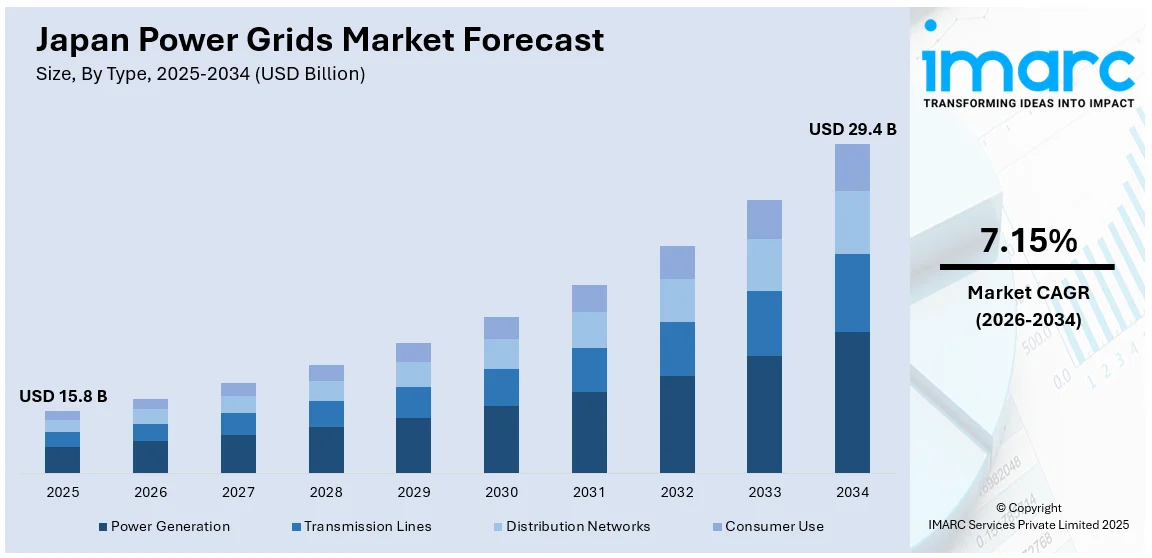

The Japan power grids market size reached USD 15.8 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 29.4 Billion by 2034, exhibiting a growth rate (CAGR) of 7.15% during 2026-2034. The market is driven by increased demand for electricity, technological advancements in grid automation, and Japan’s commitment to renewable energy integration. The shift towards smart grids and decentralized energy systems also plays a key role in transforming the market. These factors are fueling Japan power grids market share expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 15.8 Billion |

| Market Forecast in 2034 | USD 29.4 Billion |

| Market Growth Rate 2026-2034 | 7.15% |

Japan Power Grids Market Trends:

Shift Towards Smart Grid Technologies

The Japanese power grids market is undergoing a remarkable shift towards smart grid technologies. Smart grids incorporate advanced communication, automation, and data analytics that enable superior energy management, improved grid stability, and superior demand-response. The technologies enable efficient balancing of energy supply and demand, especially through the incorporation of renewable energy sources such as solar and wind. Japan's government, in keeping with its energy policy, is investing in smart grid technology to upgrade the national grid. Such grids allow utilities to track energy usage, enhance fault detection, and maximize energy distribution, which is essential to minimize grid congestion and overall improve the reliability of the power supply. This trend is fueling Japan power grids market growth. For instance, in August 2024, Japan's TEPCO plans invested $3.2 billion in its power grid to meet surging electricity demand driven by AI data centers and semiconductor plants. By 2030, 18 new large-scale substations are planned nationwide, with 40% of capacity concentrated in the Tokyo area. The investment reflects Japan’s push to upgrade infrastructure as digital industries expand. The Organization for Cross-regional Coordination of Transmission Operators compiled the substation plans, highlighting a national response to rising high-tech power needs.

To get more information on this market Request Sample

Integration of Renewable Energy Sources

Japan’s commitment to decarbonization and renewable energy integration is transforming its power grid infrastructure. The country aims to increase its renewable energy capacity as part of its efforts to meet climate targets and reduce reliance on fossil fuels. Solar, wind, and geothermal energy are gradually being integrated into the national grid, requiring upgrades to grid infrastructure. These renewable sources are intermittent and require advanced grid management to ensure stable and continuous power supply. To accommodate this, Japan is focusing on developing and deploying energy storage solutions, flexible transmission systems, and grid management software to handle the varying inputs from renewable energy sources. This transition is a driving force behind Japan power grids market growth, positioning the country as a leader in renewable energy integration. For instance, in February 2025, GE Vernova, a subsidiary of General Electric, plans to join a foreign consortium bidding for a $10 billion project to build a high-voltage power grid connecting Hokkaido, Tohoku, and Tokyo in Japan. The project aims to enhance renewable energy transmission from northern regions to high-demand areas.

Japan Power Grids Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type and energy source.

Type Insights:

- Power Generation

- Transmission Lines

- Distribution Networks

- Consumer Use

The report has provided a detailed breakup and analysis of the market based on the type. This includes power generation, transmission lines, distribution networks, and consumer use.

