Japan Print Label Market Size, Share, Trends and Forecast by Raw Material, Print Process, Label Format, End Use Industry, and Region, 2025-2033

Japan Print Label Market Overview:

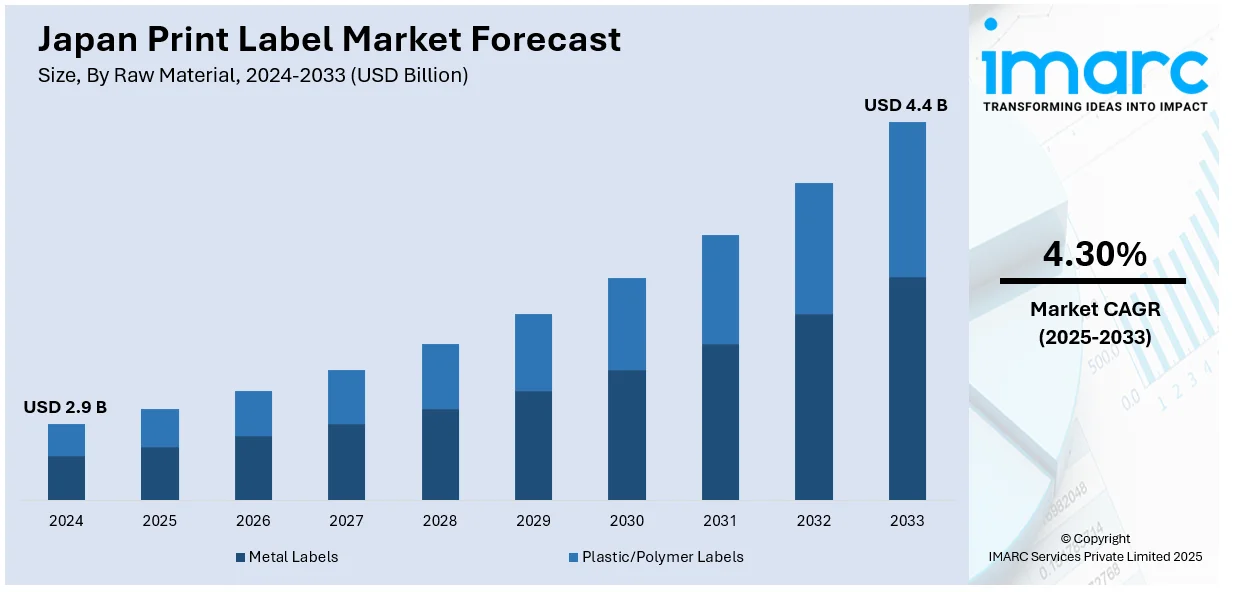

The Japan print label market size reached USD 2.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.4 Billion by 2033, exhibiting a growth rate (CAGR) of 4.30% during 2025-2033. The market is expanding steadily, led by rising needs in food packaging and retail, along with improvements in digital label printing. Eco-conscious packaging and demand for quick, customized labeling are also supporting long-term industry development.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.9 Billion |

| Market Forecast in 2033 | USD 4.4 Billion |

| Market Growth Rate 2025-2033 | 4.30% |

Japan Print Label Market Trends:

Growing Role of Digital Printing

Digital printing has become a core part of Japan's label production, especially as companies look for quicker, more flexible solutions. Businesses across sectors now require smaller label batches with variable data and clear graphics. Digital methods make this possible by cutting setup time and reducing material waste. This has proven especially valuable for local brands and seasonal product lines, which often need fast turnaround and frequent design changes. As digital printing hardware becomes more affordable and precise, it has begun replacing older mechanical systems in many operations. High-resolution output, ease of use, and compatibility with automated packaging lines are all factors pushing this change. Lower costs and shorter lead times are not just helping printers meet tight schedules but also enabling brands to be more agile in their marketing. These features are now considered essential rather than optional, especially for small and mid-sized businesses.

Shift Toward Eco-Friendly Labels

Environmental concerns are changing how print labels are made in Japan. Brands are moving toward materials that are either recyclable or biodegradable. There's also more interest in inks with a lower environmental load, including water-based and UV-curable options. Pressure from consumers and government regulations is leading to more attention on waste reduction, particularly in the food and beverage industry. One response has been the adoption of linerless labels, which avoid backing paper and reduce disposal costs. In some packaging formats, in-mold labeling is gaining traction because it merges the label with the container, cutting down on excess materials. Companies are also reviewing sourcing practices, opting for FSC-certified paper and other responsibly harvested raw inputs. As environmental labeling becomes more visible on products, these shifts are becoming central to brand image and buyer decisions, especially in urban markets where sustainability has strong consumer support.

Japan Print Label Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on raw material, print process, label format and end use industry.

Raw Material Insights:

- Metal Labels

- Plastic/Polymer Labels

The report has provided a detailed breakup and analysis of the market based on the raw material. This includes metal labels and plastic/polymer labels.

