Japan Railway System Market Size, Share, Trends and Forecast by Transit Type, System Type, Application, and Region, 2026-2034

Japan Railway System Market Overview:

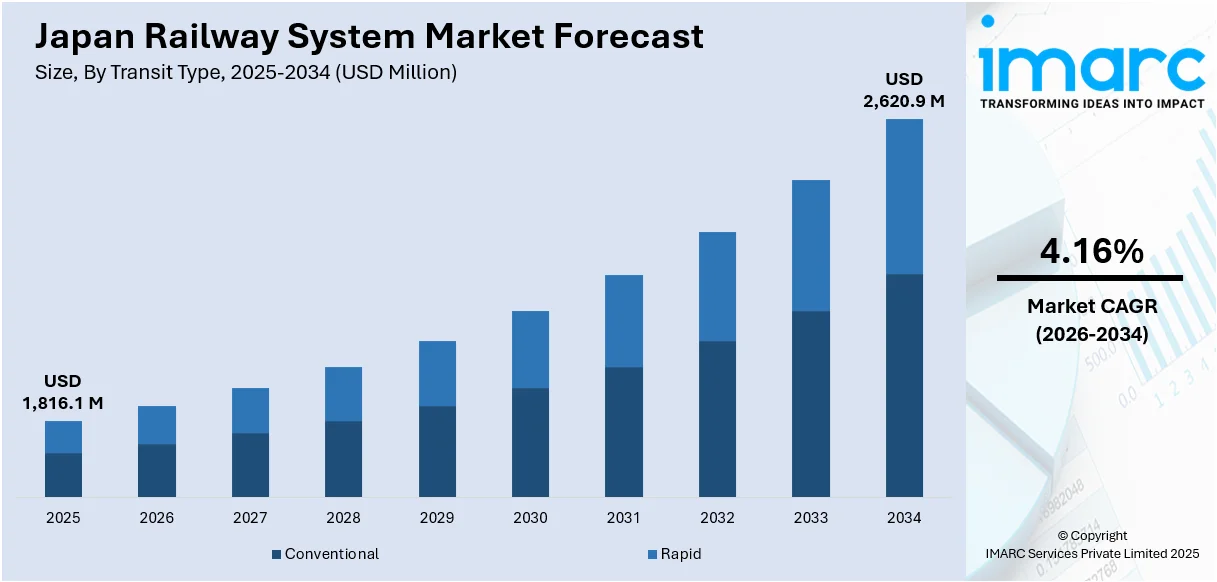

The Japan railway system market size reached USD 1,816.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 2,620.9 Million by 2034, exhibiting a growth rate (CAGR) of 4.16% during 2026-2034. The market is expanding due to investments in passenger comfort, integration of freight logistics with national transport hubs, and widespread adoption of digital technologies that improve operational efficiency, reduce costs, and support long-term infrastructure performance amid rising demand and demographic shifts.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,816.1 Million |

| Market Forecast in 2034 | USD 2,620.9 Million |

| Market Growth Rate 2026-2034 | 4.16% |

Japan Railway System Market Trends:

Passenger Experience Enhancement and Customer-Centric Services

Railway companies are significantly investing in enhancing the comfort, convenience, and enjoyment of travel. This encompasses the creation of contemporary, roomy trains equipped with amenities such as wireless fidelity (Wi-Fi), cozy seating, and tidy, properly maintained facilities. Moreover, the implementation of tailored services like designated seating, upscale lounges, and multilingual assistance at stations improves the journey experience for both local and international travelers. The focus on convenience includes smooth ticketing solutions, like mobile applications and contactless payment methods, which enable travelers to effortlessly move through the system. Focusing on user satisfaction and meeting passenger needs, the railway system draws repeat riders and motivates individuals to opt for rail instead of other transport options, thereby fostering ongoing demand and market expansion. In 2024, Japan's Kansai region rail companies announced plans to introduce contactless fare payment using credit and debit cards by 2024. Kintetsu and Hankyu Railways implemented the system, followed by Hanshin Electric Railway by 2025. This move aimed to simplify travel, especially for overseas visitors ahead of the 2025 World Expo.

To get more information on this market Request Sample

Freight Transportation and Logistics Integration

Japan's rail system is created not just for passenger transport but also to effectively transport goods nationwide, especially heavy and bulk cargo that needs long-distance delivery. The integration of the railway system with logistics hubs, ports, and distribution centers facilitates seamless and economical transport of goods including consumer items, industrial resources, and agricultural products. Rail freight is viewed as more eco-friendly than road transport because it has greater energy efficiency and reduced carbon emissions. With the growing demand for logistics services, especially in e-commerce and international trade, the railway system's capacity to serve both passengers and freight boosts its overall value proposition. This dual role enhances its market standing and supports ongoing investment in rail infrastructure. In 2024, Japan announced plans to launch an automated cargo transport system between Tokyo and Osaka to address the truck driver shortage. The system was set to operate on a three-lane dedicated highway with automated vehicles, aiming for trial runs by 2027 and full operation by the mid-2030s. This initiative sought to reduce workload, carbon emissions, and improve logistics efficiency.