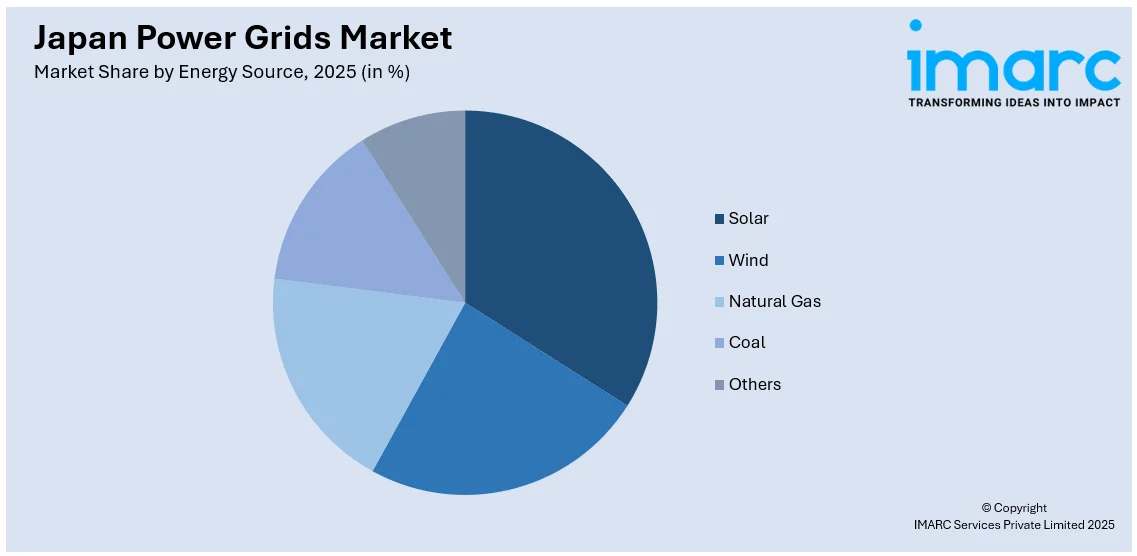

Energy Source Insights:

Access the comprehensive market breakdown Request Sample

- Solar

- Wind

- Natural Gas

- Coal

- Others

The report has provided a detailed breakup and analysis of the market based on the energy source. This includes solar, wind, natural gas, coal, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto, Kansai/Kinki, Central/ Chubu, Kyushu-Okinawa, Tohoku, Chugoku, Hokkaido, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Power Grids Market News:

- In April 2025, PowerX, NTT Anode Energy, and Seibu Electric Industry completed the Fukuoka Wakamatsu Battery Storage Station in Kitakyushu, Japan. The high-voltage grid storage facility uses three “Mega Power” lithium iron phosphate battery units with a 1,999 kW output and 8,226 kWh capacity. NTT Anode will manage operations and energy market transactions, while Seibu Electric handled design and construction. This project marks PowerX’s first delivery to NTT and Seibu’s debut in grid battery systems, aiming to support Japan’s renewable energy goals.

- In March 2025, Wärtsilä commissioned a 100 MW gas engine power plant in Sodegaura, Japan, for Tokyo Gas Engineering Solutions. Using ten Wärtsilä 34SG engines, the plant provides fast, flexible power to balance fluctuations from renewable sources. It supports Japan’s goal of achieving 40–50% renewable energy by 2040 and will operate in Japan’s balancing and capacity markets. The project highlights Wärtsilä’s role in Japan’s energy transition and ongoing collaboration with Tokyo Gas to enhance grid stability amid rising renewable integration.

- In March 2025, Nuvve Holding Corp. launched NUVVE Japan, introducing a franchise model to expand its vehicle-to-grid (V2G) technology in Asia. This model allows local investors to co-own the regional business and benefit from Nuvve’s growth without diluting shareholder equity. Led by veteran entrepreneur Masa Higashida, NUVVE Japan will target Japan’s growing EV and energy markets. The move supports Japan’s clean energy goals by enabling EVs to interact with the power grid, improving energy efficiency and grid stability.

- In December 2024, Hitachi Energy announced that it will supply Japan's first SF₆-free 300 kV circuit-breakers to Chubu Electric Power Grid. This marks a key step in Japan's power grid sustainability efforts. The EconiQ™ switchgear eliminates 99.3% of CO2-equivalent emissions from SF₆, contributing to Chubu Electric's decarbonization goals, with the switchgear set to reduce the grid's carbon footprint.

Japan Power Grids Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Power Generation, Transmission Lines, Distribution Networks, Consumer Use |

| Energy Sources Covered | Solar, Wind, Natural Gas, Coal, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan power grids market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan power grids market on the basis of type?

- What is the breakup of the Japan power grids market on the basis of energy source?

- What is the breakup of the Japan power grids market on the basis of region?

- What are the various stages in the value chain of the Japan power grids market?

- What are the key driving factors and challenges in the Japan power grids market?

- What is the structure of the Japan power grids market and who are the key players?

- What is the degree of competition in the Japan power grids market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan power grids market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan power grids market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan power grids industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)