Print Process Insights:

- Offset Lithography

- Gravure

- Flexography

- Screen

- Letterpress

- Electrophotography

- Inkjet

A detailed breakup and analysis of the market based on the print process have also been provided in the report. This includes offset lithography, gravure, flexography, screen, letterpress, electrophotography, and inkjet.

Label Format Insights:

- Wet-Glue Labels

- Pressure-Sensitive Labels

- Linerless Labels

- Multi-Part Tracking Labels

- In-Mold Labels

- Sleeves

A detailed breakup and analysis of the market based on the label format have also been provided in the report. This includes wet-glue labels, pressure-sensitive labels, linerless labels, multi-part tracking labels, in-mold labels, and sleeves.

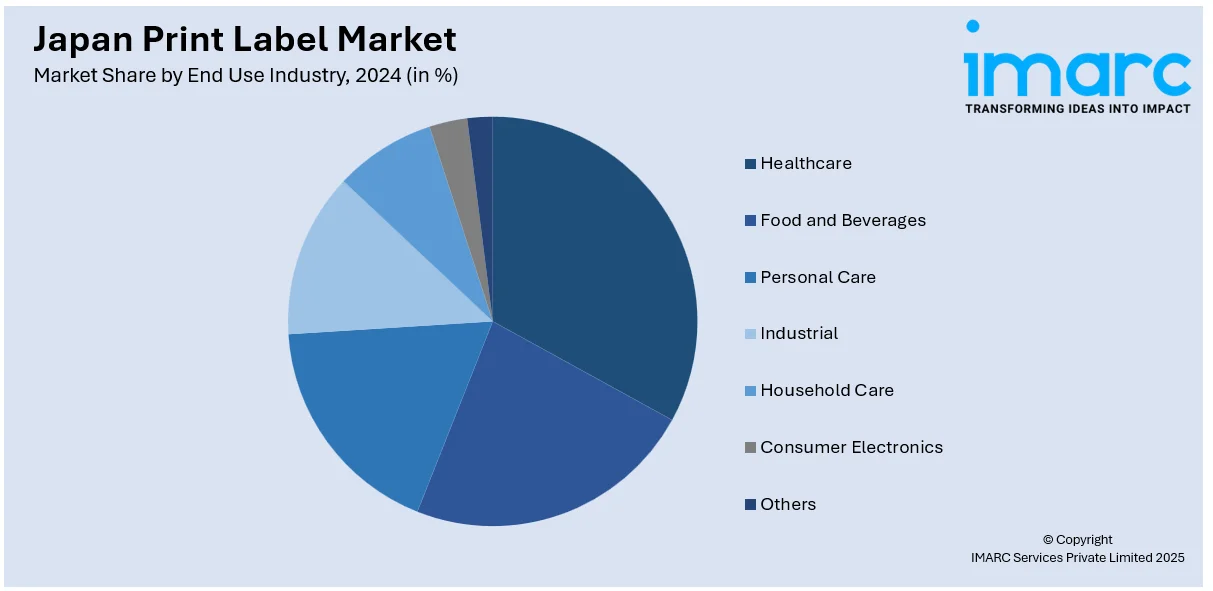

End Use Industry Insights:

- Healthcare

- Food and Beverages

- Personal Care

- Industrial

- Household Care

- Consumer Electronics

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes healthcare, food and beverages, personal care, industrial, household care, consumer electronics, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Print Label Market News:

- February 2025: Kyocera introduced the KJ4A-EX1200-RC inkjet printhead featuring ink recirculation and 1200 dpi resolution. Compatible with UV inks, it enabled high-speed, high-resolution label printing, advancing print quality and efficiency in Japan’s label printing market across diverse industrial applications.

- October 2024: Kanematsu and SCREEN GP Japan partnered to distribute overseas digital printers in Japan, starting with VALLOY’s BIZPRESS 13R label printer. This move boosted digital adoption in the label printing sector, offering compact, user-friendly solutions and reducing reliance on analog printing systems.

Japan Print Label Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | Metal Labels, Plastic/Polymer Labels |

| Print Processes Covered | Offset Lithography, Gravure, Flexography, Screen, Letterpress, Electrophotography, Inkjet |

| Label Formats Covered | Wet-Glue Labels, Pressure-Sensitive Labels, Linerless Labels, Multi-Part Tracking Labels, In-Mold Labels, Sleeves |

| End Use Industries Covered | Healthcare, Food and Beverages, Personal Care, Industrial, Household Care, Consumer Electronics, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan print label market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan print label market on the basis of raw material?

- What is the breakup of the Japan print label market on the basis of print process?

- What is the breakup of the Japan print label market on the basis of label format?

- What is the breakup of the Japan print label market on the basis of end use industry?

- What are the various stages in the value chain of the Japan print label market?

- What are the key driving factors and challenges in the Japan print label market?

- What is the structure of the Japan print label market and who are the key players?

- What is the degree of competition in the Japan print label market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan print label market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan print label market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan print label industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)