Growing Employment of Digital System to Enhance Operations

The incorporation of sophisticated digital infrastructure that enhances rail operations and asset management is bolstering the market growth. Multiple railway companies are implementing artificial intelligence (AI)-driven monitoring systems, predictive maintenance technologies, and digital platforms to oversee rolling stock, track conditions, and scheduling with increased accuracy. These technologies lessen service interruptions, lower ongoing maintenance costs, and enhance safety regulations. Additionally, the digitalization of inspection processes and automated diagnostics is allowing rail companies to move from reactive to preventive maintenance approaches. This change promotes extended asset life spans and reduces the strain on an older workforce. Moreover, smooth data exchange among operators enhances coordination, optimizes logistics, and facilitates streamlined operations throughout the national rail network. These developments enable the Japanese railway sector to uphold superior service quality while responding to demographic and economic obstacles. In 2024, Fujitsu and JR Freight launched a new system to streamline rail maintenance and management in Japan. The system digitized inspection and repair information, reducing labor and maintenance costs while ensuring compliance with regulations. JR Freight helped introduce the system to other railway operators across Japan.

Japan Railway System Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on transit type, system type, and application.

Transit Type Insights:

- Conventional

- Diesel Locomotive

- Electric Locomotive

- Electro-Diesel Locomotive

- Coaches

- Rapid

- Diesel Multiple Unit (DMU)

- Electric Multiple Unit (EMU)

- Light Rail/Tram

The report has provided a detailed breakup and analysis of the market based on the transit. This includes conventional (diesel locomotive, electric locomotive, electro-diesel locomotive, and coaches) and rapid (diesel multiple unit (DMU), electric multiple unit (EMU), and light rail/tram).

System Type Insights:

- Auxiliary Power System

- Train Information System

- Propulsion System

- Train Safety System

- HVAC System

- On-Board Vehicle Control

A detailed breakup and analysis of the market based on the system type have also been provided in the report. This includes auxiliary power system, train information system, propulsion system, train safety system, HVAC system, and on-board vehicle control.

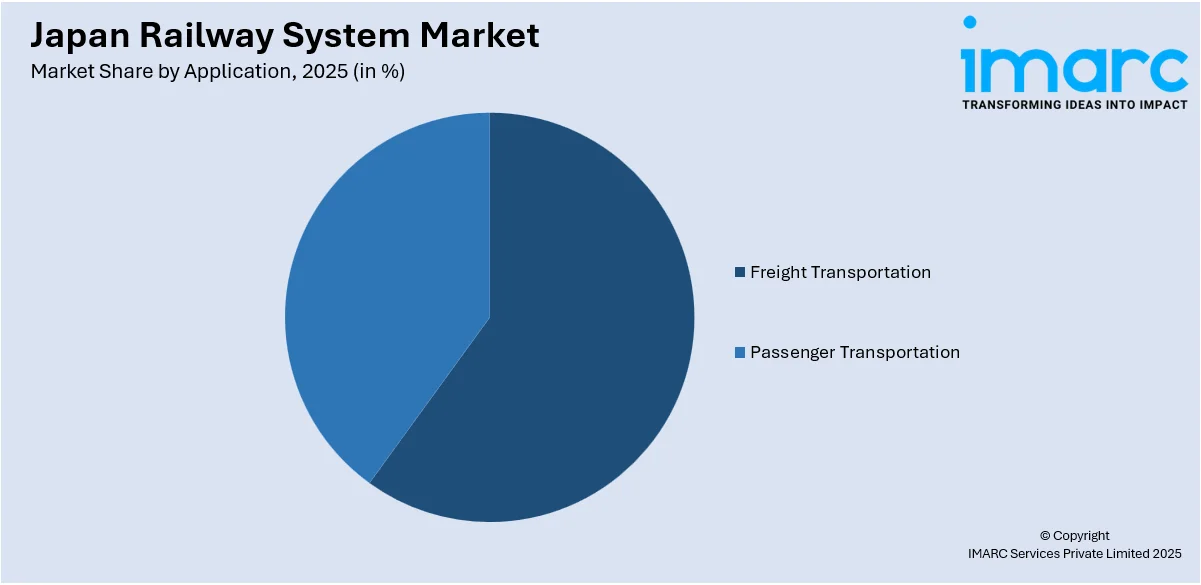

Application Insights:

Access the comprehensive market breakdown Request Sample

- Freight Transportation

- Passenger Transportation

The report has provided a detailed breakup and analysis of the market based on the application. This includes freight transportation and passenger transportation.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Railway System Market News:

- In September 2024, JR East announced plans to launch self-driving bullet trains on a 55.7-kilometer stretch of the Joetsu Shinkansen Line by 2028. The initiative was part of a broader strategy to automate the entire Joetsu Line by the mid-2030s, addressing train driver shortages.

- In July 2024, West Japan Railways introduced a humanoid robot designed for railway infrastructure maintenance. Developed in partnership with Jinki Ittai Co. and Nippon Signal Co., the robot could carry up to 40kg and operate up to 12 meters above ground. It aimed to address labor shortages, improve safety, and reduce workforce requirements for tasks like overhead wire repairs.

Japan Railway System Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Transit Types Covered |

|

| System Types Covered | Auxiliary Power System, Train Information System, Propulsion System, Train Safety System, HVAC System, On-Board Vehicle Control |

| Applications Covered | Freight Transportation, Passenger Transportation |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan railway system market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan railway system market on the basis of transit type?

- What is the breakup of the Japan railway system market on the basis of system type?

- What is the breakup of the Japan railway system market on the basis of application?

- What is the breakup of the Japan railway system market on the basis of region?

- What are the various stages in the value chain of the Japan railway system market?

- What are the key driving factors and challenges in the Japan railway system market?

- What is the structure of the Japan railway system market and who are the key players?

- What is the degree of competition in the Japan railway system market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan railway system market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan railway system market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan railway system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)